Biweekly payment mortgages offer structured repayment by splitting monthly payments into two biweekly installments, accelerating loan payoff and reducing interest over time. Crowdfunded mortgages enable borrowers to raise funds from multiple investors, providing flexible repayment options tailored to the investment agreements. Choosing between these plans depends on preferences for consistent, predictable payments versus customizable terms and potential lender diversification.

Table of Comparison

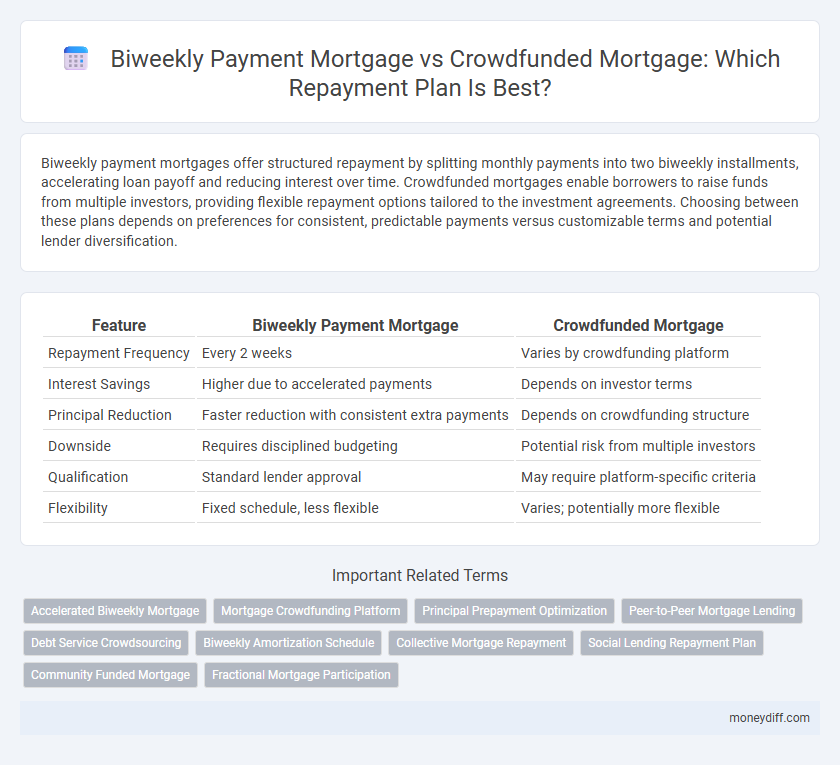

| Feature | Biweekly Payment Mortgage | Crowdfunded Mortgage |

|---|---|---|

| Repayment Frequency | Every 2 weeks | Varies by crowdfunding platform |

| Interest Savings | Higher due to accelerated payments | Depends on investor terms |

| Principal Reduction | Faster reduction with consistent extra payments | Depends on crowdfunding structure |

| Downside | Requires disciplined budgeting | Potential risk from multiple investors |

| Qualification | Standard lender approval | May require platform-specific criteria |

| Flexibility | Fixed schedule, less flexible | Varies; potentially more flexible |

Understanding Biweekly Payment Mortgages

Biweekly payment mortgages involve making half of the monthly mortgage payment every two weeks, resulting in 26 payments annually that equal 13 full monthly payments, which accelerates loan payoff and reduces interest costs over time. This repayment plan offers structured discipline and can save thousands of dollars in interest on a typical 30-year fixed-rate mortgage by shortening the loan term by several years. Unlike crowdfunded mortgages, biweekly payments are managed through traditional lenders and do not rely on pooling funds from multiple investors, providing borrowers with consistent, predictable payment schedules.

What Is a Crowdfunded Mortgage?

A crowdfunded mortgage involves multiple investors collectively financing a home loan, allowing borrowers to access funds without traditional bank lending. This repayment plan often offers flexible terms and can reduce the borrower's interest costs by eliminating typical bank fees. Compared to biweekly payment mortgages, crowdfunded mortgages provide an alternative source of capital while potentially accelerating loan repayment through customized schedules.

Key Differences Between Biweekly and Crowdfunded Repayment Plans

Biweekly payment mortgages require borrowers to make payments every two weeks, effectively resulting in one extra monthly payment per year, which accelerates loan repayment and reduces interest accrued. Crowdfunded mortgages involve pooling funds from multiple investors to finance the loan, often leading to flexible repayment terms but potentially higher costs due to investor returns. The key differences lie in payment frequency, source of funds, and impact on loan duration and overall cost, with biweekly plans focusing on borrower-driven accelerated payoff and crowdfunded plans relying on external capital with varying repayment conditions.

Interest Savings: Biweekly vs Crowdfunded Mortgages

Biweekly payment mortgages reduce total interest paid by accelerating principal repayment through 26 half-payments annually, effectively making one extra monthly payment per year. Crowdfunded mortgages may offer competitive interest rates but often depend on investor returns, potentially lengthening payoff periods and increasing interest costs over time. Comparing interest savings, biweekly plans typically result in more predictable and substantial reductions in total interest compared to the variable nature of crowdfunded mortgage repayment schedules.

Impact on Loan Term Reduction

Biweekly payment mortgages accelerate loan repayment by making 26 half-payments annually, effectively reducing the loan term by several years and decreasing total interest paid. Crowdfunded mortgages rely on multiple investors pooling funds, often maintaining traditional monthly payment schedules that do not inherently shorten loan duration. The biweekly approach directly impacts loan term reduction, while crowdfunded mortgages primarily influence funding sources rather than repayment speed.

Eligibility and Qualification Requirements

Biweekly payment mortgages typically require borrowers to have a stable income and a credit score above 620, ensuring timely bi-monthly repayments that reduce interest costs over time. Crowdfunded mortgages often have more flexible eligibility criteria, allowing borrowers with lower credit scores or unconventional income sources to qualify by leveraging multiple small investors. Both repayment plans demand thorough documentation, but crowdfunded mortgages may involve additional legal disclosures and investor agreements.

Risks and Rewards of Crowdfunded Mortgage Repayment

Crowdfunded mortgage repayment offers the reward of diversified funding sources, potentially lowering interest rates and increasing access for borrowers with non-traditional credit profiles. However, the risks include less regulatory oversight, which can lead to increased vulnerability to fraud or poorly structured terms, and potential delays in repayment due to reliance on multiple investors. Compared to biweekly payment mortgages, crowdfunded options may provide flexible capital but require thorough due diligence to mitigate financial and legal risks.

Managing Cash Flow: Biweekly vs Crowdfunded Payments

Biweekly payment mortgages improve cash flow management by splitting monthly payments into smaller, more frequent amounts, reducing interest over time and accelerating loan payoff. Crowdfunded mortgage repayment plans rely on multiple contributors pooling resources, which can offer flexible payment schedules but may introduce variability in cash flow consistency. Homeowners prioritizing steady, predictable budgeting often benefit more from biweekly payments, while those leveraging community funding might face fluctuating contributions impacting their repayment timeline.

Suitability for First-Time Homebuyers

Biweekly payment mortgages offer first-time homebuyers a more aggressive repayment schedule, reducing interest costs and loan term by making payments every two weeks. Crowdfunded mortgages provide flexible funding options, appealing to buyers with limited upfront capital by pooling resources from multiple investors. Choosing between these depends on the buyer's financial stability and preference for traditional versus alternative lending structures.

Choosing the Right Mortgage Repayment Plan for You

Biweekly payment mortgages accelerate loan repayment by splitting monthly payments into biweekly installments, reducing interest and shortening loan terms. Crowdfunded mortgages pool funds from multiple investors, offering flexible repayment options though often with variable terms and potential fees. Carefully compare interest rates, repayment schedules, associated costs, and your financial stability to choose the mortgage repayment plan that best aligns with your long-term financial goals.

Related Important Terms

Accelerated Biweekly Mortgage

Accelerated biweekly mortgage repayment plans reduce loan amortization by applying payments every two weeks, effectively making one extra monthly payment annually and decreasing interest costs over time. Crowdfunded mortgages typically involve pooled investor funds that may offer flexible terms but often lack the accelerated repayment benefits and interest savings characteristic of biweekly payment structures.

Mortgage Crowdfunding Platform

Mortgage crowdfunding platforms enable borrowers to access funds from multiple investors, offering flexible repayment plans that can reduce interest over time compared to traditional biweekly payment mortgages. By diversifying funding sources, these platforms often provide customized loan terms that may accelerate principal repayment and lower overall mortgage costs.

Principal Prepayment Optimization

Biweekly payment mortgages accelerate principal reduction by splitting monthly payments into two half-payments, effectively making one extra payment annually and reducing interest costs over time. Crowdfunded mortgages leverage multiple investors to potentially lower interest rates but may lack the structured principal prepayment optimization inherent in biweekly plans, affecting overall repayment efficiency.

Peer-to-Peer Mortgage Lending

Biweekly payment mortgages reduce interest by increasing payment frequency, accelerating principal repayment and lowering overall loan cost compared to traditional monthly plans. Crowdfunded mortgages leverage peer-to-peer lending platforms, enabling borrowers to access capital directly from multiple investors, often resulting in competitive interest rates and flexible repayment options tailored to individual financial situations.

Debt Service Crowdsourcing

Biweekly payment mortgages accelerate loan repayment by splitting monthly payments into two halves, reducing interest costs and total loan duration through more frequent principal reductions. Crowdfunded mortgages use debt service crowdsourcing, allowing multiple investors to fund portions of the mortgage, diversifying risk and potentially lowering individual monthly payments while involving community-backed financial support.

Biweekly Amortization Schedule

A biweekly payment mortgage accelerates loan repayment by splitting monthly payments in half and paying every two weeks, resulting in 26 half-payments or 13 full payments annually, which reduces principal faster and lowers overall interest costs. Unlike crowdfunded mortgages that rely on pooled investor funds and variable repayment terms, biweekly amortization schedules offer predictable, systematic principal reduction leading to earlier loan payoff and increased equity accumulation.

Collective Mortgage Repayment

Biweekly payment mortgages accelerate loan repayment by making 26 half-payments annually, reducing interest over time and shortening loan terms. Crowdfunded mortgages leverage collective investment from multiple lenders, distributing risk and potentially offering more flexible repayment plans tailored to borrower needs.

Social Lending Repayment Plan

Biweekly payment mortgages accelerate loan repayment by splitting monthly payments into two, reducing interest over time, while crowdfunded mortgages leverage social lending platforms where multiple investors fund the loan, often enabling flexible, community-driven repayment plans. Social lending repayment plans in crowdfunded mortgages typically offer customized schedules and lower fees, appealing to borrowers seeking collaborative financial solutions compared to traditional biweekly structures.

Community Funded Mortgage

Community funded mortgages leverage collective investment to provide more flexible repayment plans compared to traditional biweekly payment mortgages, often reducing interest costs and accelerating loan payoff. By pooling resources, borrowers benefit from shared risk and potentially lower monthly payments, fostering community support and financial inclusion.

Fractional Mortgage Participation

Biweekly payment mortgages accelerate loan repayment by splitting monthly payments into two, reducing interest over the term and shortening the amortization period. Crowdfunded mortgages utilize fractional mortgage participation, allowing multiple investors to share ownership and risk, enabling borrowers to access diverse funding sources with flexible repayment plans.

Biweekly Payment Mortgage vs Crowdfunded Mortgage for repayment plans. Infographic

moneydiff.com

moneydiff.com