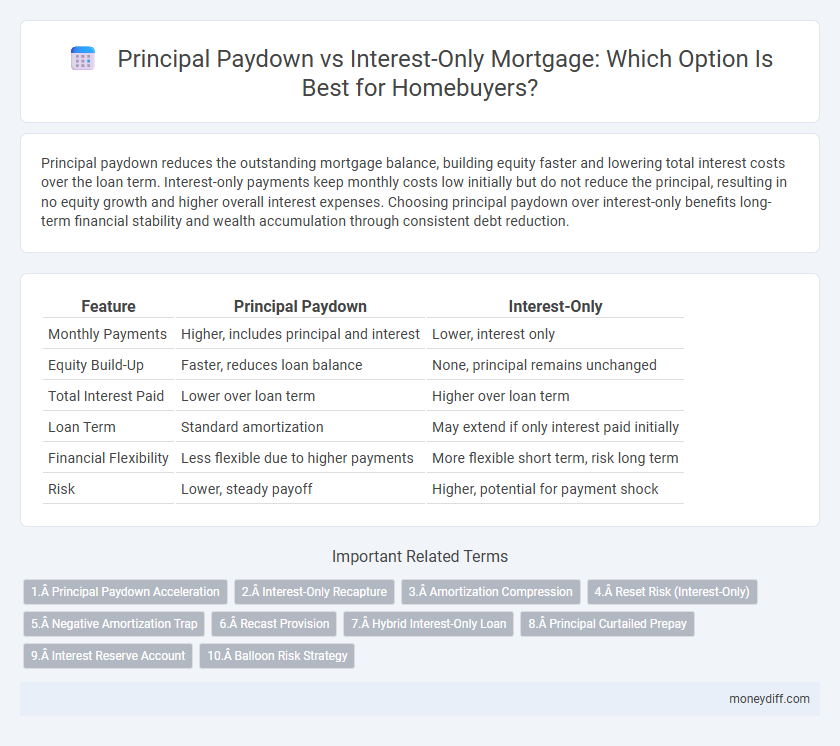

Principal paydown reduces the outstanding mortgage balance, building equity faster and lowering total interest costs over the loan term. Interest-only payments keep monthly costs low initially but do not reduce the principal, resulting in no equity growth and higher overall interest expenses. Choosing principal paydown over interest-only benefits long-term financial stability and wealth accumulation through consistent debt reduction.

Table of Comparison

| Feature | Principal Paydown | Interest-Only |

|---|---|---|

| Monthly Payments | Higher, includes principal and interest | Lower, interest only |

| Equity Build-Up | Faster, reduces loan balance | None, principal remains unchanged |

| Total Interest Paid | Lower over loan term | Higher over loan term |

| Loan Term | Standard amortization | May extend if only interest paid initially |

| Financial Flexibility | Less flexible due to higher payments | More flexible short term, risk long term |

| Risk | Lower, steady payoff | Higher, potential for payment shock |

Understanding Principal Paydown Mortgages

Principal paydown mortgages require monthly payments that reduce both the loan principal and interest, accelerating home equity growth and decreasing total interest paid over the loan term. Unlike interest-only mortgages, which temporarily minimize monthly payments by covering interest alone, principal paydown loans promote long-term financial stability and faster debt elimination. Borrowers prioritizing equity accumulation and lower overall costs benefit most from principal paydown structures.

What Is an Interest-Only Mortgage?

An interest-only mortgage allows borrowers to pay only the interest portion of their loan for a set period, typically 5 to 10 years, without reducing the principal balance. This option results in lower monthly payments initially but does not build home equity during the interest-only term. Borrowers must be prepared for higher payments once the principal payments begin, impacting long-term affordability.

Key Differences: Principal Paydown vs Interest-Only

Principal paydown mortgages reduce the loan balance with each payment, building equity and decreasing interest costs over time. Interest-only loans require payments solely on interest for a set period, offering lower initial payments but no equity growth during that phase. Choosing between these affects overall mortgage cost, equity accumulation, and financial flexibility throughout the loan term.

Impact on Monthly Payments

Principal paydown mortgages increase monthly payments over time as borrowers reduce the loan balance, leading to greater equity accumulation and lower overall interest costs. Interest-only mortgages maintain lower, fixed monthly payments initially, as borrowers pay only interest without reducing the principal. Over the long term, interest-only loans can result in higher total payments and slower equity growth compared to principal paydown options.

Building Home Equity: A Comparative Analysis

Principal paydown accelerates home equity growth by directly reducing the mortgage balance with each payment, increasing ownership stake over time. Interest-only payments, while lowering short-term costs, do not build equity and keep the principal unchanged until a lump sum payment or refinancing occurs. Homeowners seeking long-term wealth accumulation benefit more from principal paydown strategies due to the consistent increase in property equity.

Long-Term Interest Costs: Which Option Saves More?

Principal paydown reduces the mortgage balance over time, leading to significantly lower long-term interest costs compared to interest-only payments, which keep the principal unchanged and accrue interest on the full loan amount. Interest-only mortgages may offer short-term affordability but result in higher total interest paid over the life of the loan. Choosing principal paydown maximizes equity build-up and minimizes cumulative interest expenses, making it the more cost-effective option for long-term savings.

Flexibility and Risks of Each Mortgage Type

Principal paydown mortgages build equity faster by reducing the loan balance with each payment, offering less flexibility but lower long-term interest costs and reduced default risk. Interest-only mortgages provide significantly more payment flexibility by allowing lower initial payments, but they carry higher risks of negative amortization and payment shock when principal repayments begin. Borrowers must weigh the trade-off between early equity accumulation and short-term affordability against potential financial strain and market value fluctuations.

Suitability: Who Should Consider Principal Paydown?

Homebuyers aiming for long-term equity growth and reduced overall interest costs should consider principal paydown mortgages, as these loans lower the outstanding balance with each payment. Borrowers with stable income and plans to stay in their homes for several years benefit most from this approach, which accelerates debt reduction and builds home equity faster. Conversely, those seeking lower initial payments or short-term occupancy might find interest-only options more suitable.

Who Benefits Most from Interest-Only Mortgages?

Interest-only mortgages primarily benefit borrowers with irregular or seasonal income, such as self-employed professionals, who need lower initial payments to manage cash flow. These loans suit those anticipating a significant increase in future earnings or planning to refinance or sell before principal payments begin. Investors looking for maximum tax-deductible interest and improved short-term cash flow also find interest-only mortgages advantageous.

Making the Right Choice: Factors to Consider

Evaluating the choice between principal paydown and interest-only mortgage options requires assessing long-term financial goals and cash flow needs. Principal paydown reduces the loan balance, building equity and lowering total interest paid, while interest-only payments offer short-term affordability but lack equity growth. Consider factors such as loan term, interest rates, income stability, and future refinancing plans to determine the most effective strategy for mortgage management.

Related Important Terms

1. Principal Paydown Acceleration

Principal paydown acceleration reduces the total interest paid over the life of the mortgage by increasing the amount applied directly to the loan balance each month, which shortens the loan term and builds equity faster. In contrast, interest-only payments maintain a constant loan balance, delaying equity growth and resulting in higher overall interest costs.

2. Interest-Only Recapture

Interest-only recapture occurs when borrowers must repay deferred principal in a lump sum or through increased payments, often triggered by sale or refinancing within the interest-only period. This mechanism can lead to higher monthly obligations and impact overall mortgage affordability.

3. Amortization Compression

Amortization compression accelerates equity building by increasing principal paydown in a mortgage, which shortens the loan term compared to interest-only payments that extend amortization and delay equity growth. This process reduces total interest paid over the life of the loan and enhances financial stability by lowering principal balance more rapidly.

4. Reset Risk (Interest-Only)

Interest-only mortgages carry a high reset risk, as borrowers must refinance or pay off the principal once the interest-only period ends, potentially facing higher interest rates or reduced home equity. Principal paydown loans reduce this risk by gradually decreasing the loan balance, ensuring stable payments and less financial strain during rate adjustments.

5. Negative Amortization Trap

Negative amortization occurs when mortgage payments cover only interest, causing the principal balance to increase instead of decrease; this risk is significant in interest-only loans where unpaid principal accrues over time. Principal paydown schedules avoid this trap by consistently reducing the loan balance, ensuring equity growth and preventing debt escalation.

6. Recast Provision

The recast provision allows borrowers to reduce monthly mortgage payments by applying a lump sum toward the principal balance, effectively lowering the loan amortization without refinancing. This feature is beneficial for principal paydown loans, offering lower payments while interest-only loans do not typically utilize recasting since principal reduction is minimal.

7. Hybrid Interest-Only Loan

Hybrid interest-only loans combine an initial period of interest-only payments with subsequent principal and interest payments, offering lower initial monthly costs and eventual equity buildup. These loans appeal to borrowers seeking short-term cash flow relief while transitioning to standard amortization for long-term mortgage stability.

8. Principal Curtailed Prepay

Principal curtailed prepay reduces the loan balance faster by applying extra payments directly to the principal, lowering total interest paid and shortening the mortgage term. This strategy contrasts with interest-only payments, which do not reduce the principal balance and result in higher interest costs over time.

9. Interest Reserve Account

An Interest Reserve Account funds monthly interest payments during loan deferment or construction phases, preventing missed payments and preserving credit. Unlike Principal Paydown loans, which reduce the outstanding balance immediately, interest-only loans with an interest reserve focus solely on covering interest, delaying principal reduction until reserve depletion.

10. Balloon Risk Strategy

A Balloon Risk Strategy in mortgages involves making smaller interest-only payments during the loan term, leaving a large principal balance due at maturity that requires full repayment or refinancing, increasing the borrower's risk exposure. This strategy can lower initial payments but demands careful financial planning to manage the substantial balloon payment and potential refinancing challenges.

Principal Paydown vs Interest-Only for mortgage. Infographic

moneydiff.com

moneydiff.com