Refinancing a mortgage replaces your existing loan with a new one, often lowering your interest rate and monthly payments but may involve closing costs and a longer approval process. Recasting a mortgage adjusts your current loan balance by making a large lump-sum payment, which reduces your monthly payments without changing the interest rate or loan terms and typically incurs minimal fees. Choosing between refinancing and recasting depends on your financial goals, timeline, and whether you want to reduce interest costs or only lower monthly payments quickly.

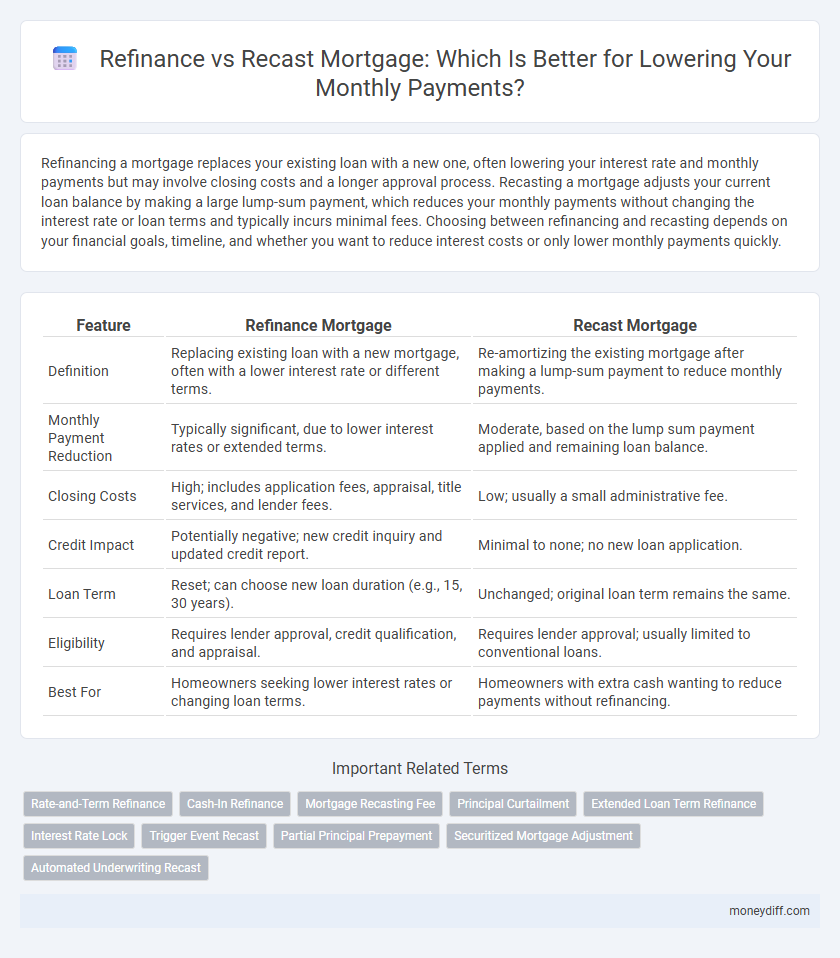

Table of Comparison

| Feature | Refinance Mortgage | Recast Mortgage |

|---|---|---|

| Definition | Replacing existing loan with a new mortgage, often with a lower interest rate or different terms. | Re-amortizing the existing mortgage after making a lump-sum payment to reduce monthly payments. |

| Monthly Payment Reduction | Typically significant, due to lower interest rates or extended terms. | Moderate, based on the lump sum payment applied and remaining loan balance. |

| Closing Costs | High; includes application fees, appraisal, title services, and lender fees. | Low; usually a small administrative fee. |

| Credit Impact | Potentially negative; new credit inquiry and updated credit report. | Minimal to none; no new loan application. |

| Loan Term | Reset; can choose new loan duration (e.g., 15, 30 years). | Unchanged; original loan term remains the same. |

| Eligibility | Requires lender approval, credit qualification, and appraisal. | Requires lender approval; usually limited to conventional loans. |

| Best For | Homeowners seeking lower interest rates or changing loan terms. | Homeowners with extra cash wanting to reduce payments without refinancing. |

Understanding Refinance vs Recast: Key Differences

Refinance mortgage replaces an existing loan with a new one, often lowering the interest rate or changing the loan term to reduce monthly payments, while recast mortgage keeps the original loan but adjusts the balance by making a lump sum payment, leading to reduced monthly installments without altering the interest rate or loan duration. Refinancing usually involves closing costs and credit checks, whereas recasting has minimal fees and no credit approval. Understanding these differences helps homeowners choose between refinancing for potentially greater savings and recasting for a simpler, cost-effective payment reduction.

What Is a Mortgage Recast?

A mortgage recast is a process where the lender recalculates your monthly payments based on the remaining principal balance and the original loan term, after you make a large lump-sum payment towards the principal. Unlike refinancing, recasting maintains your current interest rate and loan terms, resulting in lower monthly payments without the need to undergo a new loan approval process. This option is cost-effective since it typically involves minimal fees and helps homeowners reduce monthly mortgage payments while keeping their existing loan structure intact.

How Mortgage Refinancing Works

Mortgage refinancing involves replacing an existing loan with a new mortgage, typically at a lower interest rate or different term, to reduce monthly payments or overall debt. This process requires a full credit evaluation, appraisal, and closing fees, with the goal of securing better loan conditions. Unlike recasting, refinancing resets the loan terms and can include cash-out options, offering greater flexibility in managing mortgage costs.

Eligibility Requirements for Refinance and Recast

Eligibility requirements for refinance mortgages typically include a good credit score, sufficient home equity, and stable income verification, with lenders often requiring a debt-to-income ratio below 43%. Recast mortgages demand no credit check but require a lump sum payment toward the principal, usually a minimum of $5,000 to $10,000, with lender approval based on timely mortgage payments and sufficient equity. Both options aim to reduce monthly payments, but recasting offers lower fees and faster approval compared to refinancing, which resets loan terms and may involve closing costs.

Comparing Costs: Fees and Savings

Refinancing a mortgage often involves higher upfront costs, including appraisal fees, closing costs, and possible lender origination fees, but can provide significant monthly payment reductions by lowering interest rates or extending loan terms. Recasting a mortgage typically incurs minimal fees, usually a one-time payment to the lender, and reduces monthly payments by applying a lump sum principal reduction without changing the interest rate or loan term. Comparing these options, refinancing may offer greater long-term savings despite higher initial expenses, whereas recasting provides a cost-effective way to lower payments quickly without the need for credit checks or appraisal.

Impact on Monthly Mortgage Payments

Refinancing a mortgage typically lowers monthly payments by securing a new loan with a lower interest rate or extended term, which reduces principal and interest obligations. Recasting a mortgage adjusts monthly payments by recalculating based on a lump-sum principal payment, shortening the loan term without altering the interest rate. While refinancing offers potential savings through better loan terms, recasting provides immediate payment relief without the costs and paperwork of a new loan application.

How Each Option Affects Loan Terms and Interest

Refinancing a mortgage replaces your original loan with a new one, often at a lower interest rate, which can significantly reduce monthly payments but may extend the loan term or reset it to a new duration. Recasting a mortgage keeps the existing loan and interest rate intact while reducing monthly payments by applying a lump sum payment toward the principal, shortening the loan balance without changing terms or interest rates. Choosing between refinance and recast hinges on whether lowering interest rates or preserving original loan conditions aligns better with financial goals.

Pros and Cons of Refinancing Your Mortgage

Refinancing your mortgage can lower monthly payments by securing a reduced interest rate or extending the loan term, but it typically involves closing costs and may reset the loan clock, increasing total interest paid. The pros include potential significant savings over time and improved cash flow, while cons are upfront fees and possible loss of previously built equity benefits. Carefully evaluating current market rates, your credit profile, and long-term financial goals is essential to determine if refinancing outweighs alternatives like mortgage recasting.

Pros and Cons of Mortgage Recasting

Mortgage recasting lowers monthly payments by recalculating the loan based on a lump sum principal payment without changing the interest rate or loan term, preserving a borrower's original mortgage structure. Pros include lower closing costs, no credit check, and quicker processing compared to refinancing, but cons involve limited lender availability, no interest rate reduction, and the need for a substantial principal payment. Borrowers seeking to improve cash flow without altering mortgage terms often find recasting beneficial, while those wanting lower interest rates or shorter loan durations may prefer refinancing.

Choosing the Right Option for Your Financial Goals

Refinancing a mortgage replaces the existing loan with a new one, often at a lower interest rate, potentially reducing monthly payments significantly but may involve closing costs and a longer loan term. Recasting a mortgage modifies the payment schedule by applying a lump sum toward the principal, lowering monthly payments without changing the interest rate or loan terms, making it a cost-effective option if substantial funds are available upfront. Assessing financial goals, available cash, and long-term costs is crucial in choosing between refinancing and recasting to optimize mortgage payments effectively.

Related Important Terms

Rate-and-Term Refinance

Rate-and-term refinance lowers monthly mortgage payments by obtaining a new loan with a reduced interest rate or adjusted loan term without increasing the principal balance. Recast mortgage maintains the original interest rate but reduces payments by making a lump-sum principal payment, leading to faster amortization and lower monthly costs.

Cash-In Refinance

Cash-in refinance reduces monthly mortgage payments by paying down a portion of the principal upfront, lowering the loan balance and interest costs compared to a recast mortgage, which only recalculates payments based on the remaining loan balance without changing interest rates. This strategy is particularly beneficial for homeowners aiming to secure lower interest rates and significantly cut monthly outflows without extending the loan term.

Mortgage Recasting Fee

Mortgage recasting typically involves a one-time fee ranging from $300 to $500, significantly lower than refinancing closing costs, making it a cost-effective option for reducing monthly payments without changing the interest rate. Unlike refinancing, which resets the loan terms and often requires credit checks, mortgage recasting allows borrowers to lower payments by applying a lump sum directly to the principal, minimizing fees and maintaining existing loan conditions.

Principal Curtailment

Refinance mortgage reduces monthly payments by replacing the original loan with a new loan, often at a lower interest rate or extended term, significantly impacting the principal balance. Recast mortgage lowers monthly payments through principal curtailment by applying a lump sum to reduce the loan balance while keeping the original interest rate and term unchanged.

Extended Loan Term Refinance

Extending the loan term through a refinance mortgage can significantly reduce monthly payments by spreading the balance over a longer period, often resulting in lower interest rates and potential savings. In contrast, a recast mortgage lowers payments by recalculating the balance based on a lump-sum principal payment without altering the loan term, typically offering smaller monthly reductions compared to term extension refinance options.

Interest Rate Lock

Refinance mortgage options allow borrowers to secure a new interest rate lock, potentially lowering monthly payments by obtaining a lower rate, but often involve higher fees and longer processing times. In contrast, a recast mortgage adjusts the existing loan balance and monthly payments without changing the interest rate lock, offering a faster, cost-effective way to reduce payments when making a large principal lump sum.

Trigger Event Recast

Trigger event recast mortgages reduce monthly payments by allowing borrowers to pay down a lump sum principal without refinancing, resulting in lower monthly costs while keeping the original loan terms intact. Unlike refinance mortgages that replace the existing loan to obtain new terms, recasting requires minimal fees and no credit approval, making it an efficient option after significant payments or windfalls.

Partial Principal Prepayment

Refinance mortgage involves obtaining a new loan with updated interest rates and terms, often leading to lower monthly payments by extending the loan term or securing a reduced rate. Recast mortgage allows borrowers to make a partial principal prepayment, which reduces the loan balance and recalculates monthly payments without changing the original loan terms or interest rate.

Securitized Mortgage Adjustment

Refinance mortgage involves obtaining a new loan with different terms to replace an existing securitized mortgage, often securing lower interest rates or extended amortization to reduce monthly payments; recast mortgage entails modifying the original loan by applying a lump-sum payment to lower the principal balance, resulting in recalculated, reduced monthly payments without changing the loan's interest rate or term. Securitized mortgage adjustments through refinancing can incur higher closing costs and extended underwriting processes, whereas recasting offers a cost-effective, quicker option with limited impact on credit and often lower fees.

Automated Underwriting Recast

Refinance Mortgage can lower monthly payments by obtaining a new loan with better terms, but often requires full underwriting and closing costs, whereas Recast Mortgage reduces payments by recalculating the amortization schedule after a lump-sum principal payment, leveraging Automated Underwriting Recast systems to quickly approve and adjust payment terms without a full loan application or appraisal. Automated Underwriting Recast streamlines the process, minimizes fees, and accelerates payment reduction by using algorithm-driven credit and payment history analyses.

Refinance Mortgage vs Recast Mortgage for reducing monthly payments. Infographic

moneydiff.com

moneydiff.com