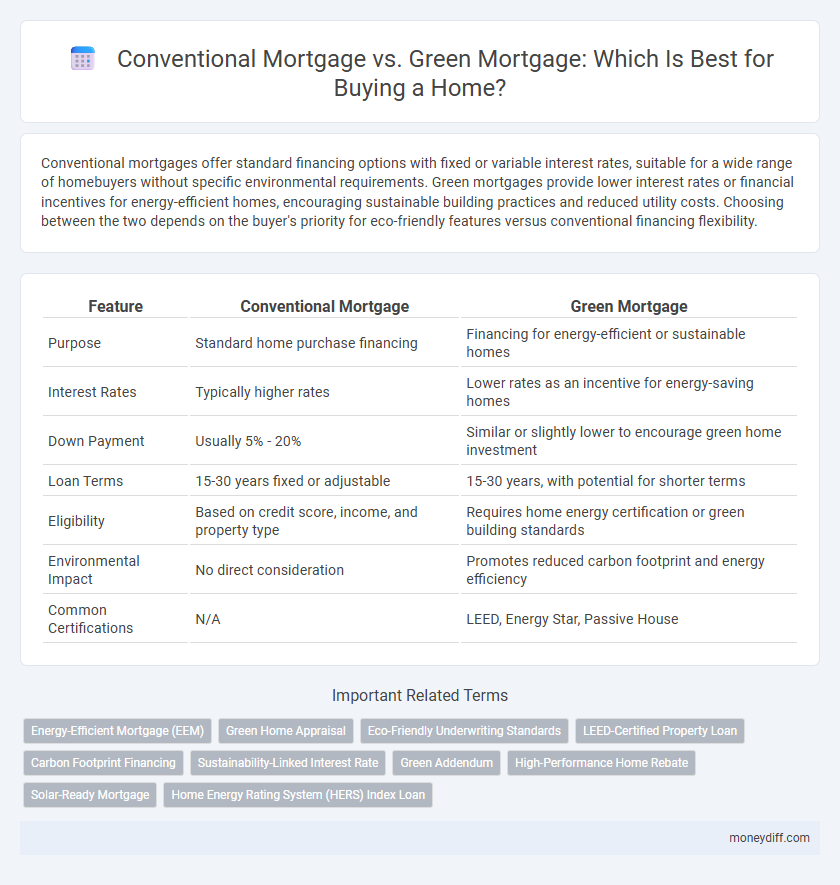

Conventional mortgages offer standard financing options with fixed or variable interest rates, suitable for a wide range of homebuyers without specific environmental requirements. Green mortgages provide lower interest rates or financial incentives for energy-efficient homes, encouraging sustainable building practices and reduced utility costs. Choosing between the two depends on the buyer's priority for eco-friendly features versus conventional financing flexibility.

Table of Comparison

| Feature | Conventional Mortgage | Green Mortgage |

|---|---|---|

| Purpose | Standard home purchase financing | Financing for energy-efficient or sustainable homes |

| Interest Rates | Typically higher rates | Lower rates as an incentive for energy-saving homes |

| Down Payment | Usually 5% - 20% | Similar or slightly lower to encourage green home investment |

| Loan Terms | 15-30 years fixed or adjustable | 15-30 years, with potential for shorter terms |

| Eligibility | Based on credit score, income, and property type | Requires home energy certification or green building standards |

| Environmental Impact | No direct consideration | Promotes reduced carbon footprint and energy efficiency |

| Common Certifications | N/A | LEED, Energy Star, Passive House |

Understanding Conventional Mortgages

Conventional mortgages are traditional home loans not insured by the government and typically require a higher credit score, a down payment of at least 5%, and stable income verification. They offer fixed or adjustable interest rates with terms usually ranging from 15 to 30 years, making them a standard choice for many homebuyers. Unlike green mortgages, conventional loans do not provide special incentives for energy-efficient homes or improvements.

What Is a Green Mortgage?

A green mortgage is a specialized loan designed to finance energy-efficient homes, offering lower interest rates or higher borrowing limits to encourage sustainable property investments. Unlike conventional mortgages, green mortgages assess a home's energy performance, considering factors such as insulation, solar panels, and energy-efficient appliances. This type of mortgage promotes environmental benefits while potentially reducing utility costs for homeowners.

Key Differences Between Conventional and Green Mortgages

Conventional mortgages typically offer standardized loan terms and are widely available with fixed or adjustable rates, primarily focusing on creditworthiness and down payment size. Green mortgages provide financing incentives such as lower interest rates or higher loan amounts for energy-efficient homes or improvements, emphasizing environmental impact and energy savings. The key difference lies in eligibility criteria, where green mortgages require verification of energy efficiency, while conventional mortgages do not consider ecological factors.

Eligibility Criteria for Each Mortgage Type

Conventional mortgages typically require a minimum credit score of 620, a down payment of at least 5%, and a debt-to-income ratio below 43%, making them accessible to a broad range of homebuyers. Green mortgages often necessitate proof of energy-efficient upgrades or certifications such as ENERGY STAR, alongside similar credit and income requirements, to qualify for favorable interest rates or incentives. Lenders may also require home appraisals that assess environmental impact or energy savings to determine eligibility for green mortgage programs.

Interest Rates: Conventional vs Green Mortgages

Conventional mortgages typically offer fixed or variable interest rates based on market conditions and borrower creditworthiness, often resulting in higher rates compared to green mortgages. Green mortgages provide lower interest rates or additional incentives to borrowers purchasing energy-efficient homes, promoting sustainable housing investments. Interest rate reductions on green mortgages can range from 0.25% to 0.50% below conventional mortgage rates, reducing overall borrowing costs significantly.

Environmental Impact and Energy Efficiency

Conventional mortgages typically do not include incentives for energy-efficient home features, whereas green mortgages offer lower interest rates or down payment assistance to buyers investing in environmentally sustainable properties. Green mortgages encourage energy-efficient upgrades like solar panels, high-performance windows, and improved insulation, significantly reducing a home's carbon footprint and utility costs. Choosing a green mortgage supports long-term environmental impact mitigation by promoting energy-saving technologies and sustainable building practices.

Financial Incentives for Green Mortgages

Green mortgages often offer lower interest rates and reduced fees compared to conventional mortgages, providing significant financial incentives for eco-conscious homebuyers. These loans may include cash-back rewards or discounts for meeting energy efficiency standards, leading to long-term savings on utility bills and increased property value. Borrowers can also benefit from government rebates or tax credits tied to green home improvements financed through green mortgage programs.

Application Process: Step-by-Step Comparison

The application process for a conventional mortgage typically involves submitting standard financial documents such as income verification, credit reports, and property appraisals, followed by underwriting and approval based on creditworthiness and debt-to-income ratio. Green mortgage applications require additional documentation demonstrating the energy efficiency or sustainability features of the property, such as energy audits, certifications like LEED or ENERGY STAR, and may involve collaboration with green building experts. Both processes require lender evaluation, but green mortgages often include verification of environmental benefits to qualify for favorable interest rates or incentives.

Pros and Cons of Conventional and Green Mortgages

Conventional mortgages offer flexibility in property choice and typically have more established lending criteria but often feature higher interest rates and limited incentives for energy efficiency. Green mortgages provide lower interest rates and incentives for purchasing energy-efficient homes or making eco-friendly upgrades, although they may require additional documentation and restrict eligible properties. Homebuyers must balance cost savings and environmental benefits against eligibility requirements and property limitations when choosing between the two mortgage types.

Which Mortgage Is Right for Your Home Purchase?

Conventional mortgages typically require a higher credit score and offer more flexible property options, making them suitable for buyers focused on standard home purchases without specific energy efficiency criteria. Green mortgages provide incentives such as lower interest rates or higher loan limits when purchasing energy-efficient or environmentally friendly homes, appealing to buyers interested in sustainability and long-term savings on utility costs. Choosing the right mortgage depends on your credit profile, property type, and commitment to eco-friendly living, balancing upfront costs against potential environmental benefits and financial incentives.

Related Important Terms

Energy-Efficient Mortgage (EEM)

Energy-Efficient Mortgages (EEMs) enable homebuyers to finance energy-saving improvements as part of their conventional mortgage, reducing overall utility costs and increasing property value. Unlike standard conventional mortgages, EEMs offer added borrowing capacity specifically for upgrades such as solar panels, insulation, and high-efficiency heating systems, promoting sustainable housing with long-term financial benefits.

Green Home Appraisal

Green home appraisal evaluates energy-efficient features and sustainable materials, directly influencing the loan amount and interest rates of green mortgages. Conventional mortgages typically rely on standard property valuations, while green mortgages incorporate environmental performance metrics to offer better financing options.

Eco-Friendly Underwriting Standards

Conventional mortgages typically follow traditional underwriting standards that prioritize credit score and income without considering environmental impact, while green mortgages integrate eco-friendly underwriting criteria such as energy efficiency ratings and sustainable building certifications. These green mortgage programs often offer lower interest rates or incentives to encourage the purchase of energy-efficient homes, promoting sustainable living and reducing carbon footprints.

LEED-Certified Property Loan

A Conventional Mortgage typically requires a standard credit score and offers fixed or variable interest rates without incentives, whereas a Green Mortgage for purchasing a LEED-Certified property provides lower interest rates and reduced down payment requirements to promote environmentally sustainable housing. LEED-Certified Property Loans support energy-efficient home features, potentially lowering utility costs while increasing property value, making them financially advantageous compared to conventional options.

Carbon Footprint Financing

Conventional mortgages typically offer standard interest rates without incentives tied to eco-friendly home features, whereas green mortgages provide reduced rates or financial benefits for purchasing energy-efficient homes that lower the property's carbon footprint. Financing a green mortgage supports investments in sustainable building materials, solar panels, and energy-efficient appliances, contributing to long-term environmental impact reduction and cost savings on utility bills.

Sustainability-Linked Interest Rate

Conventional mortgages typically offer fixed or variable interest rates without sustainability incentives, whereas green mortgages provide sustainability-linked interest rates that reduce borrowing costs for energy-efficient homes. These green loans encourage homebuyers to invest in properties with lower carbon footprints, promoting environmental responsibility while delivering financial benefits through discounted rates.

Green Addendum

A Green Addendum enhances a conventional mortgage by incorporating energy-efficient improvements, enabling borrowers to qualify for better interest rates and reduced down payments based on their home's environmental performance. This addendum incentivizes sustainable home purchases by integrating cost-effective eco-friendly upgrades into the loan terms, promoting long-term savings and environmental benefits.

High-Performance Home Rebate

Conventional mortgages typically offer standard loan terms without energy-efficiency incentives, whereas green mortgages provide financial benefits like the High-Performance Home Rebate to encourage energy-efficient home purchases. The High-Performance Home Rebate reduces closing costs and lowers monthly payments by rewarding buyers of homes that meet stringent energy-saving standards.

Solar-Ready Mortgage

A solar-ready mortgage offers tailored financing options encouraging homebuyers to invest in properties equipped for solar panel installation, often providing lower interest rates or incentives compared to conventional mortgages. These loans promote energy efficiency by supporting the upfront costs of solar readiness, resulting in long-term savings on utility expenses and increased property value.

Home Energy Rating System (HERS) Index Loan

Conventional mortgages typically do not consider a home's energy efficiency, whereas Green Mortgages, such as those using the Home Energy Rating System (HERS) Index Loan, offer lower interest rates and incentives by factoring in energy performance scores. The HERS Index quantifies a home's energy efficiency, allowing buyers to leverage increased loan amounts or better terms for homes with superior energy ratings, promoting sustainable and cost-effective homeownership.

Conventional Mortgage vs Green Mortgage for purchasing a house. Infographic

moneydiff.com

moneydiff.com