Traditional mortgages rely on credit history, steady income, and collateral such as real estate, providing a familiar and regulated method for asset leverage with consistent repayment schedules and interest rates. Cryptocurrency-backed mortgages leverage digital assets as collateral, allowing borrowers to access liquidity without selling their crypto holdings, often offering faster approval and more flexible terms but with higher volatility risks. Choosing between these options depends on the borrower's risk tolerance, asset type, and preference for innovation versus stability in financial products.

Table of Comparison

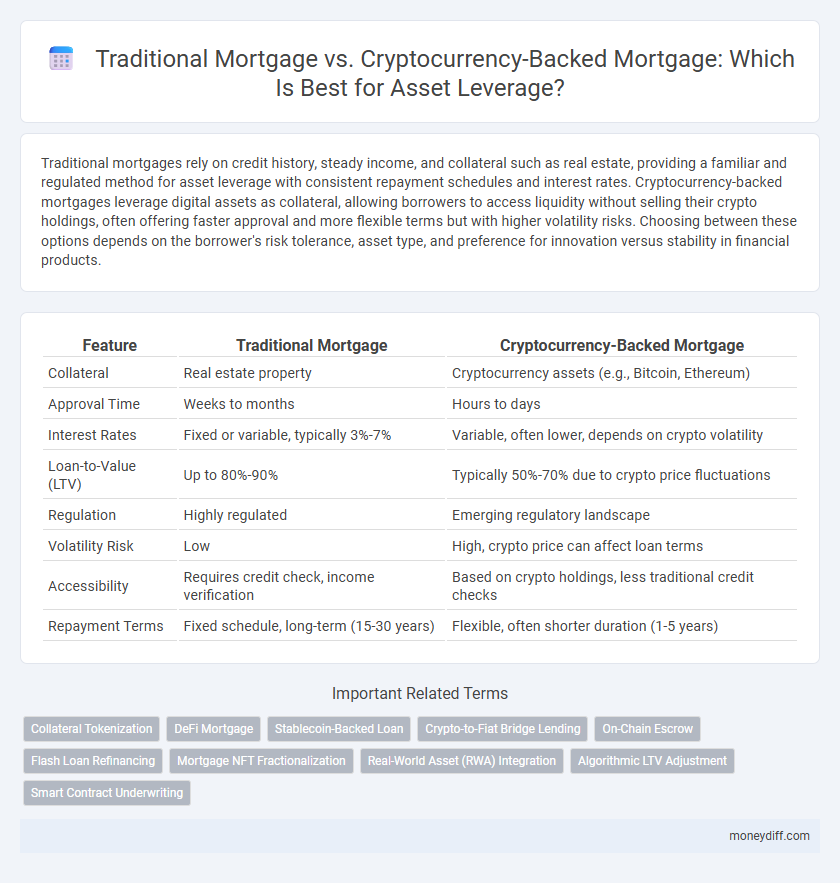

| Feature | Traditional Mortgage | Cryptocurrency-Backed Mortgage |

|---|---|---|

| Collateral | Real estate property | Cryptocurrency assets (e.g., Bitcoin, Ethereum) |

| Approval Time | Weeks to months | Hours to days |

| Interest Rates | Fixed or variable, typically 3%-7% | Variable, often lower, depends on crypto volatility |

| Loan-to-Value (LTV) | Up to 80%-90% | Typically 50%-70% due to crypto price fluctuations |

| Regulation | Highly regulated | Emerging regulatory landscape |

| Volatility Risk | Low | High, crypto price can affect loan terms |

| Accessibility | Requires credit check, income verification | Based on crypto holdings, less traditional credit checks |

| Repayment Terms | Fixed schedule, long-term (15-30 years) | Flexible, often shorter duration (1-5 years) |

Understanding Traditional Mortgages: Basics and Requirements

Traditional mortgages require a borrower to provide a steady income, good credit history, and a down payment typically ranging from 3% to 20% of the home's value. These loans involve fixed or adjustable interest rates and terms usually spanning 15 to 30 years, with rigorous approval processes via banks or mortgage lenders. Collateral in traditional mortgages is the property itself, ensuring lenders can recover losses through foreclosure if repayments are missed.

Cryptocurrency-Backed Mortgages: An Emerging Trend

Cryptocurrency-backed mortgages offer an innovative approach to asset leverage by allowing borrowers to use digital assets like Bitcoin or Ethereum as collateral, bypassing traditional credit checks and reducing reliance on fiat currency. This emerging trend leverages blockchain transparency and decentralized finance protocols, enabling faster approval processes and potentially lower interest rates compared to traditional mortgages. As adoption grows, investors benefit from enhanced liquidity and portfolio diversification, while lenders gain access to a new asset class that mitigates conventional underwriting risks.

Asset Leverage: How Mortgages Unlock Financial Potential

Traditional mortgages enable borrowers to leverage real estate assets by providing substantial loan amounts based on property value and creditworthiness, facilitating wealth accumulation through homeownership and investment. Cryptocurrency-backed mortgages offer innovative asset leverage by using digital assets like Bitcoin or Ethereum as collateral, unlocking liquidity without liquidating holdings and tapping into the growing crypto economy. Both mortgage types enhance financial potential by transforming asset value into accessible capital, but cryptocurrency-backed loans introduce new risk profiles tied to market volatility and regulatory changes.

Eligibility Criteria: Traditional vs Crypto-Backed Mortgages

Traditional mortgage eligibility typically requires a stable income, good credit score, and verified employment history, limiting accessibility for individuals without conventional financial profiles. Cryptocurrency-backed mortgages prioritize digital asset ownership and blockchain-based verification, offering more flexible criteria but demanding sufficient crypto collateral and adherence to volatile asset valuation rules. Understanding these distinct eligibility parameters helps borrowers choose between conventional creditworthiness and innovative asset leverage opportunities.

Interest Rates and Repayment Structures Compared

Traditional mortgages typically offer fixed or variable interest rates ranging from 3% to 7% with structured monthly repayments spanning 15 to 30 years. Cryptocurrency-backed mortgages often feature more flexible repayment terms and interest rates that fluctuate based on crypto market volatility, sometimes starting lower than traditional loans but with increased risk. The repayment structure for crypto loans may include options like interest-only payments or integrated token repayments, providing asset leverage but demanding careful risk management due to market unpredictability.

Risk Factors: Market Volatility and Default Risks

Traditional mortgages carry risks related to interest rate fluctuations and economic downturns that can affect borrowers' ability to repay loans. Cryptocurrency-backed mortgages pose heightened risks due to the extreme market volatility of digital assets, potentially causing sudden decreases in collateral value and triggering margin calls. Both loan types require thorough risk assessment, with crypto-backed loans exposing borrowers to default risks linked to asset price instability.

Regulatory Environment and Legal Considerations

Traditional mortgages operate within established regulatory frameworks, ensuring borrower protections, standardized underwriting processes, and clear legal recourse in case of default, governed by financial authorities such as the CFPB and state banking regulators. Cryptocurrency-backed mortgages present complex legal considerations due to the volatile nature of digital assets, evolving regulatory guidelines from agencies like the SEC and FinCEN, and concerns over compliance with anti-money laundering (AML) and know your customer (KYC) requirements. Lenders offering crypto-backed loans face challenges regarding asset valuation, custody, and cross-border jurisdiction issues, necessitating robust legal strategies to navigate uncertain regulatory landscapes.

Advantages of Traditional Mortgages for Conservative Investors

Traditional mortgages offer conservative investors stability through fixed interest rates and predictable monthly payments, reducing financial uncertainty. These loans typically benefit from well-established regulatory protections and clearer legal frameworks, ensuring a secure borrowing environment. Additionally, traditional mortgages allow investors to leverage tangible real estate assets without exposure to the high volatility associated with cryptocurrency markets.

Benefits and Challenges of Using Crypto as Collateral

Using cryptocurrency as collateral in a mortgage allows borrowers to leverage digital assets for quick access to funds without liquidating holdings, often resulting in faster approval processes and potentially lower interest rates compared to traditional mortgages. However, the volatility of cryptocurrencies poses significant risks, including sudden devaluation that can trigger margin calls or require additional collateral to maintain loan-to-value ratios. Regulatory uncertainties and limited lender acceptance further challenge the stability and accessibility of crypto-backed mortgages relative to conventional asset-based lending.

Choosing the Right Mortgage Type for Your Financial Goals

Choosing the right mortgage type depends on your financial goals and risk tolerance, with traditional mortgages offering stability through fixed interest rates and predictable payments against the backdrop of established regulatory frameworks. Cryptocurrency-backed mortgages provide asset leverage opportunities by allowing borrowers to use digital assets as collateral, appealing to those seeking innovation and diversification but exposing them to market volatility and evolving legal considerations. Evaluating cash flow, asset liquidity, and long-term growth potential is essential in selecting between these options to optimize leverage and financial security.

Related Important Terms

Collateral Tokenization

Traditional mortgages rely on tangible assets such as real estate for collateral, whereas cryptocurrency-backed mortgages leverage collateral tokenization by converting digital assets into secure, liquid tokens to unlock new financing avenues. Collateral tokenization enhances asset leverage efficiency by enabling fractional ownership, faster transactions, and broader access to capital markets compared to conventional mortgage structures.

DeFi Mortgage

DeFi mortgage platforms leverage blockchain technology to provide cryptocurrency-backed loans, allowing borrowers to use digital assets as collateral while bypassing traditional credit checks and lengthy approval processes. Traditional mortgages rely on fiat currency and credit history evaluation, whereas DeFi mortgages enable more accessible and flexible asset leverage through decentralized finance protocols.

Stablecoin-Backed Loan

Stablecoin-backed loans offer a secure and transparent alternative to traditional mortgages by leveraging blockchain technology to provide asset-backed financing with reduced volatility risk compared to typical cryptocurrency loans. This approach enables borrowers to access liquidity while maintaining asset ownership, facilitating efficient leverage without the extensive credit checks and long approval processes characteristic of conventional mortgage lending.

Crypto-to-Fiat Bridge Lending

Traditional mortgages rely on credit history and steady income to leverage assets, whereas cryptocurrency-backed mortgages utilize digital assets as collateral, enabling borrowers to access liquidity without liquidating holdings. Crypto-to-fiat bridge lending facilitates seamless conversion of crypto assets into fiat currency, optimizing leverage while mitigating market volatility risks in mortgage financing.

On-Chain Escrow

Traditional mortgages rely on centralized financial institutions to hold funds and manage loan disbursements, while cryptocurrency-backed mortgages leverage on-chain escrow smart contracts to securely automate asset transfers and enforce loan conditions. On-chain escrow enhances transparency, reduces counterparty risk, and accelerates transaction settlement in digital asset-backed lending compared to conventional mortgage processes.

Flash Loan Refinancing

Traditional mortgages rely on credit history and income verification to leverage property assets, typically involving long approval times and rigid repayment terms. Cryptocurrency-backed mortgages, enhanced by flash loan refinancing, enable instant, collateral-based borrowing without credit checks, providing flexible asset leverage through decentralized finance protocols.

Mortgage NFT Fractionalization

Mortgage NFT fractionalization enables asset leverage by dividing property ownership into tradable digital tokens, enhancing liquidity and accessibility compared to traditional mortgages that rely on single-entity loans with fixed collateral. Cryptocurrency-backed mortgages integrate blockchain technology, allowing fractionalized mortgage NFTs to streamline underwriting processes, reduce entry barriers, and facilitate diversified investment in property assets.

Real-World Asset (RWA) Integration

Traditional mortgages leverage real estate as collateral with well-established appraisal systems, providing predictable loan-to-value ratios and regulatory oversight. Cryptocurrency-backed mortgages enable asset leverage through tokenized real-world assets (RWA), integrating blockchain transparency and facilitating fractional ownership, but face volatility and evolving compliance frameworks.

Algorithmic LTV Adjustment

Traditional mortgages rely on fixed loan-to-value (LTV) ratios determined by credit assessments and property appraisals, often leading to slower adjustments in asset leverage. Cryptocurrency-backed mortgages utilize algorithmic LTV adjustments that dynamically respond to volatile digital asset valuations, enabling more flexible and real-time leverage optimization.

Smart Contract Underwriting

Smart contract underwriting streamlines the mortgage process by automating asset verification and risk assessment, enhancing transparency and reducing processing time compared to traditional manual underwriting methods. Cryptocurrency-backed mortgages leverage blockchain technology in smart contracts to enable real-time asset valuation and decentralized asset leverage, offering more efficient and secure loan approvals than conventional mortgage systems.

Traditional Mortgage vs Cryptocurrency-Backed Mortgage for asset leverage. Infographic

moneydiff.com

moneydiff.com