Jumbo mortgages cater to buyers seeking financing for high-value properties that exceed conforming loan limits, offering competitive rates but often requiring stricter credit qualifications. Energy Efficient Mortgages (EEMs) enable borrowers to finance energy-saving improvements as part of the loan amount, which can reduce utility costs and increase property value. For large property purchases, choosing between a jumbo mortgage and an EEM depends on whether prioritizing loan size or integrating sustainable upgrades is more critical to the buyer's financial strategy.

Table of Comparison

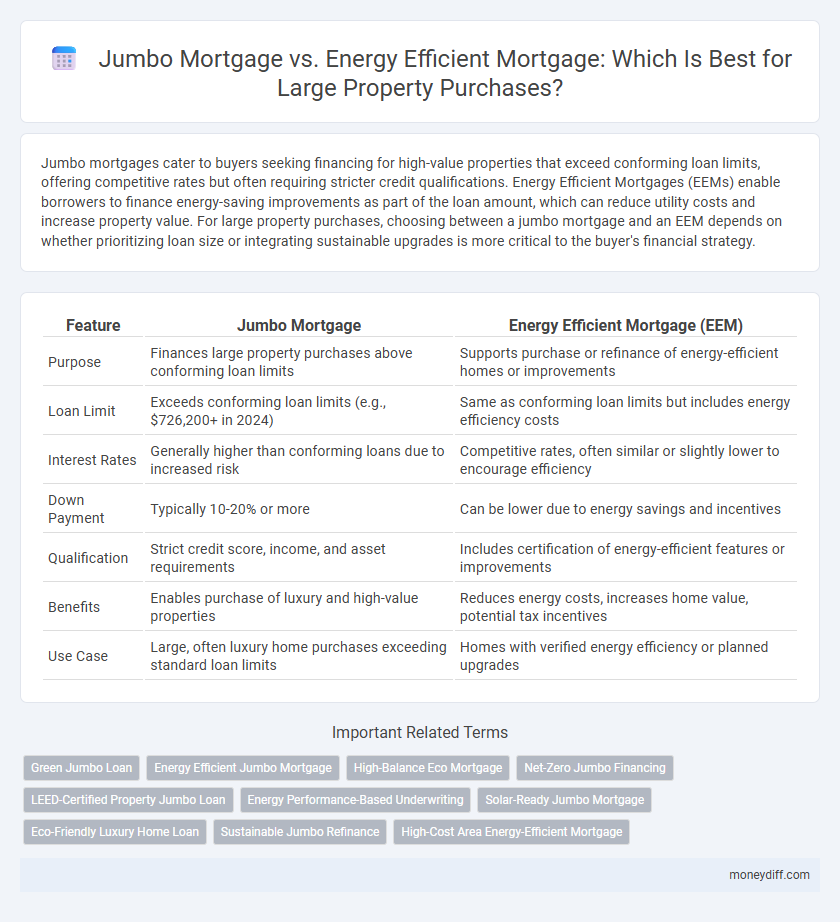

| Feature | Jumbo Mortgage | Energy Efficient Mortgage (EEM) |

|---|---|---|

| Purpose | Finances large property purchases above conforming loan limits | Supports purchase or refinance of energy-efficient homes or improvements |

| Loan Limit | Exceeds conforming loan limits (e.g., $726,200+ in 2024) | Same as conforming loan limits but includes energy efficiency costs |

| Interest Rates | Generally higher than conforming loans due to increased risk | Competitive rates, often similar or slightly lower to encourage efficiency |

| Down Payment | Typically 10-20% or more | Can be lower due to energy savings and incentives |

| Qualification | Strict credit score, income, and asset requirements | Includes certification of energy-efficient features or improvements |

| Benefits | Enables purchase of luxury and high-value properties | Reduces energy costs, increases home value, potential tax incentives |

| Use Case | Large, often luxury home purchases exceeding standard loan limits | Homes with verified energy efficiency or planned upgrades |

Understanding Jumbo Mortgages: Key Features and Requirements

Jumbo mortgages are non-conforming loans that exceed the conforming loan limits set by the Federal Housing Finance Agency, typically used for luxury or large property purchases above $726,200 in most U.S. counties. These loans require higher credit scores, substantial down payments often around 20%, and detailed financial documentation to mitigate increased lender risk. Unlike energy efficient mortgages, which finance green home improvements, jumbo mortgages focus solely on loan size with stricter underwriting standards and higher interest rates due to their non-conforming status.

What Is an Energy Efficient Mortgage? Benefits and Basics

An Energy Efficient Mortgage (EEM) enables homebuyers to finance energy-saving improvements as part of their total loan amount, offering benefits like lower utility bills and increased property value. Unlike a Jumbo Mortgage, which covers high-value properties exceeding conforming loan limits, an EEM focuses on integrating energy efficiency into financing, potentially qualifying for better interest rates or higher loan amounts. This approach supports sustainable homeownership by reducing long-term costs and promoting environmentally friendly upgrades.

Eligibility Criteria: Jumbo Mortgage vs. Energy Efficient Mortgage

Jumbo mortgages require borrowers to qualify based on higher credit scores, larger down payments, and stronger income verification due to loan amounts exceeding conforming limits, typically over $647,200 depending on the county. Energy Efficient Mortgages (EEMs) demand eligibility criteria that include the property's energy improvements meeting specific efficiency standards, validated through an energy audit or certification, alongside conventional credit and income requirements. While jumbo loans focus primarily on the borrower's financial capacity, EEMs prioritize both the borrower's qualifications and the energy performance of the property to qualify.

Loan Limits: How Much Can You Borrow?

Jumbo mortgages allow borrowing amounts exceeding conforming loan limits, often surpassing $726,200 in high-cost areas, making them suitable for expensive properties. Energy Efficient Mortgages (EEMs) add additional borrowing capacity above standard loan limits to finance energy-saving upgrades, but their base loan amounts typically align with conforming loan limits. For large property purchases, jumbo loans permit significantly higher principal amounts without energy efficiency requirements, while EEMs focus on integrating energy improvements within or slightly above conventional loan thresholds.

Interest Rates: Comparing Costs and Savings

Jumbo mortgages typically have higher interest rates than conventional loans due to the larger loan amount exceeding conforming limits, increasing overall borrowing costs. Energy Efficient Mortgages (EEMs) often offer competitive or lower interest rates by incentivizing eco-friendly upgrades, which can reduce utility expenses and enhance property value in the long term. Comparing these options, borrowers should evaluate not only the upfront interest rates but also the potential savings from energy efficiency improvements when financing large property purchases.

Down Payment Requirements: Which Mortgage Is More Accessible?

Jumbo mortgages typically require a down payment of 20% or more due to the larger loan amounts exceeding conforming limits, making them less accessible for buyers with limited upfront cash. Energy Efficient Mortgages (EEMs) offer lower down payment options, often as low as 3.5% with FHA backing, making EEMs more accessible for purchasing large properties when incorporating energy-saving features. Buyers prioritizing accessibility and lower initial costs may find EEMs more favorable compared to the higher down payment demands of jumbo loans.

Property Types: Suitability for Large and Luxury Homes

Jumbo mortgages are specifically designed for financing large and luxury homes that exceed conforming loan limits, offering flexibility for high-value residential properties. Energy Efficient Mortgages (EEMs) enable buyers to finance energy-saving upgrades within the mortgage, ideal for large homes aiming to reduce utility costs and increase sustainability. Large properties benefit from Jumbo loans' higher limits, while EEMs add value through energy efficiency improvements, making each suitable depending on the buyer's priorities for property size and eco-friendly features.

Energy Efficiency Upgrades: Qualifying Improvements

Energy Efficient Mortgages (EEMs) allow borrowers to finance energy-saving upgrades alongside their home purchase, including solar panels, high-efficiency HVAC systems, and enhanced insulation. Qualifying improvements must meet guidelines set by the Department of Energy or FHA, ensuring reduced utility costs and increased property value. Compared to Jumbo Mortgages, which primarily finance high-value properties without energy-related incentives, EEMs uniquely support long-term savings through sustainable home modifications.

Long-Term Financial Impact: Total Cost of Ownership

Jumbo mortgages typically involve higher interest rates and stricter qualification requirements, increasing long-term borrowing costs for large property purchases. Energy Efficient Mortgages (EEMs) offer lower interest rates and potential energy savings, reducing total cost of ownership through decreased utility bills and maintenance expenses. Evaluating both options requires analyzing upfront costs, monthly payments, and projected energy savings to optimize financial outcomes over the mortgage term.

Choosing the Right Mortgage: Factors to Consider

Jumbo mortgages are tailored for high-value property purchases exceeding conforming loan limits, offering competitive rates but requiring stringent credit qualifications and larger down payments. Energy Efficient Mortgages (EEMs) enable buyers to finance energy-saving improvements within their home purchase, reducing long-term utility costs and increasing property value, making them ideal for sustainable properties. Evaluating factors such as loan limits, credit requirements, energy savings potential, and long-term financial impact is crucial when selecting between jumbo and energy efficient mortgages for large property acquisitions.

Related Important Terms

Green Jumbo Loan

Green Jumbo Loans combine the benefits of jumbo mortgages with energy efficient mortgage features, allowing borrowers to finance large, luxury homes while incorporating energy-saving improvements. These loans often offer competitive interest rates and higher loan limits to support sustainable upgrades, increasing property value and reducing long-term utility costs.

Energy Efficient Jumbo Mortgage

Energy Efficient Jumbo Mortgages combine the benefits of traditional jumbo loans, which finance large property purchases exceeding conforming loan limits, with incentives for energy-efficient home improvements, enabling buyers to finance both the purchase and green upgrades in a single loan. This specialized mortgage option offers competitive interest rates and higher loan limits while promoting sustainable investing, ultimately reducing utility costs and increasing property value on high-end homes.

High-Balance Eco Mortgage

High-Balance Eco Mortgages combine the benefits of Jumbo Mortgages with Energy Efficient Mortgage features, allowing borrowers to finance large property purchases while incorporating energy-saving upgrades. These loans offer higher loan limits than standard mortgages and provide incentives for properties that meet strict energy efficiency standards, resulting in long-term cost savings and environmental benefits.

Net-Zero Jumbo Financing

Net-Zero Jumbo Financing integrates jumbo mortgage limits with energy-efficient home improvements, enabling large property buyers to finance both the purchase and sustainable upgrades under one loan. This approach contrasts with traditional Energy Efficient Mortgages by specifically catering to high-value homes aiming for net-zero energy consumption, offering competitive rates and incentives for comprehensive green building features.

LEED-Certified Property Jumbo Loan

A Jumbo Mortgage for a LEED-certified property offers competitive interest rates and higher loan limits tailored for large, energy-efficient homes, enabling buyers to finance premium green features without compromising loan size. Energy Efficient Mortgages specifically incentivize energy-saving upgrades by integrating projected utility savings into qualifying income, but may have lower maximum loan amounts compared to jumbo loans designed for luxury, environmentally responsible real estate.

Energy Performance-Based Underwriting

Energy Efficient Mortgages leverage energy performance-based underwriting to assess a property's energy savings potential, allowing borrowers to qualify for higher loan amounts or better terms by factoring lower utility costs into debt-to-income ratios. Jumbo Mortgages, designed for high-value properties exceeding conforming loan limits, typically do not incorporate energy efficiency metrics, focusing instead on creditworthiness and property value without accounting for potential energy savings.

Solar-Ready Jumbo Mortgage

Solar-Ready Jumbo Mortgages combine the high loan limits of traditional jumbo mortgages with incentives for energy-efficient home features, enabling buyers to finance large properties while preparing for solar panel installations. This specialized mortgage supports investments in renewable energy infrastructure, potentially reducing utility costs and increasing property value without compromising loan size or terms.

Eco-Friendly Luxury Home Loan

A Jumbo Mortgage typically finances luxury properties exceeding conventional loan limits, while an Energy Efficient Mortgage (EEM) provides additional funds specifically for eco-friendly upgrades, making the Eco-Friendly Luxury Home Loan ideal for large property purchases that prioritize sustainability. Combining jumbo loan amounts with energy efficiency incentives helps buyers invest in high-end homes with lower utility costs and reduced environmental impact.

Sustainable Jumbo Refinance

Sustainable Jumbo Refinance loans combine the benefits of jumbo mortgages with energy-efficient upgrades, enabling large property buyers to finance high-value homes while reducing environmental impact and utility costs. These loans often offer competitive interest rates and incentives for incorporating energy-efficient features, making them an attractive choice for refinancing luxury homes with sustainable improvements.

High-Cost Area Energy-Efficient Mortgage

High-Cost Area Energy-Efficient Mortgages (EEMs) offer competitive financing for large property purchases in expensive regions, integrating energy-saving improvements into the loan structure unlike traditional Jumbo Mortgages that primarily focus on loan size limits above conforming loan thresholds. This specialized EEM option supports energy-efficient upgrades while accommodating higher property values typical in high-cost markets, reducing utility expenses and potentially increasing long-term property value.

Jumbo Mortgage vs Energy Efficient Mortgage for large property purchases. Infographic

moneydiff.com

moneydiff.com