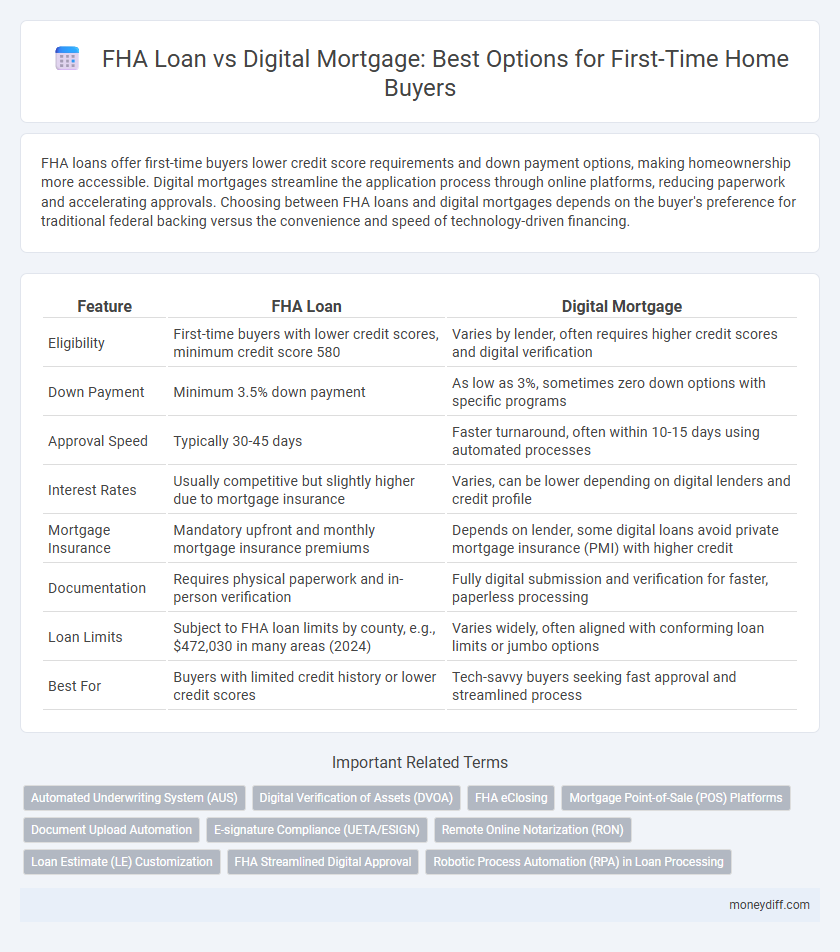

FHA loans offer first-time buyers lower credit score requirements and down payment options, making homeownership more accessible. Digital mortgages streamline the application process through online platforms, reducing paperwork and accelerating approvals. Choosing between FHA loans and digital mortgages depends on the buyer's preference for traditional federal backing versus the convenience and speed of technology-driven financing.

Table of Comparison

| Feature | FHA Loan | Digital Mortgage |

|---|---|---|

| Eligibility | First-time buyers with lower credit scores, minimum credit score 580 | Varies by lender, often requires higher credit scores and digital verification |

| Down Payment | Minimum 3.5% down payment | As low as 3%, sometimes zero down options with specific programs |

| Approval Speed | Typically 30-45 days | Faster turnaround, often within 10-15 days using automated processes |

| Interest Rates | Usually competitive but slightly higher due to mortgage insurance | Varies, can be lower depending on digital lenders and credit profile |

| Mortgage Insurance | Mandatory upfront and monthly mortgage insurance premiums | Depends on lender, some digital loans avoid private mortgage insurance (PMI) with higher credit |

| Documentation | Requires physical paperwork and in-person verification | Fully digital submission and verification for faster, paperless processing |

| Loan Limits | Subject to FHA loan limits by county, e.g., $472,030 in many areas (2024) | Varies widely, often aligned with conforming loan limits or jumbo options |

| Best For | Buyers with limited credit history or lower credit scores | Tech-savvy buyers seeking fast approval and streamlined process |

Understanding FHA Loans: Basics for First-Time Buyers

FHA loans provide first-time buyers with low down payment options, typically 3.5%, and more flexible credit score requirements compared to conventional loans. These government-backed mortgages are designed to help borrowers with limited savings or credit history secure home financing. Understanding FHA loan basics enables buyers to evaluate affordability and eligibility before exploring digital mortgage alternatives.

What is a Digital Mortgage? Key Features Explained

A digital mortgage streamlines the home loan process by leveraging online platforms to allow first-time buyers to apply, document, and receive approvals electronically, significantly reducing paperwork and processing time. Key features include automated credit checks, real-time status updates, e-signatures, and integration with financial databases for faster verification. Compared to traditional FHA loans, digital mortgages offer enhanced convenience and efficiency, although FHA loans provide government-backed security and potentially lower down payment requirements.

Eligibility Requirements: FHA Loan vs Digital Mortgage

FHA loans require first-time buyers to meet credit score minimums typically around 580, proof of steady income, and a debt-to-income ratio below 43%, ensuring accessibility for those with moderate credit histories. Digital mortgages often leverage automated income and asset verification, potentially reducing document requirements but usually demand higher credit scores and consistent financial profiles for algorithm-based approval. Both options cater to first-time buyers, but FHA loans provide more lenient eligibility standards compared to the streamlined yet stricter criteria of digital mortgage platforms.

Down Payment Differences: How They Compare

FHA loans typically require a minimum down payment of 3.5%, making them accessible for first-time buyers with limited savings. Digital mortgages often offer varied down payment options, sometimes as low as 3%, leveraging technology to streamline the approval process and potentially reduce upfront costs. Comparing these options, first-time buyers should evaluate down payment flexibility alongside digital convenience to determine the best fit for their financial situation.

Application Process: Traditional vs Digital Experience

FHA loans require a traditional application process involving in-person meetings, extensive paperwork, and manual credit assessments, which can extend approval times for first-time buyers. Digital mortgage platforms streamline the process through automated data verification, e-signatures, and real-time status updates, significantly reducing processing time and enhancing user convenience. First-time buyers often benefit from digital mortgages due to faster approval and a more transparent, user-friendly application experience compared to the conventional FHA loan process.

Interest Rates and Loan Terms: Side-by-Side Comparison

FHA loans typically offer lower interest rates and more flexible loan terms, such as down payments as low as 3.5%, making them accessible for first-time buyers with less-than-perfect credit. Digital mortgages often provide competitive interest rates through streamlined online processes but may require higher credit scores and down payments, ranging from 5% to 20%. Both options vary in loan term lengths, with FHA loans commonly offering 15- to 30-year fixed rates, while digital mortgages may provide customizable terms depending on the lender's platform.

Closing Costs: Breaking Down the Expenses

FHA loans typically have lower closing costs due to government-backed insurance and standardized fees, making them a cost-effective choice for first-time buyers. Digital mortgages often streamline the process, reducing some administrative fees and offering transparent, itemized closing costs through online platforms. Comparing both, FHA loans provide predictable expenses while digital mortgages enhance convenience and potential savings on document handling fees.

Technology Advantage: Speed and Convenience of Digital Mortgages

Digital mortgages leverage advanced technology to accelerate loan processing, often reducing approval times from weeks to days compared to traditional FHA loans. First-time buyers benefit from automated document submission and real-time status updates, enhancing convenience throughout the application. This technology advantage minimizes paperwork and streamlines communication between borrowers and lenders, making home financing faster and more efficient.

Pros and Cons: FHA Loan vs Digital Mortgage for New Buyers

FHA loans offer lower credit score requirements and down payments as low as 3.5%, making them accessible for first-time buyers with limited funds, but they include mandatory mortgage insurance premiums that increase monthly costs. Digital mortgages provide a faster, more convenient approval process through online platforms with automated document verification, yet they may have stricter credit criteria and less personalized support. Choosing between FHA loans and digital mortgages depends on the buyer's credit profile, need for speed, and comfort with technology-driven processes.

Choosing the Best Loan Option: What First-Time Buyers Should Consider

First-time homebuyers should evaluate FHA loans for their low down payment requirements and flexible credit score guidelines, making homeownership more accessible. Digital mortgages offer streamlined application processes and faster approvals by leveraging online platforms and automated underwriting systems. Comparing interest rates, mortgage insurance costs, and lender reputations will help buyers choose the best loan tailored to their financial situation and long-term goals.

Related Important Terms

Automated Underwriting System (AUS)

The FHA Loan relies heavily on the Automated Underwriting System (AUS) to streamline approval by assessing credit risk and eligibility based on set government guidelines, making it accessible for first-time buyers with lower credit scores and down payments. Digital mortgages integrate AUS technology with online platforms, offering a faster, more transparent approval process by automating document submission, verification, and real-time communication, enhancing the overall efficiency for first-time homebuyers.

Digital Verification of Assets (DVOA)

Digital Verification of Assets (DVOA) in digital mortgages offers first-time buyers faster and more accurate asset verification compared to traditional FHA loan processes, reducing underwriting time and enhancing loan approval certainty. This technology streamlines income and asset verification by securely accessing bank accounts and financial documents online, minimizing paperwork and manual errors commonly associated with FHA loans.

FHA eClosing

FHA loans offer first-time buyers government-backed benefits including lower down payments and flexible credit requirements, while digital mortgage platforms streamline the application with faster processing and enhanced eClosing capabilities. The FHA eClosing process enables secure electronic signing and remote notarization, significantly reducing paperwork and closing time compared to traditional methods.

Mortgage Point-of-Sale (POS) Platforms

Mortgage Point-of-Sale (POS) platforms enhance first-time buyers' experience by streamlining FHA loan applications with digital tools that reduce processing time and errors. Comparing traditional FHA loans to digital mortgage options, POS platforms improve access to real-time rates, automated credit checks, and seamless document uploads, accelerating approval and increasing borrower convenience.

Document Upload Automation

FHA loans offer first-time buyers government-backed financing with lower credit requirements, while digital mortgages streamline the application through document upload automation, significantly reducing processing time and enhancing user convenience. Automated document uploads minimize errors and expedite verification, making digital mortgages an efficient alternative to traditional FHA loan processing.

E-signature Compliance (UETA/ESIGN)

FHA loans traditionally require extensive paperwork, whereas digital mortgages streamline the process through e-signature compliance under UETA and ESIGN acts, ensuring secure and legally binding electronic signatures for first-time buyers. Leveraging digital mortgage platforms accelerates loan approval times while maintaining compliance with federal electronic signature standards, enhancing convenience without compromising legal integrity.

Remote Online Notarization (RON)

FHA loans provide government-backed security with lower credit requirements, while digital mortgages leverage Remote Online Notarization (RON) to streamline the signing process, reducing the need for physical presence and expediting loan closings. For first-time buyers, RON integration in digital mortgages offers enhanced convenience and efficiency, potentially accelerating access to homeownership compared to traditional FHA loan procedures.

Loan Estimate (LE) Customization

FHA loans provide standardized Loan Estimates (LE) with limited customization, ensuring clarity and regulatory compliance for first-time buyers, while digital mortgages offer highly customizable LE options that adapt to real-time borrower data and preferences, enhancing personalization and transparency. This flexibility in digital mortgage platforms allows first-time buyers to receive more tailored cost breakdowns, potentially improving decision-making during the loan selection process.

FHA Streamlined Digital Approval

FHA Streamlined Digital Approval offers first-time buyers a faster, automated process with reduced documentation compared to traditional FHA loans, enhancing accessibility and efficiency. This digital mortgage option leverages technology to expedite credit verification and underwriting, making it a convenient alternative for qualifying borrowers seeking low down payment financing.

Robotic Process Automation (RPA) in Loan Processing

FHA loans provide government-backed financing with lower credit score requirements, while digital mortgages leverage Robotic Process Automation (RPA) to streamline loan processing, reducing approval times for first-time buyers. RPA enhances accuracy and efficiency by automating document verification, data entry, and underwriting tasks, making digital mortgages a faster alternative to traditional FHA loan processing.

FHA Loan vs Digital Mortgage for first-time buyers. Infographic

moneydiff.com

moneydiff.com