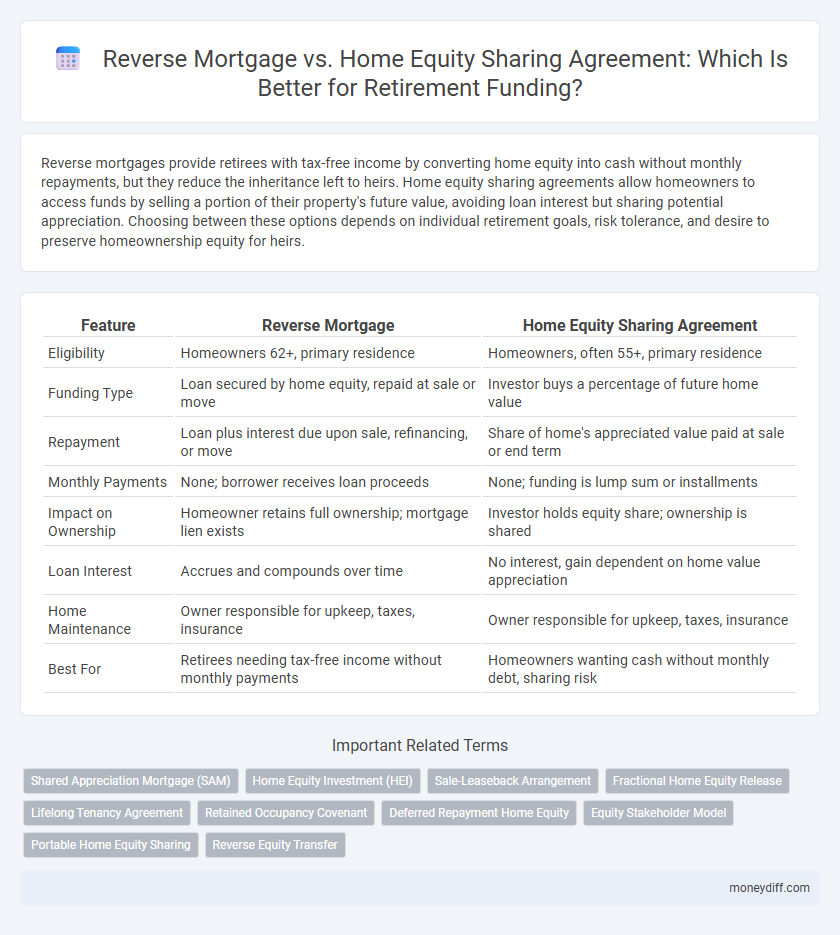

Reverse mortgages provide retirees with tax-free income by converting home equity into cash without monthly repayments, but they reduce the inheritance left to heirs. Home equity sharing agreements allow homeowners to access funds by selling a portion of their property's future value, avoiding loan interest but sharing potential appreciation. Choosing between these options depends on individual retirement goals, risk tolerance, and desire to preserve homeownership equity for heirs.

Table of Comparison

| Feature | Reverse Mortgage | Home Equity Sharing Agreement |

|---|---|---|

| Eligibility | Homeowners 62+, primary residence | Homeowners, often 55+, primary residence |

| Funding Type | Loan secured by home equity, repaid at sale or move | Investor buys a percentage of future home value |

| Repayment | Loan plus interest due upon sale, refinancing, or move | Share of home's appreciated value paid at sale or end term |

| Monthly Payments | None; borrower receives loan proceeds | None; funding is lump sum or installments |

| Impact on Ownership | Homeowner retains full ownership; mortgage lien exists | Investor holds equity share; ownership is shared |

| Loan Interest | Accrues and compounds over time | No interest, gain dependent on home value appreciation |

| Home Maintenance | Owner responsible for upkeep, taxes, insurance | Owner responsible for upkeep, taxes, insurance |

| Best For | Retirees needing tax-free income without monthly payments | Homeowners wanting cash without monthly debt, sharing risk |

Understanding Reverse Mortgages: Key Features and Benefits

Reverse mortgages provide homeowners aged 62 and older with a loan secured by their home equity, allowing tax-free cash flow without monthly mortgage payments. Key features include loan repayment deferred until the homeowner sells the property, moves out permanently, or passes away, protecting heirs from owing more than the home's value. Benefits include supplementing retirement income, remaining in the home, and retaining ownership while accessing funds.

What Is a Home Equity Sharing Agreement?

A Home Equity Sharing Agreement allows homeowners to sell a portion of their property's future appreciation in exchange for upfront cash, providing an alternative way to access home equity without monthly loan payments. Unlike a Reverse Mortgage, which is a loan secured by the home requiring repayment with interest, a Home Equity Sharing Agreement involves sharing gains or losses in property value with the investor at sale or maturity. This option is particularly beneficial for retirees seeking flexible funding without increasing debt or altering ownership control.

Qualification Criteria: Reverse Mortgage vs Home Equity Sharing

Reverse mortgage qualification primarily requires homeowners to be at least 62 years old with significant home equity and the property as their primary residence, while home equity sharing agreements generally have fewer age restrictions but require clear title ownership and equity in the home. Reverse mortgages involve strict financial assessment, including credit history and income to ensure loan repayment through home value, whereas home equity sharing focuses on property valuation and investor agreement terms rather than borrower income. Understanding these qualification distinctions is crucial for retirees seeking flexible and accessible home-based retirement funding options.

Payout Structures and Access to Funds

Reverse mortgages provide retirees with lump sum, monthly, or line-of-credit payouts based on the home's appraised value, with funds accessible without monthly repayments until the borrower moves or sells. Home equity sharing agreements deliver a lump sum or periodic payments in exchange for a percentage of the home's future appreciation, requiring no monthly payments but sharing future equity gains. Access to funds via reverse mortgages tends to be more flexible immediately, while equity sharing offers potentially larger retirement values tied to market performance.

Cost Comparison: Fees, Interest, and Long-Term Implications

Reverse mortgages typically involve higher upfront fees, mortgage insurance premiums, and accruing interest that reduces home equity over time. Home equity sharing agreements usually charge fixed fees or a percentage of home appreciation without monthly interest, potentially preserving more equity long-term. Evaluating cost implications depends on home value trends, loan terms, and the retiree's financial goals, with reverse mortgages often costing more in long-term interest compared to equity sharing arrangements.

Ownership and Equity Retention

Reverse mortgage allows retirees to access home equity without monthly repayments, but the lender gains a claim on the property, reducing future inheritance and ownership control. Home equity sharing agreements provide funds in exchange for a percentage of future home appreciation, preserving some ownership rights and enabling equity retention during the homeowner's lifetime. Evaluating the impact on long-term equity and control is crucial when choosing between reverse mortgages and home equity sharing for retirement funding.

Repayment Terms and Exit Strategies

Reverse mortgages require no monthly payments, with repayment due when the borrower sells the home, moves out permanently, or passes away, whereas home equity sharing agreements often mandate repayment or property sale upon contract maturity or predetermined exit events. Exit strategies for reverse mortgages typically involve loan repayment through home sale proceeds or refinancing, while home equity sharing agreements may include options for buyout, refinancing, or selling the home to satisfy the equity share obligation. Understanding the timing and flexibility of repayment terms is crucial for retirees planning to maximize housing wealth without jeopardizing long-term financial stability.

Tax Implications for Reverse Mortgage and Home Equity Sharing

Reverse mortgages generally offer tax-free loan proceeds since they are treated as loan advances rather than income, but interest accrued is not deductible until the loan is repaid or the home is sold. Home equity sharing agreements often involve selling a percentage of home equity, which does not create immediate tax liability but may result in capital gains tax when the property is sold, depending on the gain and residency status. Understanding the tax treatment of loan interest deferral versus capital gains is critical for retirees evaluating reverse mortgages and home equity sharing for funding retirement.

Impact on Inheritance and Estate Planning

A reverse mortgage allows homeowners to access equity without monthly payments but reduces the home's value, potentially decreasing the inheritance for heirs and complicating estate planning. In contrast, a home equity sharing agreement involves selling a portion of the home's future appreciation, preserving more equity and providing clearer terms for heirs regarding asset distribution. Careful consideration of these impacts on estate value and inheritance rights is critical to aligning retirement funding strategies with long-term family financial goals.

Choosing the Right Option: Factors to Consider for Retirees

Retirees must evaluate key factors such as interest rates, loan repayment terms, and impact on inheritance when choosing between a reverse mortgage and a home equity sharing agreement. Reverse mortgages offer tax-free cash flow without monthly payments but accrue interest that reduces home equity over time. Home equity sharing agreements provide lump-sum funding in exchange for a percentage of future home appreciation, preserving monthly cash flow but potentially reducing long-term estate value.

Related Important Terms

Shared Appreciation Mortgage (SAM)

A Shared Appreciation Mortgage (SAM) offers retirees access to home equity by allowing lenders to share in future property appreciation, providing an alternative to traditional reverse mortgages that typically require loan repayment upon sale or death. Unlike reverse mortgages that accrue interest and reduce home equity, SAMs enable homeowners to secure retirement funds without monthly payments, aligning lender returns with the property's market performance.

Home Equity Investment (HEI)

Home Equity Investment (HEI) offers retirees a non-recourse option to access home equity by selling a percentage of future home appreciation without monthly repayments, contrasting with reverse mortgages that require accruing interest and reducing loan balance over time. HEI agreements provide flexible funding aligned with retirement planning goals, avoiding increased debt and maintaining credit integrity.

Sale-Leaseback Arrangement

A Reverse Mortgage allows homeowners aged 62 and older to convert home equity into tax-free funds without monthly repayments, while a Home Equity Sharing Agreement typically involves a Sale-Leaseback arrangement where investors purchase a percentage of the property and lease it back to the owner, providing upfront capital without increasing debt. The Sale-Leaseback model offers flexibility in retirement funding by enabling homeowners to access equity while retaining residency, but it may reduce future inheritance value compared to traditional reverse mortgages.

Fractional Home Equity Release

Fractional Home Equity Release through Home Equity Sharing Agreements offers retirees a customizable alternative to Reverse Mortgages by allowing partial home equity sale without monthly repayments or interest accumulation. Unlike Reverse Mortgages, this option provides immediate liquidity while preserving homeownership rights and potential capital gains.

Lifelong Tenancy Agreement

A Lifelong Tenancy Agreement in reverse mortgages allows retirees to remain in their homes without monthly loan repayments, providing stable housing while accessing home equity as tax-free income. Unlike home equity sharing agreements that require sharing future home appreciation, reverse mortgages with lifelong tenancy secure retirement funding with fewer obligations on property value and ownership.

Retained Occupancy Covenant

The Retained Occupancy Covenant in reverse mortgages guarantees borrowers the right to remain in their home for life, providing security during retirement without monthly payments or repayment until the borrower moves or passes. In contrast, home equity sharing agreements typically limit occupancy rights and may require partial repayments or relocation, impacting long-term residence stability for retirees.

Deferred Repayment Home Equity

Deferred repayment home equity solutions, such as reverse mortgages and home equity sharing agreements, offer retirees access to their home's value without immediate loan repayment. Reverse mortgages require no monthly payments and repay upon sale or transfer, while home equity sharing agreements provide lump-sum or periodic funds in exchange for a share of future home appreciation, with repayment deferred until a triggering event like sale or refinancing.

Equity Stakeholder Model

A Reverse Mortgage provides retirees with loan proceeds based on their home's equity without immediate repayment, while a Home Equity Sharing Agreement as an Equity Stakeholder Model involves selling a percentage of future home appreciation to investors in exchange for upfront cash. The Equity Stakeholder Model aligns investor returns with property value changes, offering risk sharing and avoiding monthly payments but potentially reducing inheritance due to equity dilution.

Portable Home Equity Sharing

Portable Home Equity Sharing agreements offer retirees flexible access to home equity without monthly repayments, allowing for asset preservation and potential relocation without contract termination. Unlike reverse mortgages, which are limited to the borrower's residence and accumulate interest over time, portable equity sharing enables seniors to maintain liquidity and mobility while leveraging their property for retirement income.

Reverse Equity Transfer

Reverse Equity Transfer in a Reverse Mortgage allows retirees to convert home equity into tax-free income while retaining homeownership, contrasting with Home Equity Sharing Agreements that require sharing property appreciation with investors. This mechanism provides immediate cash flow without monthly repayments, offering financial flexibility during retirement compared to equity sharing's long-term profit split.

Reverse Mortgage vs Home Equity Sharing Agreement for retirement funding. Infographic

moneydiff.com

moneydiff.com