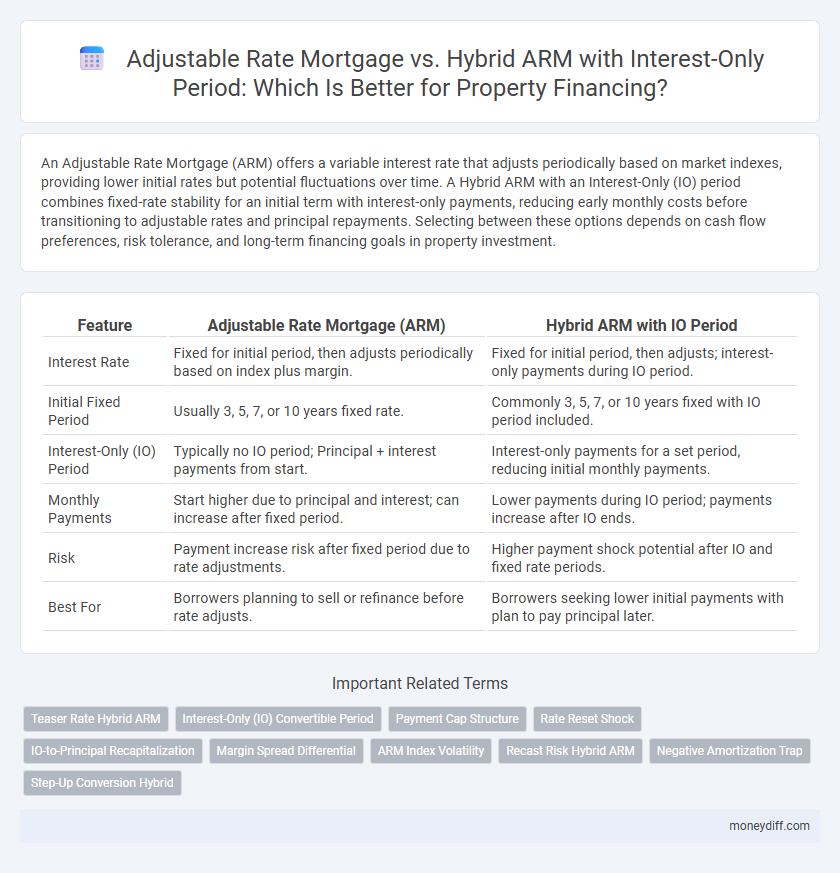

An Adjustable Rate Mortgage (ARM) offers a variable interest rate that adjusts periodically based on market indexes, providing lower initial rates but potential fluctuations over time. A Hybrid ARM with an Interest-Only (IO) period combines fixed-rate stability for an initial term with interest-only payments, reducing early monthly costs before transitioning to adjustable rates and principal repayments. Selecting between these options depends on cash flow preferences, risk tolerance, and long-term financing goals in property investment.

Table of Comparison

| Feature | Adjustable Rate Mortgage (ARM) | Hybrid ARM with IO Period |

|---|---|---|

| Interest Rate | Fixed for initial period, then adjusts periodically based on index plus margin. | Fixed for initial period, then adjusts; interest-only payments during IO period. |

| Initial Fixed Period | Usually 3, 5, 7, or 10 years fixed rate. | Commonly 3, 5, 7, or 10 years fixed with IO period included. |

| Interest-Only (IO) Period | Typically no IO period; Principal + interest payments from start. | Interest-only payments for a set period, reducing initial monthly payments. |

| Monthly Payments | Start higher due to principal and interest; can increase after fixed period. | Lower payments during IO period; payments increase after IO ends. |

| Risk | Payment increase risk after fixed period due to rate adjustments. | Higher payment shock potential after IO and fixed rate periods. |

| Best For | Borrowers planning to sell or refinance before rate adjusts. | Borrowers seeking lower initial payments with plan to pay principal later. |

Understanding Adjustable Rate Mortgages (ARM)

Adjustable Rate Mortgages (ARM) feature interest rates that periodically adjust based on a specific index, impacting monthly payments throughout the loan term. Hybrid ARMs combine a fixed-rate period with subsequent adjustable rates, often including an Interest-Only (IO) period where borrowers pay solely interest, reducing initial payments. Understanding these differences helps property buyers optimize financing strategies according to their cash flow and risk tolerance.

What Is a Hybrid ARM With Interest-Only (IO) Period?

A Hybrid Adjustable Rate Mortgage (ARM) with an Interest-Only (IO) period combines a fixed interest rate phase with an adjustable rate period, providing initial payment stability and later rate variability. During the IO period, borrowers pay only interest, reducing monthly payments and increasing cash flow without reducing the principal balance. This financing option is ideal for buyers seeking lower initial payments and potential rate adjustments aligned with market changes after the IO phase ends.

Key Differences Between Traditional ARM and Hybrid ARM with IO

Traditional Adjustable Rate Mortgages (ARMs) feature interest rates that adjust periodically based on market indexes after an initial fixed-rate period, while Hybrid ARMs combine a fixed-rate period followed by an adjustable period, often including an Interest-Only (IO) phase that allows borrowers to pay only interest for a set time. The key difference lies in the payment structure during the IO period, which can lower initial monthly payments and increase affordability but may lead to higher payments later. Hybrid ARMs with IO periods are typically chosen for short-term financing or investment properties where cash flow flexibility is prioritized over long-term fixed payments.

Initial Rate Structures: ARM vs Hybrid ARM with IO

Adjustable Rate Mortgages (ARMs) typically offer a lower initial fixed interest rate that adjusts periodically based on market indices, providing borrowers with initial payment predictability followed by potential fluctuations. Hybrid ARMs with Interest-Only (IO) periods start with a fixed-rate phase where payments include interest only, resulting in lower initial payments compared to traditional ARMs, before switching to an adjustable rate with principal and interest payments. The IO period in Hybrid ARMs allows for increased cash flow flexibility early in the loan term, which can be advantageous for investors or borrowers expecting income growth.

Payment Flexibility: How IO Periods Affect Monthly Payments

Adjustable Rate Mortgages (ARMs) offer payment variability based on periodic interest rate adjustments, while Hybrid ARMs with Interest-Only (IO) periods provide initial low monthly payments by allowing borrowers to pay only interest, enhancing short-term payment flexibility. The IO period reduces principal repayment obligations, lowering initial monthly payments compared to standard ARMs, but payments may increase significantly once principal amortization begins. Borrowers seeking manageable initial cash flow benefit from Hybrid ARM IO periods, yet must anticipate higher payment volatility post-IO period affecting long-term budgeting.

Interest Rate Adjustment Mechanisms Explained

Adjustable Rate Mortgages (ARMs) feature interest rates that fluctuate periodically based on a specific financial index plus a margin, causing monthly payments to vary over the loan term. Hybrid ARMs with an Interest-Only (IO) period combine a fixed-rate phase with an adjustable-rate phase, allowing borrowers to pay only interest for a set number of years before principal and interest payments adjust according to market indexes. The key difference lies in the initial fixed period and the IO feature, which impacts payment stability and long-term cost by delaying principal repayment and exposing borrowers to potential rate increases after the IO period ends.

Pros and Cons of Adjustable Rate Mortgages

Adjustable Rate Mortgages (ARMs) offer lower initial interest rates compared to fixed-rate loans, making monthly payments more affordable in the short term. However, ARMs carry the risk of rising interest rates after the initial fixed period, leading to potentially higher payments that can strain budgets. While Hybrid ARMs with Interest-Only (IO) periods provide lower payments during the IO phase, they may result in payment shock and increased principal balances once the interest-only period ends.

Advantages and Risks of Hybrid ARMs with IO Periods

Hybrid ARMs with interest-only (IO) periods offer lower initial payments compared to traditional Adjustable Rate Mortgages, enhancing cash flow flexibility for property financing. The IO period reduces principal repayment initially, making hybrids advantageous for borrowers expecting income growth or planning to refinance before adjustment resets. However, risks include potential payment shocks after the IO period ends, as amortization accelerates and interest rates adjust, increasing monthly obligations and exposure to market volatility.

Suitability: Which Mortgage Option Fits Your Financial Goals?

An Adjustable Rate Mortgage (ARM) offers fluctuating interest rates tied to market indices, ideal for borrowers expecting to sell or refinance before rates adjust significantly. A Hybrid ARM with an Interest-Only (IO) period combines fixed-rate stability initially with lower monthly payments due to interest-only financing, suitable for investors or buyers prioritizing cash flow in the short term. Choosing between these options depends on your long-term financial goals, risk tolerance, and plans for property ownership duration.

Choosing the Right Property Financing: ARM vs Hybrid ARM with IO

Adjustable Rate Mortgages (ARMs) offer initial lower interest rates that adjust periodically based on market indices, providing potential savings but with payment unpredictability. Hybrid ARMs with Interest Only (IO) periods combine fixed-rate initial terms with interest-only payments, reducing monthly costs early on while balancing risk through eventual principal amortization. Selecting between ARM and Hybrid ARM with IO depends on financial goals, risk tolerance, and expected property holding duration, making careful assessment of rate adjustments and payment structures crucial.

Related Important Terms

Teaser Rate Hybrid ARM

A Teaser Rate Hybrid ARM offers an initial low fixed interest rate during the introductory period, often combined with an Interest-Only (IO) payment phase, providing borrowers lower initial payments compared to traditional Adjustable Rate Mortgages (ARMs) that may start with higher, fully amortizing payments. This mortgage structure is designed to attract buyers seeking short-term affordability before rates adjust periodically, making it ideal for properties expected to be sold or refinanced before the adjustable period begins.

Interest-Only (IO) Convertible Period

Adjustable Rate Mortgages (ARMs) with an Interest-Only (IO) convertible period provide borrowers with lower initial payments by allowing interest-only payments for a set time before converting to fully amortizing payments, enhancing cash flow flexibility. Hybrid ARMs combine fixed-rate and adjustable-rate features with an IO period, balancing initial payment stability and long-term interest rate risk, making them ideal for property financing strategies that require adaptable payment options.

Payment Cap Structure

Adjustable Rate Mortgages (ARMs) typically feature periodic and lifetime payment caps that limit increases to the monthly payment, providing predictability during interest rate adjustments. Hybrid ARMs with an Interest-Only (IO) period combine fixed-rate payments initially with a payment cap structure that resumes after the IO term, helping borrowers manage cash flow and shielding them from steep payment spikes once principal repayment begins.

Rate Reset Shock

Adjustable Rate Mortgages (ARMs) typically experience rate reset shock when the initial fixed period ends, causing monthly payments to increase sharply based on current market rates. Hybrid ARM loans with an Interest-Only (IO) period may delay principal payments initially but face significant payment jumps after the IO period ends, intensifying rate reset shock compared to standard ARMs.

IO-to-Principal Recapitalization

Adjustable Rate Mortgages (ARMs) with Interest-Only (IO) periods require borrowers to pay only interest initially, leading to principal recapitalization when the loan shifts to amortization, whereas Hybrid ARMs with IO periods combine fixed initial rates and IO phases, allowing principal to accumulate before higher payments begin. Understanding IO-to-principal recapitalization impact is crucial for borrowers to manage payment shocks and long-term financing costs effectively in property mortgages.

Margin Spread Differential

Adjustable Rate Mortgages (ARMs) feature a margin spread differential that directly impacts the interest rate, calculated by adding a fixed margin to the chosen index, reflecting lender risk and profit. Hybrid ARMs with an Interest-Only (IO) period often present a different margin spread, potentially higher to compensate for the initial lower payments, influencing long-term financing costs and borrower risk profiles.

ARM Index Volatility

Adjustable Rate Mortgages (ARMs) are directly influenced by ARM index volatility, causing fluctuations in monthly payments as interest rates adjust periodically; Hybrid ARMs with an Interest-Only (IO) period mitigate initial payment volatility by locking in a fixed rate before transitioning to fluctuating rates based on the ARM index. Borrowers opting for Hybrid ARMs with IO periods benefit from predictable early payments and reduced exposure to sudden ARM index rate hikes compared to standard ARMs, which can lead to financial strain if index rates spike.

Recast Risk Hybrid ARM

Adjustable Rate Mortgages (ARMs) offer fluctuating interest rates based on market indexes, while Hybrid ARMs with Interest-Only (IO) periods provide initial fixed rates with interest-only payments followed by adjustable terms, increasing recast risk when principal payments are deferred. The recast risk in Hybrid ARM loans can lead to significant payment shock at the end of the IO period as unpaid principal balances are recalculated, impacting borrower affordability and refinancing options.

Negative Amortization Trap

Adjustable Rate Mortgages (ARMs) with interest-only (IO) periods can lead to negative amortization, where unpaid interest is added to the loan balance, increasing debt instead of reducing principal. Hybrid ARMs with IO periods combine fixed and adjustable rates but carry a higher risk of entering the negative amortization trap if borrowers fail to make sufficient payments during the IO phase.

Step-Up Conversion Hybrid

Step-Up Conversion Hybrid ARMs with an Interest-Only (IO) period combine the flexibility of initial low interest payments with scheduled rate increases that adjust periodically after the IO phase, providing borrowers predictable payment increments. Unlike standard Adjustable Rate Mortgages (ARMs), this hybrid product allows for a fixed IO period followed by step-up rate adjustments, optimizing cash flow management for property financing over time.

Adjustable Rate Mortgage vs Hybrid ARM with IO Period for property financing. Infographic

moneydiff.com

moneydiff.com