A Fixed Rate Mortgage offers predictable monthly payments with a constant interest rate throughout the loan term, providing stability for homebuyers. Shared Appreciation Mortgages allow lenders to share in the home's value appreciation, often resulting in lower initial interest rates but potentially higher costs if the property's value increases significantly. Choosing between these options depends on your financial goals and risk tolerance when buying a home.

Table of Comparison

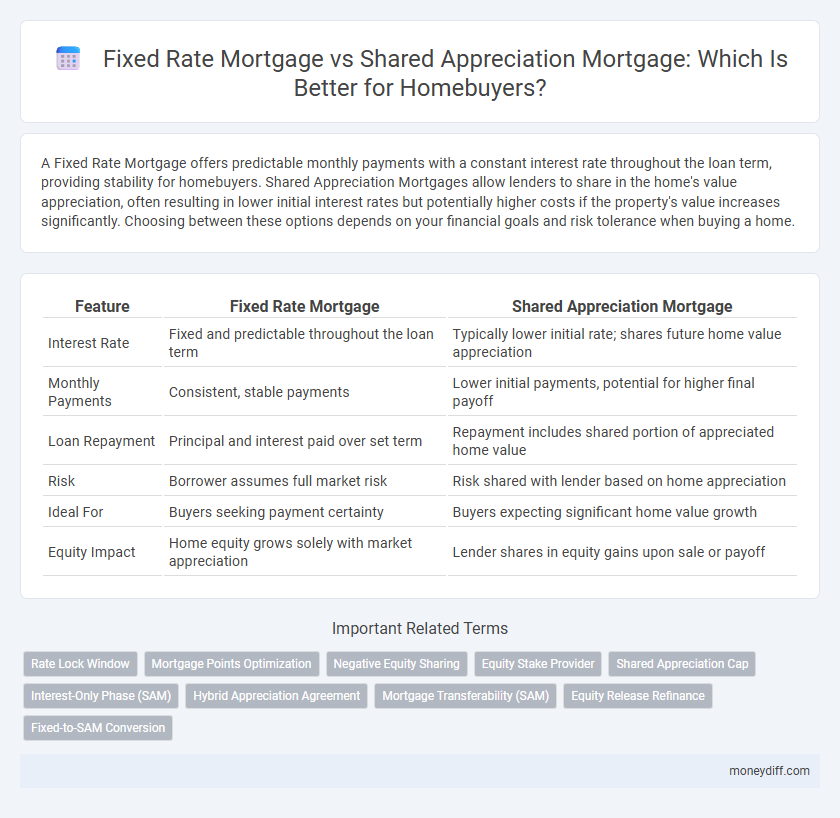

| Feature | Fixed Rate Mortgage | Shared Appreciation Mortgage |

|---|---|---|

| Interest Rate | Fixed and predictable throughout the loan term | Typically lower initial rate; shares future home value appreciation |

| Monthly Payments | Consistent, stable payments | Lower initial payments, potential for higher final payoff |

| Loan Repayment | Principal and interest paid over set term | Repayment includes shared portion of appreciated home value |

| Risk | Borrower assumes full market risk | Risk shared with lender based on home appreciation |

| Ideal For | Buyers seeking payment certainty | Buyers expecting significant home value growth |

| Equity Impact | Home equity grows solely with market appreciation | Lender shares in equity gains upon sale or payoff |

Fixed Rate Mortgage vs Shared Appreciation Mortgage: Overview

Fixed rate mortgages offer predictable monthly payments by locking in a constant interest rate over the loan term, providing stability for homebuyers. Shared appreciation mortgages involve the lender sharing a percentage of the home's future appreciation, potentially reducing upfront costs but introducing variable outcomes based on market value changes. Choosing between these options depends on factors like risk tolerance, financial goals, and expectations of real estate market trends.

Understanding Fixed Rate Mortgages: Pros and Cons

Fixed rate mortgages provide homeowners with a stable interest rate and predictable monthly payments over the loan term, typically 15 to 30 years, which aids in long-term financial planning. The main advantage is protection against rising interest rates, while the primary disadvantage lies in potentially higher initial rates compared to adjustable options, limiting flexibility if home values appreciate significantly. Borrowers must weigh the certainty of fixed payments against the opportunity cost of sharing home equity gains in alternative models like shared appreciation mortgages.

What is a Shared Appreciation Mortgage?

A Shared Appreciation Mortgage (SAM) is a loan where the lender offers a below-market interest rate in exchange for a percentage of the property's future appreciation upon sale or maturity. Unlike a Fixed Rate Mortgage, which has a consistent interest rate over the loan term, a SAM links repayment to the home's market value increase, potentially reducing monthly payments initially. This option is beneficial for buyers expecting significant home value appreciation but willing to share profits with the lender.

Interest Rate Stability: Fixed vs Shared Appreciation

Fixed rate mortgages offer consistent monthly payments with a locked-in interest rate throughout the loan term, providing borrowers with predictable budgeting and protection against market fluctuations. Shared appreciation mortgages, in contrast, typically feature lower initial interest rates but require homeowners to share a portion of the home's future appreciation with the lender, introducing variability in overall costs. Borrowers prioritizing long-term interest rate stability often favor fixed rate mortgages, while those willing to trade potential future equity for lower initial rates may consider shared appreciation options.

Upfront Costs and Affordability Comparison

Fixed rate mortgages typically require higher upfront costs, including down payments and closing fees, but offer predictable monthly payments that aid long-term budgeting. Shared appreciation mortgages often present lower initial expenses by reducing or eliminating down payments, making them more accessible for buyers with limited savings. However, shared appreciation loans involve giving a percentage of future home equity to the lender, which can impact overall affordability depending on property value appreciation.

Monthly Payment Predictability: Fixed Rate vs Shared Appreciation

Fixed rate mortgages offer consistent monthly payments based on a fixed interest rate, providing borrowers with financial stability and easier budgeting throughout the loan term. Shared appreciation mortgages typically have lower initial payments but involve variable amounts tied to the property's future value, making monthly costs less predictable. Understanding the trade-off between fixed payment stability and potential future equity sharing is crucial when choosing the right mortgage for home buying.

Long-Term Financial Implications

Fixed rate mortgages provide predictable monthly payments and stable interest rates over the loan term, aiding long-term budgeting and protecting against rising market rates. Shared appreciation mortgages often lower initial interest costs but require sharing a portion of future property appreciation, which can increase overall expenses if home values rise significantly. Evaluating potential property value trends and personal financial goals is crucial to determining which mortgage type offers the best long-term financial advantage.

Home Equity Growth and Shared Appreciation Impact

Fixed rate mortgages offer predictable monthly payments and allow homeowners to build equity steadily as principal is paid down, fostering stable home equity growth over time. Shared appreciation mortgages (SAMs) enable buyers to reduce initial payments by sharing future home value appreciation with the lender, which can limit the homeowner's equity growth potential upon sale or refinancing. Choosing between these options depends on balancing upfront affordability against long-term equity retention and the impact of shared appreciation on net home investment returns.

Suitability for First-Time Homebuyers

Fixed Rate Mortgages offer first-time homebuyers predictable monthly payments and long-term stability, making them ideal for those with a steady income and clear budgeting goals. Shared Appreciation Mortgages can be suitable for buyers expecting home value appreciation, as they reduce initial costs by trading future equity, but they carry risks if the market underperforms or values fluctuate. Understanding financial goals and risk tolerance helps first-time buyers choose between the certainty of fixed rates and the potential equity benefits of shared appreciation options.

Choosing the Right Mortgage for Your Situation

Fixed Rate Mortgages provide predictable monthly payments with stable interest rates, making them ideal for buyers seeking financial consistency and long-term planning. Shared Appreciation Mortgages allow lenders to share in home value gains, reducing initial costs but introducing variability tied to market appreciation. Evaluating your risk tolerance, financial goals, and market outlook is essential to selecting the mortgage type that aligns best with your homeownership strategy.

Related Important Terms

Rate Lock Window

Fixed Rate Mortgages provide a rate lock window typically lasting 30 to 60 days, ensuring a stable interest rate throughout the loan approval process and protecting borrowers from market fluctuations. Shared Appreciation Mortgages often lack a traditional rate lock window, as their interest rate depends on the property's future value appreciation, introducing variability and potential uncertainty during the home buying timeline.

Mortgage Points Optimization

Fixed Rate Mortgages offer predictable monthly payments with interest rates locked in, optimizing mortgage points by reducing long-term costs and simplifying financial planning. Shared Appreciation Mortgages optimize points differently by lowering upfront interest rates in exchange for a share of future property value gains, providing homebuyers with potential initial savings balanced against future equity risks.

Negative Equity Sharing

Fixed Rate Mortgages offer predictable monthly payments with no risk of negative equity sharing, whereas Shared Appreciation Mortgages expose homeowners to sharing a portion of home value decline with lenders, increasing financial risk if property prices fall. Negative equity sharing in Shared Appreciation Mortgages can lead to substantial additional costs upon sale, unlike the stability provided by fixed rates.

Equity Stake Provider

A Fixed Rate Mortgage offers predictable monthly payments with a set interest rate for the loan term, ensuring stability for homebuyers. In contrast, a Shared Appreciation Mortgage involves an equity stake provider who shares in the property's future appreciation, allowing lower initial payments but requiring a percentage of the home's increased value upon sale or refinancing.

Shared Appreciation Cap

Shared Appreciation Mortgages (SAMs) offer homebuyers lower initial interest rates by allowing lenders to share in the property's future appreciation, with a Shared Appreciation Cap limiting the maximum percentage of the home's value growth subject to repayment. This cap protects borrowers from excessive repayment amounts, balancing affordable monthly payments with potential equity sharing when the property is sold or refinanced.

Interest-Only Phase (SAM)

The Interest-Only Phase of a Shared Appreciation Mortgage (SAM) allows borrowers to pay only the interest for a set period, typically reducing initial monthly payments compared to a Fixed Rate Mortgage, where payments cover both principal and interest from the start. This phase in SAM can make home buying more affordable initially but may result in higher overall costs due to shared home appreciation upon sale or refinancing.

Hybrid Appreciation Agreement

A Hybrid Appreciation Agreement combines elements of Fixed Rate Mortgage and Shared Appreciation Mortgage, offering a stable interest rate with potential shared equity gains based on property appreciation. This mortgage type allows homebuyers to benefit from predictable monthly payments while sharing a portion of the home's increased value with the lender upon sale or refinancing.

Mortgage Transferability (SAM)

Shared Appreciation Mortgages (SAM) offer greater mortgage transferability compared to fixed rate mortgages, allowing borrowers to transfer their mortgage terms and equity share to a new property without penalty. This flexibility benefits homeowners planning to move, as SAM preserves equity growth potential while maintaining favorable loan conditions during relocation.

Equity Release Refinance

A Fixed Rate Mortgage offers predictable monthly payments with a constant interest rate, providing stability for long-term home financing, while a Shared Appreciation Mortgage (SAM) allows homeowners to reduce initial payments by sharing future home value appreciation with the lender, enabling equity release during refinancing without traditional monthly payment increases. Homebuyers leveraging equity release refinance with a SAM can tap into their property's future value growth, whereas those with Fixed Rate Mortgages maintain steady repayment schedules without equity dilution.

Fixed-to-SAM Conversion

Fixed-to-Shared Appreciation Mortgage (Fixed-to-SAM) conversion allows borrowers to start with the stability of a fixed-rate mortgage while retaining the option to switch to a shared appreciation mortgage later, potentially reducing monthly payments in exchange for a future stake in home value appreciation. This hybrid approach offers flexibility for homeowners anticipating changes in their financial situation or market conditions, balancing predictable payments with the opportunity to share equity gains.

Fixed Rate Mortgage vs Shared Appreciation Mortgage for home buying. Infographic

moneydiff.com

moneydiff.com