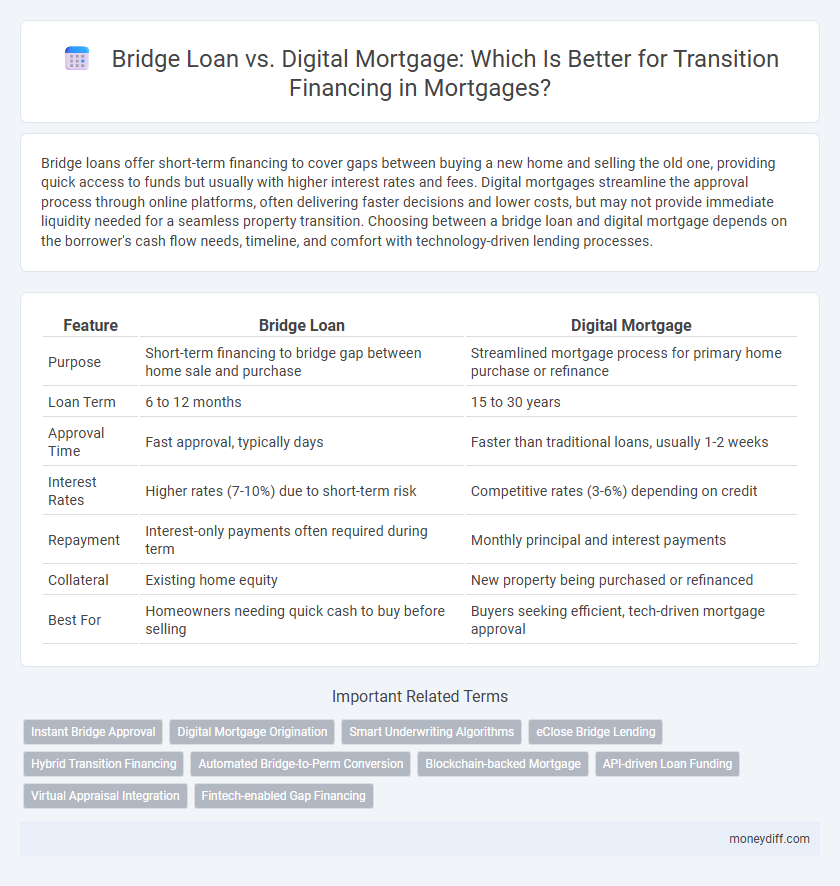

Bridge loans offer short-term financing to cover gaps between buying a new home and selling the old one, providing quick access to funds but usually with higher interest rates and fees. Digital mortgages streamline the approval process through online platforms, often delivering faster decisions and lower costs, but may not provide immediate liquidity needed for a seamless property transition. Choosing between a bridge loan and digital mortgage depends on the borrower's cash flow needs, timeline, and comfort with technology-driven lending processes.

Table of Comparison

| Feature | Bridge Loan | Digital Mortgage |

|---|---|---|

| Purpose | Short-term financing to bridge gap between home sale and purchase | Streamlined mortgage process for primary home purchase or refinance |

| Loan Term | 6 to 12 months | 15 to 30 years |

| Approval Time | Fast approval, typically days | Faster than traditional loans, usually 1-2 weeks |

| Interest Rates | Higher rates (7-10%) due to short-term risk | Competitive rates (3-6%) depending on credit |

| Repayment | Interest-only payments often required during term | Monthly principal and interest payments |

| Collateral | Existing home equity | New property being purchased or refinanced |

| Best For | Homeowners needing quick cash to buy before selling | Buyers seeking efficient, tech-driven mortgage approval |

Understanding Bridge Loans: Key Features and Benefits

Bridge loans provide short-term financing designed to bridge the gap between purchasing a new home and selling your existing property, often featuring higher interest rates and shorter repayment periods. These loans offer quick access to funds that can help cover down payments or closing costs during transitional periods. Borrowers benefit from flexibility and speed, enabling smoother home transitions without waiting for the sale of their current home.

What Is a Digital Mortgage? An Innovative Financing Solution

A digital mortgage simplifies the home financing process by leveraging online platforms to streamline applications, approvals, and document management, reducing the traditionally lengthy timeline. Unlike bridge loans, which provide short-term funding to cover gaps between property transactions, digital mortgages offer end-to-end automation that enhances transparency and speeds up closing. This innovative solution utilizes data analytics and electronic verification, making it especially suitable for borrowers seeking a fast, efficient transition without the complexity and cost of temporary loans.

Comparing Eligibility: Bridge Loan vs Digital Mortgage

Bridge loans typically require strong existing home equity and a solid credit score, making them ideal for homeowners needing short-term financing during property transitions. Digital mortgages often offer more accessible eligibility criteria, leveraging automated credit assessments and reducing documentation, which benefits tech-savvy borrowers seeking quicker approvals. Both options depend on borrower creditworthiness, but digital mortgages may accommodate a broader range of financial profiles due to streamlined underwriting processes.

Application Process: Traditional Bridge Loan vs Digital Mortgage

The application process for a traditional bridge loan involves extensive paperwork, multiple credit checks, and approval timelines that can span several weeks, often requiring in-person meetings and physical document submissions. In contrast, a digital mortgage streamlines the process through automated credit assessments, electronic documentation, and online platforms that enable faster approval, sometimes within days. This efficiency reduces friction for borrowers seeking transition financing, making digital mortgages a more convenient alternative to the labor-intensive procedures associated with bridge loans.

Speed and Convenience: Which Option Moves Faster?

Bridge loans offer rapid access to funds with minimal documentation, enabling homebuyers to quickly secure financing during property transitions. Digital mortgages leverage automated processes and online platforms to expedite approval and underwriting, often reducing closing times compared to traditional loans. While bridge loans provide immediate liquidity for short-term needs, digital mortgages enhance convenience and speed through streamlined digital workflows for a smoother transition.

Interest Rates and Costs: Bridge Loan vs Digital Mortgage

Bridge loans typically carry higher interest rates, often ranging from 6% to 12%, due to their short-term, riskier nature, resulting in increased overall costs including origination fees and closing expenses. Digital mortgages generally offer lower interest rates around 3% to 5%, benefiting from streamlined approval processes and reduced administrative costs that translate into lower fees for borrowers. Evaluating these financial factors is crucial for homeowners seeking cost-efficient transition financing during property purchases.

Risk Assessment: Pros and Cons of Each Transition Financing Option

Bridge loans provide quick access to funds during property transitions but carry higher interest rates and risk due to short repayment periods. Digital mortgages streamline application and approval processes with data-driven risk assessments, offering lower costs but potentially longer closing times depending on technology integration. Evaluating credit score impact, interest rates, and repayment flexibility is crucial in choosing between the higher-risk bridge loan and the more transparent yet tech-dependent digital mortgage options.

Best Use Cases: When to Choose a Bridge Loan or Digital Mortgage

Bridge loans are best used for short-term financing gaps when buyers need to quickly purchase a new home before selling their existing property, offering quick access to funds but higher interest rates. Digital mortgages suit those seeking a streamlined, fully online application process for refinancing or purchasing, ideal for borrowers with strong credit and stable incomes seeking convenience and competitive rates. Choosing between them depends on the urgency of funds, duration of financing needed, and the borrower's preference for speed versus cost efficiency.

Impact on Credit and Financial Health

Bridge loans typically have a short-term impact on credit scores due to immediate hard inquiries and increased debt utilization, potentially lowering creditworthiness temporarily. Digital mortgages, by streamlining application and approval processes, minimize multiple credit checks and provide clearer financial disclosures, leading to less disruption in credit health. Borrowers using digital mortgage platforms often maintain stronger credit profiles during the transition, optimizing long-term financial stability.

Making the Right Choice: Factors to Consider for Transition Financing

Evaluating bridge loans versus digital mortgages for transition financing involves assessing factors such as loan duration, interest rates, and approval speed. Bridge loans offer short-term funding to quickly cover gaps between property sales and purchases, but typically come with higher interest rates and fees. Digital mortgages streamline approval processes with automated underwriting and faster turnaround, potentially reducing costs and making them ideal for borrowers seeking efficiency and flexibility.

Related Important Terms

Instant Bridge Approval

Bridge loans provide quick, temporary financing to bridge the gap between buying a new home and selling the existing one, often offering instant approval for urgent transitions. Digital mortgages streamline the entire loan process with automated underwriting and real-time data verification, but instant approval for bridge loans remains a key advantage for homeowners needing fast, flexible funding during property transitions.

Digital Mortgage Origination

Digital mortgage origination streamlines transition financing by enabling faster approval processes, reduced paperwork, and enhanced borrower experience compared to traditional bridge loans. Leveraging AI-driven verification and automated underwriting systems, digital mortgages offer lower costs and increased transparency for homeowners navigating property closings.

Smart Underwriting Algorithms

Smart underwriting algorithms in digital mortgages accelerate approval times and enhance accuracy by analyzing vast data points, whereas bridge loans rely on traditional credit assessments with longer processing durations. The efficiency of AI-driven digital mortgage platforms reduces risk and improves borrower experience during transition financing compared to conventional bridge loan methods.

eClose Bridge Lending

eClose Bridge Lending offers a seamless, fast digital mortgage solution ideal for transition financing, combining the agility of bridge loans with streamlined eClosing technology to accelerate home purchases. This integration reduces closing times and enhances borrower experience by providing immediate funds while leveraging secure digital processes.

Hybrid Transition Financing

Hybrid transition financing combines the speed and flexibility of a bridge loan with the efficiency and lower cost of a digital mortgage, enabling borrowers to secure immediate funds for purchasing a new property while simultaneously processing a long-term mortgage approval digitally. This approach minimizes financial risk during property transitions by leveraging real-time digital underwriting alongside short-term loan liquidity.

Automated Bridge-to-Perm Conversion

Automated bridge-to-perm conversion streamlines transition financing by instantly converting a short-term bridge loan into a permanent digital mortgage, reducing paperwork and approval times. This technology-driven approach enhances cash flow management for borrowers, enabling seamless property purchases without financing gaps.

Blockchain-backed Mortgage

Blockchain-backed mortgages provide enhanced security and transparency in digital mortgage transactions, reducing fraud risks and accelerating approval processes compared to traditional bridge loans. Transition financing benefits from blockchain's immutable ledger, enabling seamless verification and efficient fund disbursement during property closing phases.

API-driven Loan Funding

API-driven loan funding accelerates bridge loan processing by enabling real-time data exchange between lenders and borrowers, facilitating quicker access to interim financing during property transitions. Digital mortgages leverage API integrations to streamline underwriting, verification, and disbursement, reducing closing times and enhancing efficiency in securing long-term financing compared to traditional bridge loans.

Virtual Appraisal Integration

Bridge loans offer quick, short-term financing but often require traditional appraisals, whereas digital mortgages leverage virtual appraisal integration, enabling faster property valuations through AI-driven analytics and remote inspections. This technology reduces delays in transition financing by streamlining appraisal accuracy and accelerating loan approval timelines.

Fintech-enabled Gap Financing

Fintech-enabled gap financing through digital mortgages offers streamlined approval and fund disbursement compared to traditional bridge loans, reducing transition time between property sales and purchases. Digital mortgage platforms leverage automation and real-time data integration, providing borrowers with enhanced transparency and lower interest rates for short-term financing needs.

Bridge Loan vs Digital Mortgage for transition financing. Infographic

moneydiff.com

moneydiff.com