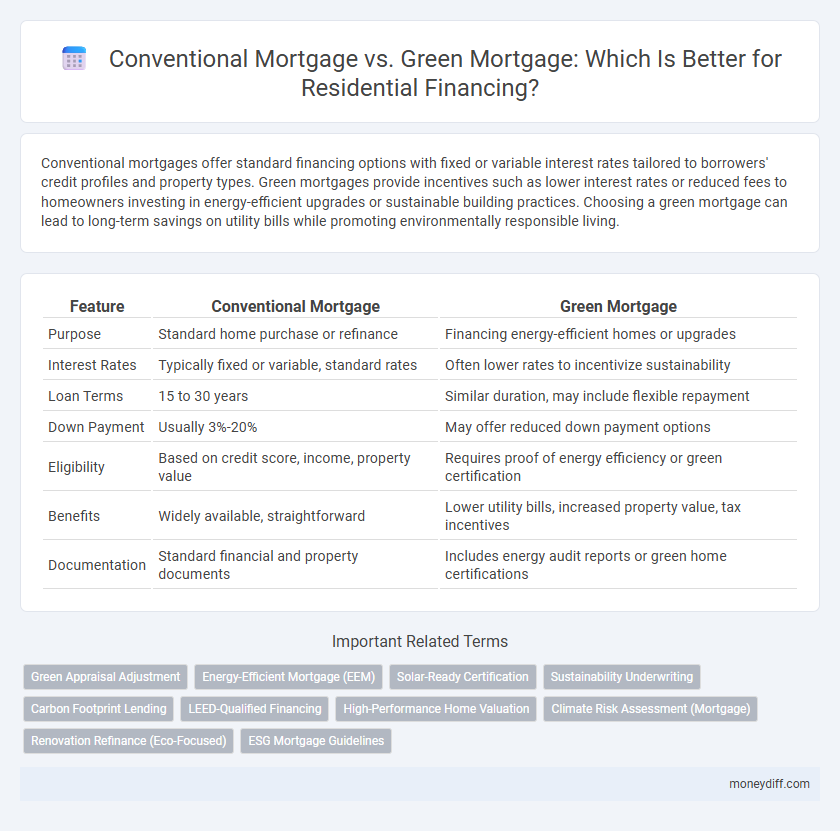

Conventional mortgages offer standard financing options with fixed or variable interest rates tailored to borrowers' credit profiles and property types. Green mortgages provide incentives such as lower interest rates or reduced fees to homeowners investing in energy-efficient upgrades or sustainable building practices. Choosing a green mortgage can lead to long-term savings on utility bills while promoting environmentally responsible living.

Table of Comparison

| Feature | Conventional Mortgage | Green Mortgage |

|---|---|---|

| Purpose | Standard home purchase or refinance | Financing energy-efficient homes or upgrades |

| Interest Rates | Typically fixed or variable, standard rates | Often lower rates to incentivize sustainability |

| Loan Terms | 15 to 30 years | Similar duration, may include flexible repayment |

| Down Payment | Usually 3%-20% | May offer reduced down payment options |

| Eligibility | Based on credit score, income, property value | Requires proof of energy efficiency or green certification |

| Benefits | Widely available, straightforward | Lower utility bills, increased property value, tax incentives |

| Documentation | Standard financial and property documents | Includes energy audit reports or green home certifications |

Introduction to Residential Mortgage Options

Conventional mortgages remain the most common residential financing option, offering fixed or adjustable interest rates with standard qualification criteria. Green mortgages incentivize energy-efficient homes by providing lower interest rates or reduced down payment requirements, promoting sustainable residential investments. Borrowers seeking cost savings and environmental benefits should evaluate eligibility for green financing alongside traditional mortgage terms.

Defining Conventional Mortgages

Conventional mortgages are home loans that are not insured or guaranteed by a government agency and typically require a higher credit score and a down payment of at least 3% to 20%. These loans offer fixed or adjustable interest rates, with terms usually ranging from 15 to 30 years, making them a popular option for traditional home financing. Conventional mortgages provide flexibility for borrowers without specific energy efficiency requirements, unlike green mortgages that incentivize sustainable home improvements.

Understanding Green Mortgages

Green mortgages offer homebuyers lower interest rates and financial incentives when purchasing or renovating energy-efficient homes, promoting sustainable living. Conventional mortgages follow standard criteria without factoring in a property's environmental performance or energy savings. Understanding green mortgages helps borrowers reduce long-term costs while supporting eco-friendly housing initiatives.

Eligibility Criteria: Conventional vs Green Mortgages

Conventional mortgages typically require a minimum credit score of 620, stable income verification, and a down payment ranging from 3% to 20%, with debt-to-income ratio guidelines around 43%. Green mortgages focus on properties with energy-efficient features or certifications such as ENERGY STAR or LEED, often requiring documentation of the home's sustainable attributes and may accept slightly flexible credit or income criteria to promote eco-friendly improvements. Both loan types demand thorough underwriting, but green mortgages incentivize energy savings by integrating property energy performance into eligibility assessments.

Interest Rates and Loan Terms Comparison

Conventional mortgages typically offer fixed or adjustable interest rates ranging from 3% to 7%, with loan terms spanning 15 to 30 years, depending on borrower creditworthiness and market conditions. Green mortgages often provide lower interest rates, sometimes discounted by 0.25% to 0.5%, incentivizing energy-efficient home purchases or improvements, with loan terms that may align with standard mortgages but include additional flexibility for green upgrades. Comparing both, green mortgages can reduce overall borrowing costs due to interest savings and potential utility rebates, making them financially advantageous for environmentally conscious homebuyers.

Down Payment and Closing Costs Differences

Conventional mortgages typically require a down payment of 5% to 20% of the home's purchase price, while green mortgages may offer reduced down payment options to encourage energy-efficient home purchases. Closing costs for green mortgages can include additional fees for energy assessments or certifications, potentially raising upfront expenses compared to conventional loans. Borrowers should compare these differences carefully, as green mortgage incentives might offset higher initial costs through long-term utility savings and tax benefits.

Energy Efficiency Requirements for Green Mortgages

Green mortgages require homes to meet specific energy efficiency standards, such as ENERGY STAR certification or compliance with green building codes, to qualify for favorable loan terms. Unlike conventional mortgages, which assess creditworthiness and property value without energy considerations, green mortgages incentivize sustainable construction by offering lower interest rates or larger loan amounts for energy-efficient residences. This emphasis on reducing carbon footprints and utility costs distinguishes green mortgages in the residential financing market.

Pros and Cons: Conventional vs Green Mortgages

Conventional mortgages offer broad eligibility and often lower upfront costs but lack incentives for energy efficiency improvements, which can result in higher long-term utility expenses. Green mortgages provide lower interest rates or additional loan amounts specifically for energy-efficient home upgrades, contributing to long-term savings and environmental benefits but may have stricter qualifying criteria and potentially higher initial rates. Borrowers should weigh immediate affordability against long-term energy cost reductions and environmental impact when choosing between conventional and green mortgage options.

Financial Incentives and Long-Term Savings

Conventional mortgages often offer standard interest rates without specialized financial incentives, whereas green mortgages provide reduced interest rates or cash rebates to encourage energy-efficient home improvements. Borrowers using green mortgages benefit from long-term savings through lower utility bills and increased property value due to sustainable features. Financial programs linked to green mortgages can include tax credits and grants that further enhance cost-efficiency over the life of the loan.

Choosing the Right Mortgage for Your Home Financing Needs

Conventional mortgages typically offer fixed or adjustable interest rates based on creditworthiness and down payment size, making them widely accessible for a variety of homebuyers. Green mortgages provide lower interest rates or additional financing incentives for energy-efficient homes, promoting sustainability while reducing long-term utility costs. Evaluating your home's energy profile and financing goals helps determine whether the cost savings and environmental benefits of a green mortgage outweigh the broader qualification criteria of conventional loans.

Related Important Terms

Green Appraisal Adjustment

Green Mortgage offers a significant advantage through the Green Appraisal Adjustment, which increases the home's appraised value based on energy-efficient features, thereby enabling borrowers to secure higher loan amounts compared to Conventional Mortgages. This adjustment reflects the reduced utility costs and environmental benefits, making green homes more financially attractive and accessible in residential financing.

Energy-Efficient Mortgage (EEM)

Energy-Efficient Mortgages (EEMs) are specialized conventional mortgages that provide borrowers with additional funds to invest in green home improvements, reducing long-term energy costs and increasing property value. These loans often offer favorable terms and lower interest rates compared to standard conventional mortgages, incentivizing sustainable residential financing and supporting energy-efficient upgrades such as solar panels, insulation, and high-efficiency HVAC systems.

Solar-Ready Certification

Conventional mortgages typically do not account for energy efficiency or sustainability features, whereas green mortgages often provide incentives for homes with Solar-Ready Certification, enhancing property value and reducing long-term energy costs. Solar-Ready Certification ensures the home is designed for easy solar panel installation, qualifying buyers for lower interest rates and potential lender credits in green mortgage programs.

Sustainability Underwriting

Conventional mortgages typically assess creditworthiness based on income, credit score, and debt-to-income ratio, while green mortgages incorporate sustainability underwriting by evaluating energy efficiency, environmental impact, and potential cost savings from eco-friendly home improvements. Lenders offering green mortgages often provide better loan terms or incentives for purchasing energy-efficient homes or financing renewable energy upgrades, promoting sustainable residential financing.

Carbon Footprint Lending

Conventional mortgages typically finance homes without considering environmental impact, while green mortgages offer lower interest rates and incentives for energy-efficient properties, directly reducing carbon footprints. Carbon footprint lending embedded in green mortgages encourages sustainable residential financing by prioritizing eco-friendly upgrades and materials, promoting long-term environmental benefits.

LEED-Qualified Financing

LEED-qualified financing for residential properties often offers lower interest rates and incentives compared to conventional mortgages, promoting energy-efficient building practices. Conventional mortgages typically lack these sustainability-focused benefits, making green mortgages more attractive for environmentally conscious homeowners seeking cost savings and reduced environmental impact.

High-Performance Home Valuation

High-performance home valuation for conventional mortgages typically relies on traditional market-based appraisals emphasizing location, size, and comparable sales, whereas green mortgages integrate energy efficiency metrics and sustainability features that can enhance property value and lower financing costs. This growing emphasis on eco-friendly home attributes in green mortgage assessments incentivizes energy-saving improvements, potentially yielding higher appraised values and long-term savings for homeowners.

Climate Risk Assessment (Mortgage)

Conventional mortgages typically do not incorporate climate risk assessments, potentially exposing lenders and borrowers to unanticipated property value declines in climate-vulnerable areas. Green mortgages evaluate climate-related risks such as flood zones, wildfire susceptibility, and energy efficiency, promoting sustainable residential financing while mitigating long-term financial exposure.

Renovation Refinance (Eco-Focused)

Conventional mortgages typically offer standard refinancing options without specific incentives for energy-efficient home improvements, whereas green mortgages provide favorable terms for renovation refinance focused on eco-friendly upgrades like solar panels, insulation, and energy-efficient windows. Borrowers seeking to reduce carbon footprints and utility costs can benefit from lower interest rates and potential tax credits through green mortgage programs specifically designed for sustainable home renovations.

ESG Mortgage Guidelines

Conventional mortgages typically focus on creditworthiness and income verification without specific environmental criteria, whereas green mortgages prioritize properties that meet ESG mortgage guidelines, emphasizing energy efficiency, reduced carbon footprint, and sustainable building practices. Lenders offering green mortgages may provide better interest rates or incentives to promote environmentally responsible home financing aligned with ESG standards.

Conventional Mortgage vs Green Mortgage for residential financing. Infographic

moneydiff.com

moneydiff.com