A second mortgage is a separate loan taken out using your home as collateral, allowing you to borrow additional funds typically at a higher interest rate and with its own repayment schedule. A piggyback mortgage combines two loans--usually an 80% first mortgage and a 10-15% second mortgage--to avoid private mortgage insurance (PMI) and finance a larger portion of the home purchase. Choosing between a second mortgage and a piggyback mortgage depends on factors like interest rates, down payment size, and your goal to minimize upfront costs or avoid PMI.

Table of Comparison

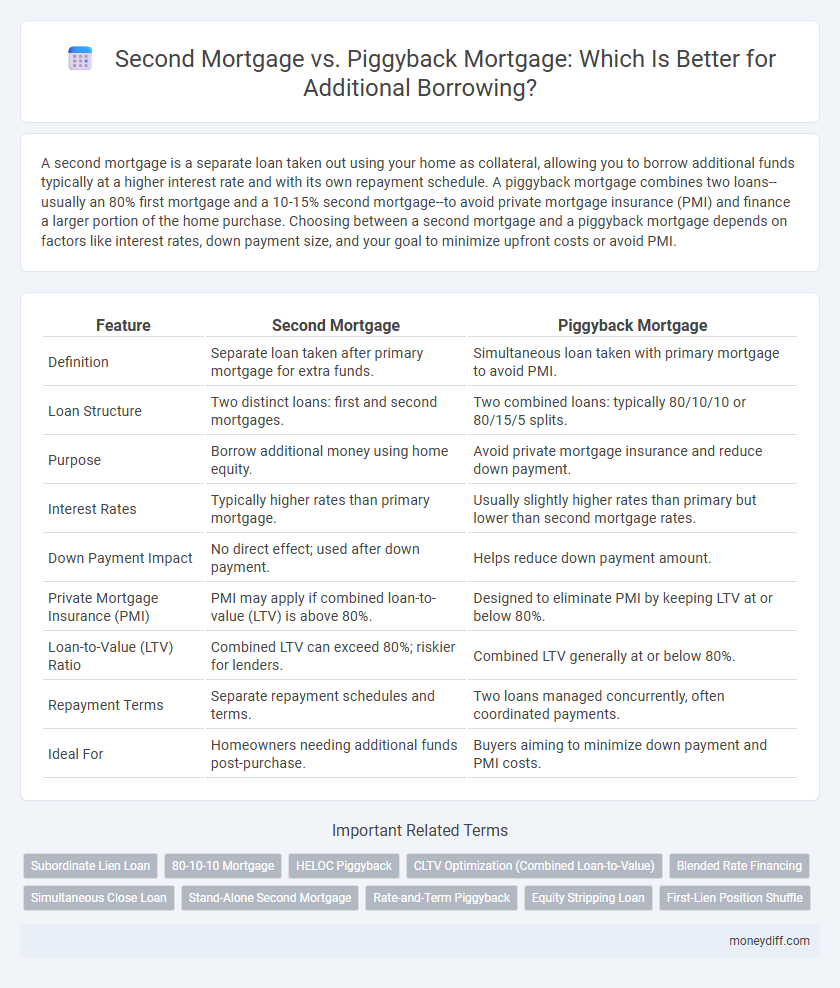

| Feature | Second Mortgage | Piggyback Mortgage |

|---|---|---|

| Definition | Separate loan taken after primary mortgage for extra funds. | Simultaneous loan taken with primary mortgage to avoid PMI. |

| Loan Structure | Two distinct loans: first and second mortgages. | Two combined loans: typically 80/10/10 or 80/15/5 splits. |

| Purpose | Borrow additional money using home equity. | Avoid private mortgage insurance and reduce down payment. |

| Interest Rates | Typically higher rates than primary mortgage. | Usually slightly higher rates than primary but lower than second mortgage rates. |

| Down Payment Impact | No direct effect; used after down payment. | Helps reduce down payment amount. |

| Private Mortgage Insurance (PMI) | PMI may apply if combined loan-to-value (LTV) is above 80%. | Designed to eliminate PMI by keeping LTV at or below 80%. |

| Loan-to-Value (LTV) Ratio | Combined LTV can exceed 80%; riskier for lenders. | Combined LTV generally at or below 80%. |

| Repayment Terms | Separate repayment schedules and terms. | Two loans managed concurrently, often coordinated payments. |

| Ideal For | Homeowners needing additional funds post-purchase. | Buyers aiming to minimize down payment and PMI costs. |

Understanding Second Mortgages: An Overview

Second mortgages allow homeowners to borrow against their property's equity, offering a lump sum or line of credit separate from the primary mortgage. These loans typically have higher interest rates and shorter terms compared to first mortgages, reflecting increased risk for lenders. Understanding the differences between second mortgages and piggyback loans is crucial for effective financial planning and leveraging home equity.

What Is a Piggyback Mortgage?

A piggyback mortgage involves taking out two loans simultaneously to finance a home purchase, typically an 80-10-10 loan structure where the first mortgage covers 80% of the home's value, the second mortgage (piggyback) covers 10%, and the buyer makes a 10% down payment. This strategy helps avoid private mortgage insurance (PMI) when the down payment is less than 20%. Unlike a traditional second mortgage used for refinancing or home equity borrowing, a piggyback mortgage is specifically structured to assist with the initial home purchase.

Key Differences Between Second and Piggyback Mortgages

Second mortgages are separate loans taken out after the primary mortgage, often with higher interest rates and a variable repayment schedule, while piggyback mortgages involve obtaining two loans simultaneously--typically an 80/10/10 structure--to avoid private mortgage insurance (PMI). Second mortgages generally impact credit differently by increasing overall debt post-primary loan, whereas piggyback loans are structured to manage down payment requirements and reduce upfront costs. The risk profile and lender requirements vary significantly, with piggyback mortgages often used to finance home purchases with lower down payments without PMI, while second mortgages provide additional borrowing options on an existing property.

Pros and Cons of Second Mortgages for Additional Borrowing

Second mortgages provide homeowners with an opportunity to access additional funds using their home equity, often at lower interest rates compared to unsecured loans, making them suitable for debt consolidation or home improvements. However, second mortgages carry risks such as higher overall borrowing costs due to two separate loans and the potential for foreclosure if payments on either mortgage are missed. Borrowers should weigh the benefits of lower interest rates and potential tax deductions against the increased monthly payment burden and the impact on home equity.

Advantages and Disadvantages of Piggyback Mortgages

Piggyback mortgages allow borrowers to avoid private mortgage insurance (PMI) by splitting a home purchase into two loans, typically an 80/10/10 arrangement, which can reduce monthly payments and improve cash flow. However, they often carry higher interest rates on the second loan and can be riskier due to potential changes in home value and refinancing challenges. Despite these drawbacks, piggyback loans provide a viable solution for buyers with limited down payments while preserving mortgage interest deductions on both loans.

Eligibility Requirements for Each Mortgage Type

Second mortgages typically require strong credit scores, stable income, and a loan-to-value ratio below 80%, as lenders assess the borrower's capacity to manage multiple loans. Piggyback mortgages often benefit borrowers with moderate credit who want to avoid private mortgage insurance, requiring a minimum down payment of 10-20% and combined loan-to-value ratios usually not exceeding 90%. Both loan types demand thorough documentation of income, employment history, and property appraisal to qualify for additional borrowing.

Costs and Fees: Second Mortgage vs Piggyback Mortgage

Second mortgages generally involve higher interest rates and closing costs compared to piggyback mortgages, as they are subordinate loans with increased risk for lenders. Piggyback mortgages, structured as simultaneous loans often used to avoid private mortgage insurance (PMI), may have lower fees but require qualification for two loans at once. Borrowers should evaluate the total cost of interest, fees, and possible PMI savings when deciding between these financing options.

Impact on Credit Score and Financial Health

Second mortgages and piggyback mortgages both increase overall debt, but second mortgages can have a greater immediate impact on credit scores due to the new separate loan account appearing on credit reports. Piggyback mortgages, typically structured as an 80-10-10 loan, may help avoid private mortgage insurance (PMI), potentially improving monthly cash flow and protecting financial health despite slightly complicating credit profiles. Borrowers should weigh the potential credit score dip from a second mortgage against the possible long-term savings and improved home equity benefits of a piggyback loan.

Choosing the Right Option for Your Borrowing Needs

Selecting between a second mortgage and a piggyback mortgage depends on your financial goals, credit profile, and loan-to-value ratio. A second mortgage allows for borrowing against home equity with potentially higher interest rates, suitable for consolidating debt or large expenses. Piggyback mortgages, often structured as an 80-10-10 split, help avoid private mortgage insurance by combining a first mortgage with a subordinate loan, benefiting homebuyers seeking lower upfront costs.

Frequently Asked Questions About Second and Piggyback Mortgages

Second mortgages are separate loans secured by the home, typically with higher interest rates and shorter terms than primary mortgages, allowing homeowners to borrow additional funds based on their home equity. Piggyback mortgages involve taking out a second loan simultaneously with the first mortgage, often to avoid private mortgage insurance (PMI) by splitting the home financing into an 80-10-10 or 80-15-5 loan structure. Common questions include differences in interest rates, loan terms, impact on credit score, tax-deductibility of interest, and qualification requirements for each option.

Related Important Terms

Subordinate Lien Loan

A second mortgage is a subordinate lien loan secured by the property, typically used for additional borrowing after the primary mortgage, often featuring higher interest rates due to increased risk. Piggyback mortgages combine a first and second loan simultaneously, allowing borrowers to avoid private mortgage insurance while maintaining a subordinate lien position on the secondary loan.

80-10-10 Mortgage

An 80-10-10 mortgage involves an 80% first mortgage, a 10% second mortgage (often called a piggyback loan), and a 10% down payment, enabling borrowers to avoid private mortgage insurance (PMI). The piggyback mortgage typically carries higher interest rates than the first mortgage but provides additional borrowing power without increasing the primary loan balance.

HELOC Piggyback

A HELOC piggyback mortgage combines a first mortgage with a home equity line of credit, enabling borrowers to avoid private mortgage insurance and access flexible funds for additional borrowing. This strategy typically offers lower interest rates on the second lien compared to traditional second mortgages, optimizing borrowing costs and repayment options.

CLTV Optimization (Combined Loan-to-Value)

Second mortgages offer additional borrowing by creating a separate lien, typically at higher interest rates, allowing homeowners to optimize CLTV without refinancing the primary loan. Piggyback mortgages combine first and second loans simultaneously, effectively lowering the overall CLTV and avoiding private mortgage insurance, which can enhance borrowing capacity and reduce upfront costs.

Blended Rate Financing

Second mortgages and piggyback mortgages both serve as options for additional borrowing, with piggyback loans often structured to avoid private mortgage insurance by combining a primary loan with a secondary loan at blended rates. Blended rate financing allows borrowers to minimize interest costs by merging the interest rates of both loans into a single, often lower overall rate, enhancing affordability and cash flow management.

Simultaneous Close Loan

A Second Mortgage typically involves obtaining a separate loan after the first mortgage is established, often with higher interest rates and closing costs, while a Piggyback Mortgage combines a first and second loan simultaneously to avoid private mortgage insurance (PMI) and reduce upfront expenses. A Simultaneous Close Loan facilitates the Piggyback Mortgage by allowing both loans to close at the same time, streamlining the process and enabling borrowers to maximize home equity without triggering PMI.

Stand-Alone Second Mortgage

A stand-alone second mortgage provides additional borrowing power by enabling homeowners to secure a separate loan using the existing equity in their property, typically with its own interest rate and terms independent of the first mortgage. Unlike piggyback mortgages, which are originated simultaneously with the first mortgage to avoid private mortgage insurance, stand-alone second mortgages are often used for home improvements or debt consolidation after the initial loan is in place.

Rate-and-Term Piggyback

A Rate-and-Term Piggyback Mortgage combines a first mortgage with a second loan to avoid private mortgage insurance and secure favorable interest rates, often structured as an 80-10-10 loan. Borrowers seeking additional funds through a second mortgage face higher interest rates and closing costs compared to the cost-effective terms offered by piggyback loans designed to optimize borrowing without increasing monthly payments significantly.

Equity Stripping Loan

A second mortgage allows homeowners to borrow against existing home equity by creating a subordinate lien, often used for substantial additional borrowing, while a piggyback mortgage involves simultaneously taking out a second loan at the time of the primary mortgage to avoid private mortgage insurance (PMI) and maximize borrowing capacity. Equity stripping loans, commonly structured as second mortgages, are specifically designed to reduce available equity and protect assets from creditors by securing debt against home value.

First-Lien Position Shuffle

A second mortgage involves taking out a loan that is subordinate to the primary mortgage, resulting in a second-lien position that carries higher interest rates due to increased lender risk. In contrast, a piggyback mortgage allows borrowers to maintain a first-lien position on both loans by splitting the financing into two simultaneous loans, commonly structured as an 80-10-10 arrangement to avoid private mortgage insurance and optimize borrowing costs.

Second Mortgage vs Piggyback Mortgage for additional borrowing. Infographic

moneydiff.com

moneydiff.com