Subprime mortgages target credit-challenged borrowers with lower credit scores, offering higher interest rates due to increased risk, while requiring full income and asset documentation. No-doc mortgages bypass traditional income verification, appealing to self-employed or irregular earners but typically come with higher rates and stricter terms. Choosing between subprime and no-doc mortgages depends on balancing documentation flexibility against cost and loan approval likelihood.

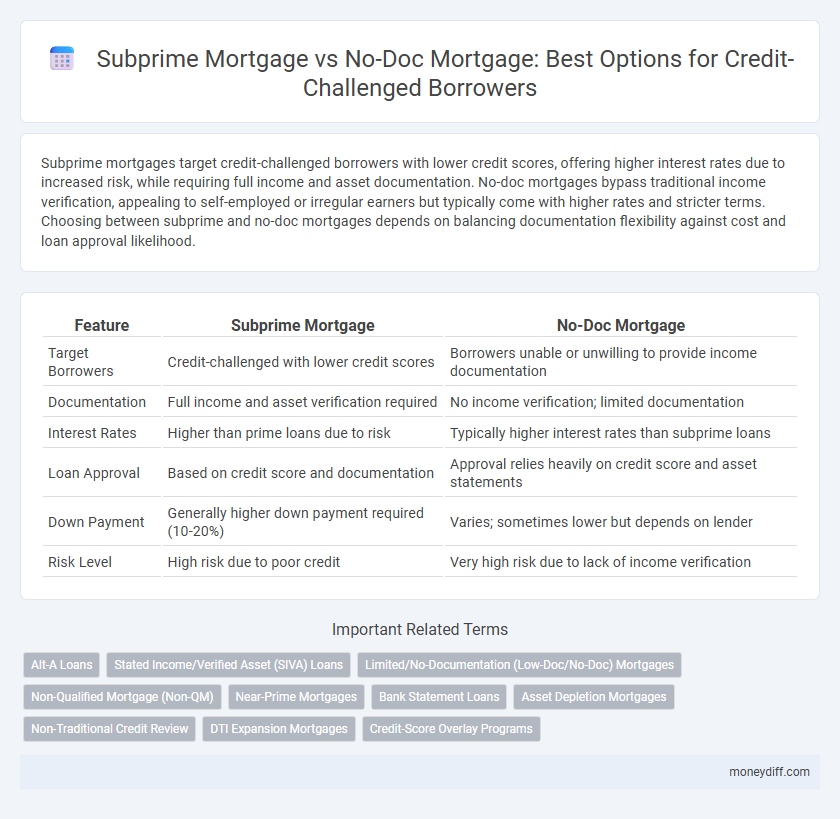

Table of Comparison

| Feature | Subprime Mortgage | No-Doc Mortgage |

|---|---|---|

| Target Borrowers | Credit-challenged with lower credit scores | Borrowers unable or unwilling to provide income documentation |

| Documentation | Full income and asset verification required | No income verification; limited documentation |

| Interest Rates | Higher than prime loans due to risk | Typically higher interest rates than subprime loans |

| Loan Approval | Based on credit score and documentation | Approval relies heavily on credit score and asset statements |

| Down Payment | Generally higher down payment required (10-20%) | Varies; sometimes lower but depends on lender |

| Risk Level | High risk due to poor credit | Very high risk due to lack of income verification |

Understanding Subprime Mortgages for Credit-Challenged Borrowers

Subprime mortgages target credit-challenged borrowers by offering loans at higher interest rates to offset increased risk due to lower credit scores or limited credit history. These loans often require detailed documentation of income, assets, and employment to assess borrower reliability, unlike no-doc mortgages that bypass such verification. Understanding subprime mortgages helps borrowers evaluate the cost and risks of higher rates and potential for loan approval compared to no-doc options with streamlined paperwork but typically stricter eligibility criteria.

What Are No-Doc Mortgages and How Do They Work?

No-doc mortgages, also known as no documentation loans, allow credit-challenged borrowers to secure financing without providing traditional income verification such as pay stubs, tax returns, or employment records. These loans rely primarily on the borrower's credit score, assets, and the property's value to assess risk, making them accessible but often accompanied by higher interest rates and stricter terms. Lenders mitigate default risks by demanding larger down payments or higher interest rates, positioning no-doc loans as an alternative to subprime mortgages for borrowers with limited documentation but varying credit profiles.

Key Differences: Subprime vs No-Doc Mortgages

Subprime mortgages target credit-challenged borrowers by offering loans with higher interest rates due to their lower credit scores, while no-doc mortgages require little to no income or asset verification, making them accessible for those without traditional documentation. Subprime loans emphasize credit risk with full underwriting despite weaker credit, whereas no-doc loans reduce documentation requirements but may carry higher default risks due to limited verification. Understanding these distinctions helps borrowers assess eligibility and financial commitment when exploring mortgage options with credit challenges.

Eligibility Requirements for Subprime Mortgages

Subprime mortgages target credit-challenged borrowers with lower credit scores, typically below 620, and demonstrate a history of late payments or defaults. Lenders require proof of income, employment stability, and often demand higher interest rates and larger down payments to offset the increased risk. These eligibility requirements contrast with no-doc mortgages, which minimize paperwork but are harder to qualify for and carry higher risk premiums.

Qualifying for a No-Doc Mortgage with Poor Credit

Qualifying for a no-doc mortgage with poor credit requires demonstrating alternative financial stability through substantial cash reserves, steady income deposits, or significant assets instead of traditional credit verification. Lenders focus on evaluating bank statements, income reliability, and overall financial behavior to mitigate risk. This approach contrasts with subprime mortgages, which rely on higher credit risk acceptance but include more rigorous documentation requirements.

Interest Rates: Subprime vs No-Doc Mortgage Comparison

Subprime mortgages typically carry higher interest rates, often ranging from 7% to 12%, due to the increased risk lenders assume with credit-challenged borrowers. No-doc mortgages, while sometimes offering slightly lower rates between 6% and 10%, compensate for limited documentation requirements by incorporating stricter qualifications or larger down payments. Borrowers must carefully consider that subprime loans often result in more predictable payment structures, whereas no-doc loans can present variable interest rate risks.

Risks and Benefits for Credit-Challenged Borrowers

Subprime mortgages offer credit-challenged borrowers access to home loans despite lower credit scores but carry higher interest rates and increased risk of default due to stricter repayment terms. No-doc mortgages eliminate income verification, providing quick approval and privacy benefits, though they often come with elevated interest rates and greater lender scrutiny post-closing. Borrowers must weigh the potential benefit of faster loan approval against the increased financial risk and long-term cost associated with each option.

Documentation Demands: What You Need for Each Loan Type

Subprime mortgages require extensive documentation, including income verification, credit history, and asset statements to assess higher risk profiles, whereas no-doc mortgages significantly relax these demands, often needing minimal or no proof of income or assets. Borrowers with credit challenges might find no-doc loans appealing due to the ease of approval, but subprime loans offer more security through detailed financial scrutiny. Understanding these documentation requirements helps credit-challenged borrowers select the best mortgage option suited to their proof abilities and risk tolerance.

Alternative Mortgage Options for Low Credit Scores

Subprime mortgages target borrowers with low credit scores, offering loans at higher interest rates due to increased risk, while requiring extensive documentation to verify income and assets. No-doc mortgages provide an alternative by minimizing income verification, appealing to credit-challenged borrowers who struggle to provide traditional paperwork but often come with premium rates and stricter terms. Both options broaden access to home financing for individuals with poor credit but require careful evaluation of interest costs and repayment obligations.

Choosing the Right Mortgage: Factors to Consider

Subprime mortgages target credit-challenged borrowers by offering loans despite lower credit scores, but they often come with higher interest rates and stricter terms. No-doc mortgages eliminate the need for income verification, benefiting those with unstable or unverifiable incomes but typically impose higher costs and rigorous credit requirements. Assessing credit history, income stability, and long-term repayment capacity are critical when choosing between subprime and no-doc mortgage options.

Related Important Terms

Alt-A Loans

Alt-A loans offer credit-challenged borrowers an alternative between subprime mortgages and no-doc mortgages by providing reduced documentation requirements with better credit standards than subprime loans. These loans typically feature moderate credit scores and limited income verification, balancing risk and accessibility in the mortgage market.

Stated Income/Verified Asset (SIVA) Loans

Stated Income/Verified Asset (SIVA) loans offer credit-challenged borrowers an alternative by allowing income to be stated without full documentation while requiring asset verification, bridging the gap between riskier subprime mortgages and stricter no-doc loans. These loans balance lender risk and borrower accessibility by combining verified assets with flexible income verification, providing a viable solution for those with limited credit history but substantial assets.

Limited/No-Documentation (Low-Doc/No-Doc) Mortgages

Limited/No-Documentation (Low-Doc/No-Doc) mortgages offer credit-challenged borrowers an alternative to traditional subprime loans by requiring minimal income verification, relying instead on credit scores and asset evaluations. These mortgage types often come with higher interest rates and stricter terms but provide a pathway for applicants with inconsistent documentation to secure home financing.

Non-Qualified Mortgage (Non-QM)

Non-Qualified Mortgages (Non-QM) cater to credit-challenged borrowers by offering alternatives like subprime and no-doc loans, which bypass strict income and credit documentation requirements yet typically carry higher interest rates and increased default risks. Subprime mortgages target borrowers with poor credit scores, while no-doc loans rely on asset verification over income proofs, providing flexible underwriting solutions outside conventional Qualified Mortgage standards.

Near-Prime Mortgages

Near-prime mortgages bridge the gap between subprime and no-doc loans by offering credit-challenged borrowers more favorable terms with moderate documentation requirements and interest rates slightly higher than prime loans. These loans mitigate risk through tailored underwriting, making them a viable option for applicants with imperfect credit histories seeking manageable debt obligations.

Bank Statement Loans

Bank Statement Loans offer credit-challenged borrowers a viable option by allowing income verification through bank statements instead of traditional employment or tax documents, differentiating them from subprime mortgages that rely on higher interest rates and stricter credit score requirements. These no-doc mortgage products reduce barriers for self-employed individuals or those with irregular income, providing more flexible lending criteria while often maintaining competitive rates compared to subprime alternatives.

Asset Depletion Mortgages

Asset Depletion Mortgages offer credit-challenged borrowers an alternative to subprime and no-doc mortgages by allowing qualification based on liquid assets rather than traditional income verification. This approach reduces reliance on credit scores or incomplete documentation, providing a viable path for those with substantial assets but irregular income histories.

Non-Traditional Credit Review

Subprime mortgages target credit-challenged borrowers with documented credit issues, involving higher interest rates due to increased default risk, while no-doc mortgages bypass traditional income verification, relying heavily on alternative credit data and assets for approval. Non-traditional credit review leverages utility payments, rental history, and bank statements to assess borrower reliability in no-doc loans, contrasting with the strict FICO score assessments typical in subprime lending.

DTI Expansion Mortgages

DTI expansion mortgages offer credit-challenged borrowers alternatives by adjusting debt-to-income ratios to qualify for loans, contrasting subprime mortgages that carry higher interest rates due to credit risk, and no-doc mortgages that require minimal income verification but may pose higher default risks. These tailored lending solutions aim to increase homeownership opportunities while managing risk through careful evaluation of borrower financials beyond traditional credit scores.

Credit-Score Overlay Programs

Credit-score overlay programs in subprime mortgages impose stricter credit score requirements beyond standard lender guidelines, affecting credit-challenged borrowers' eligibility, while no-doc mortgages typically bypass traditional credit evaluations but may carry higher interest rates and stricter income verification alternatives. These overlays aim to mitigate risk by setting minimum credit thresholds in subprime loans, contrasting with no-doc mortgages' reliance on alternative underwriting criteria to accommodate borrowers with poor or unverifiable credit histories.

Subprime Mortgage vs No-Doc Mortgage for credit-challenged borrowers. Infographic

moneydiff.com

moneydiff.com