Government-backed mortgages offer lower down payments and more flexible credit requirements, making homeownership accessible for first-time buyers and those with limited credit history. Digital mortgage platform loans streamline the application process through technology, providing faster approvals and increased transparency. Choosing between the two depends on individual financial situations, priorities, and the desire for convenience versus traditional support.

Table of Comparison

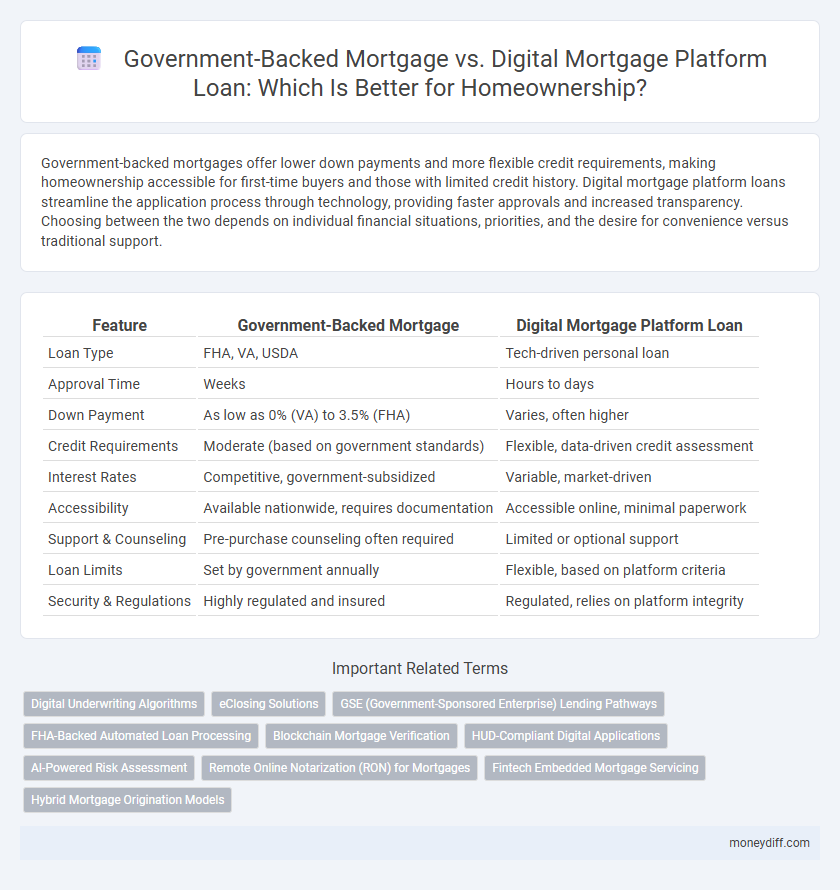

| Feature | Government-Backed Mortgage | Digital Mortgage Platform Loan |

|---|---|---|

| Loan Type | FHA, VA, USDA | Tech-driven personal loan |

| Approval Time | Weeks | Hours to days |

| Down Payment | As low as 0% (VA) to 3.5% (FHA) | Varies, often higher |

| Credit Requirements | Moderate (based on government standards) | Flexible, data-driven credit assessment |

| Interest Rates | Competitive, government-subsidized | Variable, market-driven |

| Accessibility | Available nationwide, requires documentation | Accessible online, minimal paperwork |

| Support & Counseling | Pre-purchase counseling often required | Limited or optional support |

| Loan Limits | Set by government annually | Flexible, based on platform criteria |

| Security & Regulations | Highly regulated and insured | Regulated, relies on platform integrity |

Understanding Government-Backed Mortgages

Government-backed mortgages, such as FHA, VA, and USDA loans, offer lower down payment requirements and more flexible credit criteria, making homeownership accessible to a broader range of buyers. These loans are insured by federal agencies, reducing lender risk and enabling more favorable interest rates compared to conventional financing. Understanding these benefits helps borrowers evaluate government-backed options against digital mortgage platforms, which streamline approvals but may not offer the same guarantees or terms.

What Is a Digital Mortgage Platform Loan?

A digital mortgage platform loan streamlines the homeownership process by enabling borrowers to complete loan applications, document submissions, and approvals entirely online through a secure, user-friendly interface. Unlike traditional government-backed mortgages that often require extensive paperwork and in-person visits, digital mortgage platforms leverage automation, AI, and real-time data integration to accelerate underwriting and reduce processing times. This innovation enhances transparency, convenience, and accessibility for homebuyers seeking efficient financing solutions in the housing market.

Eligibility Requirements for Each Mortgage Type

Government-backed mortgages, such as FHA, VA, and USDA loans, require specific eligibility criteria including credit score minimums typically around 580 for FHA, military service for VA loans, or rural property location for USDA loans. Digital mortgage platform loans often have more flexible eligibility standards, leveraging technology to assess alternative credit data and streamline income verification, appealing to borrowers with varying financial backgrounds. Understanding these distinct eligibility requirements helps homebuyers choose the appropriate mortgage type that aligns with their credit profile and property location.

Comparing Interest Rates and Fees

Government-backed mortgages typically offer lower interest rates and reduced fees due to federal guarantees by entities like FHA, VA, or USDA, making them attractive for first-time homebuyers or those with limited credit. In contrast, digital mortgage platform loans often provide competitive interest rates with streamlined application processes and lower overhead costs but may include variable fees depending on the technology provider and lender partnership. Comparing these options requires analyzing total loan costs, including closing fees, origination charges, and potential insurance premiums, to determine the most cost-effective path to homeownership.

Application Processes: Traditional vs Digital

Government-backed mortgage applications require extensive paperwork, including proof of income, credit checks, and detailed financial documentation, often necessitating in-person visits to lenders or agencies. Digital mortgage platform loans streamline the application process by enabling applicants to upload documents, verify information electronically, and receive real-time status updates through user-friendly online interfaces. Automation and AI-driven underwriting on digital platforms reduce approval times significantly compared to the traditional government-backed mortgage process, enhancing convenience and efficiency for prospective homeowners.

Down Payment and Credit Score Considerations

Government-backed mortgage loans typically require lower down payments, often as low as 3%, and accommodate credit scores as low as 580, making homeownership more accessible for buyers with limited funds or credit challenges. Digital mortgage platform loans may demand higher down payments, ranging from 5% to 20%, while credit score requirements often exceed 620 to qualify, reflecting streamlined approval processes and automated risk assessments. Evaluating down payment capabilities and credit profiles is crucial when choosing between government-backed options and digital mortgage platforms for optimal loan approval and affordability.

Speed and Convenience in Mortgage Approval

Government-backed mortgages often involve extensive paperwork and longer approval times due to stringent verification processes, impacting overall speed and convenience. Digital mortgage platform loans leverage automated underwriting technology and electronic document submission to significantly reduce approval timeframes, enhancing borrower experience. Homebuyers seeking faster homeownership can benefit from the streamlined digital mortgage approval process compared to traditional government-backed mortgage timelines.

Security and Privacy Concerns

Government-backed mortgages, such as FHA or VA loans, offer robust security through federally regulated underwriting processes and strict borrower identity verification, ensuring high privacy standards. Digital mortgage platforms leverage encryption and secure cloud-based systems to protect personal data, but may pose increased risks of cyber threats due to online data transmission. Homebuyers must weigh the enhanced regulatory safeguards of government-backed loans against the convenience and potential vulnerabilities inherent in digital mortgage solutions.

Long-Term Financial Impact

Government-backed mortgages, such as FHA and VA loans, offer lower down payments and competitive interest rates, reducing upfront costs for homebuyers. Digital mortgage platforms streamline the application and approval process, often providing faster decisions and potentially lower operational fees, which can impact overall loan expenses. Over the long term, government-backed loans may offer more predictable financial benefits through fixed rates and government guarantees, while digital mortgage loans can enhance convenience and cost-efficiency but depend on market-driven rates and terms.

Which Option Is Best for First-Time Homebuyers?

Government-backed mortgages, such as FHA and VA loans, offer lower down payment requirements and more flexible credit criteria, making them ideal for first-time homebuyers with limited savings or imperfect credit. Digital mortgage platforms streamline the application process through technology, providing faster approvals and greater transparency, which appeals to tech-savvy buyers seeking convenience. Evaluating eligibility, credit profile, and need for speed can help first-time buyers decide whether the traditional security of government-backed loans or the efficiency of digital platforms best suits their homeownership goals.

Related Important Terms

Digital Underwriting Algorithms

Digital underwriting algorithms streamline the mortgage approval process by rapidly analyzing vast datasets, improving accuracy and reducing human bias compared to traditional government-backed mortgage evaluations. These algorithms facilitate faster decision-making and personalized loan offers, enhancing accessibility and efficiency in digital mortgage platform loans for homeownership.

eClosing Solutions

Government-backed mortgage programs like FHA or VA loans often require traditional paper-based processes, whereas digital mortgage platform loans leverage eClosing solutions to streamline homeownership by enabling secure, remote document signing and faster loan processing. EClosing technology enhances efficiency, reduces errors, and improves borrower experience, making digital mortgage platforms a competitive alternative for obtaining government-backed loan financing.

GSE (Government-Sponsored Enterprise) Lending Pathways

Government-backed mortgage loans, primarily offered through GSEs like Fannie Mae and Freddie Mac, provide standardized underwriting, competitive interest rates, and broader eligibility criteria, enhancing affordability and access for many homebuyers. Digital mortgage platform loans leverage technology to streamline application and approval processes but often integrate GSE lending guidelines to ensure compliance and maximize loan accessibility within government-sponsored enterprise pathways.

FHA-Backed Automated Loan Processing

FHA-backed automated loan processing streamlines government-backed mortgage approvals by integrating advanced algorithms to evaluate borrower eligibility and reduce manual underwriting time. Digital mortgage platforms leveraging FHA automation enhance homeownership access by providing faster, more accurate FHA loan approvals compared to traditional government-backed mortgage workflows.

Blockchain Mortgage Verification

Government-backed mortgages provide low down payment options and federal insurance for borrower protection, while digital mortgage platforms leverage blockchain technology to enhance verification processes, ensuring secure, transparent, and tamper-proof records that accelerate loan approval and reduce fraud. Blockchain mortgage verification integrates smart contracts and decentralized ledgers to streamline document validation, offering a cutting-edge alternative to traditional government-backed loan procedures in homeownership financing.

HUD-Compliant Digital Applications

HUD-compliant digital applications streamline government-backed mortgage processes by ensuring adherence to federal housing regulations while expediting loan approval through automated data verification. This integration enhances borrower accessibility and reduces processing time compared to traditional government-backed mortgage methods, promoting efficient homeownership acquisition.

AI-Powered Risk Assessment

Government-backed mortgages offer lower interest rates and more flexible credit requirements due to federally insured risk, while AI-powered digital mortgage platforms use advanced algorithms for real-time risk assessment, enabling faster approvals and personalized loan terms. Integrating AI-driven analytics enhances accuracy in evaluating borrower creditworthiness compared to traditional government risk models, optimizing homeownership opportunities.

Remote Online Notarization (RON) for Mortgages

Remote Online Notarization (RON) enhances mortgage processes by allowing government-backed mortgage loans and digital mortgage platform loans to be executed efficiently without in-person visits, accelerating approval times and improving security. This technology supports seamless, compliant notarizations, benefiting borrowers seeking convenient homeownership financing options through secure, digital channels.

Fintech Embedded Mortgage Servicing

Government-backed mortgage programs like FHA and VA loans offer low down payments and competitive interest rates supported by federal guarantees, providing traditional security for borrowers. Fintech embedded mortgage servicing enhances homeownership by streamlining approvals, automating document verification, and enabling real-time loan tracking through digital mortgage platforms, significantly reducing processing time and improving borrower experience.

Hybrid Mortgage Origination Models

Hybrid mortgage origination models combine the reliability of government-backed mortgage programs, such as FHA or VA loans, with the efficiency of digital mortgage platforms, streamlining loan processing and enhancing accessibility for homebuyers. This approach leverages automated underwriting systems and traditional regulatory frameworks to offer competitive interest rates, faster approvals, and increased transparency in the homeownership loan process.

Government-Backed Mortgage vs Digital Mortgage Platform Loan for homeownership. Infographic

moneydiff.com

moneydiff.com