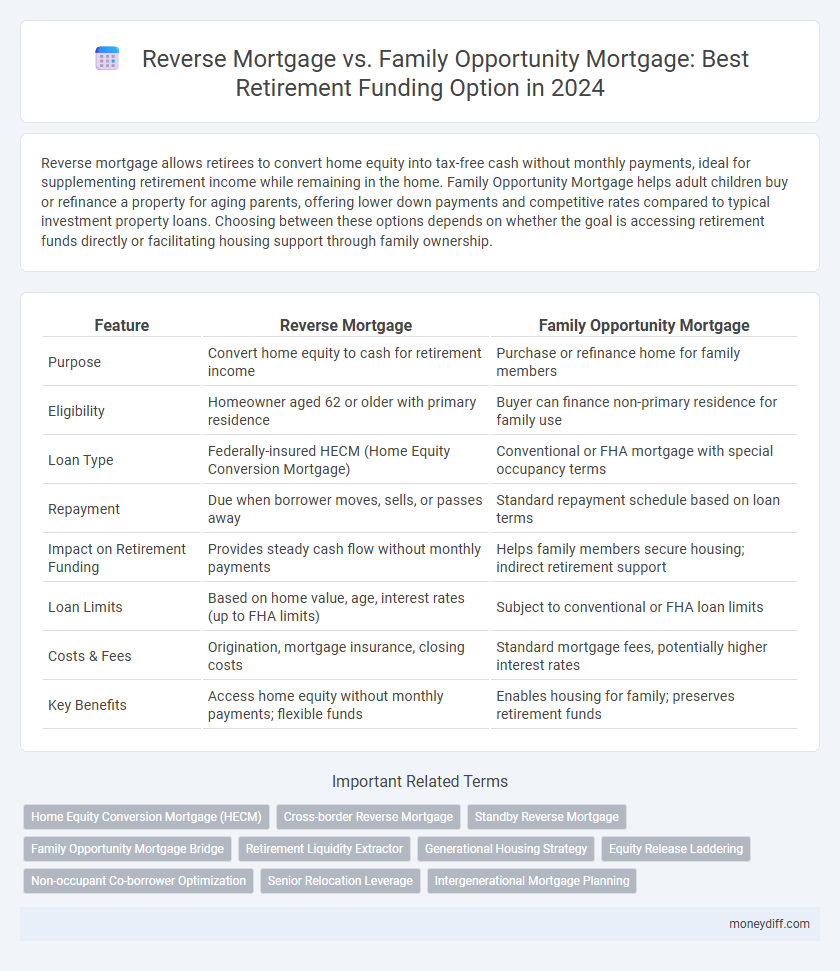

Reverse mortgage allows retirees to convert home equity into tax-free cash without monthly payments, ideal for supplementing retirement income while remaining in the home. Family Opportunity Mortgage helps adult children buy or refinance a property for aging parents, offering lower down payments and competitive rates compared to typical investment property loans. Choosing between these options depends on whether the goal is accessing retirement funds directly or facilitating housing support through family ownership.

Table of Comparison

| Feature | Reverse Mortgage | Family Opportunity Mortgage |

|---|---|---|

| Purpose | Convert home equity to cash for retirement income | Purchase or refinance home for family members |

| Eligibility | Homeowner aged 62 or older with primary residence | Buyer can finance non-primary residence for family use |

| Loan Type | Federally-insured HECM (Home Equity Conversion Mortgage) | Conventional or FHA mortgage with special occupancy terms |

| Repayment | Due when borrower moves, sells, or passes away | Standard repayment schedule based on loan terms |

| Impact on Retirement Funding | Provides steady cash flow without monthly payments | Helps family members secure housing; indirect retirement support |

| Loan Limits | Based on home value, age, interest rates (up to FHA limits) | Subject to conventional or FHA loan limits |

| Costs & Fees | Origination, mortgage insurance, closing costs | Standard mortgage fees, potentially higher interest rates |

| Key Benefits | Access home equity without monthly payments; flexible funds | Enables housing for family; preserves retirement funds |

Understanding Reverse Mortgages: Key Features and Benefits

Reverse mortgages provide homeowners aged 62 and older the ability to convert home equity into tax-free funds without monthly loan payments, supporting retirement income flexibility. These loans offer a non-recourse feature, ensuring borrowers or their heirs will never owe more than the home's value upon sale. Unlike the Family Opportunity Mortgage, which assists families purchasing homes for relatives, reverse mortgages specifically enable seniors to leverage their primary residence for financial stability during retirement.

What Is a Family Opportunity Mortgage?

A Family Opportunity Mortgage enables individuals to purchase a home for a family member, such as aging parents or adult children with disabilities, without the requirement that they occupy the property. This type of loan supports retirement funding by allowing retirees to invest in family housing while preserving their own financial flexibility. It contrasts with a reverse mortgage, which converts home equity into cash for the homeowner's use, often with repayment deferred until the borrower moves or sells.

Eligibility Criteria: Reverse Mortgage vs Family Opportunity Mortgage

Reverse Mortgage eligibility requires homeowners aged 62 or older with sufficient home equity, typically in a primary residence, while Family Opportunity Mortgage eligibility targets families purchasing homes for dependents such as elderly parents or disabled adult children, regardless of the buyer's age. Reverse Mortgages allow borrowers to convert home equity into funds without monthly mortgage payments, whereas Family Opportunity Mortgages offer conventional financing with competitive interest rates to families supporting non-occupant borrowers. Understanding these distinct eligibility criteria is essential for retirees considering tailored financing options based on age, property use, and household needs.

Costs and Fees Comparison

Reverse Mortgage typically involves higher upfront costs such as origination fees, closing costs, and mortgage insurance premiums, which can significantly reduce the loan proceeds available for retirement funding. Family Opportunity Mortgage usually has lower fees upfront, including reduced or no mortgage insurance premiums and standard closing costs, making it more cost-effective for families purchasing homes for elderly relatives. Evaluating fees over the loan term, Reverse Mortgage may accumulate greater interest due to deferred payments, whereas Family Opportunity Mortgage often features traditional fixed or adjustable rates that can result in lower overall financing costs.

Pros and Cons of Reverse Mortgages for Retirement

Reverse mortgages provide retirees with tax-free loan proceeds based on home equity, offering flexible income without monthly payments but reduce inheritance for heirs and may accrue high fees. They enable access to funds without selling the home, supporting aging in place, yet borrowers face risks if property taxes and insurance are unpaid, potentially leading to foreclosure. Compared to Family Opportunity Mortgages, which help purchase homes for family members but involve traditional loan repayments, reverse mortgages prioritize retirement cash flow at the expense of long-term estate value.

Pros and Cons of Family Opportunity Mortgages for Retirement

Family Opportunity Mortgages allow retirees to help adult children or disabled family members purchase homes while preserving the retiree's primary residence, often with lower down payment requirements and competitive interest rates. These loans provide a strategic way to support loved ones without impacting retirement cash flow but may limit the retiree's ability to access home equity for their own needs. However, Family Opportunity Mortgages require careful financial planning as obligating funds to family members' homes could reduce liquidity and complicate future retirement funding options.

Impact on Inheritance and Estate Planning

Reverse mortgages provide retirees with tax-free cash by converting home equity, but they reduce the inheritance value as the loan balance must be repaid upon the homeowner's death, often from the estate. Family Opportunity Mortgages allow purchasers to buy homes for elderly relatives without requiring the property to be the primary residence, preserving the homeowner's estate and maximizing inheritance potential. Strategic use of these loan types can significantly affect estate liquidity, tax implications, and wealth transfer plans in retirement funding.

Tax Implications for Retirees

Reverse mortgages allow retirees to access home equity as tax-free income without monthly repayments, preserving income streams for other expenses. Family Opportunity Mortgages, designed for financing homes for elderly parents, may offer potential property tax benefits and eligibility for certain deductions when the property serves as a primary residence. Understanding IRS guidelines on income recognition and property tax deductions is essential for retirees to optimize tax outcomes between these two mortgage options.

Long-term Financial Security: Which Mortgage Wins?

Reverse mortgages provide seniors with tax-free income by converting home equity into cash without monthly repayments, enhancing long-term financial security through steady retirement funding. Family Opportunity Mortgages enable homeowners to purchase or refinance a primary residence for a family member without higher investment property rates, supporting multigenerational financial stability. For sustainable retirement planning, reverse mortgages excel in liquidity and income stability, while Family Opportunity Mortgages favor preserving intergenerational wealth transfer.

Choosing the Right Mortgage for Your Retirement Needs

Reverse mortgages allow homeowners aged 62 and older to convert home equity into tax-free income without monthly payments, ideal for supplementing retirement cash flow while staying in the home. Family Opportunity Mortgages enable borrowers to purchase a home for a family member, often with lower down payment requirements, supporting intergenerational living and financial assistance during retirement. Choosing between these options depends on factors like the homeowner's age, financial goals, plans for family support, and the need for liquidity versus legacy preservation.

Related Important Terms

Home Equity Conversion Mortgage (HECM)

The Home Equity Conversion Mortgage (HECM) enables retirees to convert home equity into tax-free funds without monthly mortgage payments, providing liquidity for retirement living expenses. In contrast, the Family Opportunity Mortgage allows financing for family members' home purchases, focusing on supporting multigenerational households rather than direct retirement income supplementation.

Cross-border Reverse Mortgage

Cross-border reverse mortgage options provide retirees living abroad the ability to leverage their U.S. home equity without selling the property, enabling flexible retirement funding aligned with international residency. Unlike the Family Opportunity Mortgage, which supports family members purchasing homes, cross-border reverse mortgages specifically address retirement income needs by offering tax-efficient, low-interest loan advances against home value for expatriates.

Standby Reverse Mortgage

Standby Reverse Mortgage allows retirees to secure funds by converting home equity into a line of credit, preserving financial flexibility without monthly repayments, unlike Family Opportunity Mortgage which primarily supports family members purchasing a home. This strategy optimizes retirement funding by providing a safety net for unexpected expenses while maintaining family assistance through traditional financing options.

Family Opportunity Mortgage Bridge

Family Opportunity Mortgage Bridge enables retirees to finance a home purchase or support aging parents without disrupting existing retirement savings, offering lower down payments and competitive interest rates tailored for multigenerational living arrangements. In contrast to reverse mortgages, this option preserves home equity and avoids loan repayment until the property is sold, providing greater financial flexibility for long-term retirement planning.

Retirement Liquidity Extractor

Reverse Mortgage serves as a powerful Retirement Liquidity Extractor by allowing homeowners aged 62 and older to convert home equity into tax-free cash without monthly mortgage payments, enhancing financial flexibility during retirement. Family Opportunity Mortgage enables retirees to support loved ones by financing a family member's primary residence, but it offers less direct liquidity extraction compared to reverse mortgages, which specifically maximize retirement cash flow without requiring asset liquidation.

Generational Housing Strategy

Reverse Mortgage allows retirees to convert home equity into tax-free income without monthly payments, promoting financial independence while remaining in their homes. Family Opportunity Mortgage supports multigenerational living by enabling families to finance homes for aging parents or adult children, facilitating shared housing expenses and strengthening family bonds across generations.

Equity Release Laddering

Reverse Mortgage allows homeowners aged 62+ to convert home equity into tax-free funds without monthly repayments, ideal for retirement income supplementing; Family Opportunity Mortgage enables purchasing a home for elderly parents or disabled adult children, offering lower down payment and competitive rates. Employing an Equity Release Laddering strategy with reverse mortgages maximizes cash flow by staggering withdrawals over time, while Family Opportunity Mortgages facilitate intergenerational asset transfer without immediate equity depletion.

Non-occupant Co-borrower Optimization

Reverse Mortgage allows homeowners aged 62 and older to convert home equity into tax-free retirement income without monthly payments, optimizing cash flow while remaining in the home. Family Opportunity Mortgage enables non-occupant co-borrowers to finance a home for elderly parents or adult children, offering flexible qualification criteria and preserving retirement funds by leveraging family income.

Senior Relocation Leverage

Reverse Mortgages enable seniors to convert home equity into tax-free cash, providing flexible funds for retirement while maintaining residence, whereas Family Opportunity Mortgages allow seniors to support adult children's housing needs without home sale, leveraging property assets to facilitate multigenerational living arrangements. Senior relocation leverage is enhanced through reverse mortgages by offering liquidity without moving, while Family Opportunity Mortgages require strategic property planning to balance retirement funding with family support goals.

Intergenerational Mortgage Planning

Reverse mortgages enable retirees to convert home equity into tax-free income while remaining in their homes, facilitating liquidity without monthly payments, whereas Family Opportunity Mortgages allow multigenerational families to finance primary residences for adult children or elderly parents at favorable rates. Integrating reverse mortgages with Family Opportunity Mortgages supports intergenerational mortgage planning by preserving wealth, maintaining family homeownership stability, and optimizing retirement funding strategies across multiple generations.

Reverse Mortgage vs Family Opportunity Mortgage for Retirement Funding. Infographic

moneydiff.com

moneydiff.com