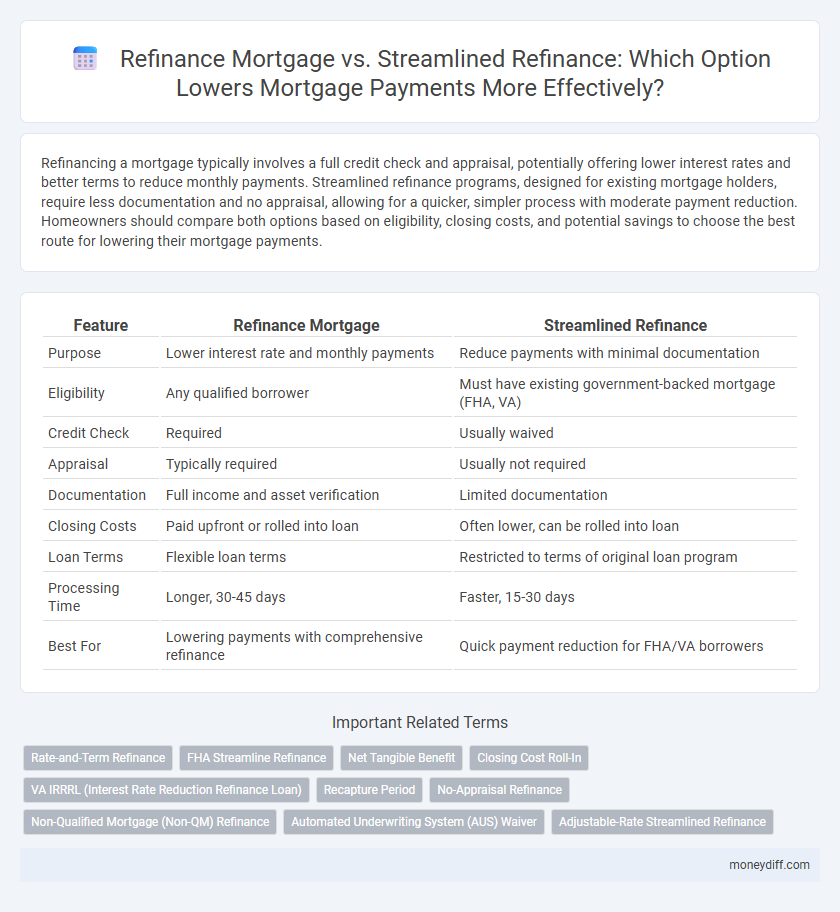

Refinancing a mortgage typically involves a full credit check and appraisal, potentially offering lower interest rates and better terms to reduce monthly payments. Streamlined refinance programs, designed for existing mortgage holders, require less documentation and no appraisal, allowing for a quicker, simpler process with moderate payment reduction. Homeowners should compare both options based on eligibility, closing costs, and potential savings to choose the best route for lowering their mortgage payments.

Table of Comparison

| Feature | Refinance Mortgage | Streamlined Refinance |

|---|---|---|

| Purpose | Lower interest rate and monthly payments | Reduce payments with minimal documentation |

| Eligibility | Any qualified borrower | Must have existing government-backed mortgage (FHA, VA) |

| Credit Check | Required | Usually waived |

| Appraisal | Typically required | Usually not required |

| Documentation | Full income and asset verification | Limited documentation |

| Closing Costs | Paid upfront or rolled into loan | Often lower, can be rolled into loan |

| Loan Terms | Flexible loan terms | Restricted to terms of original loan program |

| Processing Time | Longer, 30-45 days | Faster, 15-30 days |

| Best For | Lowering payments with comprehensive refinance | Quick payment reduction for FHA/VA borrowers |

Understanding Refinance Mortgage vs Streamlined Refinance

Refinance mortgage involves replacing an existing loan with a new one to secure better terms, often reducing interest rates and monthly payments but includes a full application process and credit check. Streamlined refinance targets borrowers with existing government-backed loans like FHA mortgages, offering simplified approval with less documentation and no appraisal, making it faster and more cost-effective for lowering payments. Understanding these options helps homeowners choose between thorough qualification and expedited processing to achieve optimal payment reduction.

Key Differences Between Refinance and Streamlined Refinance

Refinance mortgage involves a complete application process with credit checks, income verification, and appraisal, which can lead to changes in loan terms and potentially lower monthly payments. Streamlined refinance caters to borrowers with existing government-backed loans like FHA, VA, or USDA, offering a faster, more straightforward approval process without requiring extensive documentation or appraisal. Key differences include eligibility criteria, documentation requirements, and processing time, impacting the overall cost and speed of lowering mortgage payments.

Eligibility Criteria for Both Refinance Options

Eligibility criteria for a refinance mortgage typically require a minimum credit score of 620, a stable income source, and a loan-to-value ratio below 80%. Streamlined refinance programs, such as FHA Streamline, often have more lenient requirements, including no appraisal or credit underwriting, making them accessible to borrowers with lower credit scores or limited documentation. Both options demand current mortgage payments be up to date, but streamlined refinances prioritize faster approval and reduced paperwork for eligible FHA or VA loan holders.

Pros and Cons of Traditional Refinance

Traditional refinance offers the advantage of potentially lower interest rates, allowing homeowners to reduce their monthly mortgage payments significantly. However, it involves a full underwriting process, which can be time-consuming and may require closing costs and fees that increase upfront expenses. This method also resets the loan term, potentially extending the repayment period and affecting long-term equity build-up.

Streamlined Refinance: Benefits and Drawbacks

Streamlined refinance offers a faster and less paperwork-intensive option for lowering mortgage payments, designed specifically for FHA loan holders. It typically requires no appraisal or income verification, enabling quicker approval and reduced closing costs compared to traditional refinance. However, the drawback includes limited eligibility criteria and potentially higher interest rates than conventional refinances.

Impact on Monthly Payments and Interest Rates

Refinance mortgage options can significantly reduce monthly payments by securing lower interest rates, spreading out the loan term, or both. Streamlined refinance programs, typically designed for government-backed loans like FHA or VA, offer reduced documentation and faster processing but may have slightly higher interest rates compared to traditional refinances. Choosing between the two impacts overall savings: traditional refinance often achieves deeper interest rate cuts, while streamlined refinance prioritizes convenience and quicker payment relief.

Costs and Fees Associated With Each Refinance Type

Refinance mortgages typically involve higher closing costs, including appraisal fees, origination fees, and title insurance, making them more expensive upfront compared to streamlined refinances. Streamlined refinance programs, such as FHA Streamline or VA Interest Rate Reduction Refinance Loan (IRRRL), often waive appraisals and reduce documentation requirements, resulting in lower fees and faster processing. Homeowners aiming to lower monthly payments should weigh the immediate costs of a conventional refinance against the minimal fees and quicker approval of streamlined refinancing options.

How Credit Score Influences Your Refinance Choice

Credit score significantly impacts whether borrowers qualify for a traditional refinance mortgage or a streamlined refinance, as higher scores typically unlock better interest rates and terms. A traditional refinance often requires a thorough credit check, appraisal, and underwriting, favoring applicants with strong credit profiles for optimal payment reductions. Conversely, streamlined refinance options cater to borrowers with satisfactory credit, offering reduced documentation and faster processing but may have stricter eligibility criteria linked to credit score thresholds.

When Is Streamlined Refinance the Best Option?

Streamlined refinance is the best option for homeowners with existing government-backed loans, such as FHA, VA, or USDA mortgages, seeking lower monthly payments without extensive credit checks or appraisals. This program simplifies the refinancing process, reducing closing costs and paperwork, making it ideal for borrowers with stable payment history who want quick approval. It is most beneficial when interest rates have dropped significantly since the original loan, allowing for immediate savings on monthly mortgage expenses.

Expert Tips to Lower Mortgage Payments Through Refinancing

Refinance mortgage options vary in complexity and eligibility, with streamlined refinance offering a faster, less paperwork-intensive process typically reserved for existing government-backed loans like FHA or VA. Expert tips emphasize evaluating current interest rates, loan terms, and closing costs to determine if a conventional refinance or streamlined refinance maximizes monthly payment reductions. Homeowners should also consider credit score improvements and debt-to-income ratio adjustments to qualify for the most favorable refinancing programs and interest rates.

Related Important Terms

Rate-and-Term Refinance

Rate-and-term refinance reduces mortgage payments by adjusting the interest rate or loan term without increasing the loan balance, making it ideal for borrowers seeking lower monthly costs. Streamlined refinance offers a faster, simplified process primarily for FHA and VA loans but may not always provide as favorable rates or terms as a traditional rate-and-term refinance.

FHA Streamline Refinance

FHA Streamline Refinance offers a simpler, faster option to lower mortgage payments by requiring minimal documentation and no appraisal, making it ideal for borrowers with existing FHA loans aiming for reduced interest rates and monthly costs. Compared to traditional refinance mortgages, it reduces paperwork and closing costs, allowing for more accessible payment relief without stringent credit checks.

Net Tangible Benefit

Refinance mortgage options should be evaluated based on Net Tangible Benefit (NTB), which measures the financial advantage of lowering monthly payments against associated costs. Streamlined refinance typically offers quicker approval with fewer documentation requirements but may have less favorable NTB compared to a traditional refinance that allows for more comprehensive rate and term adjustments.

Closing Cost Roll-In

Refinance mortgages typically allow borrowers to roll closing costs into the new loan balance, increasing the loan amount but reducing upfront expenses, while streamlined refinance programs often minimize documentation and appraisal requirements for quicker approval with similar closing cost roll-in options. Choosing between them depends on credit profile and financial goals, as streamlined refinance is ideal for FHA, VA, or USDA loans to lower payments without upfront closing costs.

VA IRRRL (Interest Rate Reduction Refinance Loan)

VA IRRRL, also known as the VA Streamlined Refinance, offers veterans a simplified process to lower mortgage payments by reducing interest rates with minimal documentation and no appraisal required. This option typically reduces closing costs and approval time compared to traditional refinance mortgages, making it an efficient choice for eligible VA loan holders seeking monthly payment relief.

Recapture Period

Refinance mortgages typically involve a longer recapture period, allowing borrowers to gradually recover closing costs through reduced monthly payments, whereas streamlined refinancing offers a shorter recapture period with limited documentation and lower upfront fees, speeding up the break-even point on refinancing expenses. Understanding the recapture period is crucial for evaluating how quickly the savings from lower interest rates outweigh the refinancing costs in both mortgage options.

No-Appraisal Refinance

No-appraisal refinance options, such as streamlined refinance programs, significantly reduce costs and processing time by eliminating the need for property appraisals, making them ideal for homeowners seeking to lower mortgage payments quickly. Unlike traditional refinance mortgages, streamlined refinance focuses on verifying creditworthiness and payment history, ensuring faster approval and reduced paperwork while maintaining competitive interest rates.

Non-Qualified Mortgage (Non-QM) Refinance

Non-Qualified Mortgage (Non-QM) refinance options often provide more flexible underwriting criteria compared to traditional streamlined refinance programs, allowing borrowers with unique income situations or credit profiles to lower their monthly mortgage payments effectively. While streamlined refinance focuses on simplifying the process with reduced documentation for qualified borrowers, Non-QM refinance targets those who do not meet conventional standards by offering tailored loan terms that optimize payment reduction.

Automated Underwriting System (AUS) Waiver

Refinancing a mortgage using the Automated Underwriting System (AUS) waiver can streamline the approval process by reducing documentation requirements and expediting lower payment adjustments. Streamlined refinance programs leverage AUS waivers to minimize credit evaluation, making it easier for homeowners to qualify for reduced monthly mortgage payments compared to traditional refinance methods.

Adjustable-Rate Streamlined Refinance

Adjustable-Rate Streamlined Refinance offers a simplified application process with reduced documentation compared to traditional refinance mortgages, enabling borrowers to lower monthly payments more quickly. This option is particularly beneficial for homeowners with existing adjustable-rate mortgages seeking to secure a lower interest rate without extensive underwriting.

Refinance Mortgage vs Streamlined Refinance for lowering payments. Infographic

moneydiff.com

moneydiff.com