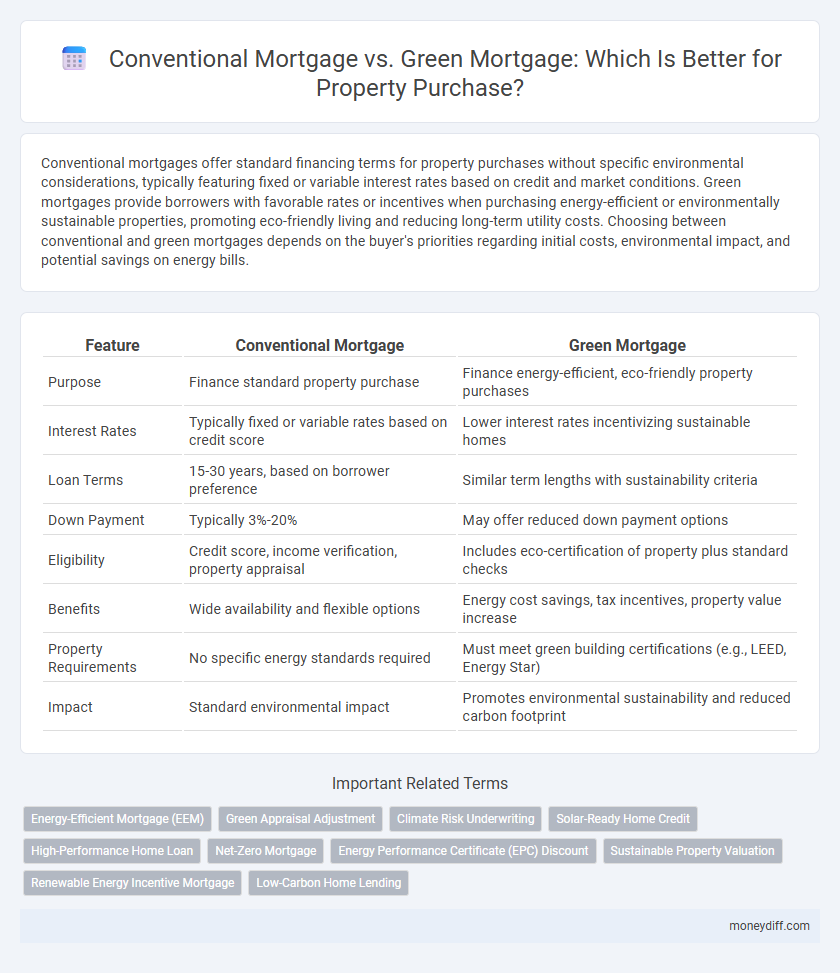

Conventional mortgages offer standard financing terms for property purchases without specific environmental considerations, typically featuring fixed or variable interest rates based on credit and market conditions. Green mortgages provide borrowers with favorable rates or incentives when purchasing energy-efficient or environmentally sustainable properties, promoting eco-friendly living and reducing long-term utility costs. Choosing between conventional and green mortgages depends on the buyer's priorities regarding initial costs, environmental impact, and potential savings on energy bills.

Table of Comparison

| Feature | Conventional Mortgage | Green Mortgage |

|---|---|---|

| Purpose | Finance standard property purchase | Finance energy-efficient, eco-friendly property purchases |

| Interest Rates | Typically fixed or variable rates based on credit score | Lower interest rates incentivizing sustainable homes |

| Loan Terms | 15-30 years, based on borrower preference | Similar term lengths with sustainability criteria |

| Down Payment | Typically 3%-20% | May offer reduced down payment options |

| Eligibility | Credit score, income verification, property appraisal | Includes eco-certification of property plus standard checks |

| Benefits | Wide availability and flexible options | Energy cost savings, tax incentives, property value increase |

| Property Requirements | No specific energy standards required | Must meet green building certifications (e.g., LEED, Energy Star) |

| Impact | Standard environmental impact | Promotes environmental sustainability and reduced carbon footprint |

Understanding Conventional vs Green Mortgages: An Overview

Conventional mortgages typically offer fixed or adjustable interest rates without specific environmental conditions, making them suitable for a wide range of property types and buyer profiles. Green mortgages incentivize energy-efficient homes by providing lower interest rates or additional funds for sustainable improvements, promoting reduced utility costs and environmental impact. Comparing both options involves evaluating long-term savings from energy efficiency against the broader accessibility and familiarity of conventional mortgage products.

Key Differences Between Conventional and Green Mortgages

Conventional mortgages typically offer fixed or adjustable interest rates based on creditworthiness and market factors, while green mortgages provide lower interest rates or incentives for energy-efficient properties. Eligibility for green mortgages often requires proof of certified energy-saving features or improvements, contrasting with conventional loans that focus primarily on borrower financials. Furthermore, green mortgages can lead to long-term savings through reduced utility costs, whereas conventional mortgages do not directly impact property operating expenses.

Eligibility Requirements for Each Mortgage Type

Conventional mortgage eligibility typically requires a minimum credit score of 620, stable income verification, and a down payment ranging from 3% to 20%. Green mortgages often demand additional criteria such as proof of energy-efficient upgrades or certification under programs like Energy Star, alongside standard credit and income checks. Borrowers must also demonstrate that the property meets specific environmental standards to qualify for green mortgage incentives.

Interest Rates: Conventional vs Green Mortgages

Green mortgages typically offer lower interest rates compared to conventional mortgages, incentivizing energy-efficient property purchases. Conventional mortgage interest rates are generally higher due to the lack of incentives tied to environmental performance. Borrowers opting for green mortgages benefit from reduced financing costs aligned with sustainable building practices.

Down Payment and Loan Terms: What to Expect

Conventional mortgages typically require a down payment of 5% to 20% and offer fixed or adjustable loan terms ranging from 15 to 30 years. Green mortgages often feature lower down payment requirements, sometimes as low as 3%, and may provide favorable loan terms or interest rates to incentivize energy-efficient property purchases. Borrowers should compare these options based on their financial goals and the potential long-term savings associated with green home improvements.

Energy Efficiency Standards in Green Mortgages

Green Mortgages prioritize properties that meet strict energy efficiency standards, often requiring energy performance certifications or upgrades to sustainable materials and systems. Conventional Mortgages typically do not factor energy efficiency into their approval criteria or interest rates, focusing primarily on creditworthiness and property value. Energy-efficient homes financed through Green Mortgages can benefit from lower interest rates and potential tax incentives, reflecting reduced environmental impact and long-term cost savings.

Costs and Fees Comparison: Conventional and Green Options

Conventional mortgages often incur higher closing costs and fees due to extensive credit checks, underwriting, and property appraisal processes, typically ranging from 2% to 5% of the loan amount. Green mortgages, designed to finance energy-efficient properties or improvements, may offer lower interest rates, reduced fees, or incentives like discounted appraisal costs, offsetting upfront expenses with long-term savings on utilities. Borrowers should analyze both loan estimates carefully to evaluate total costs, including possible tax credits or rebates associated with green mortgage programs.

Long-Term Savings and ROI: Which Mortgage Wins?

Conventional mortgages often offer stable interest rates and predictable payments, making them a reliable choice for long-term financial planning. Green mortgages provide added benefits through energy-efficient property incentives, which can lead to significant utility savings and increased property value over time. Evaluating ROI, green mortgages tend to outperform conventional options by reducing operational costs and boosting resale appeal, ultimately delivering greater long-term savings.

Sustainability Impact: Evaluating Green Mortgages

Green mortgages promote sustainability by offering lower interest rates for energy-efficient homes, encouraging reduced carbon footprints and lower utility costs. Conventional mortgages lack specific incentives tied to environmental performance or energy-saving measures, focusing mainly on creditworthiness and loan terms. Evaluating green mortgages involves assessing long-term savings, environmental benefits, and contributions to reducing housing's overall ecological impact.

Choosing the Right Mortgage for Your Property Purchase

Choosing the right mortgage for your property purchase involves comparing a conventional mortgage, which offers flexible terms and broad lender accessibility, with a green mortgage designed to finance energy-efficient homes or environmentally friendly upgrades. Conventional mortgages typically have standard interest rates and down payment requirements, while green mortgages may provide lower rates, incentives, or longer repayment terms to encourage sustainable, energy-saving investments. Evaluating factors like your property's energy efficiency, eligibility for green programs, and long-term financial goals will help determine the best mortgage option to maximize savings and enhance property value.

Related Important Terms

Energy-Efficient Mortgage (EEM)

Energy-Efficient Mortgages (EEM) offer borrowers the ability to finance energy-saving improvements as part of their home purchase or refinancing, often resulting in lower utility costs and increased property value compared to conventional mortgages. These specialized loans encourage sustainable housing by incorporating energy-efficient features, providing financial incentives such as reduced interest rates or higher loan limits to support eco-friendly investments.

Green Appraisal Adjustment

Green Appraisal Adjustment enhances property value in Green Mortgages by incorporating energy-efficient features and sustainable improvements, often resulting in higher appraisal values compared to Conventional Mortgages. This adjustment supports qualified buyers in securing better loan terms and encourages investment in environmentally friendly properties.

Climate Risk Underwriting

Conventional mortgages typically assess climate risk through standard property insurance requirements, while green mortgages incorporate comprehensive climate risk underwriting that evaluates a property's energy efficiency and exposure to environmental hazards. Lenders offering green mortgages often provide better loan terms and incentives to properties with lower carbon footprints and resilience against climate change impacts.

Solar-Ready Home Credit

Conventional mortgages typically offer standard financing without incentives for energy efficiency, whereas green mortgages provide benefits like the Solar-Ready Home Credit, which reduces upfront costs by supporting homes equipped for solar panel installation. This credit encourages sustainable property purchases by lowering mortgage expenses and promoting renewable energy adoption.

High-Performance Home Loan

High-Performance Home Loans, a type of green mortgage, offer lower interest rates and reduced fees to incentivize energy-efficient property purchases compared to conventional mortgages, which focus primarily on creditworthiness and down payment requirements. Borrowers benefit from cost savings on utilities and increased property value by choosing these sustainable financing options designed to support eco-friendly home improvements.

Net-Zero Mortgage

Net-Zero Mortgages incentivize energy-efficient home purchases by offering lower interest rates and reduced down payments compared to Conventional Mortgages, promoting sustainable property investments. These green financing options require homes to meet strict energy performance standards, significantly reducing carbon emissions and long-term utility costs for homeowners.

Energy Performance Certificate (EPC) Discount

Green mortgages offer lower interest rates or discounts tied to Energy Performance Certificate (EPC) ratings, encouraging buyers to choose energy-efficient properties, while conventional mortgages typically lack these energy-based incentives. Borrowers with high EPC-rated homes benefit from reduced borrowing costs in green mortgage schemes, promoting sustainable property purchases.

Sustainable Property Valuation

Conventional mortgages typically focus on traditional property assessments without considering energy efficiency or environmental impact, whereas green mortgages prioritize sustainable property valuation by incorporating factors like energy savings, reduced carbon footprint, and eco-friendly building materials. This approach often results in lower interest rates and increased property value for energy-efficient homes, reflecting a growing market preference for sustainability in real estate investments.

Renewable Energy Incentive Mortgage

Conventional mortgages typically require standard qualification criteria and offer fixed or variable interest rates without specific incentives for energy-efficient properties. Green mortgages, particularly Renewable Energy Incentive Mortgages, provide lower interest rates or down payment benefits to buyers investing in properties with renewable energy features, promoting sustainability and long-term energy cost savings.

Low-Carbon Home Lending

Conventional mortgages typically offer standard loan terms for property purchases without specific environmental considerations, while green mortgages provide financial incentives such as lower interest rates or down payment reductions for energy-efficient, low-carbon homes. Low-carbon home lending supports sustainable real estate by encouraging investments in properties that reduce carbon footprints through renewable energy integrations and eco-friendly building materials.

Conventional Mortgage vs Green Mortgage for property purchase. Infographic

moneydiff.com

moneydiff.com