Conventional mortgages typically offer standard interest rates and repayment terms without incentives for energy efficiency, making them suitable for a broad range of real estate investments. Green mortgages provide lower interest rates or additional benefits for properties that meet specific environmental standards, promoting sustainable and energy-efficient investments. Choosing between these options depends on the investor's priorities for cost savings and environmental impact in their real estate portfolio.

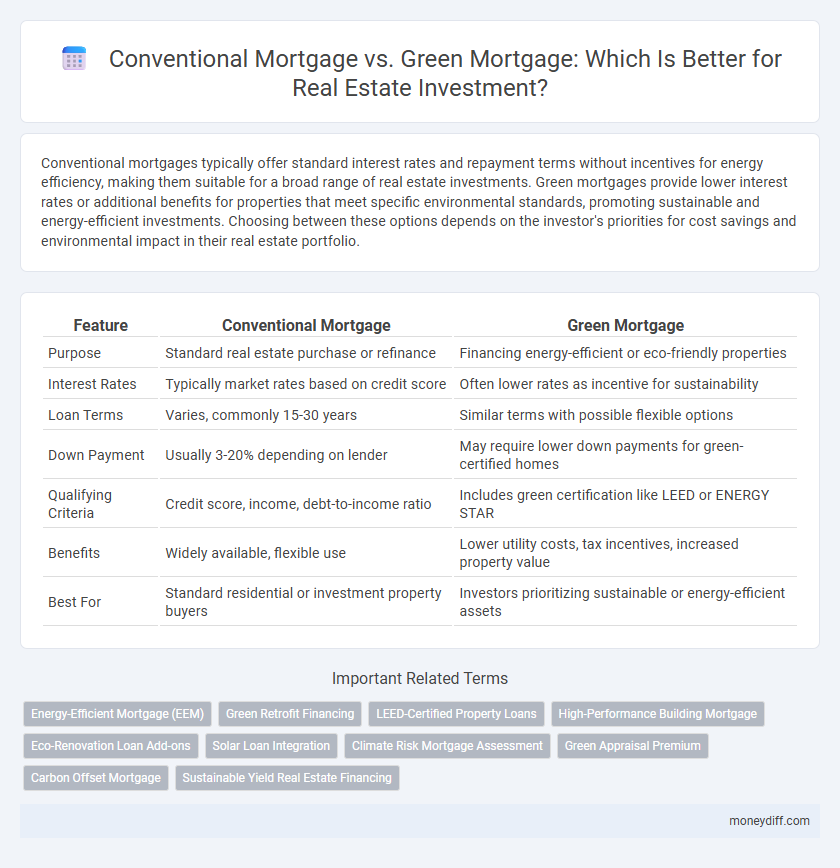

Table of Comparison

| Feature | Conventional Mortgage | Green Mortgage |

|---|---|---|

| Purpose | Standard real estate purchase or refinance | Financing energy-efficient or eco-friendly properties |

| Interest Rates | Typically market rates based on credit score | Often lower rates as incentive for sustainability |

| Loan Terms | Varies, commonly 15-30 years | Similar terms with possible flexible options |

| Down Payment | Usually 3-20% depending on lender | May require lower down payments for green-certified homes |

| Qualifying Criteria | Credit score, income, debt-to-income ratio | Includes green certification like LEED or ENERGY STAR |

| Benefits | Widely available, flexible use | Lower utility costs, tax incentives, increased property value |

| Best For | Standard residential or investment property buyers | Investors prioritizing sustainable or energy-efficient assets |

Understanding Conventional Mortgages

A conventional mortgage for real estate investment typically requires a higher credit score, a down payment of at least 20%, and offers fixed or adjustable interest rates without government backing. These loans focus solely on the borrower's financial qualifications and the property's market value, excluding energy efficiency or environmental impact considerations. Understanding these basic criteria helps investors evaluate traditional financing options against emerging green mortgage alternatives that incentivize sustainable property upgrades.

What Is a Green Mortgage?

A green mortgage is a specialized loan designed to finance energy-efficient and environmentally friendly properties, incentivizing buyers with lower interest rates or higher loan amounts based on the property's sustainability features. Unlike conventional mortgages, green mortgages often incorporate evaluations of the home's energy performance or environmental certifications, such as ENERGY STAR or LEED. This type of mortgage supports real estate investments that minimize carbon footprints and reduce long-term utility costs.

Key Differences Between Conventional and Green Mortgages

Conventional mortgages typically offer fixed or adjustable interest rates based on creditworthiness and require standard property eligibility without energy efficiency considerations. Green mortgages provide incentives such as lower interest rates or higher loan limits when purchasing or improving energy-efficient homes, focusing on properties with certified sustainability features like ENERGY STAR or LEED. The key differences lie in eligibility criteria, financing benefits tied to environmental impact, and long-term cost savings through reduced utility expenses for green mortgage holders.

Eligibility Criteria: Conventional vs Green Mortgages

Conventional mortgage eligibility primarily depends on credit score, debt-to-income ratio, and steady income, with typical requirements including a credit score above 620 and a debt-to-income ratio below 43%. Green mortgages require similar financial criteria but also mandate proof of energy-efficient home features or certifications like ENERGY STAR or LEED. Lenders evaluate the eco-friendly upgrades and potential energy savings, often offering lower interest rates or higher loan limits for qualifying green properties.

Interest Rates and Loan Terms Comparison

Conventional mortgages typically offer fixed or variable interest rates ranging from 3% to 6%, with loan terms spanning 15 to 30 years, catering to standard real estate investments. Green mortgages often feature lower interest rates, sometimes discounted by 0.25% to 0.5%, and may include flexible loan terms to incentivize energy-efficient property improvements. Investors benefit from green mortgage programs through potential cost savings over time, enhanced property value, and eligibility for government or lender-backed rebates.

Upfront Costs and Down Payments

Conventional mortgages typically require down payments ranging from 5% to 20%, with upfront costs including appraisal, origination fees, and private mortgage insurance if the down payment is below 20%. Green mortgages often feature lower upfront costs or incentives such as reduced or waived fees, designed to encourage energy-efficient property investments, sometimes requiring smaller down payments depending on lender programs. Real estate investors benefit from understanding these cost structures, as green mortgages can improve cash flow and asset value through energy savings and potential subsidies.

Long-Term Savings and Energy Efficiency

Conventional mortgages typically offer standard interest rates without incentives for energy efficiency improvements, potentially leading to higher long-term utility costs for real estate investors. Green mortgages, designed to finance energy-efficient properties or renovations, often provide lower interest rates and reduced down payment requirements, resulting in significant long-term savings on energy expenses. Investing in green mortgage properties enhances property value through sustainability features while reducing environmental impact and operational costs over time.

Incentives and Government Programs

Conventional mortgages typically offer standard interest rates and require higher down payments without specific incentives for energy efficiency, whereas green mortgages provide financial benefits such as reduced interest rates and lower down payments to encourage investment in energy-efficient properties. Government programs like the ENERGY STAR mortgage and Fannie Mae's GreenCHOICE mortgage support green financing by offering incentives tied to certified sustainable home improvements. These initiatives aim to reduce carbon footprints while enhancing property value, making green mortgages increasingly attractive for eco-conscious real estate investors.

Environmental Impact and Market Value

Conventional mortgages typically do not factor in a property's environmental impact, potentially overlooking energy efficiency and sustainability features that can increase long-term market value. Green mortgages reward environmentally friendly investments by offering lower interest rates or incentives for energy-efficient homes, which often appreciate faster due to growing demand for sustainable real estate. Integrating green mortgage options can enhance portfolio sustainability while boosting asset desirability in an eco-conscious market.

Choosing the Right Mortgage for Real Estate Investment

Choosing the right mortgage for real estate investment depends on balancing cost, benefits, and long-term value. Conventional mortgages often offer lower interest rates and wider lender availability, making them ideal for traditional property investments. Green mortgages provide incentives like reduced rates or rebates for energy-efficient properties, potentially increasing property value and lowering operating costs over time.

Related Important Terms

Energy-Efficient Mortgage (EEM)

Energy-Efficient Mortgages (EEMs) offer real estate investors lower interest rates and increased loan limits by financing energy-saving improvements, unlike conventional mortgages that do not account for property efficiency upgrades. EEMs help reduce utility costs and enhance property value, making them a strategic choice for sustainable real estate investments.

Green Retrofit Financing

Green retrofit financing offers real estate investors preferred interest rates and potential tax incentives compared to conventional mortgages by funding energy-efficient upgrades that reduce operating costs and increase property value. Conventional mortgages typically lack incentives for environmental improvements, making green mortgages more attractive for sustainable investment and long-term financial gains.

LEED-Certified Property Loans

Conventional mortgages typically offer standard loan terms without incentives for sustainability, while green mortgages for LEED-certified properties provide lower interest rates and reduced fees to encourage energy-efficient real estate investments. Investing in LEED-certified property loans not only supports environmental responsibility but also enhances long-term value through lower operational costs and potential tax benefits.

High-Performance Building Mortgage

Conventional mortgages typically offer standard interest rates and terms for real estate investments, while green mortgages, such as High-Performance Building Mortgages, provide incentives like lower interest rates and longer amortization periods for properties meeting energy-efficient and sustainability certifications. High-Performance Building Mortgages prioritize reduced utility costs and environmental impact, making them ideal for investors focused on sustainable real estate with potentially higher long-term returns.

Eco-Renovation Loan Add-ons

Conventional mortgages typically offer standard financing terms without incentives for energy efficiency, while green mortgages provide eco-renovation loan add-ons that reduce interest rates or increase loan limits for incorporating sustainable upgrades like solar panels or energy-efficient insulation. These eco-renovation add-ons enhance property value and lower utility costs, making green mortgages a strategic choice for real estate investors aiming to maximize long-term returns through environmentally responsible improvements.

Solar Loan Integration

Conventional mortgages typically offer standard financing terms for real estate investment, while green mortgages integrate solar loan options that reduce upfront costs and increase energy efficiency savings. Incorporating solar loan integration within green mortgages maximizes property value and long-term return on investment by leveraging renewable energy incentives and lower utility expenses.

Climate Risk Mortgage Assessment

Conventional mortgages primarily evaluate borrower creditworthiness and property value without integrating climate risk factors, potentially overlooking vulnerability to environmental hazards. Green mortgages incorporate climate risk mortgage assessment by analyzing property resilience to climate change impacts, enhancing investment security and promoting sustainable real estate development.

Green Appraisal Premium

Green mortgages often include a Green Appraisal Premium, reflecting higher property values due to energy-efficient features, which can increase loan eligibility and investment returns compared to conventional mortgages. This premium highlights the financial benefits of sustainable real estate investments, as energy-efficient homes typically exhibit lower operating costs and greater market demand.

Carbon Offset Mortgage

Conventional mortgages typically offer standard interest rates and repayment terms without accounting for environmental impact, while green mortgages, especially carbon offset mortgages, integrate sustainability by incentivizing energy-efficient properties and funding carbon reduction projects. Carbon offset mortgages can reduce overall investment risk and enhance property value by aligning real estate investments with eco-friendly initiatives, potentially leading to lower interest rates and improved marketability.

Sustainable Yield Real Estate Financing

Conventional mortgages typically offer fixed interest rates and standard terms without incentives for energy-efficient properties, whereas green mortgages provide lower interest rates or rebates to encourage investments in sustainable, energy-efficient real estate. Sustainable yield real estate financing integrates environmental benefits with financial returns by prioritizing properties that reduce carbon footprints and promote long-term value through energy savings and enhanced market appeal.

Conventional Mortgage vs Green Mortgage for real estate investment. Infographic

moneydiff.com

moneydiff.com