A Fixed Rate Mortgage offers predictable monthly payments with a constant interest rate, providing stability and ease of budgeting over the loan term. In contrast, a Shared Appreciation Mortgage involves lower initial payments but requires sharing a portion of the home's future appreciation with the lender upon sale or refinancing. Choosing between these mortgage types depends on financial goals, with fixed rates suiting those who prioritize consistency and shared appreciation loans appealing to buyers expecting significant property value growth.

Table of Comparison

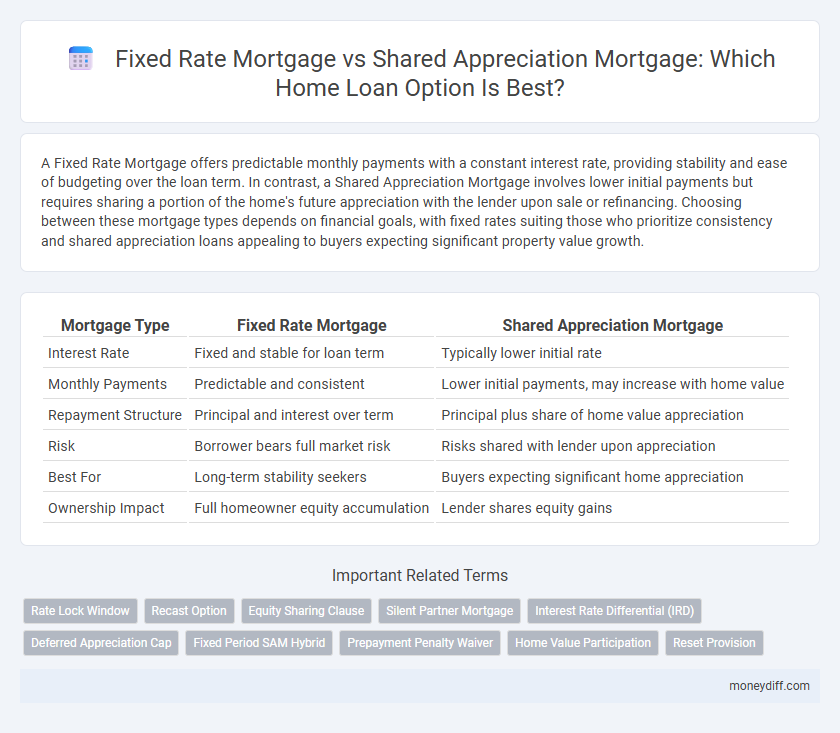

| Mortgage Type | Fixed Rate Mortgage | Shared Appreciation Mortgage |

|---|---|---|

| Interest Rate | Fixed and stable for loan term | Typically lower initial rate |

| Monthly Payments | Predictable and consistent | Lower initial payments, may increase with home value |

| Repayment Structure | Principal and interest over term | Principal plus share of home value appreciation |

| Risk | Borrower bears full market risk | Risks shared with lender upon appreciation |

| Best For | Long-term stability seekers | Buyers expecting significant home appreciation |

| Ownership Impact | Full homeowner equity accumulation | Lender shares equity gains |

Understanding Fixed Rate Mortgages

Fixed rate mortgages offer borrowers a stable interest rate and predictable monthly payments over the loan term, typically ranging from 15 to 30 years. This stability aids in long-term financial planning by shielding homeowners from market fluctuations and interest rate increases. Compared to shared appreciation mortgages, fixed rate loans provide straightforward repayment without sharing future property value gains.

What Is a Shared Appreciation Mortgage?

A Shared Appreciation Mortgage (SAM) is a home loan where the lender offers a reduced interest rate or initial loan balance in exchange for a share in the future appreciation of the property's value. Unlike a Fixed Rate Mortgage, which has a constant interest rate and predictable payments, a SAM allows lenders to benefit from the home's value increase at sale or refinancing. This type of mortgage can reduce upfront borrowing costs but requires sharing a portion of the equity gains, making it essential for borrowers to understand potential long-term financial impacts.

Key Differences Between Fixed Rate and Shared Appreciation Loans

Fixed rate mortgages offer a consistent interest rate and predictable monthly payments throughout the loan term, providing financial stability and ease of budgeting. Shared appreciation mortgages involve a lower initial interest rate or down payment in exchange for the lender receiving a portion of the property's future appreciation, which can reduce upfront costs but introduce variability in total repayment. Key differences include fixed payments versus equity sharing, risk allocation between borrower and lender, and long-term cost implications tied to property value fluctuations.

How Interest Rates Affect Your Home Loan

Fixed rate mortgages offer a stable interest rate throughout the loan term, providing predictable monthly payments unaffected by market fluctuations. Shared appreciation mortgages initially feature lower interest rates but require sharing a portion of the home's future value appreciation with the lender, which can increase overall costs if property values rise significantly. Understanding how interest rate stability versus potential equity sharing impacts long-term expenses is crucial when selecting the best home loan option.

Monthly Payment Predictability: Fixed Rate vs Shared Appreciation

Fixed rate mortgages provide stable monthly payments with consistent principal and interest amounts throughout the loan term, ensuring budget predictability for homeowners. Shared appreciation mortgages may start with lower monthly payments but include a variable component tied to property value appreciation, which can lead to unpredictable payment changes or equity sharing at sale or maturity. Choosing between these loan types depends on the borrower's preference for payment stability versus potential equity gain based on future home value growth.

Long-Term Costs and Equity Considerations

Fixed rate mortgages provide predictable monthly payments and stable long-term interest costs, making it easier for homeowners to budget over time. Shared appreciation mortgages often lower initial payments but require sharing future home value increases, which can reduce overall equity gained. Evaluating the trade-off between steady costs and potential equity loss is crucial for long-term financial planning in home loans.

Pros and Cons of Fixed Rate Mortgages

Fixed rate mortgages offer consistent monthly payments and protection from interest rate fluctuations, providing financial stability throughout the loan term. Borrowers benefit from predictable budgeting and long-term planning without the risk of rising rates, though these loans often come with higher initial interest rates compared to adjustable or shared appreciation mortgages. Limited flexibility and potentially higher total interest costs if market rates fall are key drawbacks to consider when choosing a fixed rate mortgage.

Pros and Cons of Shared Appreciation Mortgages

Shared Appreciation Mortgages (SAMs) allow borrowers to lower initial interest rates or down payments by sharing future home appreciation with the lender, potentially making homeownership more affordable. However, the major downside is that if property values rise significantly, borrowers may owe a substantial portion of the increased equity, reducing their net gains upon sale or refinancing. SAMs also carry greater complexity and less predictability compared to fixed rate mortgages, which offer stable monthly payments and full equity retention but typically require higher initial costs.

Choosing the Right Mortgage for Your Financial Goals

Fixed rate mortgages offer predictable monthly payments with stable interest rates, ideal for homeowners seeking long-term budgeting certainty. Shared appreciation mortgages require no or low initial payments but share a portion of future home value appreciation with the lender, aligning with borrowers expecting property value increase and flexible cash flow. Analyzing your financial goals, risk tolerance, and market outlook helps determine whether fixed monthly costs or equity sharing best supports your homeownership strategy.

Frequently Asked Questions About Home Loan Options

Fixed rate mortgages offer predictable monthly payments by locking in an interest rate for the loan term, making budgeting easier for homeowners. Shared appreciation mortgages require the borrower to share a portion of the home's future value increase with the lender, potentially reducing upfront costs but increasing financial risk. Common questions include eligibility criteria, how appreciation is calculated, impact on equity, and scenarios where one option may be more beneficial than the other.

Related Important Terms

Rate Lock Window

Fixed Rate Mortgages offer a predictable rate lock window, typically ranging from 30 to 60 days, allowing borrowers to secure an interest rate during this period without fluctuations. Shared Appreciation Mortgages often have shorter or variable rate lock windows due to their dependency on property value appreciation, increasing uncertainty during the loan approval process.

Recast Option

Fixed rate mortgages offer predictable monthly payments with a consistent interest rate over the loan term, but typically lack a recast option to reduce payments after significant principal repayment. Shared appreciation mortgages often include a recast option, allowing borrowers to lower monthly payments by recalculating the loan based on the current principal, while also sharing future home appreciation with the lender.

Equity Sharing Clause

The equity sharing clause in a Shared Appreciation Mortgage (SAM) allows lenders to receive a percentage of the home's appreciated value at sale or refinancing, differing from a Fixed Rate Mortgage where the interest rate and payments remain constant without sharing in property appreciation. This clause impacts long-term financial outcomes by potentially increasing lender returns based on property value growth, while Fixed Rate Mortgages provide predictable costs without equity sharing obligations.

Silent Partner Mortgage

Silent Partner Mortgages in shared appreciation home loans provide borrowers with lower initial interest rates by allowing investors to receive a percentage of future property appreciation, unlike fixed rate mortgages which maintain consistent payments and interest regardless of market value changes. This hybrid financing option benefits homeowners seeking reduced monthly costs while sharing potential equity gains with silent partners backing the loan.

Interest Rate Differential (IRD)

Fixed Rate Mortgages offer predictable monthly payments with a locked-in interest rate, minimizing the risk of fluctuating Interest Rate Differentials (IRD) upon refinancing or early repayment. Shared Appreciation Mortgages involve lower initial rates but require borrowers to share a portion of future home value appreciation, which can lead to substantial IRD costs if interest rates rise or the property value significantly increases.

Deferred Appreciation Cap

Fixed Rate Mortgages provide consistent interest rates and stable monthly payments over the loan term, while Shared Appreciation Mortgages (SAMs) include a Deferred Appreciation Cap that limits the borrower's obligation to repay a portion of the home's value increase, protecting against excessive repayment if property values rise significantly. The Deferred Appreciation Cap in SAMs ensures borrowers benefit from home equity growth up to a set threshold, making it a risk-mitigated alternative to traditional fixed rate loans.

Fixed Period SAM Hybrid

Fixed Period Shared Appreciation Mortgages (SAM) blend the stability of a fixed interest rate with potential equity sharing, typically locking in a fixed rate for an initial term of 5 to 10 years before switching to a shared appreciation model based on the home's value increase. This hybrid structure offers predictable monthly payments during the fixed period, while allowing lenders to benefit from future property appreciation, contrasting with traditional fixed rate mortgages that maintain constant interest rates without equity sharing.

Prepayment Penalty Waiver

Fixed rate mortgages typically offer predictable monthly payments but may include prepayment penalties that increase overall borrowing costs if the loan is paid off early, whereas shared appreciation mortgages often provide prepayment penalty waivers to encourage early repayment without financial penalties by sharing a portion of the property's future value appreciation with the lender. Understanding the specifics of prepayment penalty waivers in each mortgage type helps borrowers minimize costs and maximize financial flexibility when managing home loans.

Home Value Participation

Fixed Rate Mortgages offer predictable monthly payments with a constant interest rate, while Shared Appreciation Mortgages involve the lender sharing in the future increase of home value, reducing initial payments but potentially costing more if the property appreciates significantly. Home value participation in Shared Appreciation Mortgages can result in higher overall repayment tied directly to the property's market performance, contrasting with the fixed, unwavering cost structure of Fixed Rate Mortgages.

Reset Provision

Fixed Rate Mortgages offer consistent monthly payments with no fluctuations, while Shared Appreciation Mortgages include a Reset Provision allowing lenders to adjust interest rates or loan terms based on property value appreciation, impacting future payment amounts. The Reset Provision mitigates lender risk but can increase borrower costs if the property's market value significantly rises during the loan term.

Fixed Rate Mortgage vs Shared Appreciation Mortgage for home loans. Infographic

moneydiff.com

moneydiff.com