An Adjustable-Rate Mortgage (ARM) offers variable interest rates that adjust periodically based on market indexes, providing lower initial payments but potential fluctuations over time. In contrast, a Shared Appreciation Mortgage (SAM) involves the lender sharing in the property's future value appreciation in exchange for reduced initial payments or interest rates. Choosing between ARM and SAM depends on risk tolerance, market outlook, and long-term financial goals in property financing.

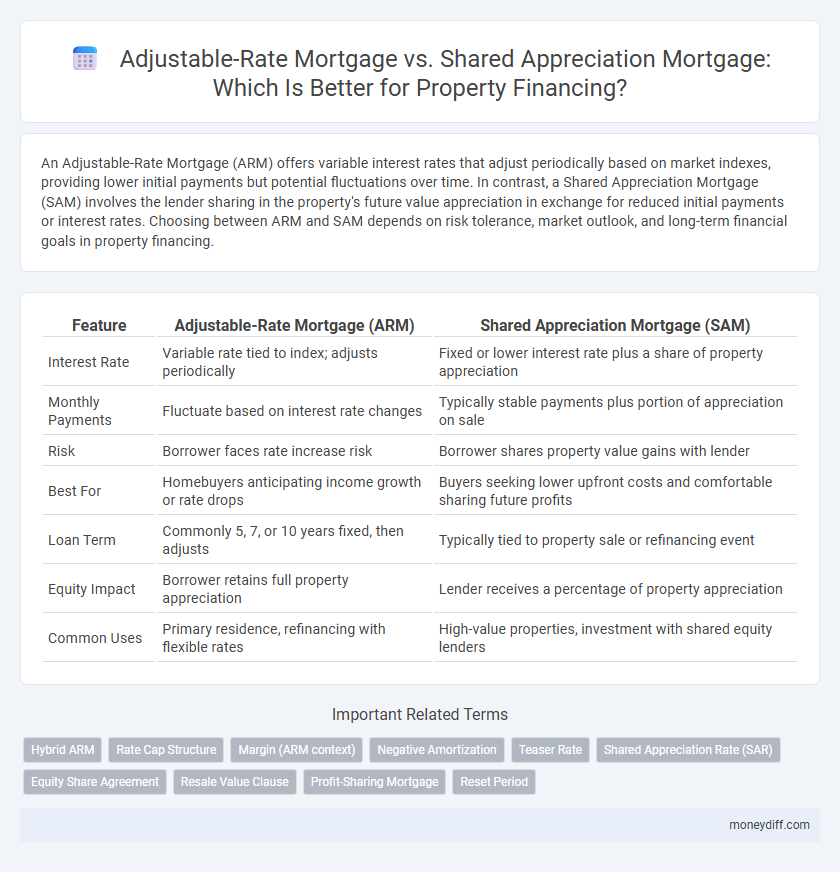

Table of Comparison

| Feature | Adjustable-Rate Mortgage (ARM) | Shared Appreciation Mortgage (SAM) |

|---|---|---|

| Interest Rate | Variable rate tied to index; adjusts periodically | Fixed or lower interest rate plus a share of property appreciation |

| Monthly Payments | Fluctuate based on interest rate changes | Typically stable payments plus portion of appreciation on sale |

| Risk | Borrower faces rate increase risk | Borrower shares property value gains with lender |

| Best For | Homebuyers anticipating income growth or rate drops | Buyers seeking lower upfront costs and comfortable sharing future profits |

| Loan Term | Commonly 5, 7, or 10 years fixed, then adjusts | Typically tied to property sale or refinancing event |

| Equity Impact | Borrower retains full property appreciation | Lender receives a percentage of property appreciation |

| Common Uses | Primary residence, refinancing with flexible rates | High-value properties, investment with shared equity lenders |

Understanding Adjustable-Rate Mortgages (ARM)

Adjustable-Rate Mortgages (ARMs) feature interest rates that fluctuate based on a specified financial index, offering lower initial rates than fixed-rate loans. Borrowers benefit from initial affordability but face potential payment increases during the adjustment periods tied to market rate changes. Understanding the index, margin, adjustment frequency, and caps is essential for managing risks compared to the fixed equity-sharing arrangement of Shared Appreciation Mortgages.

What Is a Shared Appreciation Mortgage (SAM)?

A Shared Appreciation Mortgage (SAM) is a type of home loan where the lender offers a reduced interest rate or initial loan amount in exchange for a share of the property's future appreciation value upon sale or refinancing. Unlike Adjustable-Rate Mortgages (ARMs) that have interest rates fluctuating based on market indexes, SAMs tie the lender's return directly to the home's market appreciation, aligning lender and borrower interests. This financing option benefits homeowners seeking lower monthly payments and willing to share equity gains, potentially lowering initial borrowing costs compared to traditional adjustable-rate loans.

Key Differences Between ARM and SAM

Adjustable-Rate Mortgages (ARMs) feature interest rates that fluctuate based on market indexes, leading to variable monthly payments and potential long-term savings or increased costs. Shared Appreciation Mortgages (SAMs) involve the lender receiving a percentage of the property's appreciated value upon sale or refinancing, reducing initial payments but sharing future equity gains. ARMs offer payment flexibility tied to interest rates, whereas SAMs align lender returns with property appreciation, impacting ownership equity and financial risk.

How Interest Rates Impact Your Mortgage Choice

Adjustable-rate mortgages (ARMs) feature variable interest rates that fluctuate based on market trends, potentially lowering initial payments but increasing risk when rates rise. Shared appreciation mortgages (SAMs) offer fixed or lower initial rates in exchange for a share of the property's future appreciation, reducing monthly costs but tying borrower returns to market performance. Understanding how interest rate volatility influences payment stability and overall costs helps borrowers select the mortgage option best aligned with their financial goals and market outlook.

Pros and Cons of Adjustable-Rate Mortgages

Adjustable-rate mortgages (ARMs) offer lower initial interest rates compared to fixed-rate loans, making monthly payments more affordable during the initial period and allowing homeowners to benefit from potential rate decreases. However, ARMs carry the risk of rising interest rates after the adjustment period, which can lead to higher monthly payments and financial uncertainty. Unlike shared appreciation mortgages that share property value gains with lenders, ARMs focus solely on interest rate fluctuations, making them more predictable but potentially costlier over time if rates increase.

Pros and Cons of Shared Appreciation Mortgages

Shared Appreciation Mortgages (SAMs) offer lower initial interest rates and reduced monthly payments compared to Adjustable-Rate Mortgages (ARMs), making homeownership more accessible for buyers with limited upfront capital. SAMs require borrowers to share a portion of the future property's appreciation with the lender, which can significantly increase the total repayment amount if property values rise sharply. Unlike ARMs, which expose borrowers to fluctuating interest rates and monthly payment uncertainty, SAMs provide predictable payments but carry the risk of a larger payout upon sale or refinancing.

Eligibility and Qualification Requirements

Adjustable-Rate Mortgages (ARMs) typically require borrowers to have a strong credit score, steady income, and a low debt-to-income ratio to qualify, with lenders assessing the borrower's ability to manage interest rate fluctuations. Shared Appreciation Mortgages (SAMs) often consider eligibility based on the property's appreciation potential and may require borrowers to demonstrate financial stability, but credit score requirements can be more flexible as repayment depends partly on future property value. Both mortgage types require standard documentation, including income verification, credit history, and property appraisal, but SAMs may also involve legal agreements detailing the share of future appreciation owed to the lender.

Cost Comparison: ARM vs Shared Appreciation Mortgage

Adjustable-Rate Mortgages (ARM) typically offer lower initial interest rates that can increase or decrease over time based on market indices, potentially leading to fluctuating monthly payments and overall borrowing costs that vary with interest rate trends. Shared Appreciation Mortgages (SAM) involve the lender receiving a percentage of the property's future appreciated value, which can result in significant long-term costs if the property's market value substantially increases. Comparing cost efficiency, ARMs may be preferable for borrowers expecting stable or declining rates, while SAMs could be more costly if property values rise sharply, making precise cost forecasting critical for informed mortgage selection.

Long-Term Financial Implications

Adjustable-rate mortgages (ARMs) expose borrowers to fluctuating interest rates, potentially increasing long-term monthly payments and overall loan costs as rates adjust. Shared appreciation mortgages (SAMs) require sharing a portion of the property's future value appreciation with the lender, which can reduce upfront interest expenses but may lead to significant financial obligations if property values rise substantially. Evaluating long-term financial implications involves comparing interest rate variability risks in ARMs against potential equity sharing costs in SAMs to determine overall cost-effectiveness.

Which Mortgage Is Right for Your Property Financing Needs?

Adjustable-Rate Mortgages (ARMs) offer initial low interest rates that adjust periodically based on market indexes, making them suitable for borrowers expecting short-term financing or fluctuating income. Shared Appreciation Mortgages (SAMs) require the borrower to share a portion of the property's future appreciation with the lender, aligning repayment with property value growth and appealing to investors seeking reduced monthly payments with potential equity sharing. Evaluating your risk tolerance, financial goals, and property market outlook will help determine whether the predictable adjustments of an ARM or the equity-based structure of a SAM better fits your property financing needs.

Related Important Terms

Hybrid ARM

A Hybrid Adjustable-Rate Mortgage (ARM) combines fixed and variable interest rates, offering initial stability followed by adjustments based on market indices, making it ideal for borrowers seeking lower initial payments compared to Shared Appreciation Mortgages (SAM), which require sharing future property value gains with lenders. Hybrid ARMs typically feature fixed rates for 3, 5, 7, or 10 years before switching to adjustable terms, providing flexibility without sacrificing potential long-term savings, unlike SAMs that limit profit from home appreciation.

Rate Cap Structure

Adjustable-Rate Mortgages (ARMs) feature a rate cap structure that limits the amount interest rates can increase during each adjustment period as well as over the loan's lifetime, providing borrowers with a measure of predictability and protection against steep payment hikes. In contrast, Shared Appreciation Mortgages (SAMs) do not have traditional rate caps because repayments depend partly on property value appreciation, shifting some financial risk to the lender instead of relying on fixed interest rate limits.

Margin (ARM context)

The margin in an Adjustable-Rate Mortgage (ARM) is the fixed percentage added to the index rate to determine the loan's interest rate after the initial fixed period, directly impacting monthly payments and overall interest costs. In contrast, a Shared Appreciation Mortgage does not use a traditional margin but instead involves the lender receiving a predetermined share of the property's future appreciation, affecting long-term financing costs rather than monthly interest rates.

Negative Amortization

Adjustable-Rate Mortgages (ARMs) carry the risk of negative amortization when interest rates rise, causing monthly payments to cover less interest and increasing the loan principal. Shared Appreciation Mortgages typically avoid negative amortization by linking repayment to property value gains, reducing the likelihood of principal balance growth.

Teaser Rate

Adjustable-Rate Mortgages (ARMs) often feature a teaser rate that starts significantly lower than the standard fixed rate, attracting borrowers with initial affordability before rates adjust based on market indexes. Shared Appreciation Mortgages (SAMs) rarely use teaser rates; instead, they offer lower initial payments by sharing future property appreciation with the lender, impacting overall loan cost rather than monthly interest adjustments.

Shared Appreciation Rate (SAR)

Shared Appreciation Mortgage (SAM) allows borrowers to obtain property financing with lower initial interest rates in exchange for sharing a percentage of the property's future appreciation with the lender, which can lead to significant savings if property values rise. This contrasts with Adjustable-Rate Mortgages (ARM), where interest rates fluctuate based on market indices, potentially increasing monthly payments unpredictably without any benefit tied to property appreciation.

Equity Share Agreement

An Adjustable-Rate Mortgage (ARM) offers variable interest rates adjusting periodically based on market indexes, providing potential short-term savings but unpredictable long-term costs, whereas a Shared Appreciation Mortgage (SAM) involves an Equity Share Agreement where the lender receives a portion of property appreciation upon sale, aligning financing costs with property value growth and reducing initial repayment burden. Equity Share Agreements in SAMs enable homeowners to access lower upfront payments while sharing future property gains with investors, making it an attractive option for buyers anticipating significant property appreciation.

Resale Value Clause

Adjustable-rate mortgages typically feature interest rates that fluctuate with market indexes, impacting monthly payments but rarely including a resale value clause. Shared appreciation mortgages often incorporate a resale value clause, allowing lenders to share a percentage of the property's appreciated value upon sale, which can affect the borrower's equity and long-term financial planning.

Profit-Sharing Mortgage

Profit-sharing mortgages, a form of shared appreciation mortgage, allow lenders to receive a portion of the property's future appreciation instead of fixed interest payments, aligning their returns with the property's market performance. Unlike adjustable-rate mortgages that vary interest based on benchmark rates, profit-sharing mortgages can reduce initial monthly payments and offer flexible financing options for homebuyers anticipating property value growth.

Reset Period

Adjustable-Rate Mortgages (ARMs) feature reset periods typically ranging from 1 to 10 years, during which interest rates adjust based on market indexes, affecting monthly payments. Shared Appreciation Mortgages (SAMs) do not have traditional reset periods but instead involve sharing a percentage of the property's future value appreciation with the lender upon sale or refinancing.

Adjustable-Rate Mortgage vs Shared Appreciation Mortgage for property financing. Infographic

moneydiff.com

moneydiff.com