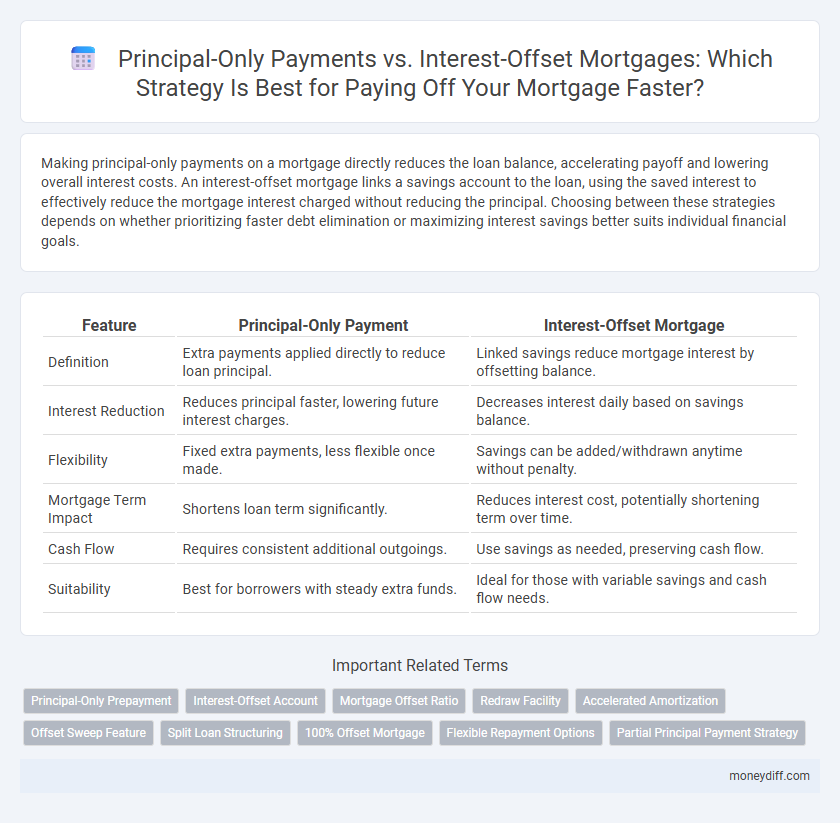

Making principal-only payments on a mortgage directly reduces the loan balance, accelerating payoff and lowering overall interest costs. An interest-offset mortgage links a savings account to the loan, using the saved interest to effectively reduce the mortgage interest charged without reducing the principal. Choosing between these strategies depends on whether prioritizing faster debt elimination or maximizing interest savings better suits individual financial goals.

Table of Comparison

| Feature | Principal-Only Payment | Interest-Offset Mortgage |

|---|---|---|

| Definition | Extra payments applied directly to reduce loan principal. | Linked savings reduce mortgage interest by offsetting balance. |

| Interest Reduction | Reduces principal faster, lowering future interest charges. | Decreases interest daily based on savings balance. |

| Flexibility | Fixed extra payments, less flexible once made. | Savings can be added/withdrawn anytime without penalty. |

| Mortgage Term Impact | Shortens loan term significantly. | Reduces interest cost, potentially shortening term over time. |

| Cash Flow | Requires consistent additional outgoings. | Use savings as needed, preserving cash flow. |

| Suitability | Best for borrowers with steady extra funds. | Ideal for those with variable savings and cash flow needs. |

Understanding Principal-Only Payments in Mortgages

Principal-only payments directly reduce the outstanding loan balance, accelerating mortgage payoff and decreasing total interest paid over the loan term. By applying extra funds solely to the principal, borrowers can shorten the amortization period without increasing monthly payment amounts. This strategy is particularly effective for fixed-rate mortgages, where controlling the principal balance leads to significant savings in interest costs and faster equity buildup.

What Is an Interest-Offset Mortgage?

An interest-offset mortgage links your savings account to your mortgage balance, reducing the interest charged by offsetting the loan principal with your savings. Unlike principal-only payments that directly reduce the loan balance, the offset account lowers interest without decreasing the original mortgage amount. This strategy can significantly reduce total interest paid and shorten the loan term while maintaining liquidity with accessible funds.

Key Differences Between Principal-Only Payments and Interest-Offset Mortgages

Principal-only payments directly reduce the mortgage balance, which shortens the loan term and decreases total interest paid over time. Interest-offset mortgages link a savings account to the mortgage, using the account balance to reduce the interest charged without lowering the principal immediately. Principal-only payments offer faster equity build-up, while interest-offset mortgages provide flexibility by minimizing interest costs while maintaining liquidity.

Pros and Cons of Principal-Only Payment Strategy

Principal-only payments reduce the mortgage balance faster, leading to significant interest savings over the loan term and a shorter payoff period. This strategy requires higher monthly payments, which can strain cash flow and reduce financial flexibility. However, it offers a clear path to debt freedom without relying on fluctuating interest rates like interest-offset mortgages.

Advantages and Disadvantages of Interest-Offset Mortgages

Interest-offset mortgages offer the advantage of reducing interest costs by linking a savings account to the mortgage balance, which lowers the principal on which interest is calculated without making extra payments. This structure provides flexibility since borrowers can access their savings anytime, unlike principal-only payments that permanently reduce the loan balance but limit liquidity. However, interest-offset mortgages may have higher fees or interest rates, and the benefit depends on maintaining a substantial savings balance, which can be a disadvantage compared to principal-only payments that guarantee a faster mortgage payoff.

Impact on Mortgage Payoff Timeline: Principal-Only vs Interest-Offset

Making principal-only payments directly reduces the outstanding loan balance, significantly shortening the mortgage payoff timeline by decreasing the amount of interest accrued over time. In contrast, an interest-offset mortgage links a savings account to the loan, reducing interest charges by offsetting the loan balance with savings, which indirectly accelerates payoff without reducing principal immediately. Choosing principal-only payments results in faster equity buildup and earlier loan completion, while interest-offset strategies offer ongoing interest savings that can shorten the mortgage term more gradually.

How to Decide: Principal-Only Payments or Interest-Offset Accounts?

Choosing between principal-only payments and interest-offset accounts depends on your financial goals and cash flow flexibility. Principal-only payments reduce the loan balance faster, saving interest over time, while interest-offset accounts use your savings to lower the interest charged without reducing the principal. Evaluate your ability to make lump-sum payments versus maintaining accessible savings to decide the most effective mortgage payoff strategy.

Tax Implications: Principal-Only Payments vs Interest-Offset Mortgages

Principal-only payments directly reduce the loan balance, lowering future interest costs but do not provide tax deductions, as mortgage interest remains deductible only on interest paid. Interest-offset mortgages link a savings account to the mortgage, reducing interest owed by offsetting balances, which can decrease deductible interest and potentially increase taxable income. Homeowners should consider that principal-only payments may preserve mortgage interest tax deductions, while interest-offset accounts could affect taxable income due to lower deductible interest expenses.

Real-Life Scenarios: Which Strategy Saves More on Interest?

Principal-only payments directly reduce the loan's principal balance, resulting in lower interest charges over time and faster mortgage payoff. Interest-offset mortgages link savings accounts to the loan, reducing interest calculations daily by offsetting the balance against the mortgage principal. In real-life scenarios, borrowers with substantial savings benefit more from interest-offset mortgages, while those prioritizing aggressive debt reduction without large savings achieve greater savings with principal-only payments.

Tips for Maximizing Savings with Your Chosen Mortgage Payoff Strategy

Making principal-only payments directly reduces the loan balance, leading to significant interest savings and faster mortgage payoff. Opt for an interest-offset mortgage to link your savings account to your loan, which lowers the daily interest calculated and accelerates debt reduction. Monitor your cash flow regularly to determine if lump-sum principal payments or optimizing your offset account balance yields the greatest financial benefit.

Related Important Terms

Principal-Only Prepayment

Making principal-only payments directly reduces the outstanding mortgage balance, accelerating loan payoff and decreasing total interest paid over the loan term. Unlike interest-offset mortgages that use deposit balances to reduce interest accrual, principal-only prepayments provide a guaranteed reduction in principal, resulting in faster equity buildup and lower overall borrowing costs.

Interest-Offset Account

An Interest-Offset Account reduces mortgage interest by linking savings directly to the loan balance, allowing borrowers to pay less interest monthly while maintaining liquidity. This strategy accelerates mortgage payoff more efficiently than Principal-Only Payments, which reduce balance but do not leverage savings to offset interest costs.

Mortgage Offset Ratio

The Mortgage Offset Ratio measures the effectiveness of offset accounts in reducing interest charges by comparing the balance in the offset account to the outstanding mortgage principal. A higher Mortgage Offset Ratio directly lowers the interest payable, making Interest-Offset Mortgages more efficient for accelerating mortgage payoff than Principal-Only Payments, which reduce principal but do not leverage offset balances.

Redraw Facility

A Redraw Facility on a mortgage allows borrowers to make extra repayments toward the principal, reducing interest and accelerating loan payoff while retaining access to those funds if needed. Comparing Principal-Only Payments and Interest-Offset Mortgages, a Redraw Facility can optimize cash flow management by combining lower interest costs with the flexibility to withdraw surplus funds, enhancing overall mortgage payoff efficiency.

Accelerated Amortization

Principal-only payments reduce the loan balance faster, leading to accelerated amortization and significant interest savings over the mortgage term. An interest-offset mortgage links a savings account to the mortgage, using the savings balance to reduce interest charged and effectively shorten the amortization period without increasing monthly payments.

Offset Sweep Feature

The Offset Sweep feature in an Interest-Offset Mortgage automatically transfers surplus funds from your linked transaction account to reduce the mortgage principal daily, effectively lowering interest accrual and shortening the loan term without additional payments. Unlike Principal-Only Payments, which require deliberate extra contributions to reduce the outstanding balance, the Offset Sweep leverages everyday cash flow to optimize mortgage payoff strategies seamlessly.

Split Loan Structuring

Split loan structuring in mortgage payoff strategies involves dividing the loan into a principal-only payment portion and an interest-offset mortgage portion, maximizing interest savings while accelerating principal reduction. This approach leverages the interest-offset account to reduce the daily interest charged on the loan balance, enabling borrowers to pay down the principal faster without increasing monthly repayments.

100% Offset Mortgage

A 100% offset mortgage links your savings account directly to your mortgage balance, effectively reducing the interest calculated on your loan by the amount in your savings, allowing you to pay off the mortgage faster without additional payments. Unlike principal-only payments that reduce loan balance by fixed amounts, the offset strategy maximizes interest savings daily, leveraging your entire savings balance to shorten the mortgage term and lower total interest cost.

Flexible Repayment Options

Principal-only payments directly reduce the mortgage balance, accelerating payoff and lowering total interest costs, while interest-offset mortgages link savings accounts to the loan, reducing effective interest without altering the principal balance. Flexible repayment options in both strategies enable borrowers to tailor payments according to financial capacity, optimizing cash flow and achieving mortgage goals more efficiently.

Partial Principal Payment Strategy

Partial principal payments reduce the outstanding loan balance faster, lowering total interest paid over the mortgage term and accelerating payoff. Interest-offset mortgages link a savings account to the loan, reducing interest charges daily but may not cut principal as effectively as targeted principal prepayments.

Principal-Only Payment vs Interest-Offset Mortgage for mortgage payoff strategies. Infographic

moneydiff.com

moneydiff.com