First-time homebuyers often choose between FHA loans and Shared Appreciation Mortgages based on their financial goals. FHA loans offer low down payments and flexible credit requirements, making homeownership more accessible. Shared Appreciation Mortgages require sharing future home appreciation with the lender in exchange for reduced initial costs, potentially benefiting buyers expecting significant property value increases.

Table of Comparison

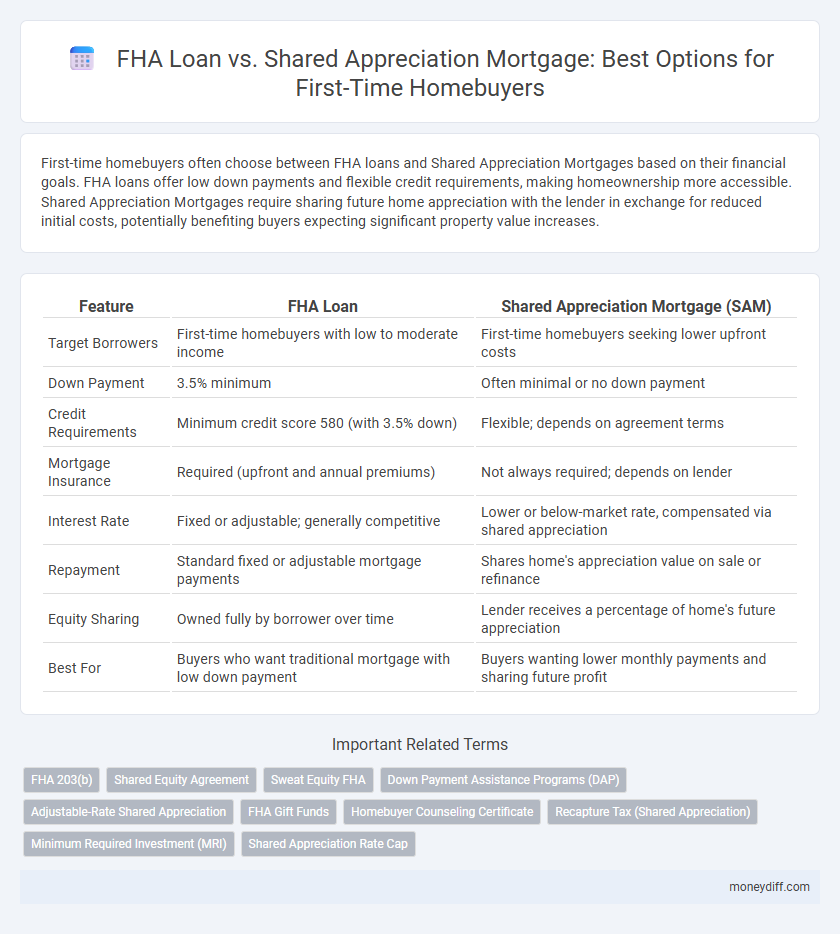

| Feature | FHA Loan | Shared Appreciation Mortgage (SAM) |

|---|---|---|

| Target Borrowers | First-time homebuyers with low to moderate income | First-time homebuyers seeking lower upfront costs |

| Down Payment | 3.5% minimum | Often minimal or no down payment |

| Credit Requirements | Minimum credit score 580 (with 3.5% down) | Flexible; depends on agreement terms |

| Mortgage Insurance | Required (upfront and annual premiums) | Not always required; depends on lender |

| Interest Rate | Fixed or adjustable; generally competitive | Lower or below-market rate, compensated via shared appreciation |

| Repayment | Standard fixed or adjustable mortgage payments | Shares home's appreciation value on sale or refinance |

| Equity Sharing | Owned fully by borrower over time | Lender receives a percentage of home's future appreciation |

| Best For | Buyers who want traditional mortgage with low down payment | Buyers wanting lower monthly payments and sharing future profit |

Understanding FHA Loans: Key Features for First-Time Buyers

FHA loans offer first-time homebuyers low down payment requirements, typically as low as 3.5%, with more flexible credit score criteria compared to conventional loans. These government-backed mortgages provide benefits such as competitive interest rates and the ability to finance closing costs, making homeownership more accessible. Borrowers must pay mortgage insurance premiums, which protect lenders but increase overall loan costs throughout the loan period.

What Is a Shared Appreciation Mortgage?

A Shared Appreciation Mortgage (SAM) allows first-time homebuyers to receive a reduced interest rate in exchange for sharing a portion of the property's future appreciation with the lender. Unlike an FHA loan, which is government-backed and requires mortgage insurance premiums, SAMs tie the lender's return directly to the home's increased value over time. This arrangement can lower initial monthly payments but requires careful consideration of the potential equity sharing at sale or refinancing.

Down Payment Differences: FHA Loan vs Shared Appreciation Mortgage

FHA loans typically require a down payment of as low as 3.5% of the home's purchase price, making them accessible for first-time homebuyers with limited savings. In contrast, Shared Appreciation Mortgages may have little to no down payment but involve sharing a portion of the property's future appreciation with the lender. Understanding these down payment differences helps first-time buyers balance upfront costs against long-term financial obligations.

Credit Score Requirements Compared

FHA loans typically require a minimum credit score of 580 for maximum financing, making them accessible for first-time homebuyers with less-than-perfect credit. Shared Appreciation Mortgages (SAMs) often have more flexible credit requirements but can vary significantly by lender and program, sometimes accepting scores as low as 620. Understanding these credit score thresholds is crucial for first-time buyers when comparing loan eligibility and affordability.

Interest Rates and Payment Structures

FHA loans offer fixed or adjustable interest rates typically ranging from 3% to 7%, providing predictable monthly payments with low down payment requirements, ideal for first-time homebuyers seeking stability. Shared Appreciation Mortgages often feature below-market initial interest rates or interest-free periods, but repayment depends on the home's future appreciation, linking payment size to property value increases and creating variable, potentially larger costs. Understanding the trade-off between FHA's steady payment structure and the Shared Appreciation Mortgage's equity-sharing risk helps buyers choose the best fit for their financial goals.

Long-Term Costs: Equity Sharing vs Traditional Mortgages

FHA loans require lower down payments and offer fixed interest rates, making monthly payments predictable for first-time homebuyers, but mortgage insurance premiums can increase overall long-term costs. Shared Appreciation Mortgages (SAMs) reduce upfront expenses by allowing lenders to share in home equity appreciation, which can result in higher total payments if property values increase significantly. Evaluating long-term costs involves comparing FHA's steady payments and insurance fees against SAM's potential for larger equity-based repayments.

Pros and Cons: FHA Loans for First-Time Homebuyers

FHA loans offer first-time homebuyers low down payment requirements, flexible credit score standards, and competitive interest rates, making homeownership more accessible. However, borrowers must pay mortgage insurance premiums for the life of the loan, increasing overall costs, and loan limits are capped based on geographic location, potentially restricting purchasing power. These factors contrast with shared appreciation mortgages, which may require equity sharing but often lower initial payments and provide alternative options for buyers with limited upfront funds.

Pros and Cons: Shared Appreciation Mortgages for New Buyers

Shared Appreciation Mortgages (SAMs) allow first-time homebuyers to secure lower initial interest rates in exchange for sharing a portion of future home appreciation with the lender, reducing upfront costs. However, the potential financial downside includes significant payoff obligations if the property's value increases substantially, impacting overall equity gains. Compared to FHA loans, which offer government-backed low down payments and fixed rates, SAMs might limit long-term wealth accumulation despite easing entry into homeownership.

Which Loan Is Right for You? Factors to Consider

FHA loans offer low down payments and flexible credit requirements, making them ideal for first-time homebuyers with limited savings or imperfect credit. Shared Appreciation Mortgages require sharing a portion of future home appreciation with the lender, which may benefit buyers expecting significant property value growth. Evaluate your financial stability, long-term plans, and risk tolerance to determine which mortgage best aligns with your homeownership goals.

Frequently Asked Questions: FHA vs Shared Appreciation Mortgage

FHA loans offer first-time homebuyers low down payments, flexible credit requirements, and government-backed mortgage insurance, making them accessible and affordable. Shared Appreciation Mortgages (SAMs) involve sharing a portion of the home's future appreciation with the lender or investor, which can reduce upfront costs but may limit future financial gains. Key FAQs often address eligibility criteria, repayment terms, impact on equity, and long-term cost comparisons between FHA loans and SAMs.

Related Important Terms

FHA 203(b)

FHA 203(b) loans offer first-time homebuyers low down payment requirements and flexible credit guidelines, making them accessible for those with limited savings or credit challenges. Unlike Shared Appreciation Mortgages, FHA 203(b) loans do not require repayment based on home value appreciation, providing stable monthly payments and predictable long-term costs.

Shared Equity Agreement

Shared Appreciation Mortgage (SAM) offers first-time homebuyers a unique Shared Equity Agreement where the lender shares a percentage of the home's future appreciation, reducing monthly payments and easing qualification compared to FHA loans. This arrangement aligns the lender's return with the property's value increase, providing an innovative alternative to traditional fixed-rate FHA financing while preserving upfront affordability.

Sweat Equity FHA

Sweat Equity FHA loans enable first-time homebuyers to contribute labor towards home improvements as a form of down payment, reducing upfront cash requirements compared to traditional FHA loans. Unlike Shared Appreciation Mortgages, which involve sharing future home appreciation with the lender, Sweat Equity FHA loans allow homeowners to build equity through personal work, making homeownership more accessible and affordable.

Down Payment Assistance Programs (DAP)

FHA loans offer first-time homebuyers low down payment requirements and eligibility for numerous Down Payment Assistance Programs (DAP), easing initial financial barriers. Shared Appreciation Mortgages (SAM) provide alternative DAP options by sharing home equity gains with lenders or investors, reducing upfront costs but impacting future home value appreciation.

Adjustable-Rate Shared Appreciation

Adjustable-Rate Shared Appreciation Mortgages (AR-SAMs) offer first-time homebuyers lower initial interest rates compared to FHA loans, with payments that adjust based on home appreciation, potentially reducing monthly costs. FHA loans provide fixed rates and government-backed insurance, but AR-SAMs link loan repayment to property value growth, enabling more flexible financing for buyers anticipating home equity gains.

FHA Gift Funds

FHA loans allow first-time homebuyers to use gift funds from family members, enabling a lower down payment of just 3.5%, which increases affordability and reduces upfront costs. Unlike Shared Appreciation Mortgages, FHA loans have clear guidelines on gift fund documentation without requiring shared equity or repayment based on home appreciation.

Homebuyer Counseling Certificate

Obtaining a Homebuyer Counseling Certificate is essential for first-time homebuyers pursuing an FHA loan, as it can improve eligibility and loan terms by demonstrating financial readiness. In contrast, Shared Appreciation Mortgages typically do not require this certificate, but may involve profit-sharing clauses that affect future equity gains.

Recapture Tax (Shared Appreciation)

First-time homebuyers using a Shared Appreciation Mortgage may face a recapture tax, which requires repayment of a portion of the home's appreciated value upon sale, unlike FHA loans that do not impose this tax. FHA loans offer more predictable costs by avoiding recapture taxes, making them a simpler financial option for buyers seeking lower upfront expenses and stable repayment terms.

Minimum Required Investment (MRI)

FHA loans require a minimum down payment of 3.5% of the home's purchase price, making them accessible for first-time homebuyers with limited savings. Shared Appreciation Mortgages often involve a lower upfront investment, as the lender receives a portion of future home appreciation instead of a significant initial down payment.

Shared Appreciation Rate Cap

Shared Appreciation Mortgages (SAM) for first-time homebuyers typically include a rate cap limiting the percentage of home value increase the lender can claim, providing protection against excessive repayment demands. FHA loans do not have this appreciation rate cap, often resulting in more predictable monthly payments but less potential benefit from home value appreciation.

FHA Loan vs Shared Appreciation Mortgage for first-time homebuyers. Infographic

moneydiff.com

moneydiff.com