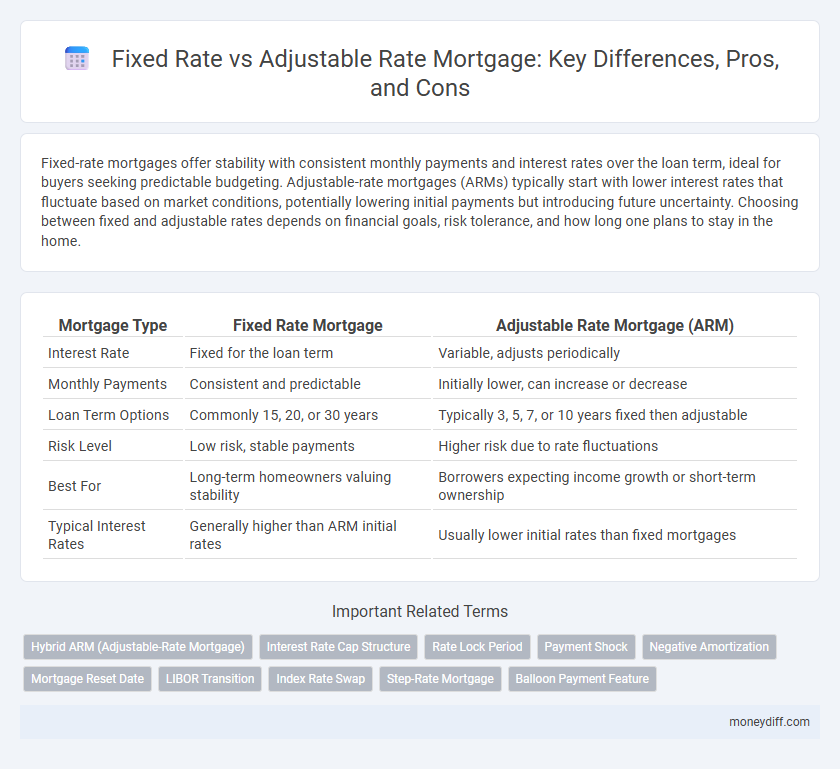

Fixed-rate mortgages offer stability with consistent monthly payments and interest rates over the loan term, ideal for buyers seeking predictable budgeting. Adjustable-rate mortgages (ARMs) typically start with lower interest rates that fluctuate based on market conditions, potentially lowering initial payments but introducing future uncertainty. Choosing between fixed and adjustable rates depends on financial goals, risk tolerance, and how long one plans to stay in the home.

Table of Comparison

| Mortgage Type | Fixed Rate Mortgage | Adjustable Rate Mortgage (ARM) |

|---|---|---|

| Interest Rate | Fixed for the loan term | Variable, adjusts periodically |

| Monthly Payments | Consistent and predictable | Initially lower, can increase or decrease |

| Loan Term Options | Commonly 15, 20, or 30 years | Typically 3, 5, 7, or 10 years fixed then adjustable |

| Risk Level | Low risk, stable payments | Higher risk due to rate fluctuations |

| Best For | Long-term homeowners valuing stability | Borrowers expecting income growth or short-term ownership |

| Typical Interest Rates | Generally higher than ARM initial rates | Usually lower initial rates than fixed mortgages |

Understanding Fixed Rate Mortgages

Fixed rate mortgages offer a consistent interest rate and predictable monthly payments throughout the loan term, typically ranging from 15 to 30 years. This stability helps homeowners budget effectively and protects against market fluctuations in interest rates. Borrowers seeking financial certainty often prefer fixed rate mortgages over adjustable rate options due to their long-term predictability.

Overview of Adjustable Rate Mortgages

Adjustable Rate Mortgages (ARMs) offer an initial lower interest rate that adjusts periodically based on market indexes such as the LIBOR or the U.S. Treasury rate, which can lead to fluctuating monthly payments. Common ARM types include 5/1 or 7/1 ARMs, where the fixed rate remains stable for the first 5 or 7 years before adjusting annually. Borrowers benefit from lower initial costs but face potential payment increases, making ARMs suitable for those planning to sell or refinance before the adjustable period begins.

Key Differences: Fixed vs Adjustable Rates

Fixed-rate mortgages maintain the same interest rate and monthly payment throughout the loan term, offering stability and predictable budgeting. Adjustable-rate mortgages (ARMs) feature interest rates that change periodically based on market indexes, which can initially be lower but may increase significantly over time. The primary difference lies in risk tolerance: fixed rates suit borrowers seeking consistency, while ARMs appeal to those willing to accept potential fluctuations for lower initial costs.

Pros and Cons of Fixed Rate Mortgages

Fixed rate mortgages offer predictable monthly payments and protection against interest rate increases, making budgeting easier for homeowners. These loans typically have higher initial interest rates compared to adjustable rate mortgages, which may result in higher overall costs if rates remain stable or decrease. Homebuyers seeking long-term stability often prefer fixed rates despite limited flexibility and potential missed savings from declining interest rates.

Pros and Cons of Adjustable Rate Mortgages

Adjustable Rate Mortgages (ARMs) offer lower initial interest rates compared to fixed-rate mortgages, which can lead to lower monthly payments during the initial fixed period. However, the primary risk lies in potential rate increases after the adjustment period, causing monthly payments to rise unpredictably and possibly straining borrower finances. ARMs are best suited for buyers planning to sell or refinance before rate resets, but they carry uncertainty that fixed rates avoid.

Which Mortgage is Best for Your Financial Situation?

Fixed-rate mortgages provide predictable monthly payments and stability, ideal for homeowners planning to stay long-term or those with a steady income. Adjustable-rate mortgages (ARMs) often start with lower initial rates, benefiting borrowers expecting to sell or refinance before the rates adjust. Evaluating your financial situation, including job stability, future plans, and risk tolerance, helps determine which mortgage type aligns best with your goals.

Interest Rate Trends and Their Impact

Fixed-rate mortgages offer stability with consistent monthly payments, insulating borrowers from rising interest rates in an inflationary environment. Adjustable-rate mortgages (ARMs) typically start with lower interest rates but expose borrowers to potential increases based on market conditions, making them sensitive to Federal Reserve policy shifts and bond yield fluctuations. Current trends in long-term Treasury yields and inflation expectations heavily influence the initial pricing and subsequent adjustments of ARMs, impacting overall mortgage affordability and risk profiles.

Long-Term Costs: Fixed vs Adjustable Rate Analysis

Fixed-rate mortgages offer predictable monthly payments and stable interest costs over the loan term, guarding against market fluctuations and potential rate hikes. Adjustable-rate mortgages (ARMs) typically start with lower initial rates but can escalate over time, increasing long-term interest expenses and payment unpredictability. When comparing long-term costs, fixed-rate loans often provide greater financial stability and cost certainty, while ARMs may yield savings only if interest rates remain low or the loan term is short.

Choosing the Right Mortgage for First-Time Homebuyers

First-time homebuyers must weigh the stability of fixed-rate mortgages, offering consistent monthly payments and protection from interest rate fluctuations, against adjustable-rate mortgages that typically start with lower initial rates but can increase over time. Evaluating personal financial stability, long-term plans, and risk tolerance helps determine whether the predictability of a fixed rate or the potential savings of an adjustable rate aligns best with their homeownership goals. Understanding these factors ensures informed decisions, optimizing mortgage affordability and financial security.

Tips for Managing Mortgage Payments Efficiently

Maintaining consistent mortgage payments is crucial when choosing between fixed-rate and adjustable-rate mortgages, as fixed rates offer predictability while adjustable rates can fluctuate based on market conditions. To manage payments efficiently, consider budgeting for potential rate increases with an adjustable mortgage and exploring refinancing options when rates decline. Utilizing automated payments and regularly reviewing your mortgage terms can help prevent missed payments and optimize long-term savings.

Related Important Terms

Hybrid ARM (Adjustable-Rate Mortgage)

A Hybrid ARM combines the stability of a fixed-rate mortgage initial period, typically 3 to 10 years, with the flexibility of adjustable rates thereafter, adjusting annually based on a benchmark index plus a margin. This option balances lower initial interest rates compared to fixed-rate mortgages and potential savings if interest rates remain stable or decline after the fixed period ends.

Interest Rate Cap Structure

Fixed-rate mortgages offer consistent monthly payments with a stable interest rate, while adjustable-rate mortgages (ARMs) feature interest rate cap structures that limit how much the rate can increase per adjustment period and over the loan's lifetime, providing potential savings but added risk. Interest rate caps on ARMs typically include periodic caps, lifetime caps, and initial adjustment caps, which protect borrowers from steep rate hikes beyond specified limits.

Rate Lock Period

Fixed rate mortgages offer a stable interest rate locked in for the entire loan term, providing predictable monthly payments and protection against market fluctuations. Adjustable rate mortgages feature an initial rate lock period, typically 3 to 10 years, after which the rate adjusts periodically based on market indices, potentially lowering payments or increasing financial risk.

Payment Shock

Fixed-rate mortgages provide predictable monthly payments, minimizing payment shock by maintaining consistent interest rates over the loan term. Adjustable-rate mortgages may cause payment shock due to fluctuating interest rates, potentially leading to substantial increases in monthly payments after the initial fixed period.

Negative Amortization

Fixed rate mortgages provide predictable monthly payments without the risk of negative amortization, ensuring loan principal decreases over time. Adjustable rate mortgages, especially those with low initial payments, may cause negative amortization where unpaid interest is added to the loan balance, increasing overall debt.

Mortgage Reset Date

Fixed-rate mortgages provide predictable monthly payments throughout the loan term, while adjustable-rate mortgages adjust periodically after the initial fixed period, often causing payment fluctuations based on the mortgage reset date. Understanding the mortgage reset date is crucial for borrowers with adjustable-rate loans, as it determines when interest rates will change, impacting overall loan affordability and financial planning.

LIBOR Transition

Fixed-rate mortgages offer stable monthly payments with interest rates locked for the loan term, providing predictability amid the LIBOR transition, which has prompted lenders to shift benchmarks to SOFR or other alternatives. Adjustable-rate mortgages may initially feature lower rates but carry uncertainty as periodic adjustments now reference replacement indices instead of LIBOR, affecting long-term costs and risk management strategies.

Index Rate Swap

Fixed-rate mortgages provide consistent monthly payments by locking in an interest rate, while adjustable-rate mortgages (ARMs) fluctuate based on an index rate swap, which tracks benchmark rates like the LIBOR or SOFR, affecting borrower costs over time. The index rate swap serves as a financial derivative that mitigates interest rate risk for lenders but can introduce variability and potential savings for borrowers depending on market trends.

Step-Rate Mortgage

Step-rate mortgage combines features of fixed and adjustable-rate loans by offering an initial fixed interest rate that increases at predetermined intervals, providing predictable payment adjustments over time. This structure helps borrowers plan finances more effectively compared to traditional adjustable-rate mortgages, which may fluctuate unpredictably with market conditions.

Balloon Payment Feature

Fixed-rate mortgages offer predictable monthly payments with no balloon payment, providing long-term financial stability, whereas adjustable-rate mortgages (ARMs) may include a balloon payment feature requiring a large lump sum at the end of the term, increasing borrower risk. Balloon payments in ARMs can lead to refinancing challenges or sudden financial strain if property values decline or credit conditions tighten.

Fixed Rate vs Adjustable Rate for mortgage. Infographic

moneydiff.com

moneydiff.com