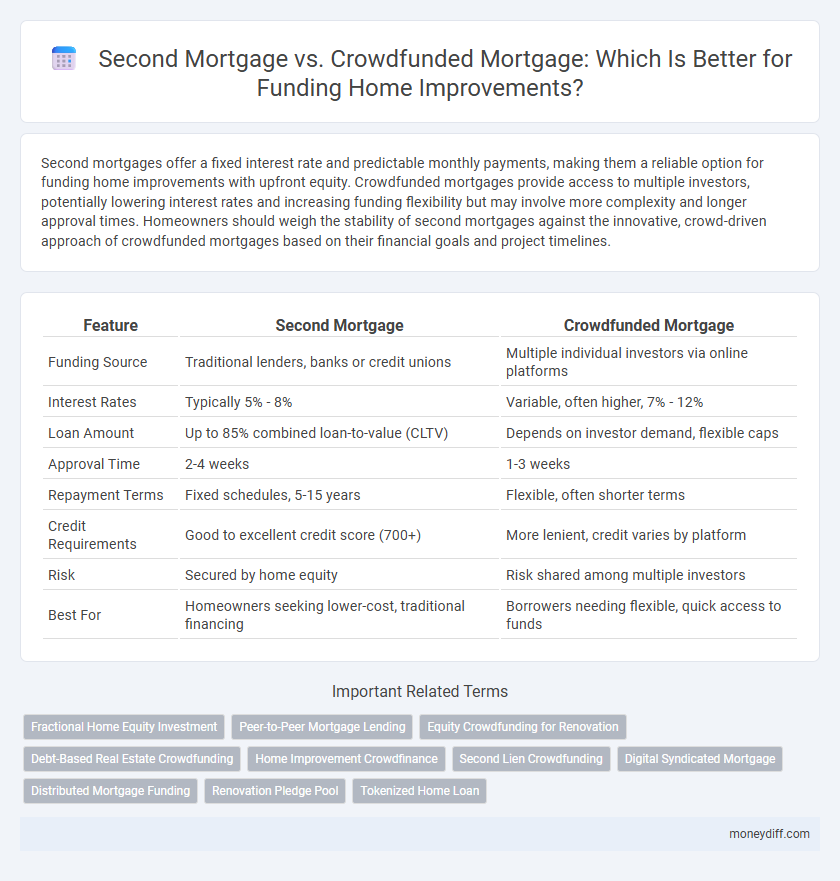

Second mortgages offer a fixed interest rate and predictable monthly payments, making them a reliable option for funding home improvements with upfront equity. Crowdfunded mortgages provide access to multiple investors, potentially lowering interest rates and increasing funding flexibility but may involve more complexity and longer approval times. Homeowners should weigh the stability of second mortgages against the innovative, crowd-driven approach of crowdfunded mortgages based on their financial goals and project timelines.

Table of Comparison

| Feature | Second Mortgage | Crowdfunded Mortgage |

|---|---|---|

| Funding Source | Traditional lenders, banks or credit unions | Multiple individual investors via online platforms |

| Interest Rates | Typically 5% - 8% | Variable, often higher, 7% - 12% |

| Loan Amount | Up to 85% combined loan-to-value (CLTV) | Depends on investor demand, flexible caps |

| Approval Time | 2-4 weeks | 1-3 weeks |

| Repayment Terms | Fixed schedules, 5-15 years | Flexible, often shorter terms |

| Credit Requirements | Good to excellent credit score (700+) | More lenient, credit varies by platform |

| Risk | Secured by home equity | Risk shared among multiple investors |

| Best For | Homeowners seeking lower-cost, traditional financing | Borrowers needing flexible, quick access to funds |

Understanding Second Mortgages: Key Features

Second mortgages allow homeowners to borrow against their home equity, providing a lump sum or line of credit with fixed or variable interest rates. These loans typically have lower interest rates compared to personal loans but require monthly payments, secured by the property. Understanding terms like loan-to-value ratio, repayment period, and potential tax benefits is essential when considering a second mortgage for home improvements.

What Is a Crowdfunded Mortgage?

A crowdfunded mortgage is a financing method where multiple investors pool their funds to provide home improvement loans, offering homeowners access to capital without traditional lenders. This approach leverages online platforms to connect borrowers with a diverse group of backers, often resulting in more flexible terms and competitive interest rates compared to second mortgages. Crowdfunded mortgages can be ideal for homeowners seeking customized funding solutions while potentially enhancing approval chances and reducing reliance on conventional banking institutions.

Eligibility Requirements: Second vs Crowdfunded Mortgages

Second mortgages typically require borrowers to have sufficient home equity, a strong credit score, and stable income to qualify, as lenders assess risk based on existing debt and repayment capacity. Crowdfunded mortgages generally have more flexible eligibility criteria, allowing investors to fund portions of the loan, which can be advantageous for borrowers with lower credit scores or limited income documentation. Both options demand property appraisal and financial verification but differ in how risk is distributed and evaluated among funding sources.

Interest Rates and Loan Terms Compared

Second mortgages generally offer fixed interest rates that are lower than crowdfunded mortgages, with terms ranging from 5 to 15 years depending on the lender. Crowdfunded mortgages often feature variable interest rates influenced by market conditions and typically have shorter loan terms, usually between 1 to 7 years. Borrowers seeking predictable payments and longer repayment periods tend to prefer second mortgages, while those looking for faster access to funds may consider crowdfunded options despite potentially higher costs.

Funding Process: Traditional vs Crowdfunded Approaches

A second mortgage involves a traditional loan process with credit checks, appraisals, and lender approval, often requiring significant paperwork and time. Crowdfunded mortgages leverage online platforms to pool funds from multiple investors, offering a faster and more flexible funding approach without stringent credit requirements. The crowdfunded method can expedite access to capital for home improvements, while second mortgages typically provide larger loan amounts with fixed terms and interest rates.

Costs and Fees: Breaking Down the Numbers

Second mortgages typically involve fixed interest rates and closing costs ranging from 2% to 5% of the loan amount, making them a predictable option for home improvement funding. Crowdfunded mortgages may offer lower upfront fees but often include platform service charges and higher overall interest rates due to investor risk premiums. Evaluating total repayment costs, including interest, fees, and loan terms, is essential to determine the most cost-effective solution for home improvement financing.

Repayment Structures: Second Mortgage vs Crowdfunded Mortgage

Second mortgages typically require fixed monthly payments with a set interest rate and repayment term, offering borrowers predictable costs and a clear timeline for payoff. Crowdfunded mortgages often have flexible repayment structures, sometimes allowing partial interest-only payments or variable terms negotiated with multiple investors. Borrowers should evaluate their cash flow and long-term financial goals to choose between the stability of second mortgages and the adaptability of crowdfunded options.

Risks and Benefits of Each Funding Option

Second mortgages offer homeowners access to substantial funds with typically lower interest rates and fixed repayment schedules, but carry the risk of foreclosure if payments are missed. Crowdfunded mortgages provide more flexible funding through multiple investors, often with less stringent credit requirements, yet they can involve higher interest rates and less regulatory oversight. Evaluating the cost of capital, repayment terms, and potential impact on credit is essential when choosing between these home improvement financing options.

Impact on Home Equity and Future Borrowing

A second mortgage directly leverages existing home equity, increasing debt and potentially limiting future borrowing capacity due to higher loan-to-value ratios. Crowdfunded mortgages, involving multiple investors, may offer more flexible repayment terms without immediately diminishing home equity but can complicate future refinancing options. Both options affect home equity differently, with second mortgages creating secured liens while crowdfunded loans might involve unique contractual obligations affecting long-term financial strategy.

Which Mortgage is Best for Home Improvements?

A second mortgage allows homeowners to borrow against their home equity with fixed interest rates and predictable repayment terms, often making it ideal for substantial or long-term home improvements. Crowdfunded mortgages pool funds from multiple investors, offering potentially lower initial costs but variable terms and less predictable repayment schedules. For home improvements requiring reliable funding and clear financial planning, a second mortgage generally provides greater stability and cost-effectiveness.

Related Important Terms

Fractional Home Equity Investment

Second mortgages offer homeowners a lump sum loan secured against their home's equity, requiring monthly repayments and interest, while crowdfunded mortgages through fractional home equity investment allow multiple investors to collectively fund home improvements in exchange for a share of future property appreciation, minimizing monthly payment obligations. Fractional home equity investments provide flexible funding options without increasing debt burden, appealing to homeowners seeking alternative financing outside traditional loan structures.

Peer-to-Peer Mortgage Lending

Peer-to-peer mortgage lending offers an alternative to traditional second mortgages by enabling homeowners to secure funding directly from individual investors, often resulting in competitive interest rates and flexible terms for home improvements. Crowdfunded mortgages leverage multiple small investments, distributing risk among lenders, whereas second mortgages typically involve a single lender with fixed collateral and payment structures.

Equity Crowdfunding for Renovation

Equity crowdfunding for renovation allows homeowners to raise capital by selling shares in the property improvement project, offering flexible funding without increasing traditional debt like a second mortgage. This method leverages multiple investors, distributing risk and often enabling larger-scale or innovative home improvement projects that may not qualify for conventional second mortgage financing.

Debt-Based Real Estate Crowdfunding

Debt-based real estate crowdfunding offers homeowners a flexible alternative to second mortgages for financing home improvements by pooling funds from multiple investors, potentially resulting in lower interest rates and fewer traditional credit requirements. Unlike second mortgages, which increase personal debt and require collateral against the property, crowdfunded mortgages distribute risk across a broad investor base, enabling faster access to capital with transparent terms tailored to individual project needs.

Home Improvement Crowdfinance

Home improvement crowdfinance leverages multiple individual investors pooling funds to provide flexible financing options that often feature competitive interest rates and less stringent credit requirements compared to traditional second mortgages. Unlike second mortgages, crowdfunded mortgages can offer homeowners tailored repayment plans and faster approval processes, making them an appealing alternative for funding home renovations.

Second Lien Crowdfunding

Second lien crowdfunding provides homeowners with an alternative to traditional second mortgages by pooling funds from multiple investors, often resulting in more flexible terms and potentially lower interest rates. This approach combines the security of a second lien position with the diversified capital sources of crowdfunding, making it an efficient option for financing home improvements without refinancing the primary mortgage.

Digital Syndicated Mortgage

Digital syndicated mortgages leverage online platforms to pool investor funds, offering competitive rates and flexible terms compared to traditional second mortgages, which often involve higher interest rates and stricter approval criteria. This innovative crowdfunding approach accelerates funding for home improvements by enabling homeowners to access a broader investor base through digital syndication, increasing transparency and reducing transaction costs.

Distributed Mortgage Funding

Distributed mortgage funding through crowdfunded mortgages allows homeowners to pool capital from multiple investors, reducing reliance on traditional second mortgages with higher interest rates and stringent approval processes. Crowdfunded mortgages offer flexible funding options and faster access to capital for home improvements, leveraging collective investment to lower individual risk and increase loan accessibility.

Renovation Pledge Pool

A Second Mortgage provides a traditional loan secured against your home equity with fixed interest rates and predictable repayment terms, while a Crowdfunded Mortgage, such as those facilitated through the Renovation Pledge Pool, leverages collective investor funds to support home improvements, often offering more flexible access to capital and potential community-driven benefits. The Renovation Pledge Pool specializes in enabling homeowners to fund renovations by connecting them with multiple backers, which can result in competitive rates and diverse financing options compared to conventional second mortgage loans.

Tokenized Home Loan

Tokenized home loans offered through crowdfunded mortgages provide a decentralized alternative to traditional second mortgages by enabling fractional ownership and increased liquidity. These blockchain-based securities enhance transparency and accessibility for homeowners seeking flexible funding options for home improvements.

Second Mortgage vs Crowdfunded Mortgage for funding home improvements. Infographic

moneydiff.com

moneydiff.com