Conforming mortgages follow standard lending guidelines with set loan limits and down payment requirements, making them widely accessible for traditional home purchases. Energy-Efficient Mortgages (EEMs) enable buyers to finance energy-saving improvements by incorporating additional funds into the loan, supporting eco-friendly upgrades without increasing upfront costs. Choosing an EEM helps reduce utility expenses and carbon footprints while qualifying for the benefits of a conventional mortgage.

Table of Comparison

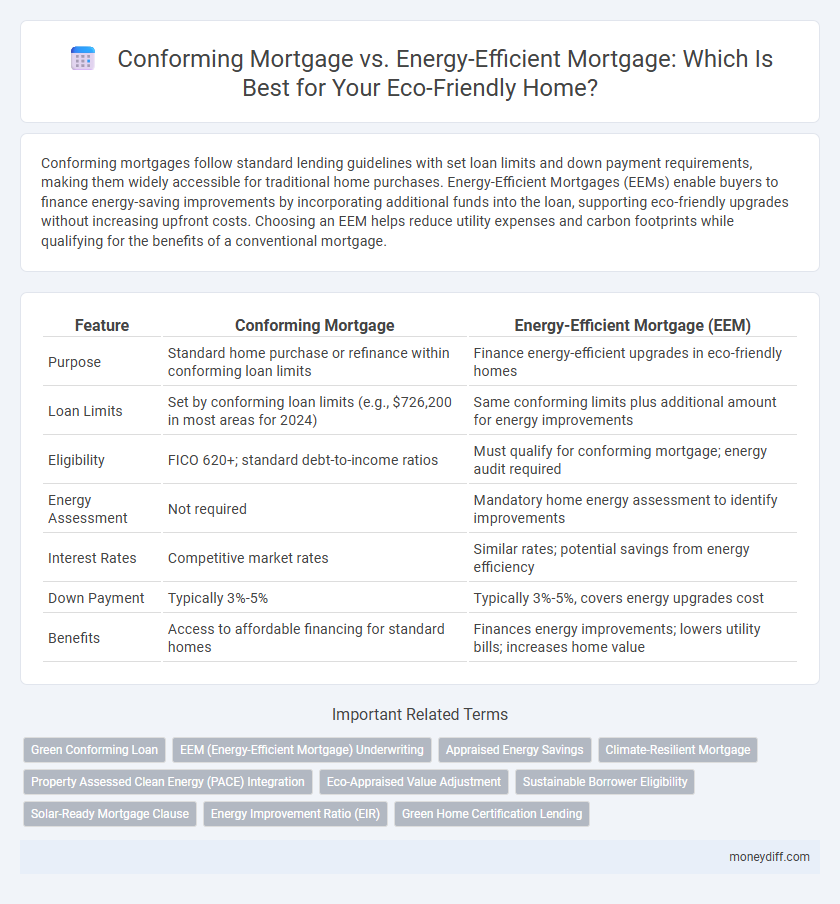

| Feature | Conforming Mortgage | Energy-Efficient Mortgage (EEM) |

|---|---|---|

| Purpose | Standard home purchase or refinance within conforming loan limits | Finance energy-efficient upgrades in eco-friendly homes |

| Loan Limits | Set by conforming loan limits (e.g., $726,200 in most areas for 2024) | Same conforming limits plus additional amount for energy improvements |

| Eligibility | FICO 620+; standard debt-to-income ratios | Must qualify for conforming mortgage; energy audit required |

| Energy Assessment | Not required | Mandatory home energy assessment to identify improvements |

| Interest Rates | Competitive market rates | Similar rates; potential savings from energy efficiency |

| Down Payment | Typically 3%-5% | Typically 3%-5%, covers energy upgrades cost |

| Benefits | Access to affordable financing for standard homes | Finances energy improvements; lowers utility bills; increases home value |

Understanding Conforming Mortgages: Basics and Benefits

Conforming mortgages adhere to loan limits set by government-sponsored enterprises like Fannie Mae and Freddie Mac, offering standardized terms and competitive interest rates ideal for most homebuyers. These loans require borrowers to meet credit score, income, and debt-to-income ratio criteria, ensuring risk management and eligibility for conventional underwriting processes. Benefits include easier qualification due to widespread acceptance of guidelines and potential for lower down payments compared to non-conforming loans.

What Is an Energy-Efficient Mortgage (EEM)?

An Energy-Efficient Mortgage (EEM) is a specialized loan designed to finance the purchase or improvement of energy-efficient homes, allowing borrowers to include the cost of energy-saving upgrades in their mortgage. Unlike standard conforming mortgages, EEMs recognize the reduced utility expenses and increased home value resulting from green improvements, potentially qualifying borrowers for higher loan amounts. This option supports eco-friendly homeownership by incentivizing sustainable building practices and lowering long-term living costs.

Key Differences Between Conforming and Energy-Efficient Mortgages

Conforming mortgages adhere to standard loan limits and underwriting guidelines set by Fannie Mae and Freddie Mac, typically offering lower interest rates and easier qualification for traditional homebuyers. Energy-Efficient Mortgages (EEMs) allow borrowers to finance energy-saving improvements by increasing the loan amount based on projected energy cost savings, promoting eco-friendly home upgrades without additional down payment. The key differences lie in loan eligibility criteria, inclusion of cost-effective energy improvements, and potential for long-term utility savings with EEMs compared to standard conforming financing.

Eligibility Requirements for Conforming vs. Energy-Efficient Mortgages

Conforming mortgages require borrowers to meet specific credit score thresholds, debt-to-income ratios, and loan limits set by Fannie Mae and Freddie Mac, ensuring eligibility aligns with conventional lending standards. Energy-Efficient Mortgages (EEMs) also require borrowers to qualify under conventional criteria but demand an energy audit or appraisal to verify potential energy savings and improvements in the eco-friendly home. Loan limits for EEMs may be higher or include additional funds to cover energy-efficient upgrades, making them suitable for borrowers investing in green home improvements.

Loan Limits: How Much Can You Borrow with Each Option?

Conforming mortgages adhere to loan limits set by the Federal Housing Finance Agency, typically $726,200 for a single-family home in most areas as of 2024, while energy-efficient mortgages (EEMs) allow borrowers to exceed these limits by incorporating the estimated energy savings into the loan amount. The EEM increases your borrowing capacity by factoring in costs for energy-efficient improvements, which can raise the loan limit by up to 15%. Borrowers seeking eco-friendly home financing benefit from this higher borrowing threshold, enabling investment in sustainability without exceeding traditional conforming loan caps.

Eco-Friendly Home Upgrades: Financing with EEMs

Energy-Efficient Mortgages (EEMs) provide specialized financing options that cover the cost of eco-friendly home upgrades, such as solar panels, improved insulation, and energy-efficient windows, enhancing a home's sustainability while potentially lowering utility bills. Unlike traditional conforming mortgages, EEMs allow borrowers to roll energy improvements into the total loan amount, enabling affordable upfront costs with long-term savings. These mortgages are backed by agencies like FHA and VA, offering accessible financing solutions for homeowners seeking to invest in green upgrades.

Interest Rates and Terms: Comparing Costs

Conforming mortgages generally offer lower interest rates due to standardized underwriting guidelines and loan limits set by Fannie Mae and Freddie Mac, making them cost-effective for typical home purchases. Energy-Efficient Mortgages (EEMs) may have slightly higher interest rates but provide the benefit of financing energy-saving improvements, potentially lowering utility costs and increasing long-term savings. Loan terms for EEMs often include flexible options for incorporating green upgrades, which can offset initial higher costs through reduced energy expenses and possible tax incentives.

Application Process: Step-by-Step Guide for Both Mortgages

The application process for a conforming mortgage involves submitting standard documentation such as income verification, credit reports, and property appraisal to meet Fannie Mae or Freddie Mac guidelines. In contrast, an energy-efficient mortgage requires additional documentation including an energy audit or Home Energy Rating System (HERS) report to qualify for financing based on the home's eco-friendly features. Both processes require lender pre-approval, property inspection, and final underwriting, but energy-efficient mortgages emphasize energy savings assessments and projected cost benefits.

Long-Term Savings: Energy Efficiency vs. Traditional Financing

Energy-Efficient Mortgages (EEMs) provide long-term savings by financing energy improvements that reduce utility costs, making eco-friendly homes more affordable over time. Conforming mortgages have fixed loan limits set by Fannie Mae and Freddie Mac, typically offering standard financing without incentives for energy savings. Choosing an EEM over traditional conforming financing enhances home value and lowers monthly expenses through improved energy efficiency and reduced environmental impact.

Choosing the Right Mortgage for Your Eco-Friendly Home Goals

Choosing the right mortgage for your eco-friendly home involves comparing a conforming mortgage, which meets conventional lending standards, with an energy-efficient mortgage (EEM) that finances energy-saving improvements. EEMs specifically support upgrades like solar panels, high-efficiency windows, and insulation, resulting in lower utility costs and increased property value. Selecting an EEM aligns your financing strategy with sustainability goals while ensuring affordability through potential energy savings.

Related Important Terms

Green Conforming Loan

Green Conforming Loans combine traditional conforming mortgage benefits with incentives for energy-efficient homes, offering lower interest rates and higher loan limits for eco-friendly property improvements. These loans support sustainable living by financing energy-saving upgrades while meeting Fannie Mae or Freddie Mac underwriting standards.

EEM (Energy-Efficient Mortgage) Underwriting

Energy-Efficient Mortgage (EEM) underwriting incorporates projected energy savings and improvements into loan qualification, allowing borrowers to finance energy-efficient home upgrades without increasing payment burdens. Unlike conforming mortgages, EEMs evaluate expected cost reductions from energy efficiency, enhancing borrower eligibility and supporting eco-friendly investments in residential properties.

Appraised Energy Savings

Conforming mortgages follow standardized loan limits and underwriting guidelines, whereas energy-efficient mortgages (EEMs) incorporate appraised energy savings into the loan qualification process, increasing borrowing power based on projected utility cost reductions. Appraised energy savings in EEMs are verified through professional home energy assessments, enabling eco-friendly homeowners to finance energy improvements and reduce long-term expenses.

Climate-Resilient Mortgage

Conforming mortgages adhere to standard loan limits set by Fannie Mae and Freddie Mac, offering predictable terms and qualifying criteria, while energy-efficient mortgages (EEMs) provide additional funds to finance eco-friendly home improvements that reduce energy consumption. Climate-resilient mortgages, a subset of EEMs, specifically target homes built or retrofitted to withstand climate risks such as flooding and extreme weather, thereby supporting sustainable and durable housing investments.

Property Assessed Clean Energy (PACE) Integration

Conforming mortgages adhere to Fannie Mae and Freddie Mac loan limits, while Energy-Efficient Mortgages (EEMs) integrate Property Assessed Clean Energy (PACE) programs, enabling borrowers to finance eco-friendly home improvements through their property tax assessments. PACE integration in EEMs lowers upfront costs for solar panels, energy-efficient insulation, and HVAC upgrades, enhancing loan eligibility and promoting sustainable housing investments.

Eco-Appraised Value Adjustment

Energy-Efficient Mortgages (EEMs) incorporate an eco-appraised value adjustment that increases the loan amount based on the home's energy-saving features, allowing borrowers to finance improvements that reduce utility costs. In contrast, conforming mortgages do not account for energy efficiency in the appraisal, limiting loan eligibility to standard property values without credit for eco-friendly upgrades.

Sustainable Borrower Eligibility

Conforming mortgages require standard credit scores and debt-to-income ratios, while energy-efficient mortgages (EEMs) often consider energy savings and sustainable property features as part of borrower eligibility. EEMs enable eco-conscious homeowners to finance improvements that reduce utility costs, appealing to lenders focused on long-term financial and environmental benefits.

Solar-Ready Mortgage Clause

A Conforming Mortgage follows standardized limits set by Fannie Mae and Freddie Mac, while an Energy-Efficient Mortgage (EEM) specifically includes provisions like the Solar-Ready Mortgage Clause to finance eco-friendly home upgrades such as solar panel installation. The Solar-Ready Mortgage Clause enables borrowers to increase loan amounts to cover costs of making homes pre-wired and structurally prepared for future solar energy systems, enhancing energy efficiency and long-term savings.

Energy Improvement Ratio (EIR)

Energy-Efficient Mortgages (EEMs) leverage the Energy Improvement Ratio (EIR) to quantify anticipated energy savings, enabling borrowers to finance eco-friendly home upgrades beyond traditional conforming mortgage limits. This specialized mortgage enhances purchasing power by incorporating projected reductions in utility costs into loan eligibility, promoting sustainable housing investments.

Green Home Certification Lending

Green Home Certification Lending under Energy-Efficient Mortgages (EEMs) offers lower interest rates and higher loan limits for eco-friendly homes meeting specific energy-saving standards. Unlike traditional Conforming Mortgages, EEMs incentivize sustainable building practices by financing upgrades that reduce utility costs and environmental impact, aligning with green certification criteria.

Conforming Mortgage vs Energy-Efficient Mortgage for Eco-Friendly Home. Infographic

moneydiff.com

moneydiff.com