Standard mortgages rely on traditional credit assessments and property appraisals to secure a loan, often involving lengthy approval processes and strict income verification. Crypto-backed mortgages use digital assets as collateral, offering faster approvals and more flexible terms but exposing borrowers to cryptocurrency market volatility. Understanding the risk and benefits of each approach helps borrowers choose the best option for their financial situation and loan objectives.

Table of Comparison

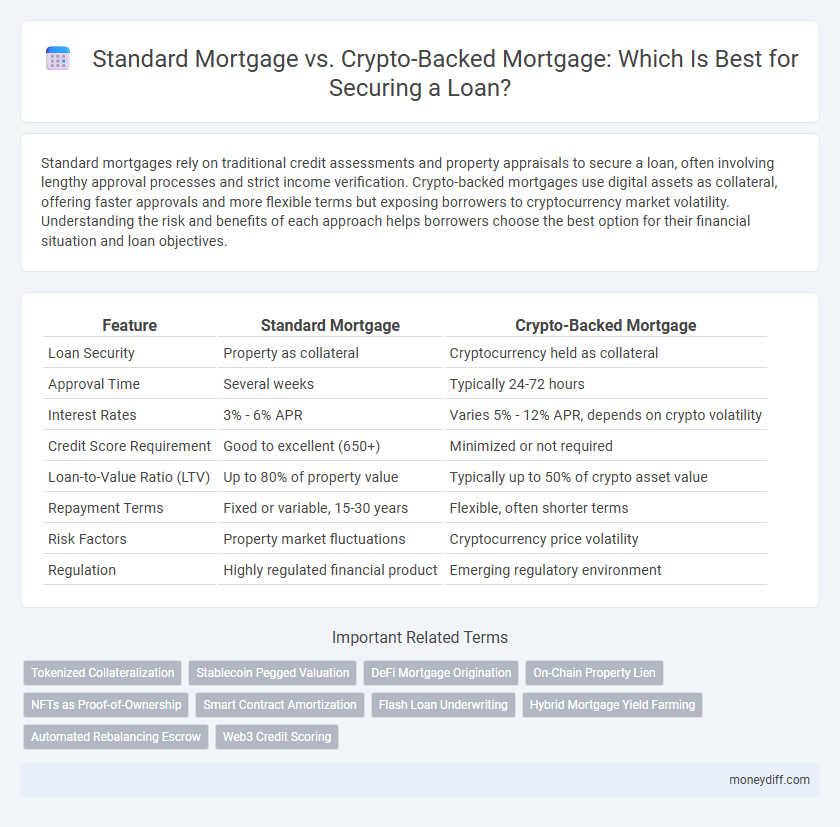

| Feature | Standard Mortgage | Crypto-Backed Mortgage |

|---|---|---|

| Loan Security | Property as collateral | Cryptocurrency held as collateral |

| Approval Time | Several weeks | Typically 24-72 hours |

| Interest Rates | 3% - 6% APR | Varies 5% - 12% APR, depends on crypto volatility |

| Credit Score Requirement | Good to excellent (650+) | Minimized or not required |

| Loan-to-Value Ratio (LTV) | Up to 80% of property value | Typically up to 50% of crypto asset value |

| Repayment Terms | Fixed or variable, 15-30 years | Flexible, often shorter terms |

| Risk Factors | Property market fluctuations | Cryptocurrency price volatility |

| Regulation | Highly regulated financial product | Emerging regulatory environment |

Understanding Standard Mortgages: The Traditional Path

Standard mortgages offer a traditional loan secured by real estate, typically requiring a down payment between 3% and 20% of the home's value, with interest rates ranging from 3% to 7% depending on credit score and market conditions. Lenders assess income, credit history, and debt-to-income ratio to determine eligibility, ensuring long-term repayment stability over 15 to 30 years. This conventional financing method provides predictable monthly payments and protection under federal regulations, making it a reliable choice for most homebuyers.

What is a Crypto-Backed Mortgage?

A crypto-backed mortgage allows borrowers to use cryptocurrency assets, such as Bitcoin or Ethereum, as collateral to secure a loan, bypassing the need to liquidate holdings. This type of mortgage provides access to liquidity while retaining exposure to potential crypto asset appreciation. Unlike standard mortgages, which rely on traditional property equity or income verification, crypto-backed loans hinge on the volatility and value of the digital assets pledged.

Key Differences Between Standard and Crypto-Backed Mortgages

Standard mortgages require borrowers to provide traditional collateral such as real estate, with approval processes relying heavily on credit scores, income verification, and property appraisal. Crypto-backed mortgages use digital assets like Bitcoin or Ethereum as collateral, enabling faster approval and potentially lower interest rates but with higher volatility risk due to fluctuating crypto values. Unlike standard loans, crypto-backed mortgages often offer more flexible terms but can demand immediate additional collateral if crypto asset values drop significantly.

Eligibility and Approval Requirements

Standard mortgage eligibility typically requires a strong credit score, steady income verification, and a low debt-to-income ratio, while crypto-backed mortgages focus on the value and volatility of digital assets as collateral. Approval for standard loans involves traditional underwriting processes and stringent documentation, whereas crypto-backed loans often emphasize asset liquidity and blockchain verification without extensive income proof. Lenders in crypto-backed mortgages assess the risk based on cryptocurrency market conditions, offering faster approvals but with higher sensitivity to asset fluctuations compared to conventional mortgages.

Interest Rates: Conventional vs Crypto-Backed Options

Interest rates for standard mortgages typically range from 3% to 7%, influenced by credit scores and market conditions, offering predictable repayment schedules. Crypto-backed mortgages often feature lower interest rates around 2% to 5%, leveraging digital asset collateral but carrying higher volatility and risk. Borrowers choosing crypto-backed loans should consider potential fluctuations in cryptocurrency value impacting overall loan security and payment stability.

Collateral: Real Estate vs Digital Assets

Standard mortgages require real estate as collateral, providing lenders with a tangible asset that typically retains value over time and offers a clear legal claim in case of default. Crypto-backed mortgages use digital assets like Bitcoin or Ethereum as collateral, which can fluctuate significantly in value, creating higher risk for both borrower and lender. The volatility of digital assets demands stricter loan-to-value ratios and rapid liquidation protocols compared to traditional property-secured loans.

Risk Factors in Standard and Crypto-Backed Mortgages

Standard mortgages carry risks such as fluctuating interest rates, credit score impact, and potential foreclosure due to missed payments. Crypto-backed mortgages involve high volatility of cryptocurrency assets, risk of liquidation during market downturns, and regulatory uncertainties affecting loan security. Both loan types require careful consideration of financial stability and market dynamics to mitigate default and loss.

Flexibility and Accessibility for Borrowers

Standard mortgages typically require extensive credit history and income verification, limiting accessibility for many borrowers, while crypto-backed mortgages offer greater flexibility by using digital assets as collateral without stringent credit checks. Crypto-backed loans provide faster approval and funding processes, appealing to borrowers with volatile or non-traditional income streams. The ability to leverage cryptocurrency holdings enhances borrowing options and access to liquidity compared to conventional mortgage requirements.

Loan Repayment and Default Consequences

Standard mortgages require monthly repayments with fixed or variable interest, and defaulting typically results in foreclosure and damage to credit scores. Crypto-backed mortgages allow borrowers to use cryptocurrency as collateral, enabling quicker loan processing but exposing borrowers to liquidation risk if crypto values drop. Failure to repay a crypto-backed mortgage can lead to automatic liquidation of collateral, often without the lengthy legal procedures common in standard mortgage defaults.

Choosing the Right Mortgage for Your Financial Goals

Standard mortgages offer fixed or variable interest rates and are backed by traditional assets like real estate, providing stable repayment terms ideal for long-term financial planning. Crypto-backed mortgages leverage digital assets as collateral, enabling faster loan approvals and greater liquidity but come with higher volatility risks. Selecting the appropriate mortgage depends on your risk tolerance, asset portfolio, and long-term financial objectives.

Related Important Terms

Tokenized Collateralization

Standard mortgages rely on traditional collateral such as property deeds, whereas crypto-backed mortgages utilize tokenized collateralization, converting digital assets into secure, on-chain tokens that represent real-world value. This tokenization enables faster loan approvals, increased transparency, and enhanced liquidity compared to conventional mortgage processes.

Stablecoin Pegged Valuation

Standard mortgages rely on traditional credit assessments and fixed interest rates, providing predictable repayment schedules but often involve lengthy approval processes. Crypto-backed mortgages use stablecoin-pegged valuations to secure loans, offering faster liquidity and reduced volatility risk compared to other cryptocurrencies while maintaining asset value stability.

DeFi Mortgage Origination

DeFi mortgage origination leverages blockchain technology to enable crypto-backed mortgages, offering faster approval times and reduced reliance on traditional credit scores compared to standard mortgages. Crypto-backed mortgages use digital assets as collateral, providing greater liquidity and accessibility for borrowers while mitigating the need for extensive paperwork and centralized intermediaries.

On-Chain Property Lien

On-chain property liens in crypto-backed mortgages provide transparent and immutable proof of collateral through blockchain technology, streamlining the lien recording process compared to traditional paper-based liens in standard mortgages. This enhances security and reduces settlement times, offering a verifiable and efficient alternative for securing loans.

NFTs as Proof-of-Ownership

Standard mortgages rely on traditional credit assessments and property deeds recorded in public registries, while crypto-backed mortgages utilize blockchain technology to secure loans using digital assets. NFTs serve as proof-of-ownership by providing immutable, verifiable digital titles, streamlining collateral verification and reducing fraud risk in crypto-backed mortgage agreements.

Smart Contract Amortization

Standard mortgages rely on traditional amortization schedules managed by lenders, whereas crypto-backed mortgages utilize smart contract amortization to automate loan term management and payment processing. Smart contracts ensure transparency, reduce administrative costs, and enable real-time updates to amortization based on blockchain data, enhancing efficiency and security in loan servicing.

Flash Loan Underwriting

Standard mortgage underwriting relies heavily on credit scores, income verification, and collateral appraisal, whereas crypto-backed mortgage underwriting incorporates blockchain asset valuation and decentralized finance protocols. Flash loan underwriting enables instant, collateral-less loans by analyzing real-time crypto asset liquidity and smart contract security, offering a revolutionary alternative in securing loans quickly and efficiently.

Hybrid Mortgage Yield Farming

Hybrid mortgage yield farming combines traditional mortgage lending with DeFi protocols, enabling borrowers to leverage crypto assets as collateral while earning yield on those assets during the loan term. This innovative approach offers higher liquidity and potential returns compared to standard mortgages, which rely solely on fiat collateral without yield generation.

Automated Rebalancing Escrow

Standard mortgage escrow accounts automate payments for taxes and insurance but lack automated rebalancing features, potentially causing payment imbalances over time. Crypto-backed mortgages integrate automated rebalancing escrow systems that dynamically adjust collateral value and payments based on cryptocurrency market fluctuations, offering enhanced loan security and reduced default risk.

Web3 Credit Scoring

Standard mortgages rely heavily on traditional credit scores and income verification, often excluding individuals with limited credit history or decentralized assets. Crypto-backed mortgages leverage Web3 credit scoring, which evaluates blockchain-based financial behavior and digital asset holdings to provide more inclusive and accurate loan risk assessments.

Standard Mortgage vs Crypto-Backed Mortgage for securing a loan. Infographic

moneydiff.com

moneydiff.com