Origination fees are upfront charges by lenders covering the administrative costs of processing a mortgage, typically ranging from 0.5% to 1% of the loan amount. Zero closing cost mortgages eliminate these fees by incorporating them into a higher interest rate or rolling them into the loan balance, reducing immediate out-of-pocket expenses. Choosing between origination fees and zero closing costs depends on your long-term financial plans and how long you intend to keep the mortgage.

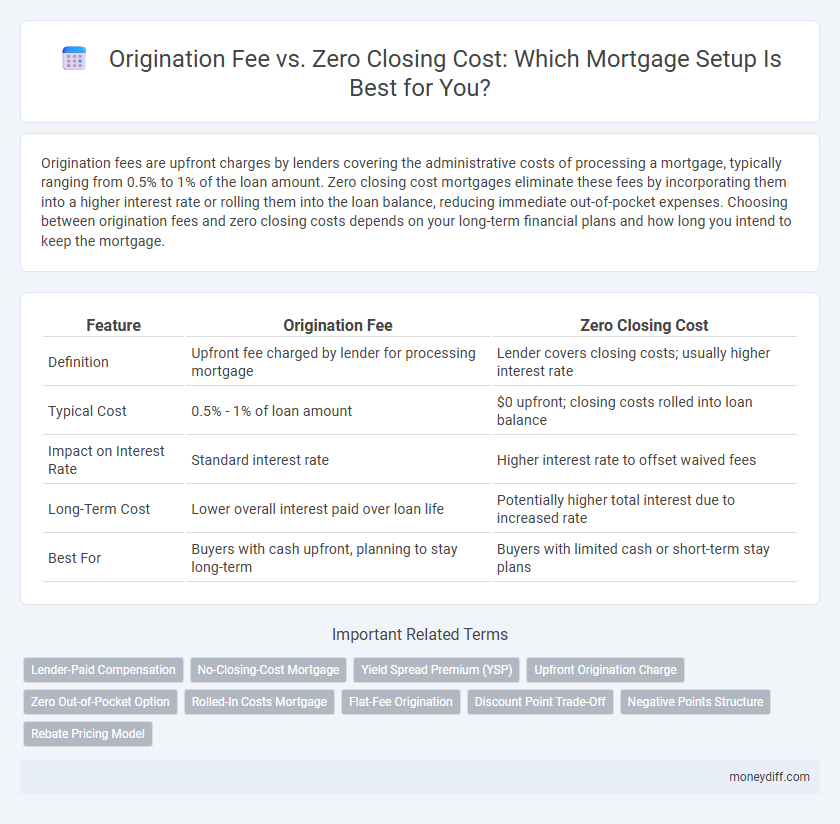

Table of Comparison

| Feature | Origination Fee | Zero Closing Cost |

|---|---|---|

| Definition | Upfront fee charged by lender for processing mortgage | Lender covers closing costs; usually higher interest rate |

| Typical Cost | 0.5% - 1% of loan amount | $0 upfront; closing costs rolled into loan balance |

| Impact on Interest Rate | Standard interest rate | Higher interest rate to offset waived fees |

| Long-Term Cost | Lower overall interest paid over loan life | Potentially higher total interest due to increased rate |

| Best For | Buyers with cash upfront, planning to stay long-term | Buyers with limited cash or short-term stay plans |

Understanding Origination Fees in Mortgages

Origination fees in mortgages are upfront charges paid to lenders for processing and underwriting a loan, typically ranging from 0.5% to 1% of the loan amount. These fees cover administrative costs such as credit checks, appraisals, and document preparation, directly impacting the borrower's initial expenses. Choosing between an origination fee and a zero closing cost mortgage often involves evaluating whether paying these upfront fees or accepting a higher interest rate over time aligns better with your financial goals.

What Are Zero Closing Cost Mortgages?

Zero closing cost mortgages eliminate upfront fees by incorporating origination costs into the loan's interest rate or principal balance, reducing initial out-of-pocket expenses. Borrowers benefit from lower immediate cash requirements yet may pay more over the loan term due to higher interest rates or rolled-in fees. This option suits buyers prioritizing cash flow at closing but requires careful comparison of long-term costs versus traditional origination fee mortgages.

Key Differences: Origination Fee vs Zero Closing Cost

Origination fees are upfront charges by lenders to process a mortgage application, typically ranging from 0.5% to 1% of the loan amount, while zero closing cost options roll these expenses into the loan balance or higher interest rates. Borrowers paying origination fees often benefit from lower interest rates, whereas zero closing cost mortgages reduce initial out-of-pocket expenses but may result in higher long-term costs. Understanding these differences helps homebuyers choose the best mortgage setup aligned with their financial goals and cash flow preferences.

How Origination Fees Impact Your Loan

Origination fees typically range from 0.5% to 1% of the loan amount and directly increase the upfront cost of your mortgage, affecting your initial cash outlay. Unlike zero closing cost mortgages, where fees are often rolled into the interest rate, paying origination fees upfront can lower your loan's interest rate and overall long-term cost. Understanding how these fees are structured helps borrowers balance immediate expenses against potential savings over the life of the loan.

The True Cost of “Zero Closing Cost” Offers

Zero closing cost mortgage offers often disguise higher interest rates or lender credits that inflate the overall loan cost, making the apparent savings misleading. Origination fees, typically ranging from 0.5% to 1% of the loan amount, are upfront charges that cover lender processing expenses and can result in lower interest rates compared to no-fee options. Borrowers should calculate the total cost over the loan term, comparing origination fees against increased interest payments to determine the true financial impact of zero closing cost deals.

Pros and Cons: Origination Fee vs No Closing Cost

Origination fees, typically 0.5% to 1% of the loan amount, provide lenders upfront compensation, often resulting in lower interest rates but higher initial costs for borrowers. Zero closing cost mortgages eliminate upfront fees by rolling those costs into a higher interest rate or loan balance, potentially increasing long-term expenses despite saving money at closing. Borrowers must weigh immediate financial capacity against total loan cost when choosing between an origination fee and zero closing cost mortgage options.

Long-Term Financial Effects of Both Options

Choosing a mortgage with an origination fee typically results in higher upfront costs but can lead to lower interest rates and reduced monthly payments over the loan term, potentially saving thousands in interest expenses. Zero closing cost mortgages eliminate initial fees by incorporating them into the loan balance or interest rate, which raises monthly payments and overall interest paid throughout the loan duration. Evaluating the long-term financial impact requires comparing total paid interest and principal under each option to determine which fits your financial goals and cash flow constraints.

Deciding Which Option Suits Your Budget

Origination fees typically range from 0.5% to 1% of the loan amount and cover lender processing costs, impacting upfront expenses in mortgage setup. Zero closing cost mortgages waive these fees by incorporating costs into higher interest rates or loan balances, affecting long-term payments. Evaluating your budget requires comparing immediate out-of-pocket costs against potential increased monthly payments to determine the most financially advantageous option.

Common Misconceptions About Closing Costs

Many borrowers mistakenly believe that zero closing cost mortgages eliminate all fees, but these costs are often incorporated into higher interest rates or loan amounts. The origination fee, typically ranging from 0.5% to 1% of the loan amount, covers lender expenses and is rarely waived without repercussions. Understanding that zero closing cost options may increase long-term payments helps buyers make informed decisions about mortgage financing.

Tips for Negotiating Mortgage Setup Fees

When negotiating mortgage setup fees, compare the origination fee, typically 0.5% to 1% of the loan amount, against zero closing cost options that may increase the interest rate over time. Request a detailed loan estimate to identify hidden fees and assess the long-term financial impact of both options. Highlight your strong credit score and market competitiveness to leverage better terms or reduced fees with lenders.

Related Important Terms

Lender-Paid Compensation

Origination fees are upfront payments charged by lenders to cover loan processing costs, while zero closing cost mortgages typically involve lender-paid compensation where the lender absorbs these fees in exchange for a higher interest rate. This trade-off affects overall loan affordability and long-term interest costs, making lender-paid compensation a key factor in comparing mortgage options.

No-Closing-Cost Mortgage

A No-Closing-Cost Mortgage eliminates upfront origination fees by incorporating these costs into the loan's interest rate, resulting in higher monthly payments but reduced initial expenses. This option benefits borrowers seeking to minimize out-of-pocket costs during mortgage setup while potentially paying more over the loan term.

Yield Spread Premium (YSP)

The origination fee represents the upfront cost charged by lenders to process a mortgage application, impacting the loan's overall expense, whereas zero closing cost mortgages often incorporate a Yield Spread Premium (YSP) paid to lenders by the mortgage broker, which can increase the interest rate to offset the waived fees. Understanding how YSP influences loan pricing is crucial for borrowers to accurately compare the true cost between paying an origination fee and choosing a zero closing cost mortgage option.

Upfront Origination Charge

The upfront origination charge is a fee lenders charge to cover the administrative costs of processing a mortgage application, typically ranging from 0.5% to 1% of the loan amount. Choosing a zero closing cost mortgage often means the origination fee is rolled into the loan balance or compensated by a higher interest rate, impacting overall loan affordability.

Zero Out-of-Pocket Option

Choosing a zero closing cost mortgage option eliminates upfront origination fees by rolling them into the loan balance or adjusting the interest rate, minimizing out-of-pocket expenses at closing. This approach benefits borrowers seeking to preserve cash flow, although it may result in higher monthly payments or increased total interest over the loan term.

Rolled-In Costs Mortgage

Rolled-in costs mortgage options incorporate origination fees directly into the loan balance, increasing the principal while reducing upfront cash requirements compared to zero closing cost mortgages that typically offer higher interest rates to offset waived fees. Borrowers choosing rolled-in costs benefit from lower initial expenses but may pay more in interest over time due to the increased loan amount.

Flat-Fee Origination

Flat-fee origination charges a set amount for mortgage processing, providing transparency compared to percentage-based fees, while zero closing cost mortgages often roll fees into higher interest rates. Borrowers seeking predictability in upfront expenses may prefer flat-fee origination to avoid long-term cost inflation inherent in zero closing cost loans.

Discount Point Trade-Off

Origination fees are upfront costs that lenders charge to process a mortgage, often allowing borrowers to negotiate lower interest rates through discount points. Choosing a zero closing cost mortgage typically means accepting a higher interest rate in exchange for the lender covering these fees, which can increase long-term payments despite no initial out-of-pocket expense.

Negative Points Structure

Origination fees increase the upfront cost of securing a mortgage, often leading to higher immediate expenses that can strain a borrower's budget. Zero closing cost mortgages typically offset these fees through higher interest rates or rolled-in costs, ultimately resulting in greater long-term payments despite lower initial out-of-pocket expenses.

Rebate Pricing Model

The Origination Fee is a upfront charge by lenders to cover the administrative costs of processing a mortgage application, typically ranging from 0.5% to 1% of the loan amount, while Zero Closing Cost options integrate these fees into the mortgage interest rate under a Rebate Pricing Model, allowing borrowers to reduce initial out-of-pocket expenses by accepting a higher long-term interest rate. This pricing strategy benefits borrowers by deferring costs, where lenders offset waived fees through slightly elevated rates, balancing affordability at closing with overall loan cost over the mortgage term.

Origination Fee vs Zero Closing Cost for mortgage setup. Infographic

moneydiff.com

moneydiff.com