Refinance mortgages offer the opportunity to replace an existing loan with a new one, often securing lower interest rates and reduced monthly payments to manage debt more effectively. Reverse mortgages provide homeowners aged 62 or older access to their home equity as tax-free funds without monthly payments, but they reduce the inheritance value of the property. Choosing between refinancing and a reverse mortgage depends on financial goals, loan terms, and the homeowner's long-term plans for debt management.

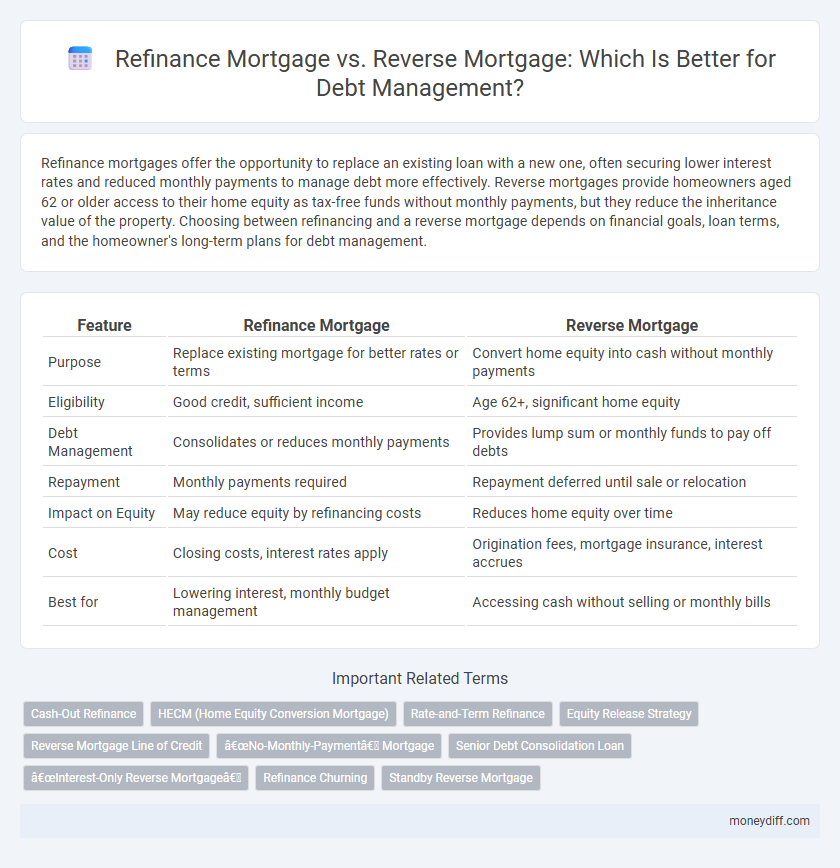

Table of Comparison

| Feature | Refinance Mortgage | Reverse Mortgage |

|---|---|---|

| Purpose | Replace existing mortgage for better rates or terms | Convert home equity into cash without monthly payments |

| Eligibility | Good credit, sufficient income | Age 62+, significant home equity |

| Debt Management | Consolidates or reduces monthly payments | Provides lump sum or monthly funds to pay off debts |

| Repayment | Monthly payments required | Repayment deferred until sale or relocation |

| Impact on Equity | May reduce equity by refinancing costs | Reduces home equity over time |

| Cost | Closing costs, interest rates apply | Origination fees, mortgage insurance, interest accrues |

| Best for | Lowering interest, monthly budget management | Accessing cash without selling or monthly bills |

Understanding Refinance Mortgages: Key Concepts

Refinance mortgages involve replacing an existing home loan with a new one to secure better interest rates, lower monthly payments, or access home equity for debt consolidation. This process can improve cash flow and reduce overall debt burden by joining high-interest debts into a manageable mortgage payment. Homeowners should evaluate refinancing costs, credit score impact, and current market rates to determine if refinancing is a strategic debt management solution.

What Is a Reverse Mortgage? A Comprehensive Overview

A reverse mortgage is a loan available to homeowners aged 62 or older that allows them to convert part of their home equity into cash without monthly repayments, providing financial relief and supporting debt management. Unlike a refinance mortgage, which replaces an existing loan with new terms, a reverse mortgage offers flexibility by paying out funds based on home value and loan limits, typically up to 50% of the equity. Understanding the pros and cons, including impacts on inheritance and loan repayment triggered by sale or moving, is essential when considering a reverse mortgage for debt management.

Eligibility Requirements: Refinance vs Reverse Mortgage

Refinance mortgages typically require a good credit score, steady income, and sufficient home equity, making them suitable for homeowners seeking lower interest rates or debt consolidation. Reverse mortgages are available to homeowners aged 62 or older with significant home equity and allow access to funds without monthly payments, ideal for those aiming to manage debt without reducing monthly cash flow. Eligibility for refinance depends largely on financial stability, while reverse mortgage qualification focuses on age and equity, tailoring each to different debt management needs.

How Each Mortgage Affects Debt Management

Refinance mortgage replaces an existing loan with a new one, potentially lowering interest rates and monthly payments to improve cash flow and reduce overall debt burden. Reverse mortgage converts home equity into tax-free loan proceeds, providing income without monthly payments but increasing overall debt owed as interest accrues. Choosing between these options depends on the homeowner's age, equity, and goals for managing monthly expenses versus long-term debt accumulation.

Comparing Interest Rates and Fees

Refinance mortgages typically offer lower interest rates compared to reverse mortgages, making them more cost-effective for borrowers aiming to consolidate high-interest debt. Reverse mortgages involve higher upfront fees and ongoing costs due to their complex structure, which can reduce the net benefit for debt management. Evaluating the total cost of borrowing, including interest rates and associated fees, is crucial when choosing between these options for effective debt reduction.

Monthly Payments: Differences Explained

Refinance mortgages reduce monthly payments by replacing an existing loan with a lower-interest or longer-term loan, easing immediate cash flow and improving debt management. Reverse mortgages do not require monthly payments, instead allowing homeowners 62 and older to convert home equity into cash while deferring repayment until the loan matures or the home is sold. Choosing between these options depends on whether the priority is lowering monthly obligations now or accessing equity without regular payment commitments.

Impacts on Home Equity and Ownership

Refinance mortgages require regular payments and may increase home equity by replacing an existing loan with better terms, allowing homeowners to manage debt while maintaining ownership. Reverse mortgages provide lump-sum or monthly funds without monthly payments but reduce home equity over time as loan balance grows, potentially affecting inheritance and ownership transfer. Choosing between them depends on balancing immediate debt relief with long-term impacts on home equity and property rights.

Tax Implications of Each Mortgage Option

Refinance mortgages often allow homeowners to deduct the interest paid on the new loan if the funds are used for home improvements, providing potential tax benefits for debt management. Reverse mortgages generally do not have tax-deductible interest because they are not considered loans in the traditional sense and the funds received are typically tax-free. Understanding these distinctions is crucial for borrowers to optimize their tax situation while managing debt through mortgage options.

Pros and Cons: Refinance vs Reverse Mortgage

Refinance mortgages offer lower interest rates and can consolidate high-interest debt, improving monthly cash flow but require good credit and steady income, with potential closing costs and extended loan terms. Reverse mortgages provide tax-free cash for homeowners aged 62 and older without monthly payments, preserving cash flow but reduce home equity and can be costly due to fees and interest accrual. Choosing between refinance and reverse mortgage depends on creditworthiness, income stability, age, and long-term financial goals for effective debt management.

Choosing the Right Strategy for Your Debt Management Goals

Refinance mortgages lower interest rates or monthly payments, providing immediate cash flow relief and simplifying debt management by consolidating high-interest debts into a single loan. Reverse mortgages allow homeowners aged 62 or older to convert home equity into tax-free income without monthly repayments, ideal for supplementing retirement income but increasing overall debt. Assess your financial goals, income stability, and long-term plans to determine whether refinancing or a reverse mortgage best supports your debt management strategy while preserving homeownership.

Related Important Terms

Cash-Out Refinance

Cash-out refinance allows homeowners to convert home equity into liquid cash, providing funds to consolidate high-interest debts and lower overall monthly payments. Unlike reverse mortgages, which are primarily for seniors and require no monthly payments but reduce home equity, cash-out refinances offer more control over debt repayment through standard loan terms.

HECM (Home Equity Conversion Mortgage)

Refinance mortgage lowers monthly payments by replacing an existing loan with a new one, improving cash flow for debt management, while a Reverse Mortgage, specifically the HECM program, converts home equity into tax-free funds without monthly repayments, ideal for seniors seeking to manage debt without reducing cash reserves. HECM loans have strict eligibility requirements, including age 62+, and must be used strategically to avoid loan balance growth that could reduce inheritance value.

Rate-and-Term Refinance

Rate-and-term refinance restructures existing mortgage debt by lowering interest rates or adjusting loan terms, effectively reducing monthly payments and easing financial burden. Reverse mortgages, while offering access to home equity without monthly repayments, are less suitable for debt management due to accumulating interest and loan balance requirements.

Equity Release Strategy

Refinance mortgage allows homeowners to replace their existing loan with a new mortgage at a lower interest rate, improving cash flow and consolidating debt while preserving home equity. Reverse mortgage provides an equity release strategy specifically for seniors, converting home equity into tax-free loan proceeds without monthly payments, ideal for supplementing income but reduces inheritance value.

Reverse Mortgage Line of Credit

A Reverse Mortgage Line of Credit (HELOC) offers homeowners 62 and older the ability to access untapped home equity without monthly payments, making it a flexible tool for debt management and emergency funds. Unlike traditional refinance mortgages that require monthly repayments and credit qualifications, the reverse mortgage line of credit grows over time, providing increasing borrowing capacity and financial security.

“No-Monthly-Payment” Mortgage

A reverse mortgage offers a no-monthly-payment option, enabling homeowners aged 62 or older to convert home equity into tax-free funds for debt management without monthly loan repayments. In contrast, a refinance mortgage typically requires monthly payments but may provide lower interest rates and consolidated debt benefits for borrowers seeking cash flow improvement.

Senior Debt Consolidation Loan

A refinance mortgage allows seniors to replace an existing loan with a new one, often at a lower interest rate, to consolidate debt and reduce monthly payments, while a reverse mortgage converts home equity into tax-free cash without monthly repayments, ideal for seniors seeking to manage debt without increasing financial strain. Seniors should evaluate interest rates, loan terms, and eligibility criteria to determine whether a refinance mortgage or reverse mortgage better supports their debt consolidation goals and long-term financial stability.

“Interest-Only Reverse Mortgage”

Interest-Only Reverse Mortgages allow homeowners aged 62 and older to convert home equity into tax-free loan proceeds without monthly payments, making them a strategic option for managing debt by reducing immediate financial burdens. Unlike traditional refinance mortgages, these loans accrue interest over time that is repaid only when the homeowner sells the property, moves out, or passes away, preserving cash flow while leveraging home equity for debt consolidation.

Refinance Churning

Refinance mortgage allows homeowners to replace an existing loan with a new one, often to secure lower interest rates or better terms, but frequent refinance churning can lead to increased fees and extended debt periods, undermining debt management goals. Reverse mortgages provide seniors with tax-free income by tapping home equity without monthly payments, yet they reduce inheritance potential and may complicate debt consolidation strategies.

Standby Reverse Mortgage

Standby reverse mortgage offers homeowners aged 62 and older the option to access home equity as a safety net without monthly repayments, making it an effective debt management tool alongside or alternative to traditional refinance mortgages. Unlike refinance mortgages that replace existing loans and require monthly payments, standby reverse mortgages provide financial flexibility by allowing funds to be drawn only when needed, preserving credit lines and reducing immediate financial burdens.

Refinance Mortgage vs Reverse Mortgage for debt management. Infographic

moneydiff.com

moneydiff.com