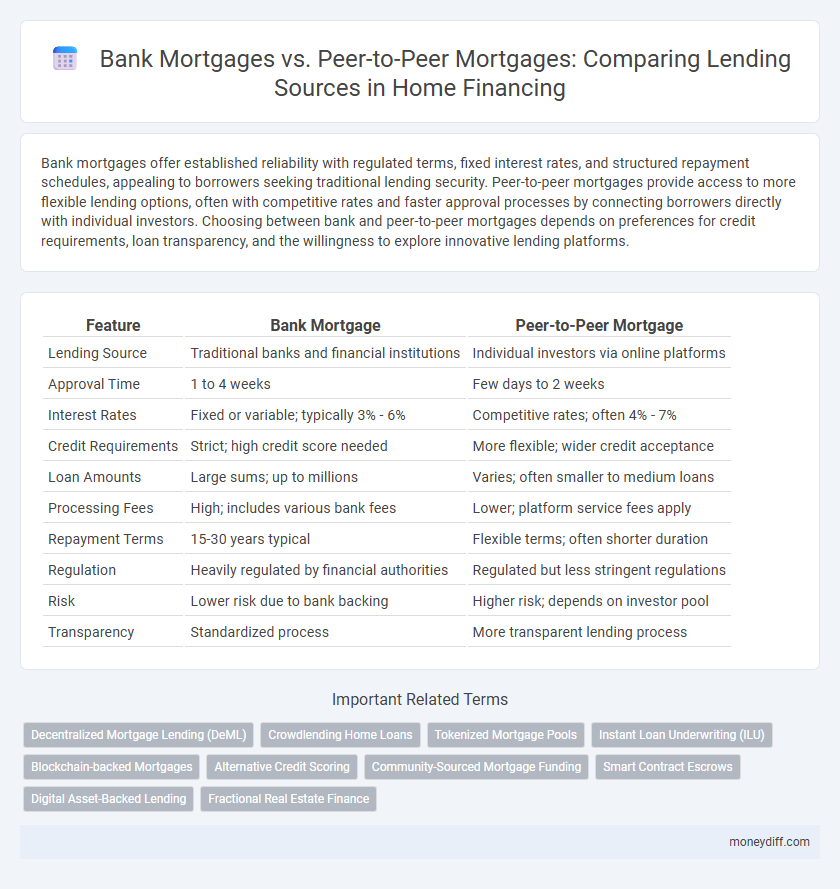

Bank mortgages offer established reliability with regulated terms, fixed interest rates, and structured repayment schedules, appealing to borrowers seeking traditional lending security. Peer-to-peer mortgages provide access to more flexible lending options, often with competitive rates and faster approval processes by connecting borrowers directly with individual investors. Choosing between bank and peer-to-peer mortgages depends on preferences for credit requirements, loan transparency, and the willingness to explore innovative lending platforms.

Table of Comparison

| Feature | Bank Mortgage | Peer-to-Peer Mortgage |

|---|---|---|

| Lending Source | Traditional banks and financial institutions | Individual investors via online platforms |

| Approval Time | 1 to 4 weeks | Few days to 2 weeks |

| Interest Rates | Fixed or variable; typically 3% - 6% | Competitive rates; often 4% - 7% |

| Credit Requirements | Strict; high credit score needed | More flexible; wider credit acceptance |

| Loan Amounts | Large sums; up to millions | Varies; often smaller to medium loans |

| Processing Fees | High; includes various bank fees | Lower; platform service fees apply |

| Repayment Terms | 15-30 years typical | Flexible terms; often shorter duration |

| Regulation | Heavily regulated by financial authorities | Regulated but less stringent regulations |

| Risk | Lower risk due to bank backing | Higher risk; depends on investor pool |

| Transparency | Standardized process | More transparent lending process |

Introduction to Mortgage Lending Sources

Mortgage lending sources primarily include traditional banks and peer-to-peer (P2P) lending platforms, each offering distinct advantages for borrowers. Banks provide structured loan products with regulated interest rates and established credit requirements, ensuring security and predictability. Peer-to-peer mortgages leverage technology to connect borrowers directly with individual investors, often delivering competitive rates and flexible terms by bypassing conventional financial intermediaries.

Understanding Bank Mortgages

Bank mortgages typically involve lending institutions that provide home loans with fixed or variable interest rates, standardized terms, and regulatory oversight ensuring borrower protection. These mortgages often require comprehensive credit checks, stable income verification, and a formal application process, resulting in structured repayment schedules and documented loan agreements. Understanding the risk management, fees, and eligibility criteria associated with bank mortgages helps borrowers compare them effectively against peer-to-peer lending alternatives.

What is Peer-to-Peer Mortgage Lending?

Peer-to-peer mortgage lending connects individual borrowers with private investors through online platforms, bypassing traditional banks and financial institutions. This alternative financing method often offers competitive interest rates and faster approval processes, leveraging technology to streamline underwriting and risk assessment. By directly linking lenders and borrowers, peer-to-peer mortgage lending reduces intermediaries, potentially lowering costs and increasing accessibility for borrowers.

Key Differences Between Banks and P2P Lenders

Banks offer mortgage loans with rigid qualification criteria, standardized interest rates, and extensive regulatory oversight, ensuring stability and consumer protection. Peer-to-peer (P2P) lending platforms provide more flexible lending terms, often enabling quicker approvals with competitive rates by connecting borrowers directly to individual investors. The key differences lie in funding sources, risk assessment methods, and the level of personalization in loan offerings.

Eligibility Criteria: Banks vs Peer-to-Peer Platforms

Banks typically require stringent eligibility criteria including high credit scores, steady income, and substantial down payments, ensuring borrowers have a strong financial profile. Peer-to-peer mortgage platforms offer more flexible eligibility standards, often accommodating borrowers with lower credit scores or unconventional income sources by leveraging technology-driven risk assessments. Such platforms provide greater accessibility for non-traditional borrowers but may come at higher interest rates or fees compared to traditional bank mortgages.

Interest Rates and Fees Comparison

Bank mortgages typically offer lower interest rates due to established credit risk models but include higher fees such as origination and administrative charges. Peer-to-peer mortgage platforms often present competitive or slightly higher interest rates with reduced fees by eliminating traditional banking intermediaries. Borrowers must weigh the trade-off between predictable bank fees and potentially variable P2P costs when selecting lending sources.

Flexibility and Loan Terms

Bank mortgages typically offer fixed interest rates and standardized loan terms, ensuring predictable monthly payments but limited flexibility in repayment options. Peer-to-peer mortgages provide more adaptable loan structures, enabling borrowers to negotiate customized interest rates and flexible repayment schedules directly with individual investors. This flexibility can accommodate unique financial situations, though it may come with varied risk levels and regulatory considerations.

Risk Factors for Borrowers

Bank mortgages typically involve rigorous credit assessments and regulatory oversight, resulting in lower default risks for borrowers but less flexibility in terms and approval speed. Peer-to-peer (P2P) mortgages offer faster access to funds with potentially lower interest rates but carry higher risks due to less stringent borrower vetting and limited regulatory protection. Borrowers should carefully evaluate credit risk, interest rate volatility, and platform reliability when choosing between bank and P2P mortgage lending sources.

Application Process: Traditional vs Digital

Bank mortgages typically involve a lengthy application process with extensive documentation, credit checks, and in-person meetings, resulting in slower approval times. Peer-to-peer mortgage platforms streamline the application using fully digital interfaces, automated underwriting, and real-time status updates, significantly reducing processing time. This digital approach enhances transparency and accessibility for borrowers compared to traditional bank procedures.

Choosing the Right Mortgage Lending Source

Bank mortgages offer structured loan products with fixed interest rates and regulatory oversight, ensuring security and predictable payments. Peer-to-peer mortgages provide flexible lending options with potentially lower rates by connecting borrowers directly to investors, but may involve higher risk and less standardization. Evaluating credit scores, loan terms, and risk tolerance is essential to choose between traditional bank lending and peer-to-peer platforms for optimal mortgage financing.

Related Important Terms

Decentralized Mortgage Lending (DeML)

Decentralized Mortgage Lending (DeML) leverages blockchain technology to facilitate peer-to-peer mortgage loans, reducing reliance on traditional banks and enabling faster, transparent, and cost-efficient lending processes. Unlike bank mortgages that involve centralized approval and underwriting, DeML platforms use smart contracts to directly connect borrowers and lenders, minimizing intermediaries and enhancing accessibility.

Crowdlending Home Loans

Crowdlending home loans leverage peer-to-peer mortgage platforms to connect borrowers directly with individual investors, often resulting in competitive interest rates and flexible terms compared to traditional bank mortgages. This decentralized lending source reduces reliance on conventional banking institutions and increases access to credit by tapping into a diversified pool of private lenders.

Tokenized Mortgage Pools

Bank mortgages typically offer stable interest rates and regulated security but often involve lengthy approval processes and higher fees, whereas peer-to-peer mortgage platforms leverage tokenized mortgage pools to provide increased liquidity, fractional ownership, and faster transactions. Tokenized mortgage pools enable investors to diversify risk by buying blockchain-based mortgage-backed securities, enhancing transparency and access to real-time market data compared to traditional bank lending sources.

Instant Loan Underwriting (ILU)

Bank mortgages typically offer slower loan processing times due to traditional underwriting procedures, contrasting with peer-to-peer (P2P) mortgage platforms that leverage Instant Loan Underwriting (ILU) technology for rapid credit evaluation. ILU utilizes real-time data analytics and AI-driven algorithms to expedite loan approval, providing borrowers faster access to funds compared to the conventional bank mortgage underwriting process.

Blockchain-backed Mortgages

Blockchain-backed mortgages leverage decentralized ledger technology to enhance transparency and reduce intermediaries, offering a streamlined alternative to traditional bank mortgages. Peer-to-peer mortgage platforms utilize blockchain to connect borrowers directly with lenders, facilitating faster approvals and potentially lower interest rates compared to conventional bank mortgage processes.

Alternative Credit Scoring

Alternative credit scoring in peer-to-peer mortgage lending incorporates non-traditional data such as social media activity, utility payments, and rental history, offering a broader risk assessment compared to traditional bank mortgage models that rely heavily on credit scores, income verification, and debt-to-income ratios. This innovation enables peer-to-peer platforms to extend loans to underbanked borrowers by accurately evaluating creditworthiness beyond conventional financial metrics.

Community-Sourced Mortgage Funding

Community-sourced mortgage funding through peer-to-peer lending platforms offers borrowers access to competitive interest rates and flexible terms by connecting them directly with individual investors. Unlike traditional bank mortgages, this decentralized approach reduces reliance on institutional lenders, enabling faster approvals and personalized lending experiences.

Smart Contract Escrows

Bank mortgages typically rely on traditional escrow accounts managed by financial institutions, while peer-to-peer mortgages utilize smart contract escrows on blockchain platforms to automate and secure transaction processes. Smart contract escrows offer enhanced transparency, reduced intermediary costs, and faster fund disbursement compared to conventional bank-managed escrow services.

Digital Asset-Backed Lending

Bank mortgages offer traditional lending with regulated interest rates and lengthy approval processes, while peer-to-peer mortgages leverage digital asset-backed lending platforms, providing faster access to funds through blockchain technology and smart contracts. Digital asset-backed lending enhances transparency, reduces intermediaries, and allows borrowers to use cryptocurrencies or tokenized assets as collateral, revolutionizing mortgage lending sources.

Fractional Real Estate Finance

Bank mortgage lending relies on traditional financial institutions offering regulated loans with fixed interest rates and structured repayment terms, providing borrowers with stability and established credit assessments. Peer-to-peer mortgage platforms enable fractional real estate finance by connecting individual investors directly with borrowers, allowing for diversified investment portfolios and potentially lower borrowing costs through decentralized funding sources.

Bank Mortgage vs Peer-to-Peer Mortgage for lending sources. Infographic

moneydiff.com

moneydiff.com