Mortgage brokers offer personalized guidance and tailored loan options by assessing individual financial situations, while robo-advisor mortgage services use automated algorithms to quickly process applications with minimal human intervention. Brokers can negotiate on behalf of clients to secure favorable terms, whereas robo-advisors provide streamlined, cost-effective solutions with faster approval times. Choosing between the two depends on whether a borrower values personalized advice or prefers speed and convenience in mortgage application processing.

Table of Comparison

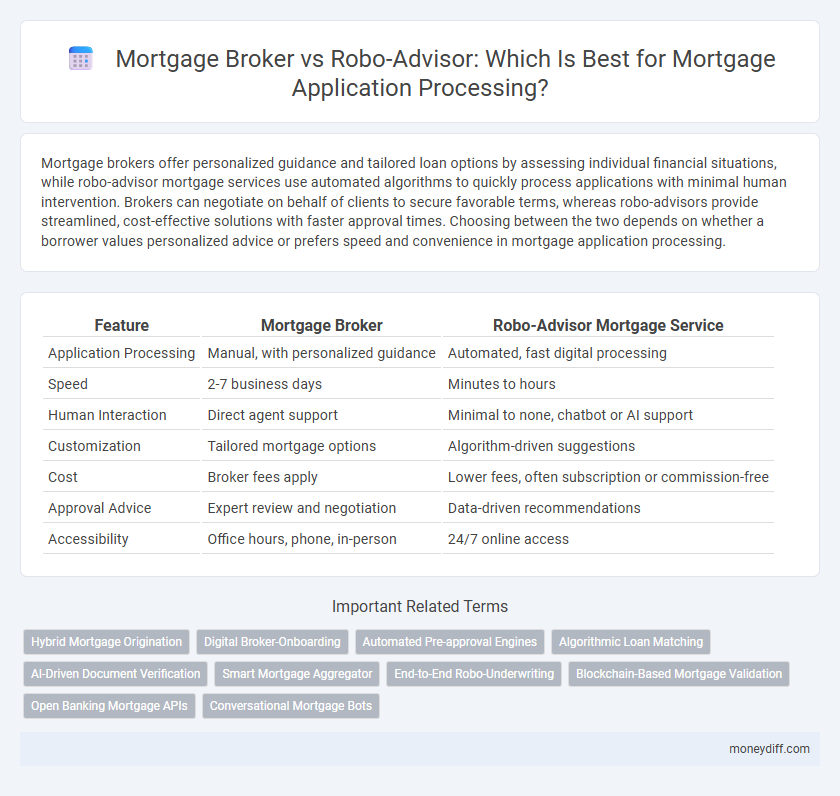

| Feature | Mortgage Broker | Robo-Advisor Mortgage Service |

|---|---|---|

| Application Processing | Manual, with personalized guidance | Automated, fast digital processing |

| Speed | 2-7 business days | Minutes to hours |

| Human Interaction | Direct agent support | Minimal to none, chatbot or AI support |

| Customization | Tailored mortgage options | Algorithm-driven suggestions |

| Cost | Broker fees apply | Lower fees, often subscription or commission-free |

| Approval Advice | Expert review and negotiation | Data-driven recommendations |

| Accessibility | Office hours, phone, in-person | 24/7 online access |

Mortgage Broker vs Robo-Advisor: An Overview

Mortgage brokers offer personalized service by assessing individual financial situations and negotiating with multiple lenders to secure the best mortgage terms, leveraging human expertise and market knowledge. Robo-advisor mortgage services automate the application process using algorithms and online platforms, providing faster pre-approvals and simplified paperwork but with limited customization and lender flexibility. Comparing Mortgage broker vs robo-advisor highlights the trade-off between tailored advice and efficiency in mortgage application processing.

Key Differences in Application Processing

Mortgage brokers provide personalized guidance throughout the application process, gathering necessary documents, verifying financial details, and tailoring loan options to specific borrower needs. Robo-advisor mortgage services automate application processing using algorithms to quickly assess eligibility, input data, and match borrowers with suitable loan products without human intervention. The key differences lie in human interaction and customization versus speed and efficiency driven by technology in handling mortgage applications.

Personalized Guidance: Human Touch vs Automation

Mortgage brokers offer personalized guidance tailored to individual financial situations, providing expert advice and human intuition that can address unique client needs. Robo-advisor mortgage services rely on automated algorithms to process applications quickly and consistently but may lack the nuanced understanding required for complex cases. Choosing between the two depends on the importance of customized support versus efficiency and cost-effectiveness in the mortgage application process.

Speed and Efficiency of Application Approval

Mortgage brokers leverage personalized expertise and extensive lender networks to expedite application processing, often securing faster approval through tailored document preparation and negotiation. Robo-advisor mortgage services utilize advanced algorithms and automated data verification, enabling near-instantaneous application assessments and streamlined submission workflows. Combining human insight with automation, mortgage application approval speeds can be optimized for efficiency and accuracy.

Cost Comparison: Broker Fees vs Robo-Advisor Charges

Mortgage brokers typically charge fees ranging from 0.5% to 1% of the loan amount, which are often paid by lenders but can sometimes affect borrower costs. Robo-advisor mortgage services offer lower fees, commonly flat rates or percentages under 0.5%, due to automated processing and fewer overhead expenses. Choosing between these options depends on balancing the potential for personalized advice against the cost savings of technology-driven service.

Accessibility and Convenience for Borrowers

Mortgage brokers offer personalized guidance and leverage industry connections to simplify the application process, making complex mortgage terms more accessible for borrowers. Robo-advisor mortgage services provide 24/7 online access with automated prequalification and document submission, enhancing convenience through instant processing and reduced wait times. Borrowers benefit from brokers' tailored support while enjoying the speed and ease of robo-advisors' technological accessibility.

Transparency in Mortgage Options and Terms

Mortgage brokers provide personalized guidance with clear explanations of loan options, fees, and terms, ensuring borrowers understand all details before commitment. Robo-advisor mortgage services offer automated, algorithm-driven processing, but may lack the nuanced transparency and tailored disclosures found in human broker interactions. Transparent communication in mortgage terms significantly impacts borrower confidence and informed decision-making throughout the application process.

Data Security and Privacy Considerations

Mortgage brokers prioritize personalized service with stringent data security protocols, often employing encrypted channels and secure document handling to protect client information during the application process. Robo-advisor mortgage services use automated algorithms and cloud-based platforms, raising concerns about data breaches and unauthorized access if robust cybersecurity measures are not implemented. Clients must evaluate each option's privacy policies, data encryption standards, and compliance with regulations like GDPR or CCPA to ensure their sensitive financial data remains secure throughout the mortgage application process.

Suitability for First-Time Homebuyers

Mortgage brokers offer personalized guidance and tailored loan options ideal for first-time homebuyers needing expert advice and clarification throughout the application process. Robo-advisor mortgage services provide quick, automated loan comparisons that benefit tech-savvy buyers seeking convenience but may lack nuanced recommendations for unique financial situations. First-time buyers often achieve better suitability and support with mortgage brokers who navigate complex eligibility criteria and lender requirements.

Which Service Is Right for Your Mortgage Needs?

Mortgage brokers offer personalized guidance and tailored loan options by analyzing your financial situation and credit profile, ensuring a more customized application processing experience. Robo-advisor mortgage services provide quick, automated application processing with competitive rate comparisons but lack human oversight for complex scenarios or nuanced financial needs. Choosing the right service depends on your preference for personalized advice versus efficiency and automation in your mortgage application journey.

Related Important Terms

Hybrid Mortgage Origination

Hybrid mortgage origination combines the personalized guidance of mortgage brokers with the efficiency of robo-advisor mortgage services, streamlining application processing while enhancing decision accuracy. This approach leverages advanced algorithms alongside expert human insight to optimize loan approvals and reduce processing times.

Digital Broker-Onboarding

Digital broker-onboarding leverages advanced algorithms and real-time data integration to streamline application processing, offering personalized mortgage solutions with faster approval times compared to traditional mortgage brokers. Robo-advisor mortgage services provide 24/7 access, automated document verification, and cost-efficient processing, enhancing user experience while minimizing human error in loan evaluation.

Automated Pre-approval Engines

Automated pre-approval engines integrated within robo-advisor mortgage services leverage advanced algorithms and real-time data analysis to expedite application processing, delivering instant eligibility assessments and personalized loan options. Mortgage brokers, while offering personalized expertise, typically require more manual intervention and longer turnaround times compared to the efficiency and speed of AI-driven pre-approval systems.

Algorithmic Loan Matching

Algorithmic loan matching in robo-advisor mortgage services leverages advanced data analytics and machine learning to quickly pair borrowers with the most suitable loan options based on credit profile, income, and preferences, enhancing efficiency and personalization. Mortgage brokers rely on human expertise to evaluate unique financial situations and negotiate terms, offering tailored advice that algorithms may overlook in complex cases.

AI-Driven Document Verification

AI-driven document verification in robo-advisor mortgage services accelerates application processing by instantly analyzing and validating financial documents with high accuracy, reducing human error and turnaround time. Mortgage brokers rely on personalized expertise but may face slower verification speeds, whereas AI systems streamline workflows using machine learning algorithms to detect discrepancies and automate approvals.

Smart Mortgage Aggregator

Smart mortgage aggregators combine data from multiple lenders to provide competitive rates and personalized mortgage options faster than traditional mortgage brokers. Robo-advisor mortgage services automate application processing using AI algorithms, reducing manual errors and accelerating approval times while offering tailored financial advice without human intervention.

End-to-End Robo-Underwriting

Robo-advisor mortgage services leverage end-to-end robo-underwriting technology to automate application processing, delivering faster approvals and increased accuracy compared to traditional mortgage brokers. This digital approach integrates AI-driven credit assessment, risk analysis, and document verification, significantly streamlining the mortgage approval timeline and reducing human error.

Blockchain-Based Mortgage Validation

Blockchain-based mortgage validation enhances transparency and security in application processing by providing an immutable ledger that both mortgage brokers and robo-advisor mortgage services can utilize to verify borrower information and property records instantly. This technology reduces fraud risk, accelerates approval times, and ensures accurate data sharing between parties, making it a critical innovation in modern mortgage workflows.

Open Banking Mortgage APIs

Mortgage brokers leverage Open Banking Mortgage APIs to securely access real-time financial data, enabling personalized loan application processing and tailored mortgage recommendations. Robo-advisor mortgage services use these APIs to automate and expedite application approvals, but often lack the nuanced decision-making and personalized guidance offered by human brokers.

Conversational Mortgage Bots

Conversational mortgage bots streamline application processing by providing instant responses, personalized guidance, and 24/7 availability, enhancing user experience compared to traditional mortgage brokers. These AI-driven tools reduce paperwork and accelerate approval times, making mortgage services more efficient and accessible.

Mortgage Broker vs Robo-Advisor Mortgage Service for application processing. Infographic

moneydiff.com

moneydiff.com