Jumbo mortgages require borrowers to qualify based on income and credit, often with higher interest rates due to larger loan amounts, making them suitable for high-value property buyers with strong financial profiles. Pledged-asset mortgages allow borrowers to use investment portfolios as collateral, potentially offering lower interest rates and quicker approval without heavy income verification. Choosing between these options depends on liquidity, investment strategy, and long-term financial goals.

Table of Comparison

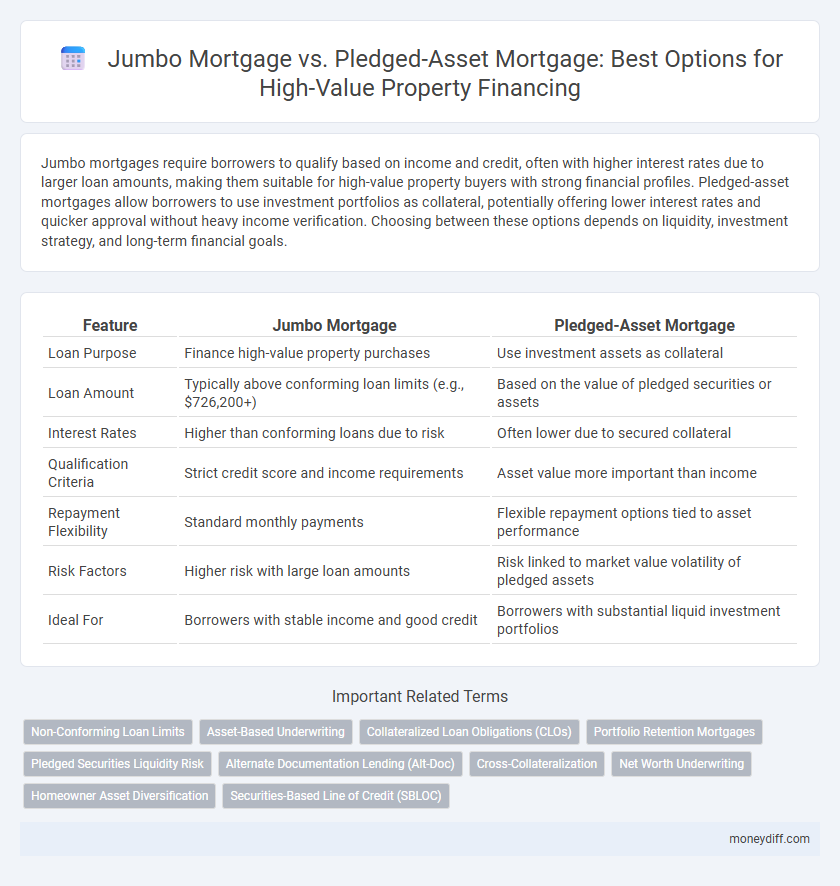

| Feature | Jumbo Mortgage | Pledged-Asset Mortgage |

|---|---|---|

| Loan Purpose | Finance high-value property purchases | Use investment assets as collateral |

| Loan Amount | Typically above conforming loan limits (e.g., $726,200+) | Based on the value of pledged securities or assets |

| Interest Rates | Higher than conforming loans due to risk | Often lower due to secured collateral |

| Qualification Criteria | Strict credit score and income requirements | Asset value more important than income |

| Repayment Flexibility | Standard monthly payments | Flexible repayment options tied to asset performance |

| Risk Factors | Higher risk with large loan amounts | Risk linked to market value volatility of pledged assets |

| Ideal For | Borrowers with stable income and good credit | Borrowers with substantial liquid investment portfolios |

Understanding Jumbo Mortgages: Key Features and Benefits

Jumbo mortgages are designed for high-value properties that exceed conventional loan limits, offering borrowers the ability to finance luxury homes without conforming to standard loan caps. These loans typically feature competitive interest rates, flexible underwriting criteria, and higher loan amounts, making them ideal for affluent buyers seeking substantial financing. Borrowers benefit from streamlined approval processes and potential tax advantages, positioning jumbo mortgages as a strategic choice for acquiring premium real estate.

What Is a Pledged-Asset Mortgage? An Introduction

A pledged-asset mortgage allows borrowers to use non-cash assets such as stocks, bonds, or investment portfolios as collateral instead of a traditional down payment, enabling access to larger loan amounts for high-value properties. This type of mortgage offers increased liquidity and flexibility, often without triggering capital gains taxes associated with liquidating assets. High-net-worth individuals prefer pledged-asset mortgages to maintain investment portfolios intact while securing financing for jumbo loans on luxury real estate.

Eligibility Criteria: Jumbo vs Pledged-Asset Mortgages

Jumbo mortgages require borrowers to meet higher credit score thresholds, significant income verification, and typically demand a down payment of 20% or more for high-value properties exceeding conforming loan limits. Pledged-asset mortgages leverage liquid financial assets such as stocks, bonds, or savings accounts as collateral, reducing the need for traditional income documentation and offering more flexible eligibility criteria based on the value and liquidity of pledged assets. Borrowers with substantial investment portfolios often qualify more easily for pledged-asset mortgages, while jumbo loans depend heavily on stringent creditworthiness and income validation.

Down Payment Requirements: Comparing Both Options

Jumbo mortgages typically require a down payment of 20% to 30% for high-value properties, reflecting stricter lending standards due to larger loan amounts. Pledged-asset mortgages often allow for lower or even no down payment by leveraging the borrower's liquid assets, such as investment portfolios, as collateral. This difference in down payment requirements significantly impacts borrower liquidity and financing flexibility in the luxury real estate market.

Interest Rates and Terms: Which Mortgage Offers Better Value?

Jumbo mortgages typically feature higher interest rates compared to pledged-asset mortgages due to the increased loan amount exceeding conforming limits, making monthly payments more expensive over time. Pledged-asset mortgages offer lower interest rates by leveraging investment portfolios as collateral, enabling borrowers to access competitive terms without selling assets. Borrowers with substantial liquid investments often find pledged-asset mortgages deliver better long-term value through flexible repayment options and reduced interest expenses.

Impact on Investment Portfolio: Pledged-Asset Implications

Pledged-asset mortgages allow borrowers to use their investment portfolios as collateral, preserving liquidity and avoiding the sale of assets during the loan term, which can lead to continued market exposure and potential growth. This type of mortgage often provides more favorable interest rates compared to jumbo mortgages, as the collateral reduces lender risk. High-net-worth individuals benefit by maintaining portfolio integrity while leveraging significant borrowing capacity for high-value property acquisitions.

Credit Score Considerations for High-Value Borrowers

High-value borrowers seeking jumbo mortgages typically require credit scores above 700 to secure favorable interest rates and loan terms. Pledged-asset mortgages often offer greater flexibility, allowing lenders to prioritize the value of the pledged securities over credit scores, which can benefit borrowers with lower credit ratings. Understanding the interplay between credit score requirements and asset valuation is crucial for optimizing financing strategies in luxury property purchases.

Pros and Cons: Jumbo Mortgage vs Pledged-Asset Financing

Jumbo mortgages allow high-value property buyers to secure large loan amounts with fixed interest rates but often require stringent credit criteria and substantial down payments, increasing initial costs. Pledged-asset financing leverages existing liquid assets as collateral, offering potentially lower interest rates and flexible repayment terms, but it exposes valuable investments to market risk and possible liquidity constraints. Choosing between these options depends on the borrower's asset portfolio, risk tolerance, and long-term financial strategy for managing high-value real estate investments.

Tax Implications for Each Mortgage Type

Jumbo mortgages often result in higher interest payments but may offer standard tax deductions for mortgage interest up to the IRS limit of $750,000 for loans taken after 2017, while pledged-asset mortgages can avoid traditional interest but may impact capital gains tax due to the liquidated assets serving as collateral. Tax benefits from jumbo mortgages depend on itemizing deductions and staying within tax code limits, whereas pledged-asset mortgages require careful consideration of potential tax events from asset liquidation and fluctuating asset values. Evaluating tax implications requires assessing loan structure, collateral performance, and individual tax situations to optimize financial outcomes for high-value property financing.

Choosing the Right Mortgage for High-Value Property

Choosing the right mortgage for high-value properties involves evaluating jumbo mortgages and pledged-asset mortgages based on interest rates, down payment requirements, and loan approval criteria. Jumbo mortgages typically require larger down payments and have stricter credit standards but offer fixed interest rates and longer terms. Pledged-asset mortgages use liquid assets as collateral, potentially enabling lower interest rates and faster approval without large down payments, ideal for borrowers with significant investment portfolios.

Related Important Terms

Non-Conforming Loan Limits

Jumbo mortgages exceed conforming loan limits set by entities like Fannie Mae and Freddie Mac, typically requiring higher credit scores and larger down payments for high-value properties. Pledged-asset mortgages use liquid assets as collateral instead of income verification, offering flexible qualification criteria and potentially lower interest rates for borrowers with substantial investable assets.

Asset-Based Underwriting

Jumbo mortgages require extensive income verification and credit assessments to underwrite high-value property loans, while pledged-asset mortgages rely primarily on the borrower's liquid asset portfolio, such as investment accounts or savings, as collateral instead of traditional income documentation. Asset-based underwriting in pledged-asset mortgages enables faster approval and often more flexible terms by leveraging the borrower's existing financial assets to secure the loan amount.

Collateralized Loan Obligations (CLOs)

Jumbo mortgages typically require higher credit scores and larger down payments for high-value properties, while pledged-asset mortgages leverage collateralized loan obligations (CLOs) or other securities as collateral, allowing borrowers to retain asset liquidity without liquidating investments. CLOs provide diversified exposure and can enhance loan-to-value ratios in pledged-asset mortgage structures, offering flexibility and potential tax advantages compared to conventional jumbo loans.

Portfolio Retention Mortgages

Portfolio Retention Mortgages allow high-net-worth borrowers to leverage their investment portfolios as collateral for jumbo loans, providing flexibility and potentially lower interest rates compared to traditional jumbo mortgages. These loans enable investors to retain their asset holdings while accessing significant liquidity, making them a strategic option for financing high-value properties without liquidating investments.

Pledged Securities Liquidity Risk

Pledged-asset mortgages allow borrowers to use securities as collateral, minimizing cash outflow but exposing them to liquidity risk if the market value of pledged assets drops significantly. Unlike jumbo mortgages, which are traditional high-value home loans, pledged-asset loans require maintaining a stable portfolio value to avoid margin calls and potential forced asset liquidation.

Alternate Documentation Lending (Alt-Doc)

Jumbo mortgages typically require comprehensive income verification and higher credit standards due to loan amounts exceeding conforming limits, whereas pledged-asset mortgages leverage existing financial assets as collateral, enabling alternate documentation lending (Alt-Doc) that reduces reliance on traditional income proof for high-value property financing. This Alt-Doc approach benefits borrowers with significant asset portfolios by streamlining approval processes and potentially offering more favorable loan terms compared to conventional jumbo loans.

Cross-Collateralization

Jumbo mortgages require large loan amounts for high-value properties without cross-collateralization, relying solely on the property as collateral. Pledged-asset mortgages utilize cross-collateralization by leveraging non-real estate assets like securities or savings, potentially securing better loan terms or lower interest rates.

Net Worth Underwriting

Jumbo mortgages require extensive net worth documentation and typically involve higher income and asset verification to qualify for high-value properties, while pledged-asset mortgages leverage liquid assets such as securities or investment accounts as collateral, often enabling faster approval with less emphasis on income verification. Net worth underwriting for pledged-asset mortgages prioritizes asset liquidity and market value stability, reducing reliance on traditional income-to-debt ratios commonly scrutinized in jumbo loan applications.

Homeowner Asset Diversification

Jumbo mortgages allow high-value property buyers to secure large loans without liquidating assets, preserving portfolio diversification and maintaining investment growth across varied asset classes. Pledged-asset mortgages use existing investments as collateral, reducing interest rates but potentially concentrating financial risk by tying substantial assets to the mortgage.

Securities-Based Line of Credit (SBLOC)

A Jumbo Mortgage typically involves borrowing a large loan amount exceeding conforming loan limits, requiring higher credit standards and potentially higher interest rates, while a Pledged-Asset Mortgage uses securities or investment portfolios as collateral to secure the loan, often enabling more favorable terms and quicker approval. The Securities-Based Line of Credit (SBLOC) linked to a Pledged-Asset Mortgage allows borrowers to leverage their investment assets for liquidity without liquidating positions, providing flexible financing solutions for purchasing or refinancing high-value properties.

Jumbo Mortgage vs Pledged-Asset Mortgage for High-Value Property. Infographic

moneydiff.com

moneydiff.com