An Adjustable Rate Mortgage (ARM) offers a variable interest rate that adjusts periodically based on market conditions, providing lower initial payments but potential fluctuations over time. An Interest-Only Mortgage allows borrowers to pay only the interest for a set period, resulting in lower monthly payments upfront but higher payments later when principal repayment begins. Choosing between these options depends on your financial stability and risk tolerance in real estate financing.

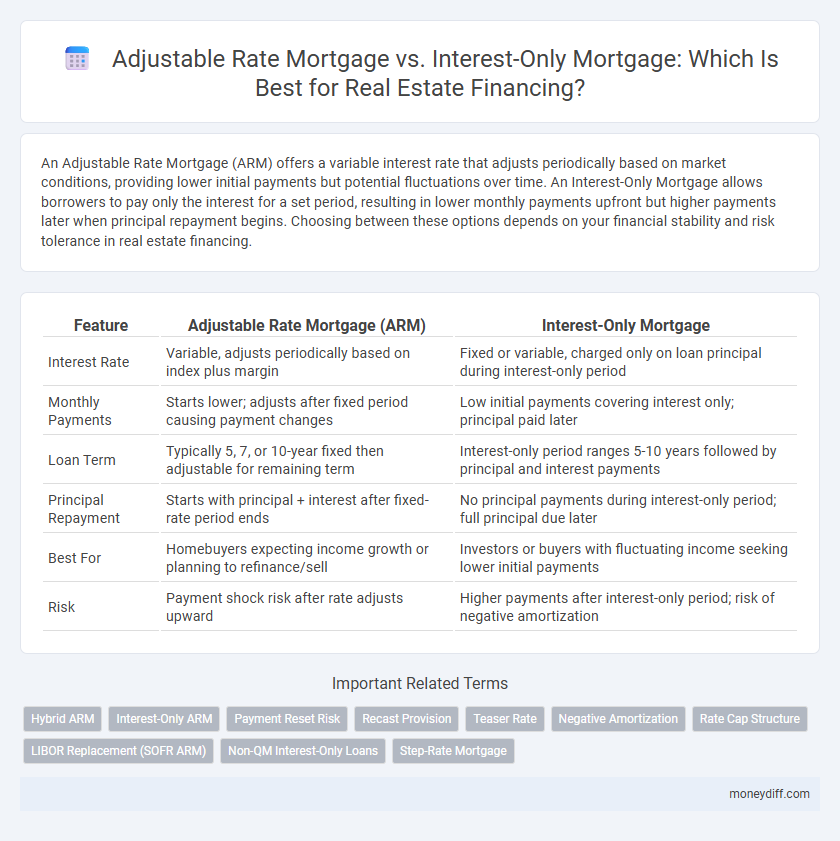

Table of Comparison

| Feature | Adjustable Rate Mortgage (ARM) | Interest-Only Mortgage |

|---|---|---|

| Interest Rate | Variable, adjusts periodically based on index plus margin | Fixed or variable, charged only on loan principal during interest-only period |

| Monthly Payments | Starts lower; adjusts after fixed period causing payment changes | Low initial payments covering interest only; principal paid later |

| Loan Term | Typically 5, 7, or 10-year fixed then adjustable for remaining term | Interest-only period ranges 5-10 years followed by principal and interest payments |

| Principal Repayment | Starts with principal + interest after fixed-rate period ends | No principal payments during interest-only period; full principal due later |

| Best For | Homebuyers expecting income growth or planning to refinance/sell | Investors or buyers with fluctuating income seeking lower initial payments |

| Risk | Payment shock risk after rate adjusts upward | Higher payments after interest-only period; risk of negative amortization |

Understanding Adjustable Rate Mortgages (ARM)

Adjustable Rate Mortgages (ARM) feature interest rates that fluctuate based on market indices, typically starting with lower initial rates compared to fixed-rate loans, making them attractive for borrowers expecting short-term home ownership or income growth. These loans adjust periodically, often annually, after an initial fixed period, with changes tied to benchmarks like the LIBOR or Treasury rates plus a margin, impacting monthly payments. Understanding ARM caps, adjustment frequency, and index-margin structure is crucial to assessing risk and potential payment increases in real estate financing.

What Is an Interest-Only Mortgage?

An interest-only mortgage allows borrowers to pay only the interest on the loan for a predetermined initial period, typically 5 to 10 years, resulting in lower monthly payments compared to traditional loans. After this interest-only phase, payments increase significantly as principal repayment begins, potentially causing affordability challenges. This type of mortgage suits investors or homeowners with fluctuating income who seek short-term cash flow flexibility but involves higher long-term risk due to payment escalation.

Key Differences Between ARM and Interest-Only Loans

Adjustable Rate Mortgages (ARMs) feature interest rates that fluctuate based on market indices, causing monthly payments to vary over time, while Interest-Only Mortgages require borrowers to pay only the interest for an initial period, resulting in lower initial payments but no principal reduction. ARMs typically shift borrowers from lower initial rates to potentially higher rates after a fixed term, contrasting with Interest-Only loans where principal repayment begins only after the interest-only phase ends. The key difference lies in payment structure and risk: ARMs expose borrowers to interest rate volatility, whereas Interest-Only loans risk payment shock when principal amortization starts.

Pros and Cons of Adjustable Rate Mortgages

Adjustable Rate Mortgages (ARMs) offer lower initial interest rates compared to fixed-rate loans, making monthly payments more affordable in the early years, which benefits borrowers expecting income growth or planning to sell before rates adjust. The primary risk of ARMs lies in interest rate fluctuations, potentially causing monthly payments to increase significantly after the initial fixed period, leading to payment shock and budget instability. Unlike Interest-Only Mortgages, ARMs gradually build home equity through principal amortization post-adjustment, balancing initial affordability with long-term investment growth.

Advantages and Drawbacks of Interest-Only Mortgages

Interest-Only Mortgages offer lower initial monthly payments by requiring borrowers to pay only interest for a set period, improving short-term cash flow and affordability for real estate investments. However, the principal balance remains unchanged during the interest-only phase, leading to potential payment shock and higher monthly costs when principal repayments begin. The risk of negative amortization and fluctuating interest rates can increase financial vulnerability compared to Adjustable Rate Mortgages, which typically adjust interest and principal together over time.

Short-Term vs Long-Term Costs Comparison

Adjustable Rate Mortgages (ARMs) typically offer lower initial interest rates than Interest-Only Mortgages, resulting in reduced short-term payments but introducing potential long-term rate increases that can significantly raise total costs. In contrast, Interest-Only Mortgages allow borrowers to pay only interest for a set period, lowering initial expenses while causing principal balances to remain unchanged, which may lead to higher long-term repayment obligations after the interest-only phase ends. Evaluating the total cost of ownership requires comparing the ARM's variable rate risks against the Interest-Only loan's deferred principal payments to determine which financing option aligns better with the borrower's financial horizon.

Which Mortgage Fits Your Financial Goals?

Adjustable Rate Mortgages (ARMs) offer lower initial interest rates that adjust periodically based on market indexes, making them suitable for borrowers anticipating income growth or short-term ownership. Interest-Only Mortgages provide lower initial payments by allowing borrowers to pay only interest for a set period, ideal for those with fluctuating cash flow or planning to refinance before principal payments begin. Choosing the right mortgage depends on your financial goals, risk tolerance, and plans for property ownership duration.

Impact of Market Fluctuations on Your Loan

Adjustable Rate Mortgages (ARMs) directly reflect market fluctuations, causing interest rates and monthly payments to vary over time, which can increase financial uncertainty during rising rate periods. Interest-Only Mortgages maintain lower initial payments by charging interest only for a set period, but when principal payments commence, borrowers face potentially sharp payment increases compounded by market rate changes. Understanding these impacts helps borrowers choose a loan aligned with their risk tolerance and market outlook.

Assessing Risk: ARM vs Interest-Only Mortgages

Adjustable Rate Mortgages (ARMs) expose borrowers to interest rate fluctuations, potentially increasing monthly payments after the initial fixed period, which heightens payment unpredictability and financial risk. Interest-Only Mortgages allow for lower initial payments by deferring principal repayment, but they carry significant risk due to the sudden payment increase when principal amortization begins, often leading to payment shock. Evaluating risk involves considering personal financial stability, market interest rate trends, and the ability to absorb future payment increases under both ARM and Interest-Only financing structures.

Tips for Choosing the Right Mortgage for Real Estate Investors

Real estate investors should evaluate their cash flow needs and market interest rate trends when choosing between an Adjustable Rate Mortgage (ARM) and an Interest-Only Mortgage. ARMs offer lower initial rates with potential for adjustment based on index rates like LIBOR or SOFR, which benefits investors anticipating rising property value and income growth. Interest-Only Mortgages allow reduced payments early on, improving short-term cash flow for investments focused on property appreciation or renovation but require careful planning for principal repayment phases.

Related Important Terms

Hybrid ARM

Hybrid Adjustable Rate Mortgages (Hybrid ARMs) combine fixed and adjustable interest periods, offering initial stability followed by rate adjustments based on market indexes, contrasting with Interest-Only Mortgages which require payments solely on the principal for a set term before transitioning to principal plus interest. Hybrid ARMs are often preferred for borrowers expecting to sell or refinance before the adjustable period begins, minimizing the risk of rising rates common in fully adjustable or interest-only structures.

Interest-Only ARM

Interest-Only Adjustable Rate Mortgages (ARMs) provide lower initial monthly payments by allowing borrowers to pay only the interest for a specified period, typically 5 to 10 years, before principal payments begin. This option benefits real estate financing by improving cash flow during the early years, but it carries the risk of payment shock when principal repayments start and interest rates adjust.

Payment Reset Risk

Adjustable Rate Mortgages (ARMs) expose borrowers to payment reset risk through periodic interest rate adjustments that can significantly increase monthly payments over time. Interest-Only Mortgages concentrate payment reset risk at the end of the interest-only period, when borrowers must begin principal and interest payments, often resulting in a substantial jump in monthly obligations.

Recast Provision

An Adjustable Rate Mortgage (ARM) offers interest rates that fluctuate based on market indexes, while an Interest-Only Mortgage allows borrowers to pay only interest for a set period before principal payments begin. Both mortgage types may include a recast provision, enabling borrowers to reset their loan amortization schedule by making a lump-sum payment, which can lower monthly payments and improve financial flexibility.

Teaser Rate

Adjustable Rate Mortgages (ARMs) often feature a teaser rate, an initial reduced interest rate lasting typically 3-7 years, designed to attract borrowers with lower starting payments before adjusting to higher variable rates. In contrast, Interest-Only Mortgages also may use teaser rates, but during the interest-only period, borrowers pay solely the interest without reducing principal, leading to eventual payment increases once principal repayments commence.

Negative Amortization

Adjustable Rate Mortgages (ARMs) generally involve fluctuating interest rates that can lead to increased monthly payments, while Interest-Only Mortgages allow borrowers to pay only the interest for a set period, potentially causing negative amortization as the principal balance remains unchanged or grows. Negative amortization occurs when unpaid interest is added to the loan balance, increasing debt and risking higher payments or loan default in both ARM and Interest-Only Mortgage structures.

Rate Cap Structure

Adjustable Rate Mortgages (ARMs) feature rate cap structures that limit how much the interest rate can increase at each adjustment period and over the life of the loan, providing borrowers with predictable maximum payment changes. Interest-Only Mortgages typically have fixed-rate or adjustable-rate options but focus on interest payments initially, with less emphasis on rate caps, potentially leading to larger payment spikes when principal repayments begin.

LIBOR Replacement (SOFR ARM)

Adjustable Rate Mortgages (ARMs) linked to the Secured Overnight Financing Rate (SOFR) have become the preferred alternative to LIBOR-based loans, offering more transparent and reliable interest rate benchmarks. Interest-Only Mortgages paired with SOFR allow borrowers to pay only interest for an initial period, but the fluctuating SOFR can lead to varying monthly payments, impacting long-term affordability and risk management.

Non-QM Interest-Only Loans

Non-QM Interest-Only Loans offer flexible payments with lower initial monthly costs by allowing borrowers to pay only interest for a set term, ideal for investors or those with fluctuating incomes. Adjustable Rate Mortgages (ARMs) feature variable interest rates that can increase over time, potentially raising monthly payments, whereas Non-QM Interest-Only Loans prioritize cash flow management without the strict qualification requirements of conventional loans.

Step-Rate Mortgage

A Step-Rate Mortgage features predetermined interest rate increases at specific intervals, offering predictable payment adjustments compared to the variable fluctuations of an Adjustable Rate Mortgage (ARM). Unlike an Interest-Only Mortgage, which requires initial payments covering only interest, a Step-Rate Mortgage gradually increases the principal repayment, balancing affordability and equity buildup over time.

Adjustable Rate Mortgage vs Interest-Only Mortgage for real estate financing. Infographic

moneydiff.com

moneydiff.com