An Adjustable Rate Mortgage (ARM) offers a variable interest rate that can change periodically, making it suitable for buyers expecting fluctuating income or planning to refinance soon. A Piggyback Mortgage involves taking out two simultaneous loans to avoid paying private mortgage insurance, often used by buyers with less than 20% down payment. Choosing between an ARM and a Piggyback Mortgage depends on your financial stability, down payment size, and risk tolerance regarding interest rate changes.

Table of Comparison

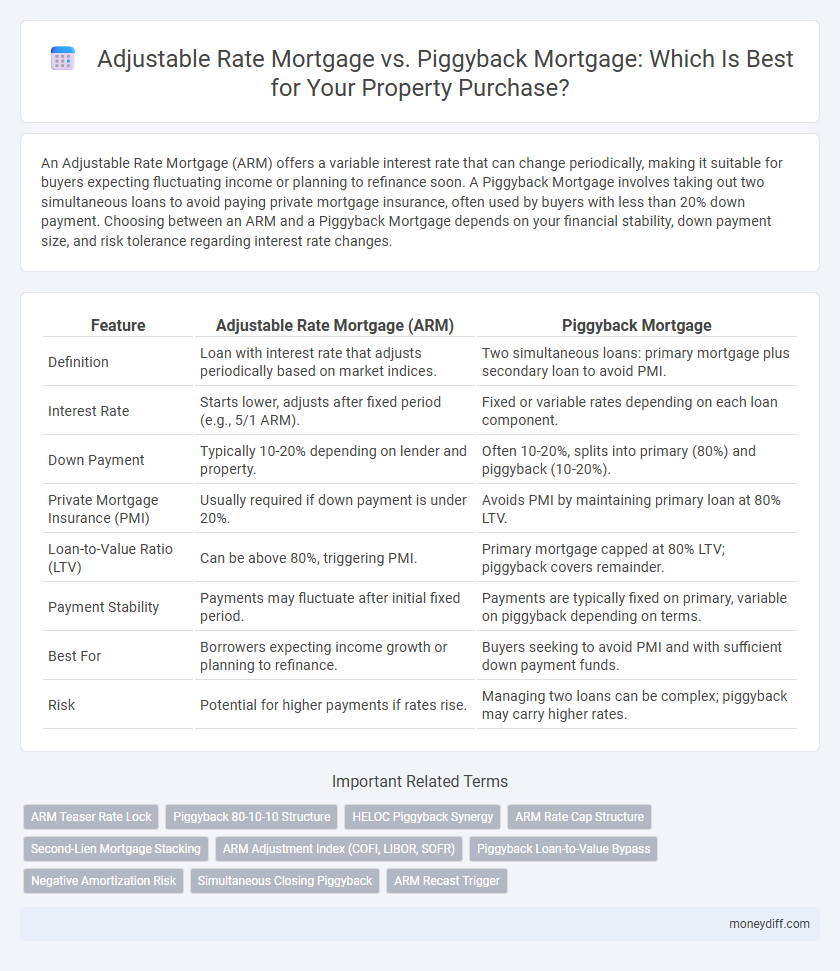

| Feature | Adjustable Rate Mortgage (ARM) | Piggyback Mortgage |

|---|---|---|

| Definition | Loan with interest rate that adjusts periodically based on market indices. | Two simultaneous loans: primary mortgage plus secondary loan to avoid PMI. |

| Interest Rate | Starts lower, adjusts after fixed period (e.g., 5/1 ARM). | Fixed or variable rates depending on each loan component. |

| Down Payment | Typically 10-20% depending on lender and property. | Often 10-20%, splits into primary (80%) and piggyback (10-20%). |

| Private Mortgage Insurance (PMI) | Usually required if down payment is under 20%. | Avoids PMI by maintaining primary loan at 80% LTV. |

| Loan-to-Value Ratio (LTV) | Can be above 80%, triggering PMI. | Primary mortgage capped at 80% LTV; piggyback covers remainder. |

| Payment Stability | Payments may fluctuate after initial fixed period. | Payments are typically fixed on primary, variable on piggyback depending on terms. |

| Best For | Borrowers expecting income growth or planning to refinance. | Buyers seeking to avoid PMI and with sufficient down payment funds. |

| Risk | Potential for higher payments if rates rise. | Managing two loans can be complex; piggyback may carry higher rates. |

Understanding Adjustable Rate Mortgages (ARM)

Adjustable Rate Mortgages (ARM) feature interest rates that adjust periodically based on a specific financial index, often resulting in lower initial payments compared to fixed-rate loans. ARMs typically offer an introductory fixed-rate period ranging from 3 to 10 years, after which the rate adjusts annually depending on market conditions, impacting monthly mortgage payments. Understanding ARM terms, such as index, margin, adjustment frequency, and rate caps, is essential for borrowers weighing the benefits and risks against alternatives like piggyback mortgages in property purchases.

What is a Piggyback Mortgage?

A piggyback mortgage involves taking out two loans simultaneously to cover a property purchase, typically combining a primary mortgage with a second loan to avoid private mortgage insurance (PMI) by keeping the down payment below 20%. This financing strategy is often structured as an 80-10-10 loan, where 80% is the primary mortgage, 10% is the piggyback loan, and 10% is the down payment. Piggyback mortgages can help buyers manage cash flow and qualify for better interest rates while reducing upfront costs compared to adjustable rate mortgages.

Key Differences Between ARM and Piggyback Mortgages

Adjustable Rate Mortgages (ARMs) feature interest rates that fluctuate based on market indices, initially offering lower rates that can increase after a fixed period, impacting monthly payments unpredictably. Piggyback Mortgages involve taking out two simultaneous loans, commonly an 80-10-10 structure, to avoid private mortgage insurance (PMI) and reduce upfront costs. Key differences include risk management, with ARMs exposing borrowers to interest rate volatility, while piggyback loans provide stable fixed rates but require more complex loan structuring.

Interest Rate Structures: ARM vs Piggyback

Adjustable Rate Mortgages (ARMs) feature interest rates that fluctuate based on market indices, typically offering a lower initial rate that adjusts periodically after a fixed term, impacting monthly payments and overall loan cost. Piggyback Mortgages combine a primary loan with a secondary loan, often a 80-10-10 structure, to avoid private mortgage insurance and secure a fixed interest rate on both loans, providing predictable payments. Understanding the differences in interest rate structures helps borrowers balance potential savings against the risk of rate increases and payment variability in property purchase financing.

Down Payment Requirements Compared

Adjustable Rate Mortgages typically require a lower initial down payment, often around 5% to 10%, allowing buyers to enter the market with less upfront cash. Piggyback Mortgages enable borrowers to avoid private mortgage insurance by combining a first mortgage of approximately 80% loan-to-value with a second loan to cover the remaining 10% to 15% down payment. Compared to ARM loans, piggyback loans demand a higher total down payment but reduce monthly mortgage insurance costs and can improve overall affordability.

Pros and Cons of Adjustable Rate Mortgages

Adjustable Rate Mortgages (ARMs) offer lower initial interest rates compared to fixed-rate loans, making them attractive for buyers expecting to sell or refinance within a few years. However, ARMs carry the risk of rising rates after the initial fixed period, which can lead to higher monthly payments and financial uncertainty. Borrowers should carefully assess market trends and their long-term plans before choosing an ARM over a Piggyback Mortgage or other financing options.

Advantages and Disadvantages of Piggyback Mortgages

Piggyback mortgages offer the advantage of helping buyers avoid private mortgage insurance (PMI) by splitting the loan into a primary mortgage and a secondary home equity loan, often enabling lower upfront costs. However, disadvantages include potentially higher interest rates on the second loan and increased overall debt burden, which may complicate repayment and increase financial risk. This strategy is best suited for buyers with sufficient income and credit to manage multiple loan payments simultaneously without impacting cash flow.

Impact on Monthly Payments and Affordability

Adjustable Rate Mortgages (ARMs) typically start with lower monthly payments due to initial fixed interest rates that adjust over time, potentially increasing payment amounts and impacting long-term affordability. Piggyback Mortgages involve taking out two loans simultaneously, which can lower initial monthly payments by avoiding private mortgage insurance (PMI) and reducing the primary loan amount, enhancing immediate affordability for property purchase. Borrowers must consider ARM rate fluctuation risks versus the dual-loan complexity and potential interest costs of piggyback loans when evaluating monthly payment stability and overall housing affordability.

Credit Score Implications for Both Options

Adjustable Rate Mortgages (ARMs) typically require higher credit scores due to the risk of fluctuating interest rates affecting payment stability, which lenders mitigate by favoring borrowers with strong credit profiles. Piggyback Mortgages, involving two simultaneous loans often to avoid private mortgage insurance, also demand good credit scores but may offer more flexibility for borrowers with slightly lower credit by splitting the risk across loans. Understanding the credit score impact on ARM and Piggyback Mortgage qualification helps buyers optimize financing strategies and enhance approval chances for property purchases.

Which Mortgage Type Suits Your Property Purchase Strategy?

Adjustable Rate Mortgages (ARMs) offer initial lower interest rates that adjust periodically based on market conditions, making them ideal for buyers planning to sell or refinance within a few years. Piggyback Mortgages combine a primary loan with a secondary loan to avoid private mortgage insurance (PMI), benefiting buyers with less than 20% down payment and stable long-term plans. Selecting between ARMs and Piggyback Mortgages hinges on your financial strategy, risk tolerance for interest fluctuations, and the anticipated timeline for property ownership.

Related Important Terms

ARM Teaser Rate Lock

Adjustable Rate Mortgages (ARMs) often feature a teaser rate lock, offering a low initial interest rate for a fixed period before adjustment, which can lower initial monthly payments but introduces potential payment volatility. Piggyback mortgages avoid private mortgage insurance by splitting the loan into two, usually fixed-rate loans, providing payment stability but lacking the initial low-rate benefit and teaser rate structure seen in ARMs.

Piggyback 80-10-10 Structure

The Piggyback 80-10-10 mortgage structure combines an 80% first mortgage, a 10% second mortgage, and a 10% down payment to avoid private mortgage insurance (PMI) and reduce overall borrowing costs. This approach enables homebuyers to secure financing with lower monthly payments compared to adjustable rate mortgages, which often carry variable interest rates and potential payment increases over time.

HELOC Piggyback Synergy

An Adjustable Rate Mortgage (ARM) offers fluctuating interest rates tied to market indexes, providing lower initial payments but potential future increases, while a Piggyback Mortgage combines a primary loan with a second HELOC to avoid private mortgage insurance (PMI) and leverage favorable rates. HELOC Piggyback synergy enhances borrowing flexibility by utilizing the revolving credit of the second loan, allowing homeowners to manage payments and potentially pay down debt faster during property purchase.

ARM Rate Cap Structure

Adjustable Rate Mortgages (ARMs) feature a rate cap structure that limits how much the interest rate can increase at each adjustment period and over the life of the loan, providing borrowers protection against sudden payment spikes. In contrast, Piggyback Mortgages typically have fixed rates on both loans, avoiding interest rate risk but often resulting in higher overall payments compared to an ARM with a favorable cap structure.

Second-Lien Mortgage Stacking

Adjustable Rate Mortgages (ARMs) offer variable interest rates that can lead to fluctuating monthly payments, whereas piggyback mortgages involve a second-lien mortgage stacked on a primary loan to avoid private mortgage insurance (PMI) or reduce down payment requirements. Second-lien mortgage stacking increases overall debt service and risk exposure, requiring careful analysis of interest rate adjustments in ARMs and combined loan-to-value ratios in piggyback financing.

ARM Adjustment Index (COFI, LIBOR, SOFR)

Adjustable Rate Mortgages (ARMs) often use indices such as COFI, LIBOR, or SOFR to determine interest rate adjustments, directly impacting monthly payment fluctuations over the loan term. In contrast, Piggyback Mortgages combine two loans to avoid private mortgage insurance, usually with fixed rates, thus offering predictable payments without reliance on index-based rate changes.

Piggyback Loan-to-Value Bypass

Piggyback mortgages enable homebuyers to bypass private mortgage insurance (PMI) by splitting the loan into a primary mortgage and a secondary loan, often structured as an 80-10-10 or 80-15-5 LTV ratio. This strategy reduces the loan-to-value (LTV) ratio on the primary mortgage below 80%, allowing borrowers to avoid PMI costs typically associated with adjustable-rate mortgages exceeding this threshold.

Negative Amortization Risk

Adjustable Rate Mortgages (ARMs) carry a significant negative amortization risk as fluctuating interest rates can cause monthly payments to fall short of covering accrued interest, increasing the loan balance over time. Piggyback Mortgages typically avoid this risk by combining a primary loan with a secondary loan, allowing borrowers to maintain more stable principal payments and reduce exposure to rising interest rates.

Simultaneous Closing Piggyback

Simultaneous closing piggyback mortgages involve obtaining two loans at the same time to avoid private mortgage insurance (PMI) and manage down payment requirements, typically combining a primary first mortgage with a second loan covering 10-20% of the property's value. Adjustable Rate Mortgages (ARMs) offer initial lower interest rates that adjust periodically, but simultaneous closing piggyback loans provide stable financing by separating the loan amounts, which can enhance cash flow management during property purchases.

ARM Recast Trigger

An Adjustable Rate Mortgage (ARM) recast trigger allows borrowers to adjust their monthly payments based on interest rate fluctuations and principal repayments without refinancing, enhancing payment flexibility over the loan term. In contrast, a Piggyback Mortgage involves two separate loans to avoid private mortgage insurance, but typically lacks the recast feature, resulting in fixed payment structures for both loans throughout the property purchase process.

Adjustable Rate Mortgage vs Piggyback Mortgage for Property Purchase. Infographic

moneydiff.com

moneydiff.com