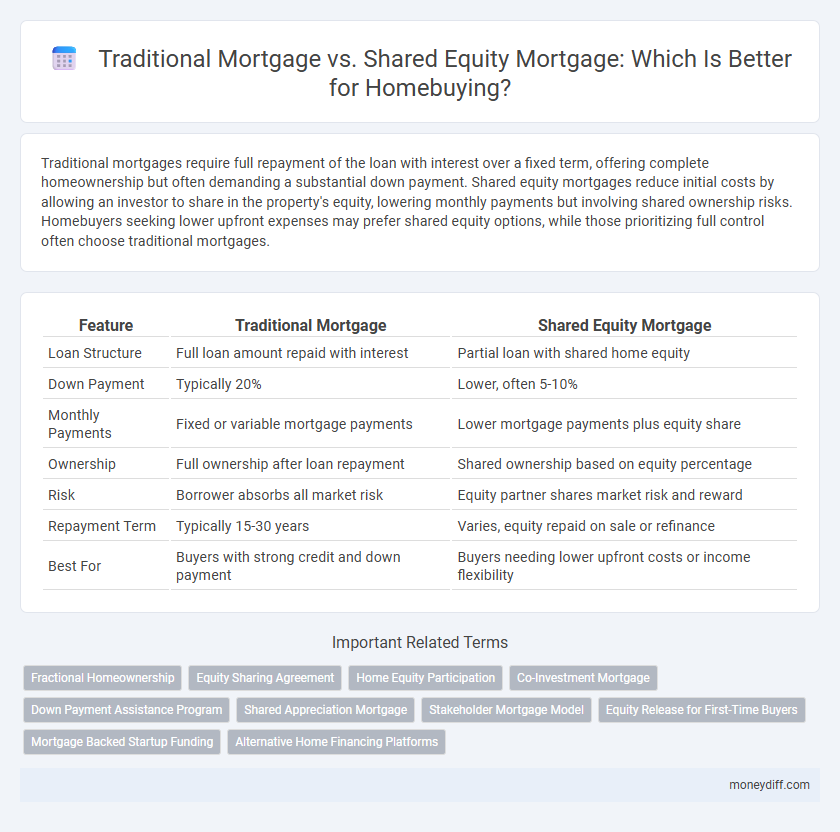

Traditional mortgages require full repayment of the loan with interest over a fixed term, offering complete homeownership but often demanding a substantial down payment. Shared equity mortgages reduce initial costs by allowing an investor to share in the property's equity, lowering monthly payments but involving shared ownership risks. Homebuyers seeking lower upfront expenses may prefer shared equity options, while those prioritizing full control often choose traditional mortgages.

Table of Comparison

| Feature | Traditional Mortgage | Shared Equity Mortgage |

|---|---|---|

| Loan Structure | Full loan amount repaid with interest | Partial loan with shared home equity |

| Down Payment | Typically 20% | Lower, often 5-10% |

| Monthly Payments | Fixed or variable mortgage payments | Lower mortgage payments plus equity share |

| Ownership | Full ownership after loan repayment | Shared ownership based on equity percentage |

| Risk | Borrower absorbs all market risk | Equity partner shares market risk and reward |

| Repayment Term | Typically 15-30 years | Varies, equity repaid on sale or refinance |

| Best For | Buyers with strong credit and down payment | Buyers needing lower upfront costs or income flexibility |

Understanding Traditional Mortgages

Traditional mortgages require borrowers to secure a loan based on their credit score, income, and down payment, offering full home ownership from day one. Interest rates and repayment terms vary depending on lender criteria and loan type, often including fixed or adjustable rates. Homebuyers assuming traditional mortgages bear full responsibility for monthly payments, property taxes, and maintenance costs throughout the loan term.

What Is a Shared Equity Mortgage?

A Shared Equity Mortgage involves a homebuyer partnering with an investor or government entity that contributes to the down payment in exchange for a percentage of future home value appreciation. This arrangement reduces the initial financial burden for the buyer compared to a traditional mortgage, which requires full repayment of the loan with interest over time. Shared equity agreements often include terms that specify how profits or losses will be divided when the property is sold or refinanced.

Key Differences: Traditional vs Shared Equity Mortgages

Traditional mortgages require full loan repayment with interest over a set term, typically involving a fixed or variable interest rate paid solely by the borrower. Shared equity mortgages involve a partnership where the lender or investor shares ownership and benefits from property appreciation, reducing the initial borrowing cost but sharing future profits or losses. Key differences lie in repayment structure, ownership division, and risk allocation between borrower and lender.

Pros and Cons of Traditional Mortgages

Traditional mortgages provide full homeownership with predictable fixed or adjustable interest rates and established lending criteria, offering borrowers long-term stability and control over their property. However, they often require substantial down payments and stringent credit qualifications, which can limit accessibility for first-time buyers or those with limited savings. Borrowers also bear full responsibility for mortgage payments and property appreciation risks, contrasting with shared equity mortgages that distribute these financial burdens with equity partners.

Pros and Cons of Shared Equity Mortgages

Shared equity mortgages allow homebuyers to reduce upfront costs by sharing property ownership with an investor or government entity, enhancing affordability and access to higher-value homes. However, homeowners must share future property appreciation, potentially limiting long-term financial gains compared to traditional mortgages where full equity buildup occurs. This arrangement can result in less control over the property and complexities during resale or refinancing.

How Down Payments Differ in Each Option

Traditional mortgages typically require a down payment of 10% to 20% of the home's purchase price, making initial costs higher for buyers. Shared equity mortgages allow buyers to reduce or eliminate their down payment by sharing ownership equity with a lender or investor, which lowers upfront cash requirements. This approach enables buyers to enter the market sooner but involves sharing future property appreciation or profits.

Impact on Monthly Payments and Home Equity

Traditional mortgages typically involve fixed or adjustable monthly payments that cover principal and interest, directly increasing the homeowner's equity as the loan is repaid. Shared equity mortgages reduce monthly payments by having an investor or lender own a portion of the home's equity, which means the homeowner builds equity more slowly and shares appreciation or depreciation upon sale. Understanding these differences is crucial for buyers to balance immediate affordability with long-term equity building and financial goals.

Eligibility and Qualification Criteria

Traditional mortgages typically require a strong credit score, steady income, and a down payment ranging from 3% to 20%, with lenders assessing debt-to-income ratios and employment history for eligibility. Shared equity mortgages often target first-time homebuyers or those with limited savings, requiring lower upfront costs but necessitating agreement on equity sharing terms with the investor or government entity involved. Qualification for shared equity mortgages may also include additional criteria such as income caps and home price limits, reflecting their goal to improve housing affordability.

Long-Term Financial Implications

Traditional mortgages typically require full principal and interest payments over a fixed term, leading to predictable long-term financial commitments and complete home equity accumulation. Shared equity mortgages involve sharing homeownership and future appreciation with an equity partner, reducing initial payment burdens but potentially limiting full equity gains and impacting resale profits. Evaluating long-term financial implications requires balancing monthly affordability against total asset growth and flexibility in home equity control.

Which Mortgage Fits Your Homebuying Goals?

Traditional mortgages offer full property ownership with fixed or variable interest rates, suitable for buyers seeking long-term control and equity growth. Shared equity mortgages provide partial ownership by partnering with investors who share in future home value appreciation, making them ideal for buyers with limited upfront funds looking to reduce monthly payments. Assessing your financial stability, desired ownership level, and long-term plans helps determine whether a traditional or shared equity mortgage aligns best with your homebuying goals.

Related Important Terms

Fractional Homeownership

Fractional homeownership through shared equity mortgages allows buyers to reduce initial down payments by partnering with investors who share in property appreciation, contrasting with traditional mortgages where the borrower holds full equity and repayment responsibility. This approach provides increased access to homeownership for those unable to secure large loans, while traditional mortgages remain preferable for buyers seeking complete control and long-term equity accumulation.

Equity Sharing Agreement

Traditional mortgages require borrowers to repay the full loan amount with interest over a fixed term, maintaining complete ownership and equity buildup in the property. Shared Equity Mortgages involve an equity sharing agreement where the lender or investor owns a percentage of the property, sharing in both risks and future appreciation, which can reduce upfront costs and monthly payments for homebuyers.

Home Equity Participation

Traditional mortgages require full principal and interest payments, allowing homeowners to build 100% equity over time, whereas shared equity mortgages involve a third party investing alongside the buyer in exchange for a percentage of the future home appreciation, reducing the initial loan burden but sharing equity gains or losses. Home equity participation in shared equity mortgages enables buyers to access more affordable financing by leveraging external capital, but it limits the homeowner's ability to accumulate full property value independently.

Co-Investment Mortgage

A co-investment mortgage, a form of shared equity mortgage, allows homebuyers to partner with an investor who contributes a portion of the down payment or purchase price in exchange for a stake in the property's future appreciation. Unlike traditional mortgages that require full borrower financing and repayment with interest, co-investment mortgages reduce monthly payments and initial capital requirements while sharing both risks and potential gains between homeowner and investor.

Down Payment Assistance Program

Traditional mortgages typically require a substantial down payment, often 20%, which can be a barrier for many homebuyers, whereas Shared Equity Mortgages reduce initial costs by partnering with investors who provide down payment assistance in exchange for a portion of the property's future appreciation. Down Payment Assistance Programs integrated with Shared Equity Mortgages enable buyers to enter the housing market sooner with lower upfront cash, optimizing affordability and long-term investment potential.

Shared Appreciation Mortgage

Shared Appreciation Mortgages (SAM) offer homebuyers a unique financing option by allowing lenders to share in the future appreciation of the property's value, reducing initial monthly payments compared to traditional fixed-rate mortgages. This structure benefits buyers with lower upfront costs and potential financial flexibility, while lenders gain a return tied to the property's market performance rather than fixed interest alone.

Stakeholder Mortgage Model

Traditional mortgages involve a single borrower obtaining full loan responsibility directly from a lender, while the Stakeholder Mortgage Model within shared equity mortgages includes multiple parties like investors and homeowners sharing ownership and financial risk. This collaborative approach aligns stakeholder interests through equity sharing, reducing individual borrower burden and potentially increasing home affordability.

Equity Release for First-Time Buyers

Traditional mortgages require full repayment with interest based on the loan amount, which can strain first-time buyers' finances, whereas shared equity mortgages allow buyers to release equity by partnering with a lender or investor who shares ownership and future profits, reducing upfront costs and monthly payments. This equity release approach provides first-time buyers greater access to homeownership by lowering entry barriers while aligning repayment with property value increases.

Mortgage Backed Startup Funding

Traditional mortgages rely on borrower creditworthiness and steady income for approval, often limiting access to home ownership. Shared equity mortgages, increasingly supported by mortgage-backed startup funding, offer a collaborative approach where investors fund part of the purchase in exchange for a share of the home's future appreciation, reducing initial borrower debt and risk.

Alternative Home Financing Platforms

Traditional mortgages require full loan repayment with interest based on the borrower's creditworthiness, providing predictable monthly payments over the loan term. Shared equity mortgages offer an alternative by allowing homebuyers to share future property appreciation with investors, reducing initial financing costs but potentially impacting long-term equity gains.

Traditional Mortgage vs Shared Equity Mortgage for homebuying. Infographic

moneydiff.com

moneydiff.com