Reverse mortgages allow retirees to convert home equity into cash without monthly repayments, ideal for those who want to stay in their home and access funds tax-free. Equity release mortgages, including lifetime mortgages and home reversion plans, generally provide a lump sum or regular payments but may reduce inheritance as interest accrues over time. Choosing between these depends on financial needs, property value, and long-term estate planning objectives.

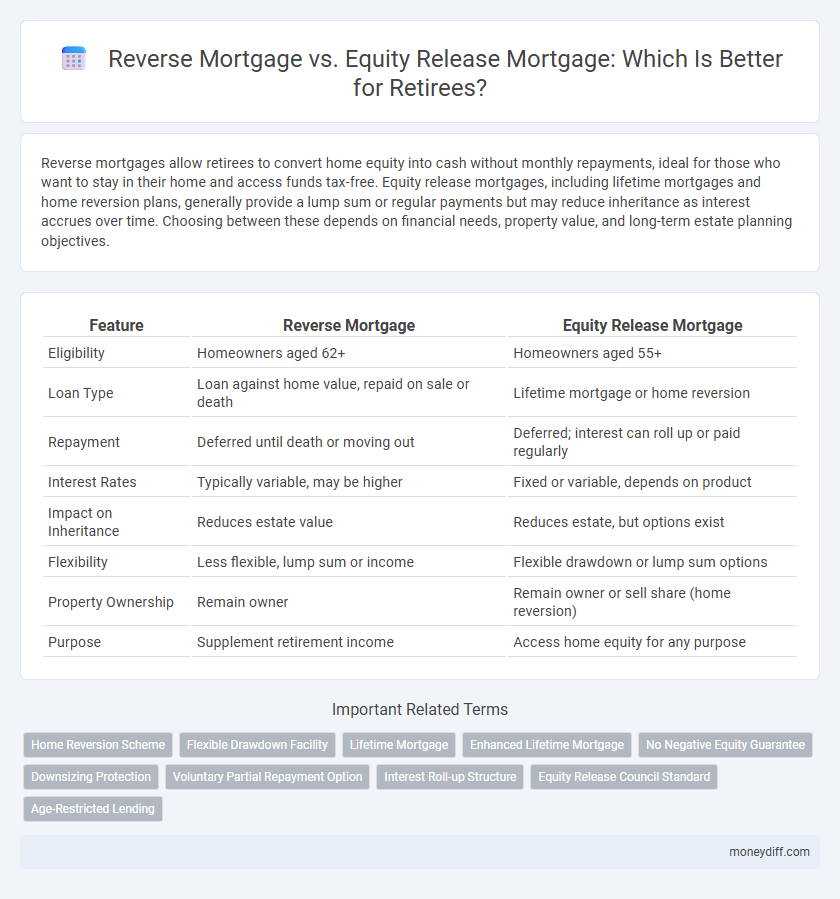

Table of Comparison

| Feature | Reverse Mortgage | Equity Release Mortgage |

|---|---|---|

| Eligibility | Homeowners aged 62+ | Homeowners aged 55+ |

| Loan Type | Loan against home value, repaid on sale or death | Lifetime mortgage or home reversion |

| Repayment | Deferred until death or moving out | Deferred; interest can roll up or paid regularly |

| Interest Rates | Typically variable, may be higher | Fixed or variable, depends on product |

| Impact on Inheritance | Reduces estate value | Reduces estate, but options exist |

| Flexibility | Less flexible, lump sum or income | Flexible drawdown or lump sum options |

| Property Ownership | Remain owner | Remain owner or sell share (home reversion) |

| Purpose | Supplement retirement income | Access home equity for any purpose |

Understanding Reverse Mortgages: A Retiree’s Guide

Reverse mortgages allow retirees to convert home equity into tax-free cash without monthly repayments, offering financial flexibility while retaining home ownership. Equity release mortgages, including lifetime mortgages, provide lump sum or regular payments against property value, with interest accruing until repayment typically occurs after death or moving out. Understanding these options helps retirees choose based on their income needs, property value, and long-term estate planning.

What Is an Equity Release Mortgage? Key Features Explained

An equity release mortgage allows retirees to access the cash tied up in their property without having to move, primarily through lifetime mortgages or home reversion plans. Key features include retaining homeownership, receiving a tax-free lump sum or regular income, and deferring repayments until death or moving into long-term care. Unlike reverse mortgages, equity release often offers more flexible options tailored to retirees' financial needs and estate planning goals.

Reverse Mortgage vs Equity Release: Definitions & Differences

Reverse mortgage allows retirees to convert home equity into tax-free income without monthly repayments, typically available to homeowners aged 62 or older. Equity release mortgage broadly includes lifetime mortgages and home reversion plans, enabling older homeowners to access funds by either borrowing against or selling a portion of their property while retaining the right to live there. The primary difference lies in product structure and repayment terms: reverse mortgages accrue interest with no monthly payments until sale or death, whereas equity release options vary with some requiring repayment upon move or death.

Eligibility Criteria for Retirees: Who Qualifies?

Reverse mortgage eligibility for retirees typically requires the homeowner to be at least 62 years old, own the property outright or have significant equity, and use the home as their primary residence. Equity release mortgages often have a similar minimum age requirement, generally starting at 55, but may allow for varying equity thresholds depending on the lender's criteria. Both products require a thorough financial assessment to ensure borrowers can meet obligations like home maintenance and taxes throughout the loan term.

Accessing Home Equity: How the Two Mortgages Work

Reverse mortgages allow retirees to access home equity by converting a portion of their home's value into tax-free funds without selling the property, typically through lump sum, monthly payments, or a line of credit. Equity release mortgages, particularly lifetime mortgages, enable homeowners to borrow against their property value while retaining ownership, with interest rolling up and repayment due upon moving out or death. Both products require the home to be the borrower's main residence and are designed to provide financial flexibility by unlocking home equity during retirement.

Costs and Fees: Comparing Reverse and Equity Release Options

Reverse mortgage costs typically include higher interest rates and origination fees compared to equity release mortgages, which often have more transparent fee structures. Equity release options may involve fewer upfront charges but can include arrangement fees, valuation fees, and early repayment penalties. Retirees should carefully compare total cost implications, including cumulative interest and product fees, to determine the most cost-effective choice.

Impact on Retirement Income and Lifestyle

Reverse mortgages provide retirees with a tax-free lump sum or monthly income by converting home equity without monthly repayments, thus enhancing cash flow and maintaining lifestyle flexibility. Equity release mortgages, often structured with fixed interest rates, allow access to capital while preserving ownership, but may reduce inheritance and increase long-term costs impacting overall retirement income. Choosing between the two depends on balancing immediate income needs against future financial security and lifestyle goals in retirement.

Inheritance Considerations: What Happens to Your Home?

Reverse mortgages allow retirees to access home equity without monthly repayments, but the loan balance and interest are repaid from the home's sale after the borrower's death, potentially reducing inheritance value. Equity release mortgages, often in the form of lifetime mortgages, similarly defer repayment until death or moving into long-term care, preserving the right to leave the remaining home equity to heirs after settling the loan. Understanding how each product impacts inheritance is crucial for retirees to balance accessing funds with preserving home value for beneficiaries.

Risks and Drawbacks: What Retirees Should Watch For

Reverse mortgages and equity release mortgages both allow retirees to access home equity but carry distinct risks that require careful consideration. Reverse mortgages may lead to accumulating interest that reduces the inheritance left to heirs and could result in foreclosure if property taxes or insurance are unpaid. Equity release mortgages can have higher fees and may restrict the ability to move or sell the home without repaying the loan, potentially impacting retirees' financial flexibility.

Choosing the Right Option: Factors to Consider for Retirees

Retirees should evaluate factors such as age, home equity, and income needs when choosing between a Reverse Mortgage and an Equity Release Mortgage. Reverse Mortgages typically provide tax-free lump sums or monthly payments without monthly repayments, but may reduce inheritance. Equity Release Mortgages offer flexible access to home equity while allowing downsizing options, with considerations for interest rates and potential impact on means-tested benefits.

Related Important Terms

Home Reversion Scheme

The Home Reversion Scheme, a common form of equity release mortgage, enables retirees to sell a portion of their home equity in exchange for a lump sum or regular payments while retaining the right to live in the property rent-free until death or relocation. Unlike reverse mortgages, which accumulate interest over time, the Home Reversion Scheme allows homeowners to receive tax-free cash without monthly repayments, though the purchased share of the property is returned to the provider upon sale.

Flexible Drawdown Facility

A Flexible Drawdown Facility in reverse mortgages allows retirees to access funds incrementally, adapting to changing financial needs without incurring immediate interest on unused amounts. Equity release mortgages generally offer less flexible withdrawal options, often providing lump sums or limited drawdown schedules, which may restrict retirees' ability to manage cash flow effectively.

Lifetime Mortgage

Lifetime mortgages, a popular form of equity release, allow retirees to borrow against their home's value without monthly repayments, with interest rolled up until the property is sold. Unlike reverse mortgages, lifetime mortgages typically offer more flexible terms, including fixed or capped interest rates, making them a preferred option for retirees seeking to access housing wealth while retaining home ownership.

Enhanced Lifetime Mortgage

Enhanced Lifetime Mortgages offer retirees higher loan amounts compared to standard equity release options by factoring in health and lifestyle, making them a popular alternative to traditional reverse mortgages for maximizing retirement funds. Unlike reverse mortgages, Enhanced Lifetime Mortgages do not require monthly repayments and allow homeowners to retain ownership while accessing tax-free cash based on property value and life expectancy.

No Negative Equity Guarantee

A Reverse Mortgage and an Equity Release Mortgage both offer retirees access to home equity without monthly repayments, but the No Negative Equity Guarantee ensures borrowers never owe more than the property's value upon sale. This safeguard protects retirees from market fluctuations, making it a crucial consideration when choosing between these equity release options.

Downsizing Protection

Reverse mortgages allow retirees to access home equity without selling, preserving downsizing options by converting property value into tax-free loan proceeds. Equity release mortgages provide lump-sum or regular payments but may reduce inherited property value, impacting future downsizing plans.

Voluntary Partial Repayment Option

The Voluntary Partial Repayment Option in reverse mortgages allows retirees to reduce interest accrual by making payments without altering the loan term, offering flexibility not typically found in equity release mortgages. Equity release mortgages generally lack this feature, limiting borrowers' ability to manage debt proactively while retaining homeownership benefits.

Interest Roll-up Structure

Reverse mortgages and equity release mortgages both use an interest roll-up structure, where interest accrues on the outstanding loan balance and is repaid at maturity or sale, allowing retirees to access home equity without monthly payments. While reverse mortgages are typically government-insured with capped interest rates, equity release mortgages often offer more flexible terms but may have higher variable interest rates, impacting overall cost for retirees.

Equity Release Council Standard

Equity Release Mortgages certified by the Equity Release Council provide retirees with regulated, transparent products offering lifetime security, fixed interest rates, and no negative equity guarantees. Reverse Mortgages lack these standardized protections, often resulting in less favorable terms and limited consumer safeguards compared to Equity Release Council-accredited schemes.

Age-Restricted Lending

Reverse mortgages primarily target retirees aged 62 and older, allowing homeowners to convert home equity into tax-free income without monthly repayments, while equity release mortgages often cater to those 55 and above with flexible options combining lifetime mortgages and home reversion plans. Age-restricted lending criteria in reverse mortgages emphasize borrower eligibility and property requirements, whereas equity release products tend to offer broader age ranges and diverse payout structures tailored to retirees' financial needs.

Reverse Mortgage vs Equity Release Mortgage for retirees. Infographic

moneydiff.com

moneydiff.com