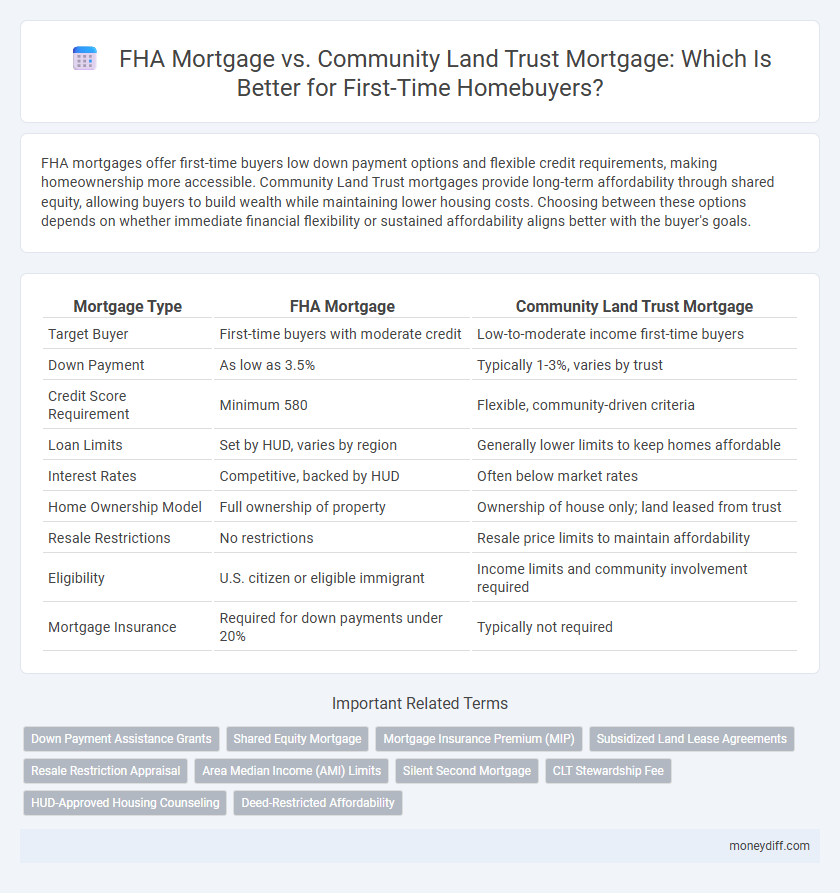

FHA mortgages offer first-time buyers low down payment options and flexible credit requirements, making homeownership more accessible. Community Land Trust mortgages provide long-term affordability through shared equity, allowing buyers to build wealth while maintaining lower housing costs. Choosing between these options depends on whether immediate financial flexibility or sustained affordability aligns better with the buyer's goals.

Table of Comparison

| Mortgage Type | FHA Mortgage | Community Land Trust Mortgage |

|---|---|---|

| Target Buyer | First-time buyers with moderate credit | Low-to-moderate income first-time buyers |

| Down Payment | As low as 3.5% | Typically 1-3%, varies by trust |

| Credit Score Requirement | Minimum 580 | Flexible, community-driven criteria |

| Loan Limits | Set by HUD, varies by region | Generally lower limits to keep homes affordable |

| Interest Rates | Competitive, backed by HUD | Often below market rates |

| Home Ownership Model | Full ownership of property | Ownership of house only; land leased from trust |

| Resale Restrictions | No restrictions | Resale price limits to maintain affordability |

| Eligibility | U.S. citizen or eligible immigrant | Income limits and community involvement required |

| Mortgage Insurance | Required for down payments under 20% | Typically not required |

Understanding FHA Mortgages for First-Time Buyers

FHA mortgages offer first-time buyers lower down payment requirements, typically 3.5%, and more flexible credit score criteria, making homeownership more accessible. These government-backed loans provide competitive interest rates and allow for higher debt-to-income ratios, benefiting buyers with limited savings or moderate credit history. Understanding FHA mortgage options helps first-time buyers compare them effectively against alternatives like Community Land Trust mortgages, which focus on long-term affordability and shared equity models.

What Is a Community Land Trust (CLT) Mortgage?

A Community Land Trust (CLT) mortgage is designed to help first-time buyers purchase homes on land owned and managed by a nonprofit organization, ensuring long-term affordability and community control. Unlike FHA mortgages that provide federal insurance to lenders for conventional home loans, CLT mortgages typically involve shared equity agreements, limiting resale prices to keep homes affordable for future buyers. This model reduces upfront costs and stabilizes housing markets by separating land ownership from home ownership, making it an attractive alternative for buyers seeking sustainable homeownership options.

Key Differences: FHA vs CLT Mortgages

FHA mortgages offer government-insured loans with lower down payment requirements and standardized credit criteria, making them accessible for first-time buyers with limited savings. Community Land Trust (CLT) mortgages involve purchasing only the home while the land is leased, significantly lowering upfront costs and ensuring long-term affordability through resale restrictions. Unlike FHA loans, CLT mortgages emphasize community control and preservation of affordable housing rather than loan insurance or federal backing.

Eligibility Requirements: FHA Mortgage vs CLT Mortgage

FHA mortgages require a minimum credit score of 580 and a 3.5% down payment, making them accessible for first-time buyers with moderate credit and savings. Community Land Trust (CLT) mortgages prioritize income eligibility and residency in the trust's designated area, often requiring buyers to meet local affordability criteria and commit to long-term homeownership. Both options support first-time buyers but differ significantly in eligibility focus: FHA emphasizes credit and down payment, while CLT centers on income limits and community involvement.

Down Payment and Closing Costs Compared

FHA mortgages typically require a minimum down payment of 3.5%, making them accessible for many first-time buyers, while closing costs can vary but often range between 2% to 5% of the loan amount. Community Land Trust (CLT) mortgages generally offer lower down payment requirements, sometimes as low as 1% or deferred until sale, and significantly reduced closing costs due to nonprofit partnerships and shared equity models. First-time buyers seeking lower upfront expenses may benefit from CLT mortgages, but FHA loans provide more standardized federal backing and broader lender acceptance.

Long-Term Affordability and Equity Building

FHA mortgages offer lower down payments and flexible credit requirements, making them accessible for first-time buyers but often with higher monthly mortgage insurance premiums that can impact long-term affordability. Community Land Trust mortgages provide sustained affordability by separating land ownership from housing, enabling buyers to build equity while ensuring lower resale prices to future low- and moderate-income families. First-time buyers focused on long-term equity and community stability may benefit more from Community Land Trust mortgages due to their shared equity model and protection against market volatility.

Mortgage Insurance: FHA vs CLT Explained

FHA mortgages require upfront and annual mortgage insurance premiums (MIP), which protect lenders but increase borrower costs regardless of down payment size. Community Land Trust (CLT) mortgages often have lower or no mortgage insurance because the land trust's shared ownership model reduces lender risk and promotes affordability. First-time buyers benefit from CLT mortgages by avoiding the added expense of MIP, making homeownership more accessible compared to traditional FHA loans.

Resale Restrictions and Homeownership Rights

FHA Mortgages allow first-time buyers full homeownership rights with the ability to sell or refinance without restrictions, providing greater flexibility in property use. In contrast, Community Land Trust Mortgages impose resale restrictions to maintain long-term affordability, limiting profit from home resale but ensuring continued access to affordable housing. These resale restrictions prioritize community stability and equity, impacting the homeowner's control compared to traditional FHA loans.

Which Option Offers Greater Flexibility?

FHA mortgages provide first-time buyers with flexible credit and income requirements, allowing for lower down payments and easier qualification compared to conventional loans. Community Land Trust (CLT) mortgages offer long-term affordability through shared equity models but may come with restrictions on resale and property modifications. The FHA option generally allows greater flexibility in terms of financial qualifications and property use, while CLTs prioritize community stability and price control over broad flexibility.

Making the Best Choice: FHA or CLT for First-Time Buyers

First-time homebuyers should evaluate FHA mortgages and Community Land Trust (CLT) mortgages by comparing down payment requirements, eligibility criteria, and long-term affordability. FHA loans offer low down payments and government-backed insurance, making them accessible to buyers with lower credit scores, while CLT mortgages focus on shared equity and preserving affordability through land ownership separation. Selecting the best option depends on financial readiness, creditworthiness, and the buyer's preference for homeownership stability versus potential equity growth.

Related Important Terms

Down Payment Assistance Grants

FHA mortgages offer first-time buyers low down payment requirements and access to down payment assistance grants that reduce upfront costs, making homeownership more attainable. Community Land Trust mortgages often pair with local down payment assistance programs that provide grants or forgivable loans, helping buyers secure affordable homes while maintaining long-term community affordability standards.

Shared Equity Mortgage

FHA mortgages offer low down payments and flexible credit requirements, making them accessible to many first-time buyers, while Community Land Trust (CLT) mortgages emphasize shared equity, allowing buyers to purchase homes at below-market prices with the trust retaining ownership of the land. Shared equity mortgages under CLTs limit resale profits, preserving long-term affordability and promoting community stability for low- to moderate-income families.

Mortgage Insurance Premium (MIP)

FHA mortgages require the payment of an upfront and annual Mortgage Insurance Premium (MIP) to protect lenders from default risk, which can increase overall loan costs for first-time buyers. In contrast, Community Land Trust mortgages typically avoid MIP fees, offering more affordable monthly payments by separating land ownership from the home loan, making them a cost-effective alternative for first-time homebuyers.

Subsidized Land Lease Agreements

FHA mortgages offer low down payment options for first-time buyers, while Community Land Trust (CLT) mortgages provide long-term affordability through subsidized land lease agreements that separate land ownership from home ownership. Subsidized land lease agreements in CLTs reduce upfront costs and monthly payments, promoting sustainable homeownership in high-cost markets.

Resale Restriction Appraisal

FHA mortgages offer flexible appraisal guidelines but lack resale restrictions, allowing first-time buyers more freedom in property resale, while Community Land Trust mortgages impose resale restrictions that stabilize community equity but may limit appraisal value growth. Resale restriction appraisals in Community Land Trusts focus on maintaining affordable housing through controlled price appreciation, contrasting with the market-driven appraisals typical in FHA loans.

Area Median Income (AMI) Limits

FHA mortgages provide first-time buyers with lower down payment options but often have broader eligibility criteria compared to Community Land Trust mortgages, which restrict eligibility based on Area Median Income (AMI) Limits to ensure affordability for low-to-moderate income households. Community Land Trust mortgages typically limit buyers to incomes below 80-120% of the AMI, aligning with local affordability goals, while FHA loans do not impose direct AMI restrictions but adhere to general underwriting standards.

Silent Second Mortgage

FHA mortgages offer first-time buyers low down payments and government-backed insurance, while Community Land Trust mortgages often include a Silent Second Mortgage that provides additional funding without immediate repayment, reducing upfront costs and monthly payments. Silent Second Mortgages in Community Land Trust programs enable buyers to secure affordable homeownership by covering down payments or closing costs, making them a valuable option for low to moderate-income families.

CLT Stewardship Fee

Community Land Trust (CLT) mortgages typically include a stewardship fee that supports ongoing property management and community programs, making homeownership more affordable for first-time buyers compared to FHA mortgages, which primarily focus on low down payments and government insurance. This stewardship fee is a unique feature of CLT mortgages, helping maintain long-term affordability and community stability beyond the initial purchase.

HUD-Approved Housing Counseling

FHA Mortgages offer government-backed financing with lower down payment requirements, while Community Land Trust Mortgages provide affordable homeownership through shared equity models. HUD-approved housing counseling guides first-time buyers in both programs, ensuring understanding of loan terms and long-term affordability.

Deed-Restricted Affordability

FHA mortgages offer government-backed loans with lower down payments and flexible credit requirements, making homeownership accessible for first-time buyers, while Community Land Trust (CLT) mortgages emphasize deed-restricted affordability to maintain long-term housing stability by separating land ownership from home ownership. Deed restrictions in CLTs ensure that homes remain affordable by limiting resale prices and preserving community control, contrasting with FHA loans' focus on individual borrower eligibility and market-driven home values.

FHA Mortgage vs Community Land Trust Mortgage for first-time buyers. Infographic

moneydiff.com

moneydiff.com