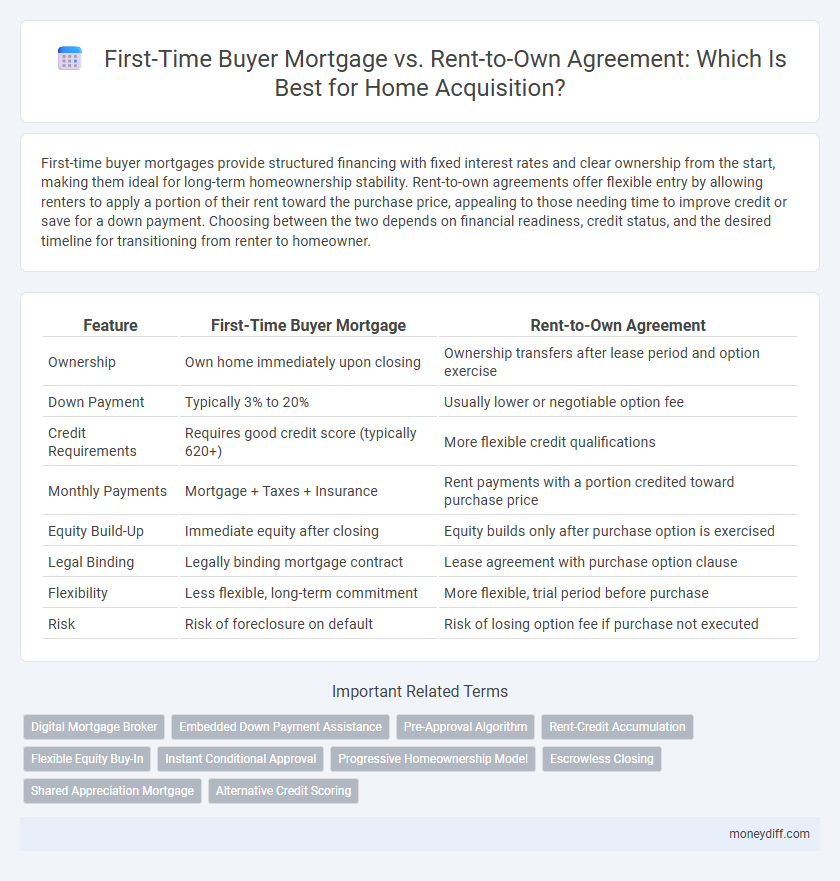

First-time buyer mortgages provide structured financing with fixed interest rates and clear ownership from the start, making them ideal for long-term homeownership stability. Rent-to-own agreements offer flexible entry by allowing renters to apply a portion of their rent toward the purchase price, appealing to those needing time to improve credit or save for a down payment. Choosing between the two depends on financial readiness, credit status, and the desired timeline for transitioning from renter to homeowner.

Table of Comparison

| Feature | First-Time Buyer Mortgage | Rent-to-Own Agreement |

|---|---|---|

| Ownership | Own home immediately upon closing | Ownership transfers after lease period and option exercise |

| Down Payment | Typically 3% to 20% | Usually lower or negotiable option fee |

| Credit Requirements | Requires good credit score (typically 620+) | More flexible credit qualifications |

| Monthly Payments | Mortgage + Taxes + Insurance | Rent payments with a portion credited toward purchase price |

| Equity Build-Up | Immediate equity after closing | Equity builds only after purchase option is exercised |

| Legal Binding | Legally binding mortgage contract | Lease agreement with purchase option clause |

| Flexibility | Less flexible, long-term commitment | More flexible, trial period before purchase |

| Risk | Risk of foreclosure on default | Risk of losing option fee if purchase not executed |

Understanding First-Time Buyer Mortgages

First-time buyer mortgages often provide lower interest rates and government-backed incentives designed to ease the financial burden of purchasing a home, making them a cost-effective option for new homeowners. These mortgages typically require a smaller down payment than traditional loans, improving accessibility for buyers without significant savings. Understanding key features such as fixed or variable interest rates, repayment terms, and eligibility criteria enables buyers to make informed decisions that suit their financial situation and long-term housing goals.

What Is a Rent-to-Own Agreement?

A rent-to-own agreement allows prospective homebuyers to rent a property with the option to purchase it later, often applying a portion of the rent toward the down payment. This arrangement benefits individuals with limited credit history or savings, offering a path to homeownership without immediate mortgage qualification. Unlike traditional first-time buyer mortgages, rent-to-own agreements provide flexibility in financial planning but may come with higher monthly costs and less guaranteed ownership.

Down Payment Requirements: Mortgage vs Rent-to-Own

First-time buyer mortgages typically require a down payment ranging from 3% to 20% of the property's purchase price, depending on the loan type and lender criteria. Rent-to-own agreements often require a smaller initial option fee, usually 1% to 5% of the home's value, which can be applied toward the purchase price. The mortgage down payment demands upfront cash and credit qualification, while rent-to-own offers a lower entry cost with rent credits accumulating over time toward equity.

Credit Score Considerations for Both Options

First-time buyer mortgages typically require a higher credit score, usually around 620 or above, to qualify for favorable interest rates and loan terms, reflecting stronger financial reliability. Rent-to-own agreements often have more lenient credit score requirements, making them accessible to individuals with lower or imperfect credit, as the purchase commitment happens over time. Understanding credit score implications helps potential homeowners choose the best path for home acquisition that aligns with their financial profile and credit history.

Monthly Payment Comparison: Mortgage vs Rent-to-Own

Monthly payments in a first-time buyer mortgage typically include principal, interest, taxes, and insurance, often resulting in a higher upfront financial commitment compared to rent-to-own agreements. Rent-to-own arrangements usually feature lower monthly payments that combine rent with an additional option fee, which may be partially credited toward a future down payment. Over time, mortgage payments build equity in the property, whereas rent-to-own payments mostly contribute to housing costs unless the purchase option is exercised.

Legal Rights and Responsibilities of Home Occupants

First-time buyer mortgages grant homeowners full legal ownership and rights upon closing, including the ability to build equity and modify the property, while requiring borrowers to meet specific repayment obligations and maintain insurance. Rent-to-own agreements provide tenants with the option to purchase after a lease period, but occupants only hold leasehold rights during tenancy and must comply with rental terms without equity accumulation. Legal responsibilities vary significantly, with mortgage holders accountable for property taxes and upkeep, whereas rent-to-own occupants must adhere to lease conditions until the purchase option is exercised.

Flexibility and Commitment: Which Option Suits You?

First-time buyer mortgages offer structured repayment plans with long-term commitment, providing stability through fixed or variable interest rates. Rent-to-own agreements deliver flexibility by allowing tenants to live in and test the property before fully committing to a purchase, often with option fees and rent credits contributing to homeownership. Choosing between these depends on your financial readiness and desire for commitment versus adaptability in the home acquisition process.

Building Equity: Mortgage vs Rent-to-Own

First-time buyer mortgages allow homeowners to build equity from the start by making monthly principal payments that increase ownership in the property. Rent-to-own agreements typically allocate a portion of rent toward future equity, but this buildup is slower and less guaranteed compared to traditional mortgage amortization. Mortgage equity accumulation provides more predictable financial growth and potential tax benefits than rent-to-own arrangements.

Risks and Pitfalls to Avoid in Each Option

First-time buyer mortgages involve risks such as variable interest rates leading to increased monthly payments and potential difficulty in meeting qualifying criteria, which can result in loan denial or unfavorable terms. Rent-to-own agreements carry pitfalls including the possibility of forfeiting upfront option fees if the buyer fails to complete the purchase and the risk of property market depreciation affecting the agreed purchase price. Both options require careful assessment of financial stability, contract terms, and long-term affordability to avoid unexpected losses and legal complications.

Making the Financial Choice: Which Path Fits Your Goals?

First-time buyer mortgages offer a structured path to homeownership with fixed interest rates, long-term equity building, and potential tax benefits, making them ideal for individuals with stable credit and upfront funds for down payments. Rent-to-own agreements provide flexible entry with lower initial costs, allowing tenants to apply rent payments toward future purchase while testing the property and neighborhood before committing. Evaluating credit score, financial stability, and long-term goals helps determine if immediate ownership or incremental investment aligns best with your home acquisition strategy.

Related Important Terms

Digital Mortgage Broker

Digital mortgage brokers streamline the first-time buyer mortgage process by offering quick access to competitive loan rates and personalized financing options tailored to individual credit profiles. Rent-to-own agreements provide alternative home acquisition paths but often involve higher costs and less transparency, making digital brokers a more efficient solution for unlocking affordable homeownership opportunities.

Embedded Down Payment Assistance

First-time buyer mortgages often include embedded down payment assistance programs that reduce initial financial barriers by providing grants or forgivable loans, directly lowering upfront costs. Rent-to-own agreements typically require smaller initial payments but lack formal down payment assistance, leading to higher long-term acquisition costs and less equity buildup during the rental period.

Pre-Approval Algorithm

The pre-approval algorithm for first-time buyer mortgages evaluates credit score, income stability, and debt-to-income ratio to determine borrowing capacity and interest rates. Rent-to-own agreements rely less on traditional pre-approval algorithms and instead emphasize contractual terms and upfront option fees to assess buyer commitment and eligibility.

Rent-Credit Accumulation

Rent-to-own agreements allow first-time buyers to accumulate rent credits, which can be applied toward the future purchase price, providing a pathway to homeownership without immediate mortgage qualification. This credit accumulation contrasts with traditional first-time buyer mortgages, where buyers must secure financing upfront, often requiring higher credit scores and down payments.

Flexible Equity Buy-In

First-time buyer mortgages offer direct homeownership with traditional financing and equity accumulation through regular payments, while rent-to-own agreements provide flexible equity buy-in by allowing tenants to build equity gradually via rent credits before full purchase. This flexibility in rent-to-own structures can benefit buyers with limited upfront capital or credit challenges seeking a more accessible path to eventual homeownership.

Instant Conditional Approval

First-time buyer mortgages often feature instant conditional approval, providing quicker access to financing based on preliminary credit and income verification, which streamlines the home buying process. In contrast, rent-to-own agreements typically do not offer instant conditional approval, as they rely on monthly rental payments with an option to purchase later, delaying formal mortgage qualification.

Progressive Homeownership Model

First-time buyer mortgages provide immediate property ownership with fixed interest rates and equity accumulation, while rent-to-own agreements offer a progressive homeownership model allowing tenants to apply rental payments toward a future purchase. This phased approach benefits buyers by easing financial barriers and building credit history before full mortgage qualification.

Escrowless Closing

First-time buyer mortgages typically involve escrow accounts to manage property taxes and insurance, ensuring secure financial transactions during home acquisition. Escrowless closing, often found in rent-to-own agreements, allows buyers to bypass escrow, providing more flexibility but requiring greater diligence in managing payments and obligations independently.

Shared Appreciation Mortgage

A Shared Appreciation Mortgage offers first-time buyers a lower initial interest rate in exchange for sharing future home value appreciation with the lender, providing a cost-effective alternative compared to traditional rent-to-own agreements that often involve higher overall payments and limited equity buildup. This financing option enables buyers to enter the housing market sooner while aligning lender and borrower interests through shared investment risk and potential rewards.

Alternative Credit Scoring

First-time buyer mortgages often rely on traditional credit scoring systems, which can limit access for individuals with limited credit history, whereas rent-to-own agreements provide an alternative structure that may accommodate alternative credit scoring methods, such as rental payment histories and utility bill records. Utilizing alternative credit data in rent-to-own agreements can improve home acquisition opportunities for buyers lacking conventional credit profiles, expanding eligibility beyond standard mortgage underwriting criteria.

First-Time Buyer Mortgage vs Rent-to-Own Agreement for home acquisition. Infographic

moneydiff.com

moneydiff.com