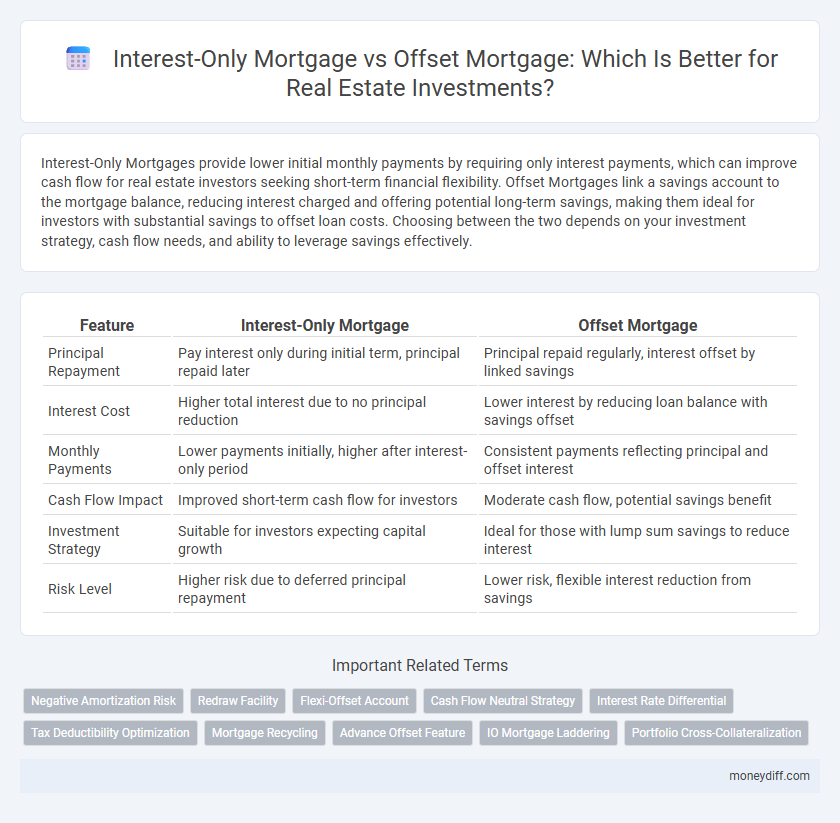

Interest-Only Mortgages provide lower initial monthly payments by requiring only interest payments, which can improve cash flow for real estate investors seeking short-term financial flexibility. Offset Mortgages link a savings account to the mortgage balance, reducing interest charged and offering potential long-term savings, making them ideal for investors with substantial savings to offset loan costs. Choosing between the two depends on your investment strategy, cash flow needs, and ability to leverage savings effectively.

Table of Comparison

| Feature | Interest-Only Mortgage | Offset Mortgage |

|---|---|---|

| Principal Repayment | Pay interest only during initial term, principal repaid later | Principal repaid regularly, interest offset by linked savings |

| Interest Cost | Higher total interest due to no principal reduction | Lower interest by reducing loan balance with savings offset |

| Monthly Payments | Lower payments initially, higher after interest-only period | Consistent payments reflecting principal and offset interest |

| Cash Flow Impact | Improved short-term cash flow for investors | Moderate cash flow, potential savings benefit |

| Investment Strategy | Suitable for investors expecting capital growth | Ideal for those with lump sum savings to reduce interest |

| Risk Level | Higher risk due to deferred principal repayment | Lower risk, flexible interest reduction from savings |

Introduction to Mortgage Options for Real Estate Investors

Interest-only mortgages allow real estate investors to pay only the interest for a set period, reducing initial monthly payments and improving cash flow. Offset mortgages link savings accounts to the mortgage balance, effectively lowering interest costs by offsetting savings against the loan principal. Choosing between these options depends on investment goals, cash flow strategies, and long-term financial planning for property portfolios.

What Is an Interest-Only Mortgage?

An interest-only mortgage allows real estate investors to pay only the interest portion of the loan for a set period, typically 5 to 10 years, reducing initial monthly payments and improving cash flow. Unlike traditional mortgages, the principal balance remains unchanged during the interest-only term, which can benefit investors seeking short-term liquidity or planning property appreciation before principal repayment. This structure is advantageous for maximizing investment returns but requires careful planning to manage large principal payments or refinancing when the interest-only period ends.

Understanding Offset Mortgages

Offset mortgages link your savings account to your mortgage balance, reducing the interest charged by offsetting the savings against the loan principal. This arrangement allows real estate investors to lower their interest payments while maintaining liquidity and flexible access to funds. Compared to interest-only mortgages, offset mortgages provide a dynamic way to minimize costs and potentially shorten the loan term without sacrificing cash flow.

Key Differences Between Interest-Only and Offset Mortgages

Interest-only mortgages require borrowers to pay only the interest for an initial period, resulting in lower monthly payments but no reduction in the principal balance, ideal for investors seeking short-term cash flow flexibility. Offset mortgages link the borrower's savings account to the mortgage balance, effectively reducing interest charges and accelerating principal repayment, offering long-term savings and financial efficiency. Key differences include payment structure, interest calculation, and impact on equity buildup, influencing investment strategy and cash flow management.

Pros and Cons of Interest-Only Mortgages for Investors

Interest-only mortgages offer real estate investors lower initial monthly payments by requiring only interest payments, enhancing short-term cash flow management. However, the principal remains unchanged, increasing the risk of negative equity if property values decline, and potentially leading to higher overall interest costs compared to traditional mortgages. These loans are best suited for investors expecting significant property appreciation or who plan to refinance or sell before principal repayment begins.

Advantages and Disadvantages of Offset Mortgages

Offset mortgages link your home loan to a savings account, reducing the interest payable by offsetting the loan balance with your savings. Advantages include interest savings without locking away cash, increased flexibility in managing repayments, and potential tax efficiency since the offset reduces interest rather than earning taxable income. Disadvantages involve generally higher interest rates compared to traditional loans, the necessity of maintaining substantial savings to maximize benefits, and eligibility criteria that may exclude some borrowers.

Impact on Cash Flow: Interest-Only vs Offset Mortgages

Interest-only mortgages improve short-term cash flow by requiring payments only on the interest, freeing up capital for additional real estate investments or operational expenses. Offset mortgages link the mortgage balance to an attached savings or transaction account, reducing interest payable and effectively increasing monthly cash flow through interest savings. Investors seeking maximum liquidity often prefer interest-only loans, while offset mortgages benefit those aiming to minimize total interest costs and improve cash flow over time.

Tax Implications of Each Mortgage Type

Interest-only mortgages allow investors to deduct interest payments as tax-deductible expenses, potentially lowering taxable income during the interest-only period. Offset mortgages reduce the interest payable by linking savings to the mortgage balance, which decreases interest costs but offers limited direct tax deductions compared to interest-only loans. Understanding these tax implications helps real estate investors optimize cash flow and maximize after-tax returns based on their financial strategies.

Choosing the Right Mortgage for Your Investment Strategy

Interest-only mortgages offer lower initial monthly payments by requiring borrowers to pay only the interest, maximizing cash flow for investors focused on short-term gains or property renovations. Offset mortgages link savings accounts to the mortgage balance, reducing interest payable and benefiting investors with substantial savings who prioritize long-term wealth accumulation. Selecting the right mortgage depends on balancing immediate cash flow needs with overall financial strategy, considering factors like interest rates, investment horizon, and property appreciation potential.

Final Thoughts: Maximizing ROI with the Right Mortgage

Choosing between an interest-only mortgage and an offset mortgage significantly impacts real estate investment returns by influencing cash flow and tax efficiency. Interest-only mortgages offer lower initial payments, maximizing short-term liquidity for reinvestment, while offset mortgages reduce interest costs by linking savings accounts to the loan balance, enhancing long-term savings. Investors should evaluate their investment horizon, risk tolerance, and cash flow needs to select the mortgage type that best maximizes return on investment.

Related Important Terms

Negative Amortization Risk

Interest-only mortgages carry a significant negative amortization risk because borrowers pay only the interest, causing the loan principal to remain unchanged or increase if payments are missed, potentially leading to higher debt over time. Offset mortgages reduce this risk by linking savings accounts to the loan, effectively lowering the principal balance on which interest is charged, thereby mitigating negative amortization and enhancing real estate investment stability.

Redraw Facility

An Interest-Only Mortgage allows investors to pay only the interest for an initial period, maximizing cash flow, while an Offset Mortgage links the borrower's savings to the loan balance to reduce interest payments. Redraw facilities enable repayments on either mortgage type to be accessed again, providing flexible cash flow management for real estate investments.

Flexi-Offset Account

An Interest-Only Mortgage allows investors to pay only the interest on the loan during the initial period, reducing monthly payments and improving cash flow, while an Offset Mortgage, particularly with a Flexi-Offset Account, links savings and transaction accounts to the mortgage balance to reduce interest charged, offering greater flexibility and potential savings for real estate investments. The Flexi-Offset Account maximizes financial efficiency by allowing real-time offsetting of funds against the loan, effectively lowering interest expenses without sacrificing liquidity.

Cash Flow Neutral Strategy

Interest-only mortgages reduce monthly payments by deferring principal repayment, maximizing short-term cash flow for reinvestment, while offset mortgages link savings to the loan balance, effectively lowering interest costs and improving cash flow over time. Investors aiming for a cash flow neutral strategy benefit from interest-only loans to maintain liquidity, whereas offset mortgages suit those prioritizing gradual debt reduction and interest savings.

Interest Rate Differential

Interest-only mortgages typically feature a higher interest rate differential compared to offset mortgages, leading to increased overall borrowing costs despite lower initial repayments. Offset mortgages reduce interest charges by linking the mortgage balance to a savings account, effectively lowering the interest rate differential and enhancing cash flow efficiency for real estate investors.

Tax Deductibility Optimization

Interest-only mortgages maximize tax deductibility by allowing investors to deduct interest payments fully, enhancing cash flow for reinvestment, whereas offset mortgages reduce interest payable but may limit deductible interest expenses due to diminished loan interest. Strategic selection between these mortgage types hinges on optimizing tax benefits aligned with investment goals and cash flow requirements.

Mortgage Recycling

Interest-Only Mortgages allow investors to maximize cash flow by paying only the interest on the loan, freeing up capital for other investments, while Offset Mortgages link savings accounts to the mortgage balance to reduce interest charged, effectively lowering overall loan costs. Mortgage recycling strategies leverage the cash flow advantages of Interest-Only loans alongside the interest-saving features of Offset Mortgages to optimize real estate investment returns and improve debt management efficiency.

Advance Offset Feature

An Interest-Only Mortgage allows investors to pay only the interest for a defined period, optimizing cash flow but potentially increasing long-term costs, whereas an Offset Mortgage with an Advance Offset Feature links savings accounts to the mortgage principal, reducing interest payable immediately and maximizing tax-efficient equity growth. The Advance Offset Feature enhances real estate investment returns by using linked deposit balances to lower mortgage interest daily, effectively accelerating loan reduction and improving overall financial flexibility.

IO Mortgage Laddering

Interest-only mortgage laddering strategically staggers multiple interest-only loans to optimize cash flow and leverage in real estate investments, allowing investors to minimize monthly payments while maximizing liquidity for property acquisition or improvement. This approach contrasts with offset mortgages, which link a savings account to reduce interest charges, prioritizing interest savings over liquidity management, making IO mortgage laddering more suitable for investors seeking aggressive portfolio growth and flexible capital deployment.

Portfolio Cross-Collateralization

Interest-only mortgages allow investors to maximize cash flow by paying only interest initially, making them suitable for leveraging portfolio cross-collateralization strategies across multiple properties. Offset mortgages reduce interest costs by linking savings accounts to the loan balance, optimizing overall debt efficiency within a cross-collateralized real estate investment portfolio.

Interest-Only Mortgage vs Offset Mortgage for real estate investments. Infographic

moneydiff.com

moneydiff.com