Mortgage preapproval involves a thorough review of your financial documents by a lender, providing a conditional commitment that strengthens your home buying position by showing sellers you are serious. Instant mortgage approval offers rapid preliminary feedback based on automated data analysis but may lack the detailed verification that preapproval includes. Choosing preapproval increases the likelihood of a smoother closing process, while instant approval offers speed that helps quickly assess affordability.

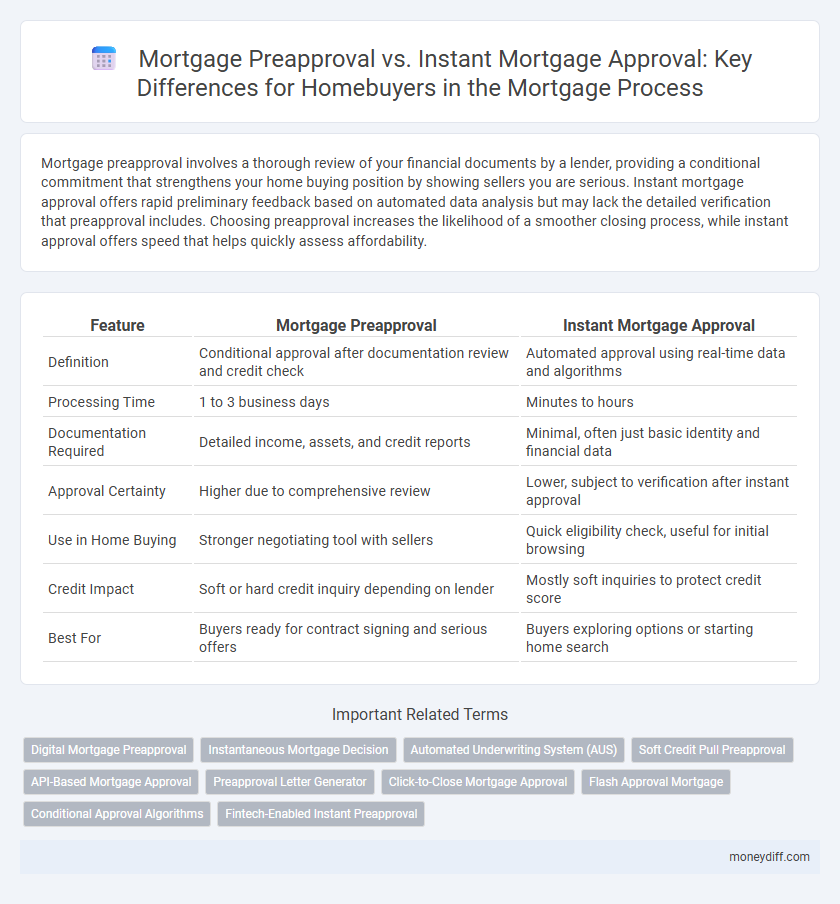

Table of Comparison

| Feature | Mortgage Preapproval | Instant Mortgage Approval |

|---|---|---|

| Definition | Conditional approval after documentation review and credit check | Automated approval using real-time data and algorithms |

| Processing Time | 1 to 3 business days | Minutes to hours |

| Documentation Required | Detailed income, assets, and credit reports | Minimal, often just basic identity and financial data |

| Approval Certainty | Higher due to comprehensive review | Lower, subject to verification after instant approval |

| Use in Home Buying | Stronger negotiating tool with sellers | Quick eligibility check, useful for initial browsing |

| Credit Impact | Soft or hard credit inquiry depending on lender | Mostly soft inquiries to protect credit score |

| Best For | Buyers ready for contract signing and serious offers | Buyers exploring options or starting home search |

Understanding Mortgage Preapproval

Mortgage preapproval provides a detailed evaluation of a buyer's financial situation, including credit score, income, debts, and assets, offering a conditional commitment from the lender for a specific loan amount. This process helps homebuyers understand their budget and strengthens their negotiating position by demonstrating seriousness to sellers. Unlike instant mortgage approval, which offers a quick but often preliminary estimate, preapproval involves thorough verification that reduces the risk of loan denial during underwriting.

What Is Instant Mortgage Approval?

Instant mortgage approval is a streamlined lending process that uses automated algorithms and real-time data verification to quickly determine a borrower's eligibility, often within minutes. Unlike traditional mortgage preapproval, which requires extensive documentation and manual underwriting, instant approval leverages technology to assess creditworthiness, income, and property information rapidly. This method provides homebuyers with an immediate indication of loan qualification, accelerating the home buying timeline and enhancing decision-making confidence.

Key Differences Between Preapproval and Instant Approval

Mortgage preapproval involves a thorough review of your financial documents, credit score, and income to estimate the loan amount you qualify for, providing a stronger negotiating position with sellers. Instant mortgage approval uses automated algorithms and limited data to quickly determine eligibility, offering faster responses but less accuracy and reliability. Preapproval generally holds more weight in competitive housing markets, while instant approval suits buyers seeking speed and convenience.

The Home Buying Process: Where Approvals Fit In

Mortgage preapproval involves a thorough evaluation of a buyer's financial background, including credit score, income, and debts, providing a conditional commitment from a lender before house hunting begins. Instant mortgage approval uses automated systems to quickly assess basic financial information, offering a faster but less comprehensive decision that may require further verification. Both approvals play crucial roles in the home buying process by defining budget boundaries and strengthening offers, with preapproval typically seen as more reliable by sellers and agents.

Benefits of Mortgage Preapproval

Mortgage preapproval provides homebuyers with a clear understanding of their borrowing capacity, enhancing their negotiating power during property offers. It streamlines the home buying process by identifying any potential credit or financial issues early, reducing the risk of delays or denials at closing. Lenders' preapproval letters also strengthen buyer credibility, making sellers more likely to accept offers quickly and confidently.

Advantages of Instant Mortgage Approval

Instant mortgage approval accelerates the home buying process by providing immediate feedback on loan eligibility, reducing uncertainty for buyers. This fast approval utilizes automated credit and income verification, enhancing accuracy and efficiency compared to traditional preapproval. Buyers gain a competitive edge in the market by demonstrating financial readiness with instant approval, increasing the chances of securing their desired property swiftly.

Potential Drawbacks of Each Approval Method

Mortgage preapproval involves a thorough review of your financial documents, which can delay the home buying process and is based on preliminary data that may change, potentially leading to final denial. Instant mortgage approval offers quick decisions using automated algorithms but often relies on limited information, increasing the risk of inaccurate approvals or higher interest rates. Both methods carry the risk of misalignment with final lender requirements, potentially causing setbacks during closing.

How Lenders Assess Borrowers in Both Approval Types

Lenders assess borrowers in mortgage preapproval by evaluating credit scores, income stability, debt-to-income ratios, and employment history to provide a conditional estimate of loan eligibility. Instant mortgage approval uses automated underwriting systems that quickly analyze similar financial data but rely heavily on algorithms and real-time credit checks for immediate decision-making. Both methods prioritize financial reliability but differ in processing speed and the depth of manual verification by lenders.

Choosing Between Preapproval and Instant Approval

Mortgage preapproval involves a thorough evaluation of a borrower's financial background, typically taking a few days and providing a conditional loan commitment that strengthens negotiating power with sellers. Instant mortgage approval uses automated algorithms to quickly assess eligibility, offering faster decisions but often with less comprehensive verification, which may lead to surprises later in the underwriting process. Homebuyers should weigh the reliability of preapproval against the speed of instant approval based on their urgency and the competitive nature of the housing market.

Tips for Streamlining Your Mortgage Approval Process

Obtaining mortgage preapproval involves submitting financial documents for lender review, offering a clearer understanding of your borrowing capacity and strengthening your home purchase offer. Instant mortgage approval leverages automated systems to quickly assess eligibility but may lack the thoroughness of a comprehensive preapproval, potentially impacting final loan terms. Streamline your mortgage approval process by organizing key documents such as income statements and credit reports in advance, comparing lender requirements early, and maintaining open communication to promptly address any additional information requests.

Related Important Terms

Digital Mortgage Preapproval

Digital mortgage preapproval leverages automated technology to quickly assess a borrower's financial information, providing conditional approval that streamlines the home buying process by identifying budget limits early. Unlike instant mortgage approval, which offers immediate but often preliminary results, digital preapproval involves a more thorough evaluation using integrated credit reports and income verification, enhancing accuracy and lender confidence.

Instantaneous Mortgage Decision

Instant mortgage approval provides homebuyers with immediate loan eligibility confirmation by using automated underwriting systems that analyze credit scores, income, and property details in real-time. This rapid decision process accelerates the home buying timeline, giving buyers a competitive edge in fast-moving markets compared to traditional mortgage preapproval, which often involves manual verification and longer wait times.

Automated Underwriting System (AUS)

Mortgage preapproval involves a thorough evaluation through an Automated Underwriting System (AUS), generating a conditional loan offer based on verified financial documents, which strengthens a buyer's position during home negotiations. Instant mortgage approval uses AUS algorithms for rapid risk assessment and tentative loan qualification but often requires further validation before final commitment.

Soft Credit Pull Preapproval

Mortgage preapproval using a soft credit pull allows homebuyers to receive an estimate of their borrowing capacity without impacting their credit score, providing a less intrusive way to gauge affordability early in the home buying process. Instant mortgage approval often involves a hard credit inquiry, which can affect credit scores, whereas soft pull preapproval offers a more consumer-friendly approach that streamlines initial qualification while preserving credit integrity.

API-Based Mortgage Approval

API-based mortgage approval streamlines the home buying process by instantly validating borrower data and credit information, reducing waiting times compared to traditional mortgage preapproval that requires manual verification. Leveraging real-time data integration and automated underwriting systems, this technology enhances accuracy and accelerates decision-making for lenders and buyers alike.

Preapproval Letter Generator

Mortgage preapproval provides a conditional commitment based on a thorough evaluation of credit, income, and assets, offering homebuyers a stronger negotiating position, while instant mortgage approval relies on automated systems for quick eligibility checks but may lack comprehensive verification. The Preapproval Letter Generator streamlines this process by accurately producing official preapproval letters that real estate agents and sellers trust, enhancing buyer credibility and speeding up the home buying journey.

Click-to-Close Mortgage Approval

Click-to-Close mortgage approval streamlines the home buying process by combining mortgage preapproval with instant final approval, reducing wait times and enhancing buyer confidence. This digital workflow leverages real-time data verification and automated underwriting to provide near-immediate loan commitment, accelerating transaction speed and improving closing predictability.

Flash Approval Mortgage

Flash Approval Mortgage offers rapid preapproval by leveraging automated data verification and credit scoring algorithms, enabling homebuyers to secure conditional approval within minutes. This streamlined process reduces uncertainty and accelerates the home buying timeline compared to traditional mortgage preapproval methods.

Conditional Approval Algorithms

Mortgage preapproval relies on conditional approval algorithms that analyze credit scores, income, and debt-to-income ratios to provide a preliminary loan eligibility estimate, which requires further verification. Instant mortgage approval utilizes real-time data integration and advanced AI-driven conditional algorithms to deliver immediate decisions by cross-referencing multiple financial databases, reducing wait times in the home buying process.

Fintech-Enabled Instant Preapproval

Fintech-enabled instant mortgage preapproval leverages advanced algorithms and real-time data integration to provide homebuyers with immediate eligibility insights, significantly accelerating the home buying process compared to traditional mortgage preapproval methods that often require manual verification and longer wait times. This innovation enhances decision-making by offering precise loan estimates and reducing uncertainty, thus streamlining buyer-seller negotiations and strengthening competitive offers in dynamic housing markets.

Mortgage Preapproval vs Instant Mortgage Approval for home buying process. Infographic

moneydiff.com

moneydiff.com