Refinancing replaces your existing mortgage with a new loan, often to secure a lower interest rate or change loan terms, resulting in potentially lower monthly payments or a shorter loan duration. Recasting involves paying a lump sum toward the principal balance, then recalculating the monthly payments based on the reduced balance without altering the loan terms or interest rate. Choosing between refinancing and recasting depends on your financial goals, credit profile, and current market conditions, with refinancing offering more flexibility and recasting providing a cost-effective way to reduce payments.

Table of Comparison

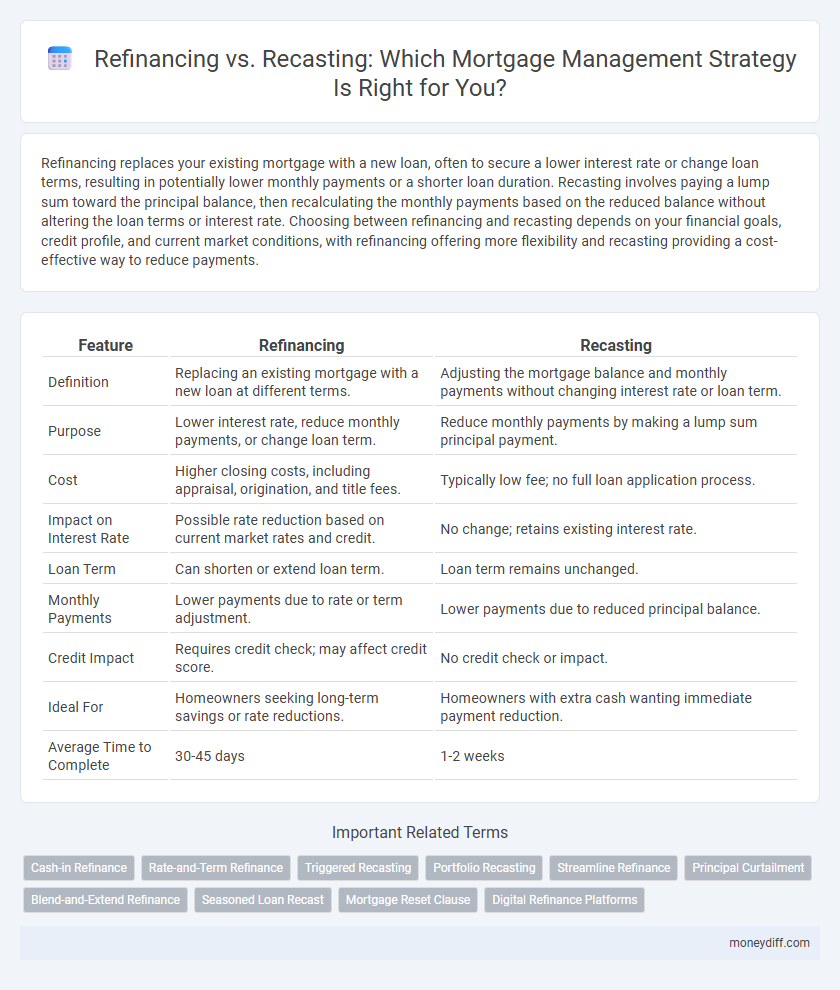

| Feature | Refinancing | Recasting |

|---|---|---|

| Definition | Replacing an existing mortgage with a new loan at different terms. | Adjusting the mortgage balance and monthly payments without changing interest rate or loan term. |

| Purpose | Lower interest rate, reduce monthly payments, or change loan term. | Reduce monthly payments by making a lump sum principal payment. |

| Cost | Higher closing costs, including appraisal, origination, and title fees. | Typically low fee; no full loan application process. |

| Impact on Interest Rate | Possible rate reduction based on current market rates and credit. | No change; retains existing interest rate. |

| Loan Term | Can shorten or extend loan term. | Loan term remains unchanged. |

| Monthly Payments | Lower payments due to rate or term adjustment. | Lower payments due to reduced principal balance. |

| Credit Impact | Requires credit check; may affect credit score. | No credit check or impact. |

| Ideal For | Homeowners seeking long-term savings or rate reductions. | Homeowners with extra cash wanting immediate payment reduction. |

| Average Time to Complete | 30-45 days | 1-2 weeks |

Understanding Mortgage Refinancing

Mortgage refinancing involves replacing an existing loan with a new one to secure better interest rates, lower monthly payments, or change loan terms, totaling potentially significant savings over the loan's lifetime. Unlike recasting, refinancing requires a credit check, appraisal, and closing costs but can reduce the loan balance or switch from an adjustable to a fixed rate mortgage. Homeowners seeking to optimize long-term financial benefits often choose refinancing to capitalize on market conditions or to access home equity.

What Is Mortgage Recasting?

Mortgage recasting is the process of applying a lump sum payment directly to your loan principal, which recalculates and reduces your monthly mortgage payments without changing the original loan terms or interest rate. Unlike refinancing, recasting avoids closing costs and credit checks, making it a cost-effective option for borrowers with extra funds who want to lower their monthly payments. This strategy is most beneficial for fixed-rate mortgages and can help homeowners improve cash flow while maintaining their existing loan structure.

Key Differences Between Refinancing and Recasting

Refinancing replaces your existing mortgage with a new loan, often to secure a lower interest rate or alter loan terms, while recasting involves paying a lump sum toward the principal to reduce monthly payments without changing the loan's interest rate or term. Refinancing typically incurs higher closing costs and requires credit approval, whereas recasting has minimal fees and no credit checks. Borrowers choose refinancing for long-term savings or loan restructuring, and recasting for immediate payment relief and cost-effectiveness.

Costs Involved: Refinancing vs Recasting

Refinancing a mortgage typically involves higher costs, including application fees, appraisal fees, and closing costs that can amount to 2-5% of the loan balance, whereas recasting requires a minimal fee, usually between $200 and $500. Refinancing resets the loan term and interest rate, which can lead to long-term savings but demands significant upfront expenses. Recasting maintains the original loan terms and interest rate, offering a cost-effective way to reduce monthly payments without incurring major fees or extending the loan duration.

Impact on Monthly Mortgage Payments

Refinancing a mortgage replaces the existing loan with a new one, often lowering the interest rate and significantly reducing monthly mortgage payments over the loan term. Recasting involves paying a lump sum toward the principal balance, which recalculates mortgage payments based on the new lower balance, offering immediate savings without changing the loan terms. While refinancing may come with closing costs and a reset of the mortgage timeline, recasting provides a cost-effective way to reduce monthly payments without qualifying for a new loan.

Effect on Loan Terms and Interest Rates

Refinancing a mortgage replaces the original loan with a new one, often securing a lower interest rate and altered loan terms, which can reduce monthly payments or loan duration. Recasting involves making a lump sum payment toward the principal, keeping the original loan's interest rate and term unchanged, but lowering monthly payments based on the reduced balance. Choosing refinancing impacts interest rates directly, while recasting optimizes loan terms without changing the interest rate structure.

Qualification Requirements for Refinancing and Recasting

Refinancing a mortgage requires meeting strict credit score thresholds, income verification, and typically involves a new appraisal to qualify for better interest rates or terms. Recasting, on the other hand, demands fewer qualification criteria, generally only requiring a minimum payment toward the principal without the need for income verification or a credit check. Borrowers with strong financial profiles may prefer refinancing for long-term savings, whereas recasting offers a straightforward option with lower qualification barriers and reduced closing costs.

Pros and Cons of Refinancing Your Mortgage

Refinancing your mortgage can lower your interest rate and monthly payments, offering potential long-term savings and access to cash through home equity. However, it often involves closing costs, fees, and a longer loan term that may increase overall interest paid. Refinancing is beneficial for homeowners seeking improved loan terms or cash-out options but requires careful consideration of upfront costs versus future savings.

Pros and Cons of Mortgage Recasting

Mortgage recasting offers lower monthly payments by recalculating the loan balance after a large principal payment without changing the original interest rate or loan term. It typically involves minimal fees compared to refinancing, making it a cost-effective option for borrowers seeking reduced payments without extensive underwriting. However, recasting does not allow for accessing home equity or switching loan terms, limiting flexibility compared to refinancing options.

Choosing the Best Option for Your Financial Goals

Refinancing replaces your existing mortgage with a new loan, often offering lower interest rates or adjusted loan terms to reduce monthly payments or shorten the loan period. Recasting involves making a lump-sum payment toward the principal, then recalculating your mortgage payments based on the new balance, which lowers monthly payments without changing your interest rate or loan term. Evaluating your financial goals, including cash flow needs and long-term savings, is crucial in deciding whether refinancing or recasting provides the best mortgage management strategy.

Related Important Terms

Cash-in Refinance

Cash-in refinance involves paying a lump sum to reduce the mortgage principal, leading to lower monthly payments and potential interest savings without altering loan terms significantly. Compared to recasting, which simply recalculates payments based on a reduced balance, cash-in refinancing can also improve loan-to-value ratio and may help eliminate private mortgage insurance (PMI).

Rate-and-Term Refinance

Rate-and-term refinance involves obtaining a new mortgage loan to replace an existing one, primarily to secure a lower interest rate or modify the loan term, which can result in reduced monthly payments and overall interest costs. In contrast, recasting keeps the original loan intact while recalculating monthly payments based on a lump-sum principal payment, making it a cost-effective option without the need for credit checks or closing costs.

Triggered Recasting

Triggered recasting occurs when a borrower makes a substantial principal payment, prompting the lender to recalculate the monthly mortgage payment based on the new loan balance while maintaining the original loan term. This mortgage management strategy can reduce monthly payments without the costs and credit checks associated with refinancing, offering a cost-effective alternative for homeowners seeking immediate cash flow relief.

Portfolio Recasting

Portfolio recasting allows mortgage borrowers to reduce monthly payments by applying a lump sum to the principal balance without altering the loan's original terms, making it an efficient strategy for portfolio mortgage management. Unlike refinancing, which involves new loan approval and potential changes in interest rates or terms, portfolio recasting preserves existing favorable rates while improving cash flow and investment diversification.

Streamline Refinance

Streamline refinance offers a simplified mortgage refinancing option with reduced documentation and faster approval, ideal for borrowers seeking lower interest rates without a full financial reassessment. Unlike recasting, which adjusts the existing loan balance and amortization after a lump sum payment, streamline refinance replaces the current mortgage entirely to optimize monthly payments and overall loan terms.

Principal Curtailment

Refinancing replaces an existing mortgage with a new loan, often lowering interest rates and monthly payments while resetting the loan term, whereas recasting involves a lump-sum principal curtailment applied to the original mortgage, reducing monthly payments without changing the interest rate or loan duration. Principal curtailment through recasting directly decreases the outstanding loan balance, leading to immediate payment reductions and significant interest savings over time without incurring closing costs associated with refinancing.

Blend-and-Extend Refinance

Blend-and-extend refinance combines the current mortgage rate with a new rate, extending the loan term to lower monthly payments without resetting the amortization schedule. This strategy offers a cost-effective alternative to traditional refinancing by minimizing closing costs and leveraging existing loan benefits while improving cash flow.

Seasoned Loan Recast

Seasoned loan recast allows homeowners to reduce monthly mortgage payments by applying a lump sum toward the principal without changing the original loan terms or interest rate, making it a cost-effective alternative to refinancing. This strategy is particularly beneficial for borrowers with established payment history who wish to lower payments without incurring closing costs or extending the loan duration.

Mortgage Reset Clause

Mortgage reset clauses allow borrowers to adjust their interest rates when refinancing, often resulting in new loan terms and potential savings. Recasting involves recalculating the loan balance with a lump-sum payment, lowering monthly payments without changing the original interest rate or loan duration.

Digital Refinance Platforms

Digital refinance platforms streamline mortgage refinancing by offering competitive rates and quick approval processes, enabling borrowers to reduce interest costs or change loan terms effectively. Recasting, often unavailable digitally, involves a lump-sum payment to lower monthly payments without altering loan terms, making refinancing more flexible through these online tools.

Refinancing vs Recasting for mortgage management. Infographic

moneydiff.com

moneydiff.com