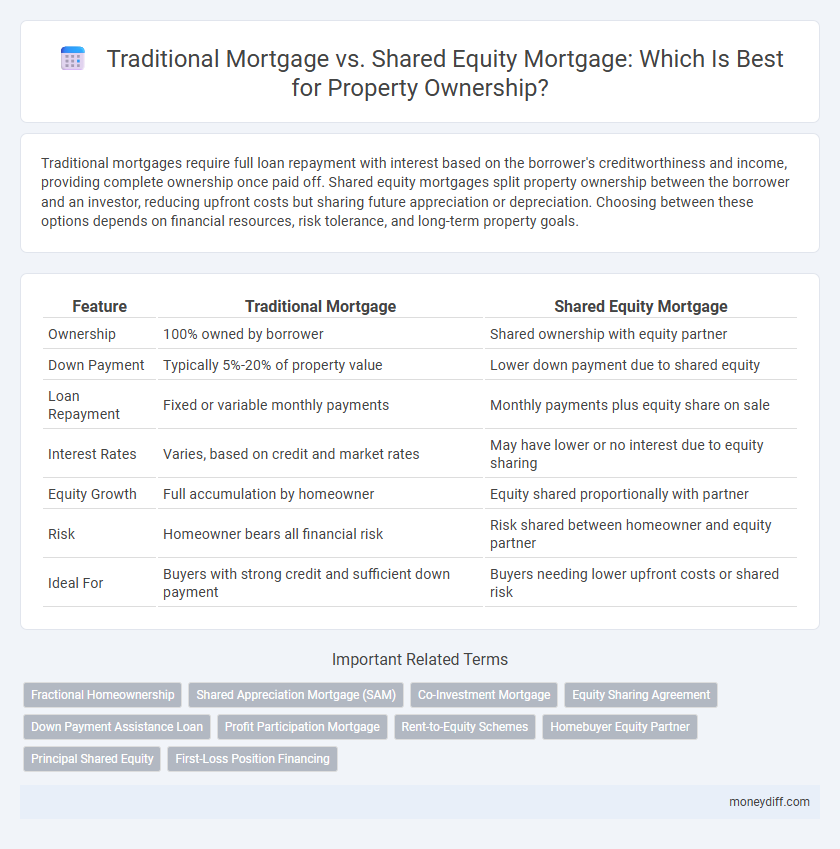

Traditional mortgages require full loan repayment with interest based on the borrower's creditworthiness and income, providing complete ownership once paid off. Shared equity mortgages split property ownership between the borrower and an investor, reducing upfront costs but sharing future appreciation or depreciation. Choosing between these options depends on financial resources, risk tolerance, and long-term property goals.

Table of Comparison

| Feature | Traditional Mortgage | Shared Equity Mortgage |

|---|---|---|

| Ownership | 100% owned by borrower | Shared ownership with equity partner |

| Down Payment | Typically 5%-20% of property value | Lower down payment due to shared equity |

| Loan Repayment | Fixed or variable monthly payments | Monthly payments plus equity share on sale |

| Interest Rates | Varies, based on credit and market rates | May have lower or no interest due to equity sharing |

| Equity Growth | Full accumulation by homeowner | Equity shared proportionally with partner |

| Risk | Homeowner bears all financial risk | Risk shared between homeowner and equity partner |

| Ideal For | Buyers with strong credit and sufficient down payment | Buyers needing lower upfront costs or shared risk |

Understanding Traditional Mortgages

Traditional mortgages involve borrowing a fixed amount from a lender to purchase a property, with repayments typically made through monthly installments over a 15 to 30-year term. Interest rates can be fixed or variable, directly impacting the total repayment amount and monthly budget planning. This type of mortgage grants full ownership to the borrower once the loan is fully repaid, making it a straightforward option for long-term property investment.

What Is a Shared Equity Mortgage?

A shared equity mortgage involves partnering with an investor or government entity to finance part of a property's purchase, reducing the borrower's upfront costs and monthly payments. Unlike traditional mortgages, which require full repayment plus interest, shared equity agreements typically involve sharing future property appreciation or proceeds upon sale. This option provides greater affordability and access to homeownership, especially for buyers with limited savings or credit challenges.

Comparing Ownership Structures

Traditional mortgages involve full property ownership transferred to the borrower upon loan approval, with monthly repayments covering principal and interest. Shared equity mortgages split ownership between the borrower and an investor, who typically gains a percentage of the property's future appreciation or depreciation. This structure reduces upfront borrowing costs but requires sharing equity gains, contrasting the sole ownership and fixed repayment terms of traditional mortgages.

Down Payment Requirements: Traditional vs Shared Equity

Traditional mortgages typically require a down payment ranging from 5% to 20% of the property's purchase price, which can be a significant upfront financial barrier for many buyers. Shared equity mortgages often demand a lower initial down payment, as the equity partner contributes a portion of the purchase price in exchange for a share of the property's future appreciation. This reduced down payment requirement in shared equity arrangements makes homeownership more accessible for buyers with limited savings.

Monthly Payment Differences

Traditional mortgages require borrowers to make full monthly principal and interest payments based on the entire loan amount, resulting in higher monthly obligations. Shared equity mortgages reduce monthly payments by allowing homeowners to share a portion of property ownership with an investor, lowering the loan principal and thus monthly costs. This arrangement offers more affordable monthly payments but entails sharing future property appreciation or depreciation.

Long-Term Financial Impacts

Traditional mortgages require full loan repayment with interest over a fixed term, often leading to higher monthly payments and long-term debt accumulation, impacting overall financial stability. Shared equity mortgages reduce upfront borrowing costs by allowing investors to share property appreciation or depreciation, potentially lowering monthly payments but sharing future gains or losses. Evaluating long-term financial impacts involves considering interest rates, market property value fluctuations, and ownership equity growth potential.

Pros and Cons of Traditional Mortgages

Traditional mortgages offer full property ownership and build home equity over time, providing long-term financial stability and potential tax benefits. However, they require significant down payments and monthly payments, which can strain budgets and pose risks if property values decline. Borrowers also bear full responsibility for interest rates and credit qualifications, making it harder for some to qualify or manage repayment during financial difficulties.

Advantages and Disadvantages of Shared Equity Mortgages

Shared equity mortgages allow homeowners to reduce their initial loan amount by partnering with an investor or government scheme, leading to lower monthly payments and easier qualification. However, this arrangement often results in sharing future property appreciation and potential restrictions on selling or modifying the home. Borrowers benefit from reduced financial pressure but must weigh the trade-off of shared ownership and possible loss of full equity gains.

Suitability: Which Mortgage Fits Your Financial Goals?

Traditional mortgages suit borrowers with stable income and strong credit, offering full property ownership and predictable monthly payments. Shared equity mortgages appeal to those seeking lower upfront costs and willingness to share future property appreciation with an investor. Evaluating financial goals, risk tolerance, and long-term plans helps determine which mortgage aligns best with individual circumstances.

Key Considerations Before Choosing Your Mortgage Type

Evaluate your financial stability and long-term goals when choosing between a traditional mortgage and a shared equity mortgage, as traditional mortgages require full repayment with interest, while shared equity involves sharing future property appreciation with the lender or investor. Consider your credit score, down payment capacity, and willingness to share ownership benefits, since traditional mortgages typically demand higher down payments but grant full ownership. Analyze market trends and potential property value growth to determine if sharing equity aligns better with your risk tolerance and investment strategy.

Related Important Terms

Fractional Homeownership

Traditional mortgages require full loan repayment and sole property ownership, often demanding higher down payments and qualifying criteria. Shared equity mortgages enable fractional homeownership by splitting property equity and financial responsibility between the homeowner and an investor, reducing upfront costs and sharing appreciation benefits.

Shared Appreciation Mortgage (SAM)

Shared Appreciation Mortgages (SAM) allow borrowers to receive reduced interest rates in exchange for sharing a percentage of the property's future appreciation with the lender, aligning incentives between both parties and reducing initial financial burden compared to traditional fixed-rate loans. In contrast, traditional mortgages require full repayment of principal and interest without equity sharing, often resulting in higher monthly payments and limited flexibility in leveraging property value growth.

Co-Investment Mortgage

Co-Investment Mortgages combine traditional mortgage financing with shared equity investment, allowing borrowers to reduce their loan amount by partnering with an investor, often a government or financial institution, that acquires a stake in the property's future appreciation. This approach lowers monthly repayments and upfront costs compared to conventional mortgages, while sharing both risks and rewards of property value fluctuations.

Equity Sharing Agreement

Traditional mortgage requires full repayment of principal and interest over a fixed term, granting sole ownership to the borrower, while a Shared Equity Mortgage involves an equity sharing agreement where the lender or investor holds a percentage of the property's equity, reducing initial borrower costs but sharing future property appreciation or depreciation. Equity sharing agreements impact long-term financial returns and obligations, making them suitable for buyers seeking lower upfront payments and shared risk in property value changes.

Down Payment Assistance Loan

Traditional mortgages require a full down payment, typically ranging from 3% to 20%, placing significant financial burden on homebuyers, whereas Shared Equity Mortgages reduce upfront costs by involving investors who share property ownership equity in exchange for partial financing. Down Payment Assistance Loans complement Shared Equity Mortgages by providing additional funds to cover initial payments, thereby increasing affordability and access to homeownership for low-to-moderate income buyers.

Profit Participation Mortgage

Profit Participation Mortgages allow lenders to receive a share of the property's appreciation in addition to interest payments, contrasting with Traditional Mortgages where borrowers repay fixed principal and interest without profit sharing. Shared Equity Mortgages also involve equity sharing but typically require the borrower to share a portion of ownership, making Profit Participation Mortgages a hybrid solution for leveraging property value growth while maintaining more borrower control.

Rent-to-Equity Schemes

Rent-to-equity schemes combine features of traditional mortgages and shared equity mortgages, allowing buyers to gradually acquire property ownership by paying rent that contributes toward equity accumulation. These arrangements reduce upfront costs and enable shared financial risk between the homeowner and the equity provider, making homeownership more accessible in competitive markets.

Homebuyer Equity Partner

Traditional mortgages require homebuyers to secure full loan financing and repay principal plus interest independently, building 100% equity over time. Shared Equity Mortgages involve a Homebuyer Equity Partner who co-invests in the property, reducing initial loan amounts and monthly payments while sharing future appreciation or depreciation in home value.

Principal Shared Equity

Principal Shared Equity offers homebuyers reduced upfront costs by partnering with the government or private investors who provide a shared percentage of the down payment, making homeownership more accessible compared to traditional mortgages that require full borrower equity. This arrangement allows borrowers to benefit from lower monthly mortgage payments while sharing property appreciation or depreciation with the equity partner upon sale or refinancing.

First-Loss Position Financing

Traditional mortgages place the lender in a senior position with full claim on property value until the loan is fully repaid, ensuring lower risk but requiring higher borrower equity and credit strength. Shared equity mortgages involve a first-loss position financing arrangement where the equity partner absorbs initial losses, reducing borrower down payment and interest rates while aligning risks between homeowner and investor.

Traditional Mortgage vs Shared Equity Mortgage for property ownership. Infographic

moneydiff.com

moneydiff.com