Interest-only mortgages allow borrowers to pay only the interest for a set period, resulting in lower initial monthly payments but no principal reduction. Offset mortgages link the mortgage to a savings account, using the savings balance to reduce the interest charged on the loan, which can accelerate loan repayment and save money over time. Choosing between these options depends on financial goals, cash flow, and the desire to build equity faster while minimizing interest costs.

Table of Comparison

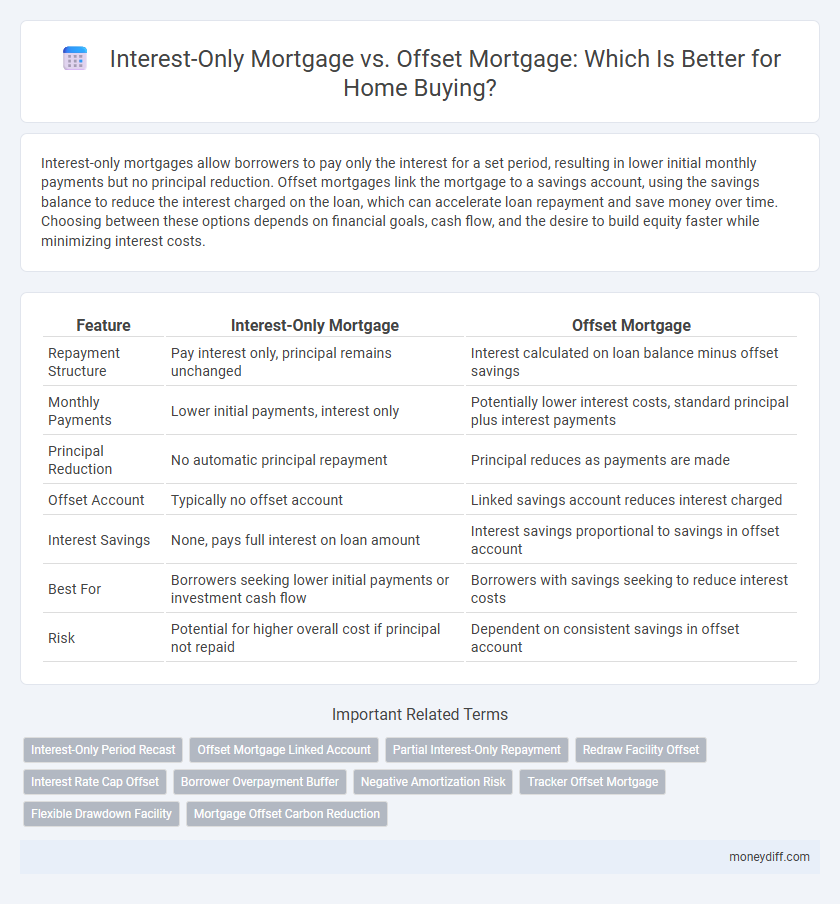

| Feature | Interest-Only Mortgage | Offset Mortgage |

|---|---|---|

| Repayment Structure | Pay interest only, principal remains unchanged | Interest calculated on loan balance minus offset savings |

| Monthly Payments | Lower initial payments, interest only | Potentially lower interest costs, standard principal plus interest payments |

| Principal Reduction | No automatic principal repayment | Principal reduces as payments are made |

| Offset Account | Typically no offset account | Linked savings account reduces interest charged |

| Interest Savings | None, pays full interest on loan amount | Interest savings proportional to savings in offset account |

| Best For | Borrowers seeking lower initial payments or investment cash flow | Borrowers with savings seeking to reduce interest costs |

| Risk | Potential for higher overall cost if principal not repaid | Dependent on consistent savings in offset account |

Understanding Interest-Only Mortgages

Interest-only mortgages require borrowers to pay only the interest portion of the loan for a set period, typically 5 to 10 years, resulting in lower monthly payments during that time. This structure allows for increased cash flow but does not reduce the principal balance, which must be repaid or refinanced later. Understanding the potential risks, such as higher payments after the interest-only period ends and lack of equity buildup, is essential for homeowners considering this option.

Key Features of Offset Mortgages

Offset mortgages link the borrower's savings and current account balances to their mortgage, reducing the outstanding loan amount on which interest is charged. This key feature allows interest savings, as the linked funds effectively lower the mortgage principal, leading to quicker repayment and lower overall interest costs. Borrowers benefit from flexible access to their savings, ensuring liquidity while optimizing mortgage interest expenses.

Interest-Only Mortgage: Pros and Cons

Interest-only mortgages allow borrowers to pay only the interest for a set period, resulting in lower initial monthly payments and increased cash flow flexibility, ideal for buyers expecting future income growth. However, these mortgages do not reduce the principal balance during the interest-only term, leading to higher payments later and potential challenges in building home equity. Borrowers must carefully assess repayment plans and long-term financial goals to determine if an interest-only mortgage aligns with their home buying strategy.

Offset Mortgage: Advantages and Disadvantages

An offset mortgage links your savings and current account balances to your mortgage, reducing the interest you pay by offsetting your loan principal with your savings. This can lead to significant interest savings and quicker repayment without reducing your liquidity, making it beneficial for homeowners with substantial savings. However, offset mortgages often have higher interest rates and require disciplined financial management to maximize their advantages, which may not suit all borrowers.

How Interest-Only Mortgages Affect Monthly Payments

Interest-only mortgages significantly reduce monthly payments during the initial loan term by requiring borrowers to pay only the interest, not the principal. This lowers cash outflow but results in no equity buildup, potentially leading to higher payments later when principal repayments begin. Borrowers should carefully consider how these lower initial payments impact long-term financial planning and home equity growth.

Impact of Offset Mortgages on Interest Savings

Offset mortgages reduce the interest payable by linking the mortgage balance with a savings or current account, effectively lowering the loan principal on which interest is charged. This can result in substantial interest savings over the mortgage term, as the interest is calculated on the net mortgage amount after deducting the offset account balance. Homebuyers using an offset mortgage benefit from faster mortgage repayment and increased financial flexibility without sacrificing access to their savings.

Eligibility Criteria: Interest-Only vs Offset Mortgages

Interest-only mortgages typically require borrowers to meet stricter credit score criteria, steady income verification, and often a larger deposit due to the higher risk of not reducing principal during the loan term. Offset mortgages usually have more flexible eligibility requirements but demand linked savings accounts and proof of consistent income to leverage savings against loan interest. Lenders assess income stability, credit history, and the borrower's financial strategy differently for each product, impacting the approval process significantly.

Long-Term Costs: Comparing Interest-Only and Offset Options

Interest-only mortgages typically have lower initial monthly payments but can result in higher overall interest payments over the loan term due to the principal remaining unchanged. Offset mortgages link a savings account to the loan balance, reducing the interest charged and potentially lowering long-term costs significantly. Evaluating total interest paid and repayment flexibility is crucial when comparing these mortgage types for cost efficiency.

Which Mortgage Suits Different Homebuyers?

Interest-only mortgages suit homebuyers seeking lower initial monthly payments and expecting income growth or property appreciation before principal repayment begins. Offset mortgages benefit buyers aiming to reduce interest costs by linking savings accounts to their home loan, ideal for those with significant savings and stable cash flow. Choosing between these depends on financial goals, cash flow stability, and long-term homeownership plans.

Final Verdict: Choosing Between Interest-Only and Offset Mortgages

Interest-only mortgages offer lower initial payments by focusing solely on interest for a set period, which can improve short-term cash flow but may result in higher overall costs due to principal repayment later. Offset mortgages link your savings to your loan balance, reducing the interest charged and accelerating principal repayment, often leading to significant long-term savings. Choosing between them depends on financial discipline, cash flow needs, and long-term homeownership goals, with offset mortgages typically favored for wealth building and interest-only for temporary affordability.

Related Important Terms

Interest-Only Period Recast

An Interest-Only Mortgage allows borrowers to pay only the interest for a set period, after which the loan is recast and principal repayments increase, potentially causing a significant rise in monthly payments. In contrast, an Offset Mortgage links savings to the mortgage balance, reducing interest costs continuously without requiring a recast, making it a more flexible option for managing cash flow after the interest-only period ends.

Offset Mortgage Linked Account

An offset mortgage links a savings or current account to the home loan, allowing the balance to reduce the mortgage interest calculated daily, resulting in significant savings over time. This flexible arrangement offers borrowers the advantage of paying interest only on the net mortgage balance, accelerating loan repayment without increasing monthly payments.

Partial Interest-Only Repayment

Partial interest-only repayment offers borrowers lower initial monthly payments by paying interest on a portion of the mortgage balance, while offset mortgages link a savings account to the home loan, reducing interest charged by offsetting the savings against the principal. This hybrid approach allows homeowners to optimize cash flow management and potentially reduce overall interest costs compared to fully amortizing loans.

Redraw Facility Offset

An interest-only mortgage allows borrowers to pay only the interest for a set period, keeping monthly repayments lower but with no reduction in principal, while an offset mortgage links a savings account to the loan balance, reducing interest payable by offsetting savings against the mortgage principal. The redraw facility combined with offset accounts enables flexible access to extra repayments, optimizing cash flow management and potentially reducing the overall interest cost on a home loan.

Interest Rate Cap Offset

Interest-Only Mortgages offer lower initial payments by requiring interest payments only, but often come with higher interest rates and no equity buildup, whereas Offset Mortgages link savings balances to the mortgage principal, effectively reducing the interest charged and can include an Interest Rate Cap to protect borrowers from rising rates. The Interest Rate Cap in Offset Mortgages limits the maximum interest rate applied, providing payment stability and risk mitigation for homeowners while still benefiting from interest savings through linked accounts.

Borrower Overpayment Buffer

An interest-only mortgage offers lower initial payments but lacks a built-in overpayment buffer, increasing financial risk if property values decline or income fluctuates. Offset mortgages link savings accounts to the loan balance, providing borrowers with flexible overpayment options that reduce interest costs and create a valuable buffer against market or income uncertainties.

Negative Amortization Risk

Interest-only mortgages carry a significant risk of negative amortization, where monthly payments may not cover interest costs, causing the loan balance to increase over time; offset mortgages, in contrast, link savings balances to the loan, reducing interest charged and minimizing the chance of negative amortization. Homebuyers must carefully assess the impact of rising loan principal in interest-only plans versus the interest savings offered by offset accounts to manage financial risk effectively.

Tracker Offset Mortgage

Tracker Offset Mortgages link your home loan interest rate directly to the Bank of England base rate while allowing you to offset your savings against your mortgage balance, reducing the interest charged and shortening repayment terms. This type of mortgage offers flexibility and potential cost savings compared to Interest-Only Mortgages, where borrowers pay only the interest and must repay the principal separately, often resulting in higher long-term costs.

Flexible Drawdown Facility

An interest-only mortgage offers a flexible drawdown facility allowing borrowers to pay only the interest during the loan term, which reduces monthly payments and preserves cash flow. In contrast, an offset mortgage links the loan balance to a savings account, enabling borrowers to reduce interest costs by offsetting their savings against the mortgage principal while still allowing access to funds if needed.

Mortgage Offset Carbon Reduction

Interest-only mortgages offer lower initial payments but do not reduce principal, limiting overall carbon footprint savings compared to offset mortgages which link home loan balances to savings accounts, effectively reducing interest paid and enabling faster principal reduction, thereby decreasing carbon emissions associated with prolonged debt. Mortgage offset accounts promote carbon reduction by minimizing the loan term and interest accrual, supporting sustainable homeownership through financial efficiency and lower resource consumption.

Interest-Only Mortgage vs Offset Mortgage for Home Buying. Infographic

moneydiff.com

moneydiff.com