Conventional mortgages require traditional credit checks and steady income verification, making them accessible to a broad range of buyers with established financial histories. Crypto-backed mortgages, on the other hand, allow borrowers to leverage their digital assets as collateral, offering faster approval and potentially lower interest rates without selling their cryptocurrency. Both options present unique benefits and risks, with conventional mortgages providing stability and crypto-backed loans offering innovative flexibility in home buying.

Table of Comparison

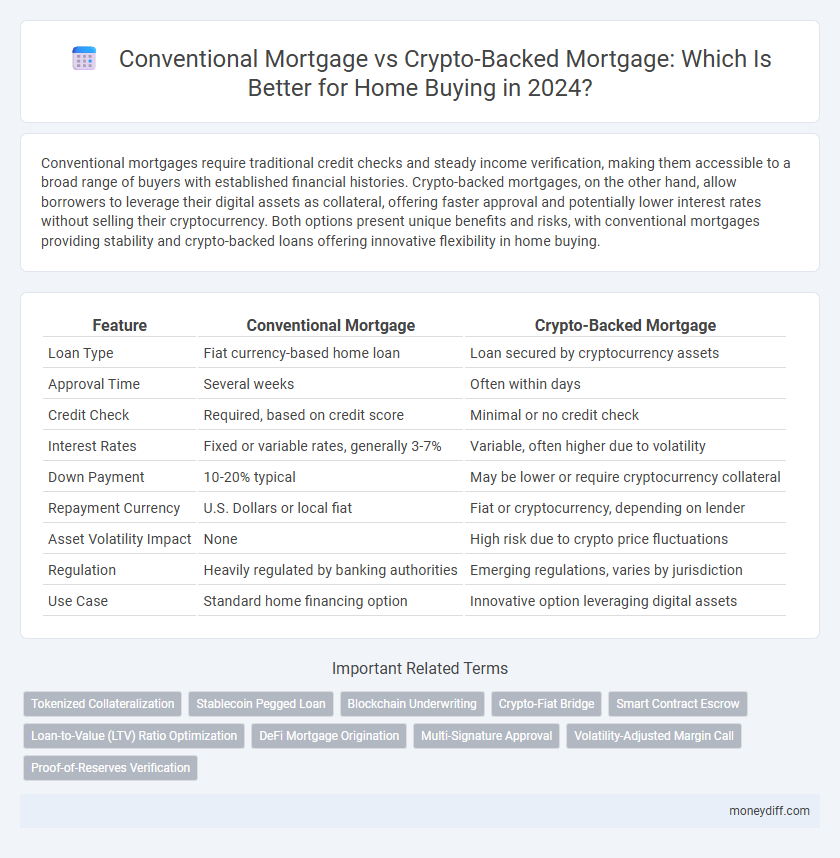

| Feature | Conventional Mortgage | Crypto-Backed Mortgage |

|---|---|---|

| Loan Type | Fiat currency-based home loan | Loan secured by cryptocurrency assets |

| Approval Time | Several weeks | Often within days |

| Credit Check | Required, based on credit score | Minimal or no credit check |

| Interest Rates | Fixed or variable rates, generally 3-7% | Variable, often higher due to volatility |

| Down Payment | 10-20% typical | May be lower or require cryptocurrency collateral |

| Repayment Currency | U.S. Dollars or local fiat | Fiat or cryptocurrency, depending on lender |

| Asset Volatility Impact | None | High risk due to crypto price fluctuations |

| Regulation | Heavily regulated by banking authorities | Emerging regulations, varies by jurisdiction |

| Use Case | Standard home financing option | Innovative option leveraging digital assets |

Understanding Conventional Mortgages

Conventional mortgages typically require a strong credit score, steady income, and a down payment of at least 3% to 20%, with fixed or adjustable interest rates based on market conditions. These loans are often backed by government-sponsored enterprises like Fannie Mae or Freddie Mac, ensuring standardized underwriting and predictable repayment terms. Borrowers benefit from widespread acceptance and established legal protections, making conventional mortgages a reliable option for home financing compared to emerging crypto-backed alternatives.

What Is a Crypto-Backed Mortgage?

A crypto-backed mortgage allows homebuyers to use their cryptocurrency holdings as collateral to secure a loan, providing an alternative to traditional credit-based conventional mortgages. This financing option leverages blockchain assets, enabling borrowers to unlock liquidity without selling their crypto investments, often resulting in faster approval and flexible terms. Lenders assess the value and volatility of the crypto collateral, making risk management a critical factor in these innovative mortgage solutions.

Key Differences Between Conventional and Crypto-Backed Mortgages

Conventional mortgages rely on traditional credit scores, stable income verification, and lengthy approval processes while crypto-backed mortgages use digital assets as collateral, allowing faster approval and potentially lower interest rates for borrowers with substantial cryptocurrency holdings. Loan-to-value ratios in crypto-backed mortgages tend to be more conservative due to market volatility, often requiring larger down payments compared to conventional loans. Regulatory scrutiny and valuation challenges make crypto-backed mortgages less widespread but increasingly attractive for tech-savvy buyers seeking alternative financing options.

Eligibility Requirements: Traditional vs Crypto-Backed Loans

Conventional mortgage eligibility requires a solid credit score, steady income proof, and a low debt-to-income ratio, often demanding lengthy documentation and approval processes. Crypto-backed mortgages prioritize digital asset ownership, allowing borrowers to leverage cryptocurrency holdings as collateral, sometimes bypassing credit checks. This method benefits those with significant crypto portfolios but may involve higher volatility risk and different regulatory standards.

Down Payments: Fiat Currency vs Cryptocurrency Collateral

Conventional mortgages require down payments in fiat currency, typically ranging from 3% to 20% of the home's purchase price, which can be a barrier for buyers with limited liquid cash. Crypto-backed mortgages allow borrowers to use cryptocurrency holdings as collateral, reducing or eliminating the need for traditional cash down payments while leveraging volatile digital assets. This method provides greater liquidity flexibility but involves risks associated with crypto market fluctuations that can affect loan terms and collateral requirements.

Interest Rates and Loan Terms Comparison

Conventional mortgages typically offer fixed or adjustable interest rates ranging from 3% to 7%, with loan terms commonly spanning 15 to 30 years, providing predictable payment schedules and long-term stability. Crypto-backed mortgages often feature higher interest rates between 6% and 12%, paired with shorter loan terms from 1 to 5 years, reflecting the increased volatility and risk associated with digital assets. Borrowers choosing between these options should weigh the stability of conventional rates against the flexibility and innovation presented by crypto-backed loans in the evolving real estate market.

Risks and Security Considerations

Conventional mortgages offer regulatory protections, fixed interest rates, and established credit assessment processes, reducing financial risks for borrowers. Crypto-backed mortgages involve high volatility of digital assets, potential regulatory uncertainties, and the risk of liquidation during market downturns, increasing overall financial exposure. Security considerations include traditional fraud prevention measures for conventional loans versus the need for robust cybersecurity and digital asset custody solutions in crypto-backed mortgages.

Flexibility and Accessibility for Home Buyers

Conventional mortgages typically require strict credit scores, verified income, and extensive documentation, limiting accessibility for some home buyers. Crypto-backed mortgages offer greater flexibility by allowing applicants to use cryptocurrency assets as collateral, often resulting in faster approval processes and reduced reliance on traditional financial histories. This accessibility is particularly advantageous for tech-savvy buyers or those with irregular income streams who may struggle to qualify under conventional lending criteria.

Regulatory and Legal Implications

Conventional mortgages are governed by well-established regulatory frameworks, including federal and state consumer protection laws, ensuring transparency and borrower safeguards. Crypto-backed mortgages operate in a rapidly evolving legal environment with varying regulations across jurisdictions, often lacking standardized oversight and clear consumer protections. Navigating these differences is critical for borrowers and lenders to mitigate risks associated with compliance, valuation volatility, and legal enforceability.

Choosing the Right Mortgage for Your Financial Goals

Conventional mortgages offer fixed interest rates and predictable repayment schedules, making them a reliable choice for buyers seeking stability and long-term planning. Crypto-backed mortgages utilize cryptocurrency assets as collateral, providing quicker approval and potential for lower interest rates but come with higher volatility and risk. Evaluating factors such as risk tolerance, asset volatility, and financial goals is crucial when deciding between a conventional mortgage and a crypto-backed mortgage for home financing.

Related Important Terms

Tokenized Collateralization

Tokenized collateralization in crypto-backed mortgages allows homeowners to use digital assets as collateral, enabling faster approval and potentially lower interest rates compared to conventional mortgages. Unlike traditional loans reliant on credit scores and physical property appraisal, this method leverages blockchain technology to securely tokenize and liquidate collateral, providing increased liquidity and transparency in the home buying process.

Stablecoin Pegged Loan

A conventional mortgage typically involves fixed or variable interest rates with monthly payments based on credit score and income verification, while a crypto-backed mortgage leverages stablecoin pegged loans to provide liquidity without liquidating digital assets, offering lower volatility and faster approval times. Stablecoin pegged loans maintain value stability by being tied to fiat currency, reducing risk exposure and enabling seamless blockchain-based transactions in home buying.

Blockchain Underwriting

Blockchain underwriting enhances transparency and efficiency in both conventional and crypto-backed mortgages by securely verifying borrower data and automating approval processes. Crypto-backed mortgages leverage decentralized ledger technology to reduce fraud risk and expedite lending, while conventional mortgages benefit from improved data accuracy and faster credit assessments through blockchain integration.

Crypto-Fiat Bridge

Crypto-backed mortgages leverage the crypto-fiat bridge by allowing borrowers to use digital assets as collateral while the loan is disbursed in traditional currency, facilitating smoother transactions without the need to liquidate crypto holdings. Conventional mortgages rely solely on fiat currency and creditworthiness, lacking the flexibility and liquidity benefits offered by integrating blockchain technology in crypto-backed lending.

Smart Contract Escrow

Smart contract escrow in crypto-backed mortgages automates fund transfers and enforces contract terms transparently, reducing reliance on traditional intermediaries seen in conventional mortgages. This technology enhances security and efficiency by executing payments and releasing funds only when predefined conditions are met, revolutionizing the home buying process.

Loan-to-Value (LTV) Ratio Optimization

Conventional mortgages typically offer loan-to-value (LTV) ratios up to 80%, requiring borrowers to provide significant down payments and maintain strict credit standards. Crypto-backed mortgages may allow higher LTV ratios by leveraging digital asset collateral, enabling increased borrowing power but introducing volatility risks due to cryptocurrency price fluctuations.

DeFi Mortgage Origination

Conventional mortgages rely on traditional credit assessments and banking institutions, often resulting in slower approval and higher fees, while crypto-backed mortgages leverage decentralized finance (DeFi) platforms to enable faster, borderless loan origination using digital assets as collateral. DeFi mortgage origination enhances transparency, reduces intermediaries, and offers innovative lending models that cater to borrowers with significant cryptocurrency holdings looking to invest in real estate without liquidating their assets.

Multi-Signature Approval

Conventional mortgages rely on traditional credit assessments and single-party approval processes, while crypto-backed mortgages utilize blockchain technology with multi-signature approval, requiring several stakeholders to authorize transactions, enhancing security and reducing fraud risks. Multi-signature approval in crypto-backed mortgages allows for decentralized control and increased transparency, making it a more secure alternative for homebuyers leveraging digital assets.

Volatility-Adjusted Margin Call

Conventional mortgages offer fixed interest rates and predictable monthly payments, minimizing the risk of margin calls due to market volatility. Crypto-backed mortgages, however, are subject to significant price fluctuations of the underlying digital assets, often triggering volatility-adjusted margin calls that require borrowers to deposit additional collateral or face liquidation.

Proof-of-Reserves Verification

Conventional mortgages rely on traditional proof of income and asset verification through bank statements and credit reports, while crypto-backed mortgages use proof-of-reserves verification to confirm digital asset holdings on blockchain. This method enhances transparency and reduces fraud risk by providing verifiable and real-time data on crypto collateral, streamlining the approval process for homeowners leveraging cryptocurrency assets.

Conventional Mortgage vs Crypto-Backed Mortgage for home buying. Infographic

moneydiff.com

moneydiff.com