Balloon mortgages require a large lump-sum payment at the end of the loan term, making them suitable for borrowers expecting increased income or planning to refinance before the balloon payment is due. Graduated payment mortgages start with lower initial payments that increase gradually over time, easing cash flow in the early years for borrowers with rising income prospects. Choosing between these options depends on the borrower's financial stability and long-term payment capacity.

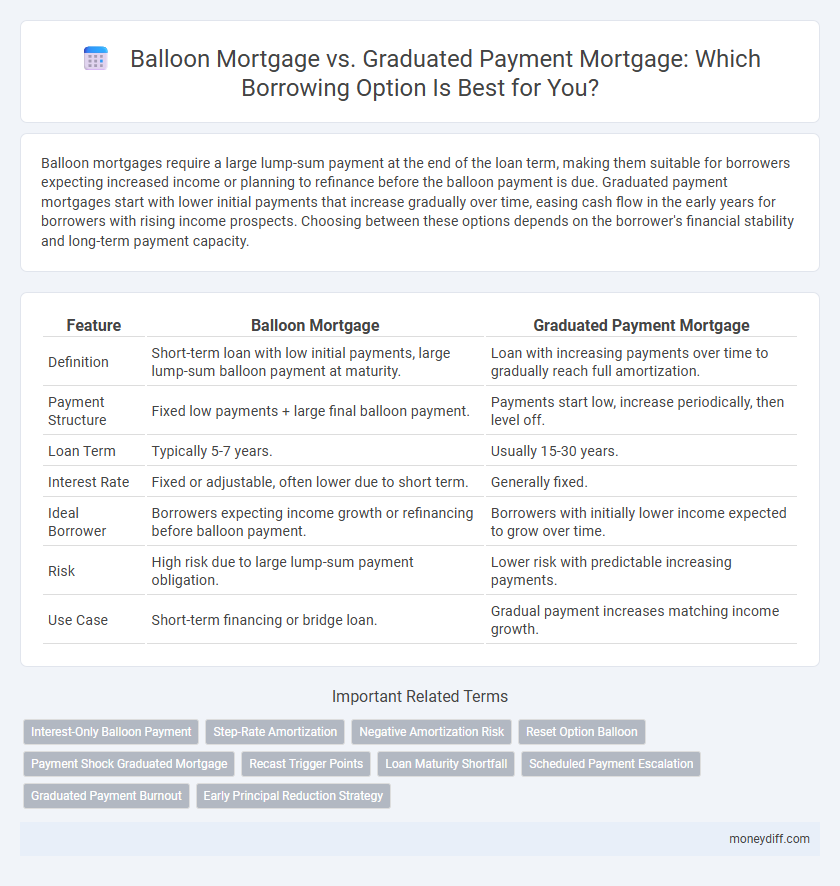

Table of Comparison

| Feature | Balloon Mortgage | Graduated Payment Mortgage |

|---|---|---|

| Definition | Short-term loan with low initial payments, large lump-sum balloon payment at maturity. | Loan with increasing payments over time to gradually reach full amortization. |

| Payment Structure | Fixed low payments + large final balloon payment. | Payments start low, increase periodically, then level off. |

| Loan Term | Typically 5-7 years. | Usually 15-30 years. |

| Interest Rate | Fixed or adjustable, often lower due to short term. | Generally fixed. |

| Ideal Borrower | Borrowers expecting income growth or refinancing before balloon payment. | Borrowers with initially lower income expected to grow over time. |

| Risk | High risk due to large lump-sum payment obligation. | Lower risk with predictable increasing payments. |

| Use Case | Short-term financing or bridge loan. | Gradual payment increases matching income growth. |

Understanding Balloon Mortgages

Balloon mortgages require a large lump-sum payment at the end of a loan term, typically 5 to 7 years, making them ideal for borrowers expecting increased income or a property sale. These loans often offer lower initial interest rates compared to traditional fixed-rate mortgages, reducing early monthly payments but posing refinancing risks. Understanding balloon mortgages involves evaluating the borrower's ability to manage the final payment or secure refinancing under potentially different market conditions.

Key Features of Graduated Payment Mortgages

Graduated Payment Mortgages (GPMs) feature initial low monthly payments that gradually increase over a scheduled period, typically five to ten years, allowing borrowers with lower initial incomes to qualify more easily. Unlike balloon mortgages, GPMs adjust payments based on a predetermined percentage increase, preventing a large lump-sum payment at the end of the term. This structure helps manage cash flow while building home equity over time, catering to borrowers expecting income growth.

Pros and Cons of Balloon Mortgages

Balloon mortgages offer lower initial monthly payments and shorter loan terms, appealing to borrowers expecting increased income or refinancing opportunities within 5 to 7 years. However, they carry the risk of a large lump-sum payment at maturity, which may require refinancing or sale of the property, posing financial challenges if market conditions change or credit availability tightens. Unlike graduated payment mortgages that gradually increase payments, balloon loans lack payment flexibility, making them less suitable for long-term or fixed-income borrowers.

Pros and Cons of Graduated Payment Mortgages

Graduated Payment Mortgages (GPMs) offer lower initial monthly payments that gradually increase over time, making homeownership accessible for borrowers with expected income growth. The main advantage is the affordability during the first years, but this comes with the risk of higher payments later, which can strain finances if income does not rise as anticipated. A key disadvantage is the potential for negative amortization if the early payments do not cover the interest, increasing the loan balance.

Interest Rate Structures: Balloon vs Graduated Payment

Balloon mortgages feature a fixed interest rate with lower initial monthly payments followed by a large lump-sum payment at the end of the term, making them suitable for borrowers expecting increased future income or refinancing ability. Graduated payment mortgages start with lower interest rates and gradually increase the monthly payments over time, aligning with anticipated income growth and reducing initial payment strain. Both structures affect long-term cost and risk differently, with balloon loans posing higher refinancing risk and graduated payments offering a more predictable increase in payment amounts.

Payment Flexibility and Affordability

Balloon mortgages offer lower initial monthly payments with a large lump sum due at the end, providing short-term payment flexibility but potential affordability challenges when the balloon payment comes due. Graduated payment mortgages start with lower payments that gradually increase over time, aligning with expected income growth to improve long-term affordability. Borrowers prioritizing short-term cash flow might prefer balloon loans, while those seeking predictable payment increases aligned with income growth benefit from graduated payment mortgages.

Risk Factors: What Borrowers Should Consider

Balloon mortgages carry the risk of a large lump-sum payment at the end of the loan term, which can cause financial strain if the borrower has not planned for refinancing or sale. Graduated payment mortgages start with lower payments that increase over time, potentially leading to payment shock as income growth may not keep pace with rising loan installments. Borrowers should carefully evaluate their income stability, future financial projections, and market conditions to mitigate the risks associated with both mortgage types.

Long-Term Financial Impact

A balloon mortgage offers lower initial payments with a large lump sum due at the end, posing risks if refinancing options become limited, while a graduated payment mortgage gradually increases payments over time, potentially leading to higher total interest but improved affordability in early years. Borrowers must assess their ability to manage future payment escalations or a significant payoff amount to avoid financial strain. Long-term financial impact depends on income growth stability, interest rates, and market conditions influencing refinancing opportunities.

Suitability for Different Borrower Profiles

Balloon mortgages suit borrowers expecting a significant income increase or a lump sum payment before the balloon payment is due, offering lower initial monthly payments but higher risk at term end. Graduated payment mortgages are ideal for borrowers with modest current incomes that are projected to rise steadily, allowing gradually increasing payments that align with anticipated financial growth. Choosing between these loans depends heavily on income stability, future earning potential, and risk tolerance, guiding borrowers toward the most manageable repayment structure.

Choosing the Right Mortgage for Your Financial Goals

Balloon mortgages offer lower initial monthly payments with a large lump sum due at the end of the term, making them suitable for borrowers expecting a significant increase in income or planning to refinance before the balloon payment matures. Graduated Payment Mortgages (GPMs) start with lower payments that increase gradually over time, aligning with anticipated income growth, ideal for borrowers with rising earning potential but limited initial cash flow. Selecting between balloon and graduated payment mortgages depends on your financial stability, income projections, and risk tolerance to ensure the loan structure supports your long-term financial goals.

Related Important Terms

Interest-Only Balloon Payment

Interest-only balloon mortgages require borrowers to pay only interest for a set term, followed by a large principal payment, minimizing initial monthly costs but risking higher future payments. Graduated payment mortgages start with lower payments that gradually increase over time, easing early cash flow but potentially leading to higher interest accumulation compared to balloon loans.

Step-Rate Amortization

Step-rate amortization in balloon mortgages involves fixed payments with a large lump-sum due at maturity, making it suitable for borrowers expecting increased cash flow later. Graduated payment mortgages use step-rate amortization with initially lower payments that gradually increase, easing early affordability while adjusting to anticipated income growth.

Negative Amortization Risk

Balloon mortgages pose a significant risk due to large lump-sum payments at term-end, often leading to refinancing challenges or default, while graduated payment mortgages carry negative amortization risk as initial payments are below interest accrual, causing loan principal to increase over time. Borrowers must evaluate their cash flow stability and refinancing options carefully to mitigate potential financial strain from these repayment structures.

Reset Option Balloon

A Balloon Mortgage with a Reset Option allows borrowers to adjust the loan term or payment schedule at the balloon maturity, reducing the risk of a large lump-sum payment and providing greater financial flexibility. Unlike Graduated Payment Mortgages, which gradually increase payments over time, Reset Option Balloons offer customizable refinancing terms that can better accommodate changing market conditions and borrower circumstances.

Payment Shock Graduated Mortgage

Balloon mortgages require a large lump-sum payment at the end of the term, potentially causing significant payment shock for borrowers unprepared for the final balloon payment. Graduated payment mortgages start with lower initial payments that gradually increase over time, which can minimize immediate payment shock but may lead to higher overall costs as payments escalate.

Recast Trigger Points

Balloon mortgages feature large final payments that can trigger recast options when borrowers refinance to avoid lump-sum payoff, whereas graduated payment mortgages gradually increase payments over time, reducing the likelihood of recast triggers due to steady payment adjustments. Understanding recast trigger points is essential for choosing a borrowing option, as balloon loans may require early refinancing, while graduated payment mortgages manage borrower cash flow with predictable payment growth.

Loan Maturity Shortfall

Balloon mortgages present a significant loan maturity shortfall risk as the borrower must repay the remaining principal in a lump sum at the end of the term, often leading to refinancing challenges. Graduated payment mortgages, with their increasing payment structure over time, reduce the shortfall risk by gradually aligning payments with the borrower's income growth, minimizing the chance of a large unpaid balance at maturity.

Scheduled Payment Escalation

Balloon mortgages require a large lump sum payment at the end of a fixed term, while graduated payment mortgages feature scheduled payment escalation, gradually increasing monthly payments over time to accommodate initial lower affordability. Graduated payment mortgages help borrowers manage early financial strain by starting with lower payments that escalate predictably, whereas balloon mortgages rely on refinancing or a lump sum to cover the final principal balance.

Graduated Payment Burnout

Graduated Payment Mortgages (GPM) feature increasing monthly payments that start low and gradually rise, which can lead to graduated payment burnout when borrowers struggle to meet higher payments over time. Unlike Balloon Mortgages that require a large lump-sum payment at the end of the term, GPMs risk borrower default during the phase of escalating payment amounts due to insufficient income growth.

Early Principal Reduction Strategy

Balloon mortgages require a large lump-sum payment at the end of the term, making early principal reduction crucial to minimize the final payoff amount and reduce overall interest costs. Graduated payment mortgages allow for lower initial payments that gradually increase, offering a strategic advantage in early principal reduction by accelerating payments as income grows, thereby lowering total interest paid over time.

Balloon Mortgage vs Graduated Payment Mortgage for borrowing options. Infographic

moneydiff.com

moneydiff.com