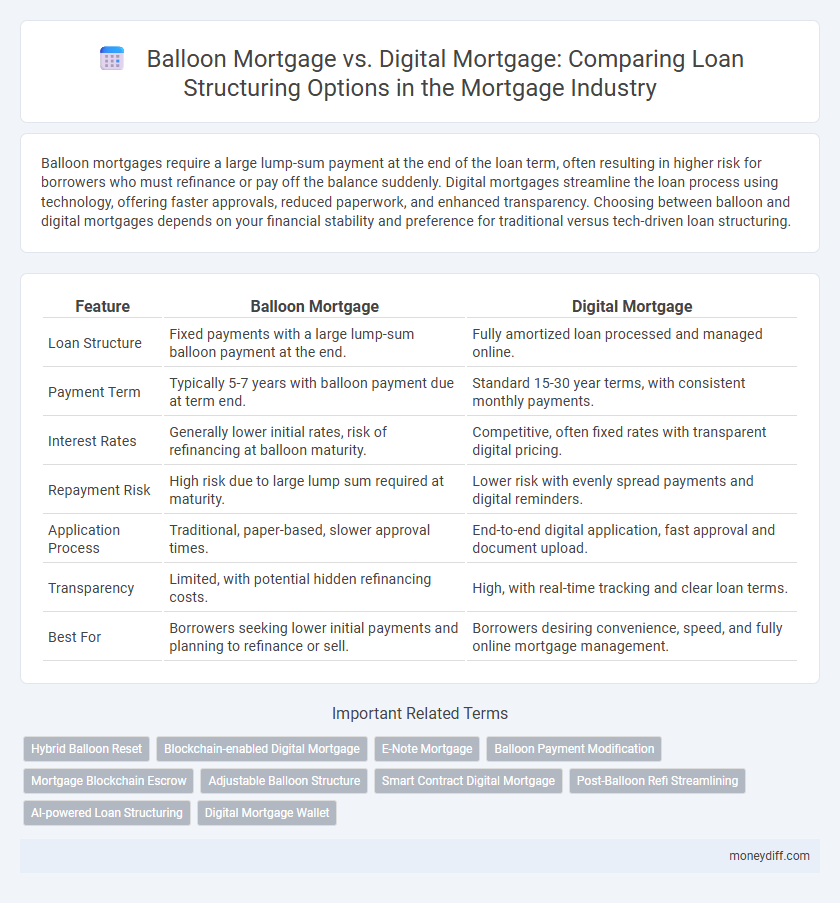

Balloon mortgages require a large lump-sum payment at the end of the loan term, often resulting in higher risk for borrowers who must refinance or pay off the balance suddenly. Digital mortgages streamline the loan process using technology, offering faster approvals, reduced paperwork, and enhanced transparency. Choosing between balloon and digital mortgages depends on your financial stability and preference for traditional versus tech-driven loan structuring.

Table of Comparison

| Feature | Balloon Mortgage | Digital Mortgage |

|---|---|---|

| Loan Structure | Fixed payments with a large lump-sum balloon payment at the end. | Fully amortized loan processed and managed online. |

| Payment Term | Typically 5-7 years with balloon payment due at term end. | Standard 15-30 year terms, with consistent monthly payments. |

| Interest Rates | Generally lower initial rates, risk of refinancing at balloon maturity. | Competitive, often fixed rates with transparent digital pricing. |

| Repayment Risk | High risk due to large lump sum required at maturity. | Lower risk with evenly spread payments and digital reminders. |

| Application Process | Traditional, paper-based, slower approval times. | End-to-end digital application, fast approval and document upload. |

| Transparency | Limited, with potential hidden refinancing costs. | High, with real-time tracking and clear loan terms. |

| Best For | Borrowers seeking lower initial payments and planning to refinance or sell. | Borrowers desiring convenience, speed, and fully online mortgage management. |

Balloon Mortgage vs Digital Mortgage: An Introduction

Balloon mortgages require a large lump-sum payment at the end of the loan term, often making monthly payments initially lower but causing refinancing risks. Digital mortgages leverage technology for faster processing, improved accuracy, and streamlined documentation, enhancing borrower convenience and lender efficiency. Comparing balloon mortgage vs digital mortgage highlights a trade-off between traditional payment structures and modern digital advancements in loan management.

Key Features of Balloon Mortgages

Balloon mortgages require a large lump-sum payment at the end of a short-term loan, typically 5 to 7 years, offering lower initial monthly payments compared to traditional fixed-rate loans. These loans appeal to borrowers expecting increased income or planning to refinance before the balloon payment is due, but they carry significant risk if the borrower cannot make the final payment or sell the property. Key features include low initial interest rates, a shorter loan term, and a balloon payment that can lead to refinancing challenges or potential default if not managed properly.

Key Features of Digital Mortgages

Digital mortgages streamline the loan application process through automated underwriting, real-time documentation upload, and faster approvals, significantly reducing turnaround times compared to traditional balloon mortgages. They leverage advanced data analytics and secure electronic signatures to enhance accuracy, compliance, and borrower convenience. This technology-driven approach minimizes paperwork and manual errors, enabling borrowers to access loan terms and closing disclosures digitally, often resulting in cost savings and increased transparency.

Loan Structuring: Comparing Flexibility

Balloon mortgages offer structured short-term payments with a large lump-sum due at maturity, providing lower initial monthly outflows but less flexibility in refinancing options. Digital mortgages streamline loan structuring through automated processes, enabling personalized terms and quicker adjustments to payment schedules based on borrower profiles. The adaptability of digital mortgages often surpasses balloon loans by integrating real-time data analytics for dynamic loan modification and risk assessment.

Interest Rates and Payment Structures

Balloon mortgages typically offer lower initial interest rates with a large lump-sum payment due at the end of the term, making monthly payments more affordable initially but requiring refinancing or full repayment later. Digital mortgages streamline the loan approval process through automated underwriting and electronic documentation, often providing competitive interest rates and flexible payment structures tailored to borrower needs. Choosing between balloon and digital mortgages depends on balancing short-term payment affordability against long-term financial planning and interest rate stability.

Risks and Rewards: Balloon vs Digital Mortgages

Balloon mortgages offer lower initial payments with a large lump-sum due at the end, posing significant refinancing risk if the borrower cannot secure new financing. Digital mortgages streamline the loan process through technology, reducing closing times and increasing transparency, but they may involve data security and technology adoption risks. Choosing between balloon and digital mortgages requires balancing immediate affordability against long-term financial stability and the borrower's comfort with digital platforms.

Technology’s Role in Digital Mortgage Processes

Digital mortgages utilize advanced technology such as AI-driven underwriting, e-signatures, and automated document verification, significantly reducing loan processing time and enhancing accuracy compared to traditional balloon mortgages. The integration of cloud computing and secure data encryption in digital platforms streamlines borrower verification and risk assessment, ensuring a more efficient and secure loan structuring process. This technological advancement facilitates greater transparency and accessibility, improving overall borrower experience and lender operational efficiency.

Suitability: Who Benefits from Each Option?

Balloon mortgages benefit borrowers seeking lower initial payments and planning to refinance or sell before the large final payment, often suitable for those with fluctuating incomes or short-term ownership goals. Digital mortgages appeal to tech-savvy applicants looking for convenient, streamlined loan processing with faster approvals and reduced paperwork, ideal for first-time homebuyers or those prioritizing efficiency. Selecting between balloon and digital mortgages depends on cash flow flexibility, loan duration, and the borrower's comfort with digital tools.

Regulatory Considerations and Transparency

Balloon mortgages require clear disclosure of lump-sum payment terms to comply with regulatory frameworks like the Truth in Lending Act (TILA), ensuring borrowers understand payment risks. Digital mortgages leverage automated compliance checks and e-signatures to enhance transparency and streamline regulatory adherence. Regulators increasingly favor digital solutions for their ability to provide real-time audit trails and reduce errors in loan structuring documentation.

Choosing the Right Mortgage for Effective Money Management

Balloon mortgages require a large payment at the end of the loan term, which can challenge cash flow management but often come with lower initial interest rates. Digital mortgages streamline the approval process through automated documentation and faster underwriting, providing convenience and speed without compromising loan structure options. Selecting between a balloon mortgage and a digital mortgage depends on one's ability to manage future payments versus the need for a quicker, more efficient loan approval process.

Related Important Terms

Hybrid Balloon Reset

Hybrid balloon reset mortgages combine traditional balloon payments with digital mortgage platforms, offering borrowers flexible loan structuring and automated application processing. This hybrid model enhances repayment options by allowing periodic loan resets, reducing the risk of large lump-sum payments while leveraging digital tools for faster underwriting and improved borrower experience.

Blockchain-enabled Digital Mortgage

Blockchain-enabled digital mortgages streamline loan structuring by automating verification processes, reducing fraud risks, and accelerating approvals compared to traditional balloon mortgages that require large lump-sum payments at the end of the term. By leveraging decentralized ledger technology, digital mortgages enhance transparency and secure data integrity, offering borrowers a more efficient and cost-effective alternative to conventional balloon loan models.

E-Note Mortgage

Balloon mortgages require a large lump-sum payment at the end of the loan term, often posing refinancing risks, whereas digital mortgages streamline the approval process through electronic documentation and automated underwriting. E-Note mortgages enhance digital mortgage efficiency by enabling secure electronic promissory notes, reducing paperwork and expediting loan servicing and transfers.

Balloon Payment Modification

Balloon mortgage loans feature a large lump-sum payment at the end of the term, often requiring modification options to manage this substantial final payout effectively. Digital mortgages streamline balloon payment modifications by enabling quicker, data-driven adjustments through automated underwriting and real-time credit analysis.

Mortgage Blockchain Escrow

Balloon mortgages offer lower initial payments with a large final lump sum, while digital mortgages streamline loan processing through automated underwriting and e-signatures, enhancing efficiency in mortgage blockchain escrow transactions. Integrating mortgage blockchain escrow ensures secure, transparent, and immutable record-keeping, reducing fraud and accelerating loan settlement for both balloon and digital mortgage structures.

Adjustable Balloon Structure

An adjustable balloon mortgage features a low initial interest rate with periodic adjustments followed by a large lump-sum payment at maturity, offering flexibility for borrowers anticipating income growth or refinancing opportunities. In contrast, digital mortgages streamline loan processing through automated underwriting and remote documentation, significantly reducing approval times but maintaining standard fixed or adjustable rate structures without a balloon component.

Smart Contract Digital Mortgage

Balloon mortgages require a large lump-sum payment at the end of the loan term, leading to higher repayment risk, whereas Smart Contract Digital Mortgages utilize blockchain to automate loan structuring and enforce payment terms with enhanced transparency and security. Utilizing smart contracts reduces processing time and errors while enabling real-time tracking of loan performance, creating a more efficient and reliable mortgage experience.

Post-Balloon Refi Streamlining

Balloon mortgages require a large lump-sum payment at the end of the term, often triggering refinancing challenges, whereas digital mortgages streamline post-balloon refinancing by automating document verification and underwriting processes. By leveraging advanced algorithms and e-closings, digital mortgage platforms reduce processing time and costs, enhancing borrower experience during the critical post-balloon reevaluation phase.

AI-powered Loan Structuring

AI-powered loan structuring enhances mortgage options by analyzing borrower profiles to optimize between balloon mortgages, which offer lower initial payments but require a lump sum payoff, and digital mortgages that streamline approval with automated data processing for faster, more accurate underwriting. Leveraging machine learning algorithms allows lenders to personalize mortgage products, balancing risk and cost-efficiency while improving borrower experience through seamless digital platforms.

Digital Mortgage Wallet

Digital Mortgage Wallet streamlines loan structuring by securely storing borrower documents and facilitating instant lender access, reducing approval times compared to traditional Balloon Mortgage processes. This technology enhances accuracy and transparency in underwriting, enabling more efficient decision-making and improved borrower experience.

Balloon Mortgage vs Digital Mortgage for loan structuring. Infographic

moneydiff.com

moneydiff.com