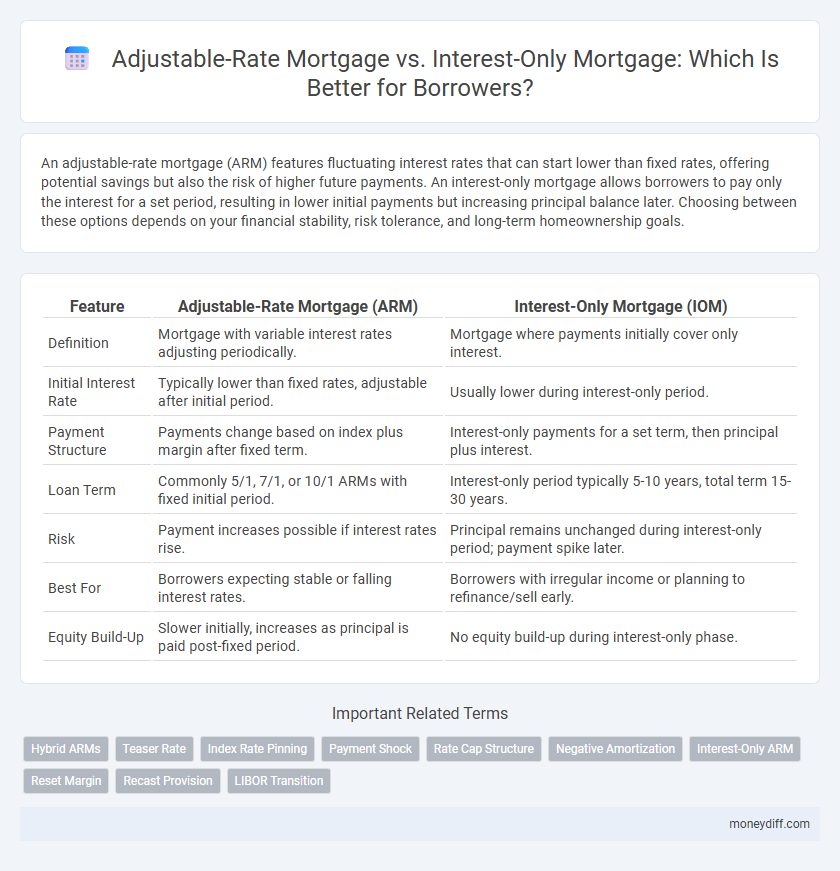

An adjustable-rate mortgage (ARM) features fluctuating interest rates that can start lower than fixed rates, offering potential savings but also the risk of higher future payments. An interest-only mortgage allows borrowers to pay only the interest for a set period, resulting in lower initial payments but increasing principal balance later. Choosing between these options depends on your financial stability, risk tolerance, and long-term homeownership goals.

Table of Comparison

| Feature | Adjustable-Rate Mortgage (ARM) | Interest-Only Mortgage (IOM) |

|---|---|---|

| Definition | Mortgage with variable interest rates adjusting periodically. | Mortgage where payments initially cover only interest. |

| Initial Interest Rate | Typically lower than fixed rates, adjustable after initial period. | Usually lower during interest-only period. |

| Payment Structure | Payments change based on index plus margin after fixed term. | Interest-only payments for a set term, then principal plus interest. |

| Loan Term | Commonly 5/1, 7/1, or 10/1 ARMs with fixed initial period. | Interest-only period typically 5-10 years, total term 15-30 years. |

| Risk | Payment increases possible if interest rates rise. | Principal remains unchanged during interest-only period; payment spike later. |

| Best For | Borrowers expecting stable or falling interest rates. | Borrowers with irregular income or planning to refinance/sell early. |

| Equity Build-Up | Slower initially, increases as principal is paid post-fixed period. | No equity build-up during interest-only phase. |

Understanding Adjustable-Rate Mortgages (ARMs)

Adjustable-Rate Mortgages (ARMs) feature interest rates that adjust periodically based on an underlying index, typically resulting in lower initial rates compared to fixed-rate mortgages. Borrowers benefit from initial affordability, but must be aware of potential rate increases that can lead to higher monthly payments over time. Understanding the terms of the adjustment period, index benchmarks like the LIBOR or SOFR, and caps on rate changes is crucial for managing the risks associated with ARMs.

What Is an Interest-Only Mortgage?

An interest-only mortgage allows borrowers to pay solely the interest on the loan for a predetermined period, typically 5 to 10 years, resulting in lower initial monthly payments. Unlike adjustable-rate mortgages where interest rates fluctuate based on market indices, interest-only loans maintain fixed payments during the interest-only phase but require full principal and interest payments afterward. This type of mortgage benefits borrowers seeking short-term affordability but carries the risk of payment increases once the interest-only period ends.

Key Differences Between ARMs and Interest-Only Mortgages

Adjustable-Rate Mortgages (ARMs) feature interest rates that fluctuate based on market indexes, impacting monthly payments over time, while Interest-Only Mortgages allow borrowers to pay only interest for an initial period before principal payments commence. ARMs typically have lower initial rates compared to fixed loans but carry risk of increased payments, whereas Interest-Only Mortgages offer lower initial payments but may result in payment shock once principal repayment begins. The choice depends on borrowers' financial stability, risk tolerance, and expectations about future interest rate movements.

Pros and Cons of Adjustable-Rate Mortgages

Adjustable-Rate Mortgages (ARMs) offer initial lower interest rates compared to fixed mortgages, making them attractive for borrowers seeking lower monthly payments early on. Rates adjust periodically based on market indexes, which can lead to unpredictable increases in payment amounts and potential financial strain over time. ARMs benefit borrowers planning to sell or refinance before rate adjustments, but carry the risk of rising interest costs for long-term holders.

Advantages and Disadvantages of Interest-Only Loans

Interest-only mortgages offer lower initial monthly payments by allowing borrowers to pay only the interest for a set period, improving short-term cash flow and affordability. However, the principal balance remains unchanged during the interest-only period, leading to higher payments later and increased risk of negative amortization if property values decline. Borrowers must carefully consider potential payment shocks and the impact on long-term equity when choosing interest-only loans compared to adjustable-rate mortgages.

How Monthly Payments Compare: ARM vs Interest-Only

Adjustable-Rate Mortgages (ARMs) typically start with lower monthly payments than fixed-rate loans, but these payments can increase or decrease over time based on market interest rate changes, leading to potential payment variability. Interest-Only Mortgages require borrowers to pay only the interest for an initial period, resulting in significantly lower monthly payments during that phase compared to ARMs, but principal repayment begins later, causing a payment surge. Borrowers choosing between ARM and Interest-Only options should evaluate their risk tolerance for payment fluctuations versus initial affordability.

Risks Associated with Adjustable-Rate and Interest-Only Mortgages

Adjustable-rate mortgages (ARMs) carry the risk of payment increases due to interest rate fluctuations, potentially leading to unaffordable monthly payments. Interest-only mortgages pose the danger of principal accumulation without reduction, resulting in higher payments once the interest-only period ends. Both loan types also expose borrowers to market volatility, which can complicate long-term financial planning and increase default risk.

Who Should Consider an ARM or Interest-Only Mortgage?

Borrowers with fluctuating income or plans to sell or refinance within a few years should consider an Adjustable-Rate Mortgage (ARM) due to its typically lower initial rates and potential savings. Interest-Only Mortgages suit those seeking lower initial payments, such as real estate investors or individuals with irregular cash flow who can handle higher payments once principal repayment begins. Both options require careful assessment of future financial stability and market rate projections to avoid payment shock.

Long-Term Financial Impact: ARM vs Interest-Only

Adjustable-rate mortgages (ARMs) typically start with lower initial interest rates that can adjust periodically based on market conditions, potentially leading to increased payments and financial uncertainty over time. Interest-only mortgages allow borrowers to pay only the interest for an initial period, resulting in lower early payments but larger principal payments later, which can strain finances if property value does not increase. Evaluating long-term financial impact requires considering payment variability, total interest costs, and the potential for payment shock associated with both ARM and interest-only mortgage structures.

Choosing the Right Mortgage for Your Money Management Strategy

An Adjustable-Rate Mortgage (ARM) offers initial lower interest rates that fluctuate based on market indexes, making it suitable for borrowers expecting income growth or short-term home ownership. Interest-Only Mortgages allow payments of only interest for a set period, providing lower initial monthly payments but increasing principal risk later. Evaluating your financial stability, risk tolerance, and long-term plans is crucial for selecting the mortgage that aligns best with your money management strategy.

Related Important Terms

Hybrid ARMs

Hybrid Adjustable-Rate Mortgages (Hybrid ARMs) combine fixed interest rates for an initial period, typically 3, 5, 7, or 10 years, with variable rates thereafter, offering borrowers lower initial payments compared to Interest-Only Mortgages that require interest payments exclusively for a set term before principal repayment begins. Hybrid ARMs provide a balance of stability and flexibility, whereas Interest-Only Mortgages may result in payment shocks once principal payments start, making Hybrid ARMs a preferred option for borrowers seeking predictable costs followed by adjustable terms.

Teaser Rate

Adjustable-Rate Mortgages (ARMs) often feature a teaser rate, a low initial interest rate that adjusts periodically based on market indices, potentially increasing the monthly payment over time. Interest-Only Mortgages also may offer teaser rates but require borrowers to pay only the interest initially, resulting in no principal reduction and possible payment shocks when the interest-only period ends.

Index Rate Pinning

Adjustable-Rate Mortgages (ARMs) feature index rate pinning where the interest rate is tied to a specific financial index, causing periodic adjustments based on market fluctuations, whereas Interest-Only Mortgages allow borrowers to pay solely the interest without principal reduction, often linked to similar index benchmarks but without immediate amortization impact. Understanding the specific index rate pinning mechanisms in ARMs is crucial for borrowers to anticipate payment changes and compare this with the stable interest-only payments during the initial term of Interest-Only Mortgages.

Payment Shock

Adjustable-Rate Mortgages (ARMs) often lead to payment shock when interest rates rise after an initial fixed period, causing monthly payments to increase significantly. Interest-Only Mortgages defer principal repayment, resulting in low initial payments but a sudden payment surge once the interest-only period ends and principal repayments begin.

Rate Cap Structure

Adjustable-Rate Mortgages (ARMs) feature rate cap structures that limit how much the interest rate can increase per adjustment period and over the loan's lifetime, providing borrowers protection against drastic payment hikes. Interest-Only Mortgages typically do not have rate caps on the interest portion, resulting in potentially higher payment volatility once the principal repayment phase begins.

Negative Amortization

Adjustable-rate mortgages (ARMs) periodically adjust interest rates, potentially increasing monthly payments, whereas interest-only mortgages allow initial payments covering only interest, risking negative amortization if principal defaults occur. Negative amortization arises when loan payments fail to cover accruing interest, causing the loan balance to grow, a risk notably higher in interest-only loans with rising rates.

Interest-Only ARM

Interest-Only Adjustable-Rate Mortgages (ARMs) offer borrowers lower initial monthly payments by requiring only interest payments for a fixed period, typically 5 to 10 years, before principal payments begin and the interest rate adjusts periodically. This option suits borrowers expecting increased future income or planning to refinance but carries the risk of payment shocks when the loan resets.

Reset Margin

Adjustable-Rate Mortgages (ARMs) adjust interest rates based on a reset margin added to the index rate, impacting monthly payments after each adjustment period. Interest-Only Mortgages often have a fixed payment during the interest-only phase, but the reset margin influences the interest rate once principal and interest payments begin, affecting overall borrowing costs.

Recast Provision

An Adjustable-Rate Mortgage (ARM) with a recast provision allows borrowers to adjust monthly payments based on changes in interest rates while recalculating the loan balance, offering flexibility in managing fluctuating rates. In contrast, an Interest-Only Mortgage typically lacks a recast option, leading to fixed payments during the interest-only period and potential payment increases later without the benefit of recalculating amortization.

LIBOR Transition

Adjustable-Rate Mortgages (ARMs) are increasingly based on new benchmarks like SOFR following the LIBOR transition, affecting interest rate adjustments and borrower risk exposure. Interest-Only Mortgages also face changes as lenders replace LIBOR with alternative rates, altering payment structures and potentially increasing volatility in interest costs over the loan term.

Adjustable-Rate Mortgage vs Interest-Only Mortgage for borrowing. Infographic

moneydiff.com

moneydiff.com