Adjustable Rate Mortgages (ARMs) offer fluctuating interest rates tied to market indices, providing initial lower payments that can increase or decrease over time, ideal for borrowers expecting rate drops or short-term ownership. Balloon Payment Mortgages feature fixed payments with a large lump sum due at the end of the term, suited for borrowers who anticipate refinancing or selling before the balloon payment is due. Choosing between these mortgage types depends on cash flow flexibility, risk tolerance, and long-term financial plans for efficient loan structuring.

Table of Comparison

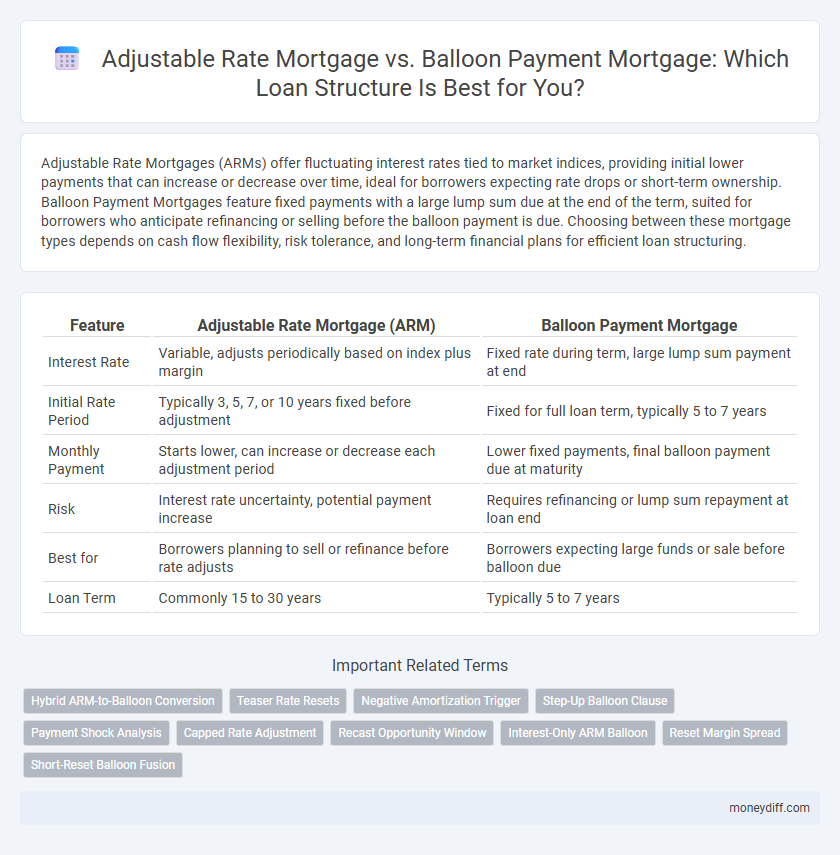

| Feature | Adjustable Rate Mortgage (ARM) | Balloon Payment Mortgage |

|---|---|---|

| Interest Rate | Variable, adjusts periodically based on index plus margin | Fixed rate during term, large lump sum payment at end |

| Initial Rate Period | Typically 3, 5, 7, or 10 years fixed before adjustment | Fixed for full loan term, typically 5 to 7 years |

| Monthly Payment | Starts lower, can increase or decrease each adjustment period | Lower fixed payments, final balloon payment due at maturity |

| Risk | Interest rate uncertainty, potential payment increase | Requires refinancing or lump sum repayment at loan end |

| Best for | Borrowers planning to sell or refinance before rate adjusts | Borrowers expecting large funds or sale before balloon due |

| Loan Term | Commonly 15 to 30 years | Typically 5 to 7 years |

Understanding Adjustable Rate Mortgages (ARMs)

Adjustable Rate Mortgages (ARMs) feature interest rates that periodically adjust based on a specific benchmark or index, such as the LIBOR or U.S. Treasury rates, affecting monthly payments over the loan term. These mortgages often start with a lower initial rate compared to fixed-rate loans, offering potential savings but carrying the risk of increased payments when rates rise. Understanding the indexing method, adjustment frequency, and caps on rate changes is crucial for borrowers to effectively manage financial exposure in loan structuring.

What is a Balloon Payment Mortgage?

A Balloon Payment Mortgage features lower initial monthly payments with a large lump-sum payment due at the end of the loan term, typically five to seven years. This structure suits borrowers expecting increased future income or refinancing options before the balloon payment is due. Unlike Adjustable Rate Mortgages, which have variable interest rates adjusting periodically, balloon loans maintain fixed payments until the balloon amount is repaid.

Key Differences Between ARMs and Balloon Payment Mortgages

Adjustable Rate Mortgages (ARMs) feature interest rates that fluctuate periodically based on an underlying index, leading to variable monthly payments over the loan term, while Balloon Payment Mortgages require smaller regular payments with a large lump-sum payment due at the end of the term. ARMs often include initial fixed-rate periods followed by adjustable phases, whereas balloon loans typically involve fixed payments until maturity when the outstanding principal balance becomes due. The key difference lies in payment structure timing--ARMs adjust payments throughout, whereas balloon mortgages defer significant repayment to loan maturity.

Pros and Cons of Adjustable Rate Mortgages

Adjustable Rate Mortgages (ARMs) offer initial lower interest rates compared to fixed-rate loans, which can reduce monthly payments and improve cash flow flexibility during the early years of the loan. However, ARMs carry the risk of rising rates after the adjustment period, leading to potentially higher monthly payments and financial uncertainty for borrowers. The variability of ARMs makes them suitable for borrowers expecting to sell or refinance before rates adjust, but less ideal for those seeking long-term payment stability.

Pros and Cons of Balloon Payment Mortgages

Balloon payment mortgages offer lower initial interest rates and smaller monthly payments, making them attractive for borrowers expecting to refinance or sell before the large final payment is due. However, the significant lump-sum payment at the end of the loan term poses a risk if refinancing opportunities are limited or property values decline, potentially leading to financial strain or default. This loan structure benefits those with short-term financing needs but requires careful planning to avoid payment shocks and ensure the availability of funds when the balloon payment matures.

Interest Rate Fluctuations: Impact on Loan Structuring

Adjustable Rate Mortgages (ARMs) feature interest rates that fluctuate periodically based on market indices, affecting monthly payments and overall loan affordability. Balloon Payment Mortgages maintain fixed rates during the term but require a large lump sum payment at maturity, influencing cash flow planning and refinancing risk. Understanding interest rate variability is crucial for loan structuring to balance payment stability against potential cost increases.

Payment Stability: ARM vs Balloon Mortgage

Adjustable Rate Mortgages (ARMs) offer initial low interest rates that adjust periodically based on market indices, resulting in fluctuating monthly payments and less payment stability over time. Balloon Payment Mortgages provide fixed monthly payments during the loan term with a large lump-sum payment due at maturity, creating predictable payments until the balloon is due but requiring significant refinancing or payment upon loan end. Borrowers prioritizing payment stability benefit from understanding ARMs' variability versus the fixed interim payments and substantial end-payment risk inherent in Balloon Mortgages.

Risk Factors in ARM and Balloon Payment Loans

Adjustable Rate Mortgages (ARMs) expose borrowers to interest rate volatility, which can significantly increase monthly payments when market rates rise, creating uncertainty in long-term affordability. Balloon Payment Mortgages carry the risk of a large lump-sum payment at the end of the term, potentially leading to refinancing challenges or default if the borrower cannot secure new financing. Both loan structures require careful risk assessment regarding future financial capacity and market conditions to avoid payment shock or foreclosure.

Loan Suitability: Which Mortgage Fits Your Financial Goals?

Adjustable Rate Mortgages (ARMs) suit borrowers seeking lower initial payments with flexibility to benefit from market interest rate fluctuations, ideal for those planning to sell or refinance before rates adjust. Balloon Payment Mortgages require smaller monthly payments with a large lump-sum payment at the end, fitting borrowers confident in increased future income or asset liquidity to cover the balloon amount. Evaluating your financial stability, risk tolerance, and long-term plans is crucial in selecting the mortgage structure that aligns with your financial goals and cash flow projections.

Choosing Between ARM and Balloon Payment Mortgage for Optimal Money Management

Choosing between an Adjustable Rate Mortgage (ARM) and a Balloon Payment Mortgage depends on your financial stability and market interest rate predictions. ARM offers fluctuating interest rates tied to market indexes, potentially lowering initial payments but risking increases over time, while Balloon Payment Mortgages provide fixed lower payments with a large lump sum due at the end, requiring sound refinancing or payoff strategy. Careful assessment of cash flow, risk tolerance, and future rate expectations is essential for optimal loan structuring and money management.

Related Important Terms

Hybrid ARM-to-Balloon Conversion

A Hybrid ARM-to-Balloon conversion combines the benefits of adjustable-rate mortgages with a balloon payment structure, offering initial low interest rates that adjust periodically before a large final lump-sum payment is due. This loan structuring option provides flexibility for borrowers anticipating refinancing or asset liquidation prior to the balloon maturity, balancing short-term affordability with long-term repayment risks.

Teaser Rate Resets

Adjustable Rate Mortgages (ARMs) often feature teaser rate resets that begin with low initial interest rates, attracting borrowers with lower monthly payments before periodic adjustments based on market indices increase rates and payments. Balloon Payment Mortgages require a large lump-sum payment at the end of the term, but do not typically involve teaser rates, making ARMs more suitable for borrowers seeking initial affordability with rate adjustments over time.

Negative Amortization Trigger

An Adjustable Rate Mortgage (ARM) may include a Negative Amortization Trigger that increases payments if the loan balance surpasses a set limit due to unpaid interest accumulation, whereas a Balloon Payment Mortgage typically avoids negative amortization by requiring full repayment or refinancing at loan maturity. Understanding these triggers is crucial for loan structuring to mitigate the risk of unexpected payment surges or refinancing challenges.

Step-Up Balloon Clause

The Step-Up Balloon Clause in mortgage loan structuring combines features of Adjustable Rate Mortgage (ARM) and Balloon Payment Mortgage by allowing periodic interest rate increases alongside a large lump-sum payment at loan maturity. This hybrid approach benefits borrowers seeking lower initial payments and manageable rate adjustments but requires strong financial planning to handle the eventual balloon payment.

Payment Shock Analysis

Adjustable Rate Mortgages (ARMs) expose borrowers to payment shock risk due to fluctuating interest rates after the initial fixed period, potentially increasing monthly payments significantly. Balloon Payment Mortgages require a large lump-sum payment at the end of the term, posing substantial payment shock risk if refinancing or refinancing options are unavailable when the balloon payment is due.

Capped Rate Adjustment

An Adjustable Rate Mortgage (ARM) with a capped rate adjustment limits the maximum interest rate increase during the loan term, providing predictable payment changes for borrowers. In contrast, a Balloon Payment Mortgage typically features fixed rates but requires a large lump-sum payment at the end of the term, increasing refinancing risk without rate adjustment caps.

Recast Opportunity Window

Adjustable Rate Mortgages (ARMs) provide a recast opportunity window allowing borrowers to modify payment terms as interest rates fluctuate, enhancing payment flexibility over the loan's life. Balloon Payment Mortgages typically have a shorter recast window with a large lump-sum payment due at maturity, limiting long-term payment adjustment options but potentially lowering initial monthly costs.

Interest-Only ARM Balloon

Interest-Only Adjustable Rate Mortgages (ARMs) offer initial low monthly payments by allowing borrowers to pay only interest for a set period before principal payments begin, creating cash flow flexibility but potential payment shocks later. Balloon Payment Mortgages combine fixed low payments with a large lump-sum balloon due at loan maturity, requiring strategic refinancing or full repayment to manage interest costs and loan duration risks effectively.

Reset Margin Spread

Adjustable Rate Mortgages (ARMs) feature a reset margin spread that determines changes in interest rates tied to benchmark indexes, providing flexibility in loan structuring based on market fluctuations. Balloon Payment Mortgages typically have fixed rates with a lump sum due at the end, lacking a reset margin spread, which can limit interest rate adjustments during the loan term.

Short-Reset Balloon Fusion

Short-reset balloon mortgages combine the flexibility of adjustable rate mortgages with a final lump-sum payment, offering lower initial interest rates and periodic rate adjustments before the balloon payment is due, typically within 5 to 7 years. This loan structuring suits borrowers seeking short-term financing with manageable monthly payments and the option to refinance or pay off the remaining balance upon reset.

Adjustable Rate Mortgage vs Balloon Payment Mortgage for loan structuring. Infographic

moneydiff.com

moneydiff.com