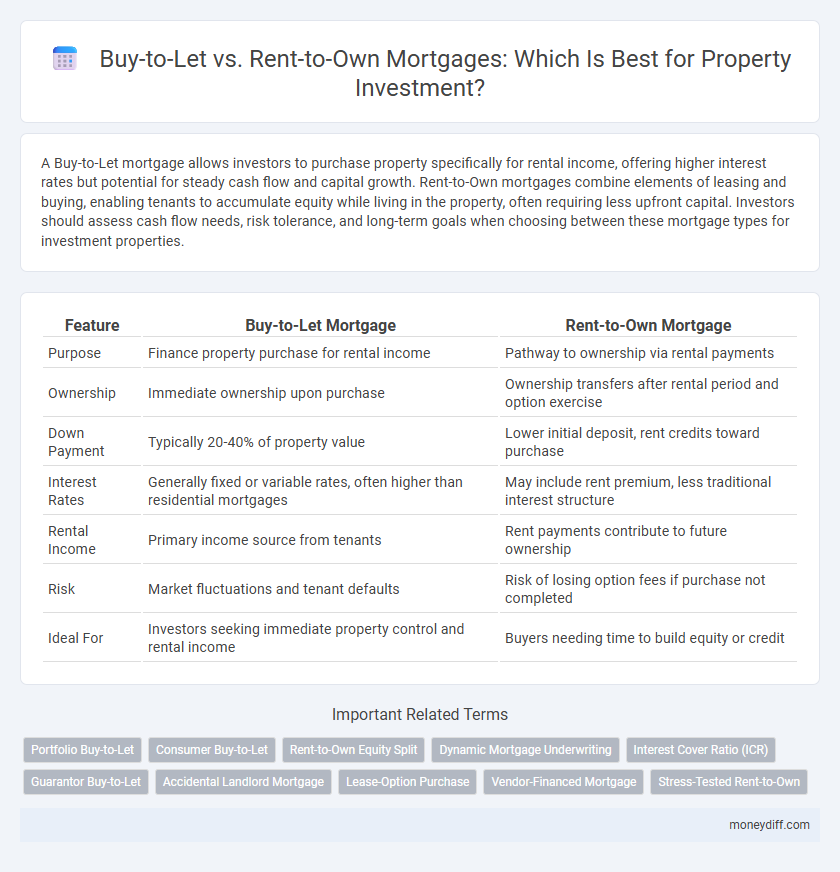

A Buy-to-Let mortgage allows investors to purchase property specifically for rental income, offering higher interest rates but potential for steady cash flow and capital growth. Rent-to-Own mortgages combine elements of leasing and buying, enabling tenants to accumulate equity while living in the property, often requiring less upfront capital. Investors should assess cash flow needs, risk tolerance, and long-term goals when choosing between these mortgage types for investment properties.

Table of Comparison

| Feature | Buy-to-Let Mortgage | Rent-to-Own Mortgage |

|---|---|---|

| Purpose | Finance property purchase for rental income | Pathway to ownership via rental payments |

| Ownership | Immediate ownership upon purchase | Ownership transfers after rental period and option exercise |

| Down Payment | Typically 20-40% of property value | Lower initial deposit, rent credits toward purchase |

| Interest Rates | Generally fixed or variable rates, often higher than residential mortgages | May include rent premium, less traditional interest structure |

| Rental Income | Primary income source from tenants | Rent payments contribute to future ownership |

| Risk | Market fluctuations and tenant defaults | Risk of losing option fees if purchase not completed |

| Ideal For | Investors seeking immediate property control and rental income | Buyers needing time to build equity or credit |

Understanding Buy-to-Let Mortgages: A Quick Overview

Buy-to-let mortgages are specifically designed for property investors looking to purchase residential real estate to rent out, often requiring a larger deposit of 25% or more and higher interest rates compared to standard mortgages. These mortgages calculate affordability based on potential rental income rather than the borrower's personal earnings, making them suitable for generating steady rental cash flow and long-term capital growth. Understanding the emphasis on rental yield and lender criteria is essential for investors seeking to maximize returns from buy-to-let investments.

What Is a Rent-to-Own Mortgage? Essential Facts

A rent-to-own mortgage allows tenants to lease a property with an option to purchase it after a set period, combining rental payments with equity building. This option is attractive for investors seeking predictable returns while providing tenants a pathway to homeownership. Unlike traditional buy-to-let mortgages, rent-to-own agreements can generate income from rent and potential future sale profits.

Key Differences Between Buy-to-Let and Rent-to-Own Mortgages

Buy-to-Let mortgages require investors to secure financing based on rental income potential with typically higher interest rates and stricter lending criteria compared to standard mortgages. Rent-to-Own mortgages combine elements of renting and purchasing, allowing tenants to build equity over time before committing to a full mortgage, which involves different risk profiles and repayment structures. Investors must evaluate cash flow stability, investment horizon, and tenant commitment when choosing between Buy-to-Let and Rent-to-Own financing options.

Investment Goals: Which Mortgage Option Aligns Best?

Buy-to-Let mortgages suit investors aiming for long-term rental income and property appreciation, providing immediate landlord benefits and tax advantages. Rent-to-Own mortgages appeal to those focusing on gradual equity building and eventual homeownership, combining rental payments with future purchase options. Choosing between these depends on investment goals, risk tolerance, and cash flow priorities.

Risk Factors: Buy-to-Let vs Rent-to-Own Explained

Buy-to-let mortgages pose risks such as rental voids and interest rate fluctuations, impacting consistent cash flow and loan affordability. Rent-to-own agreements shift some risks to tenants, including potential non-payment and property maintenance disputes, but offer steady income through option fees and rent premiums. Investors must weigh tenant reliability and market stability when choosing between these financing strategies for property investment.

Income Potential and Cash Flow Comparisons

Buy-to-let mortgages typically generate steady rental income, offering consistent cash flow that can cover mortgage payments and yield profit, making them attractive for long-term investment stability. Rent-to-own mortgages often provide upfront option fees and potentially higher monthly payments, enhancing immediate income potential but with less predictable cash flow due to tenant purchase delays. Analyzing rental yield, tenant creditworthiness, and property appreciation is crucial for maximizing income potential and managing cash flow risks in both mortgage types.

Tenant Considerations for Each Mortgage Strategy

Buy-to-let mortgages require tenants to secure private rental agreements, providing landlords with steady rental income but necessitating ongoing property management and tenant screening. Rent-to-own mortgages offer tenants the opportunity to build equity over time through rental payments credited toward future ownership, appealing to renters seeking eventual property acquisition but involving longer commitment periods and higher monthly costs. Tenant creditworthiness and long-term financial goals are critical factors influencing the suitability of each mortgage strategy for investment properties.

Legal Obligations and Regulatory Requirements

Buy-to-Let mortgages require landlords to comply with strict regulatory requirements, including tenant protection laws and adherence to Housing Health and Safety Rating System (HHSRS) standards, ensuring safe and habitable rental properties. Rent-to-Own mortgages involve complex legal obligations, such as drafting enforceable option agreements and complying with consumer protection regulations under the Consumer Credit Act, which safeguard tenant-buyer rights. Both investment strategies demand thorough understanding of property licensing, tax implications, and compliance with landlord registration schemes to mitigate legal risks.

Tax Implications: Maximizing ROI for Both Options

Buy-to-let mortgages allow investors to deduct mortgage interest and allowable expenses from rental income, reducing taxable profits and enhancing ROI for investment properties. Rent-to-own mortgages, while offering potential future property ownership, often result in less favorable tax deductions during the lease period, as payments may be treated partly as rent rather than mortgage interest. Understanding the distinct tax treatments of these financing options is crucial for maximizing returns and planning effective investment strategies in real estate.

Which Mortgage Suits Your Investment Strategy?

Buy-to-let mortgages are ideal for investors seeking steady rental income and long-term property appreciation, offering lower interest rates and tax relief benefits on mortgage interest. Rent-to-own mortgages attract investors who prefer gradual ownership transfer while generating rental income, mitigating upfront costs and market volatility risks. Assessing your cash flow needs, risk tolerance, and investment timeline helps determine the mortgage type that aligns best with your property investment strategy.

Related Important Terms

Portfolio Buy-to-Let

Portfolio Buy-to-Let mortgages enable investors to finance multiple rental properties under one agreement, offering streamlined management and potential cost savings compared to individual Buy-to-Let loans. Rent-to-Own mortgages focus on eventual homeownership for tenants, making them less suitable for investors seeking scalable property portfolios and consistent rental income.

Consumer Buy-to-Let

Consumer Buy-to-Let mortgages provide property investors with a loan specifically designed for purchasing rental properties, often requiring higher deposits and considering rental income in affordability assessments. In contrast, rent-to-own mortgages combine elements of renting and purchasing, allowing tenants to build equity over time but typically offer less immediate control and long-term financial benefits compared to traditional buy-to-let investments.

Rent-to-Own Equity Split

Rent-to-own mortgages for investment properties involve an equity split where tenants gradually build ownership by allocating a portion of monthly payments toward equity accumulation, contrasting with buy-to-let mortgages that primarily generate rental income without tenant equity participation. This equity-sharing model in rent-to-own arrangements can enhance investor returns by combining rental yields with potential property appreciation and tenant equity growth.

Dynamic Mortgage Underwriting

Dynamic mortgage underwriting for Buy-to-Let mortgages leverages real-time data analysis to evaluate rental income potential and borrower creditworthiness, optimizing investment property financing decisions. In contrast, Rent-to-Own mortgage underwriting incorporates tenant payment behavior and property appreciation forecasts, enabling more flexible risk assessment tailored to evolving market conditions.

Interest Cover Ratio (ICR)

Buy-to-Let mortgages typically require an Interest Cover Ratio (ICR) of at least 125% to ensure rental income comfortably exceeds mortgage payments, mitigating investment risk. Rent-to-Own mortgages may have more flexible ICR criteria but often involve higher interest rates, impacting overall investment returns.

Guarantor Buy-to-Let

Guarantor Buy-to-Let mortgages enable investors to leverage a family member's financial strength to secure favorable loan terms on investment properties, often resulting in higher borrowing limits and improved interest rates. This option contrasts with Rent-to-Own mortgages, which combine rental payments and eventual ownership but typically lack the immediate financing benefits and security provided by a guarantor's backing in traditional buy-to-let agreements.

Accidental Landlord Mortgage

An Accidental Landlord Mortgage provides flexible terms for property owners who unintentionally become landlords, often offering competitive interest rates compared to traditional Buy-to-Let Mortgages designed specifically for investment properties. Rent-to-Own Mortgages, while less common in the UK market, differ by allowing tenants a pathway to ownership, making Accidental Landlord Mortgages more suitable for investors needing immediate rental income without long-term tenant-buy options.

Lease-Option Purchase

Buy-to-let mortgages provide investors with traditional rental income by financing properties for lease to tenants, while rent-to-own mortgages, particularly lease-option purchases, offer tenants the opportunity to rent with the option to buy later, creating a hybrid investment that combines rental yields and potential property appreciation. Lease-option purchase agreements lock in a future sale price and typically include an upfront option fee and higher rent credits, appealing to investors seeking long-term capital gains alongside steady cash flow from rental payments.

Vendor-Financed Mortgage

Buy-to-Let mortgages require investors to secure traditional financing for rental properties, typically involving higher credit standards and deposit requirements, whereas Rent-to-Own mortgages, often structured as vendor-financed mortgages, allow buyers to lease properties with an option to purchase while making rental payments that contribute to equity. Vendor-financed mortgages reduce reliance on third-party lenders by enabling the seller to act as lender, providing flexible terms and potential tax advantages for investment property acquisition.

Stress-Tested Rent-to-Own

Stress-tested rent-to-own mortgages require rigorous affordability assessments, ensuring investors can manage payments even under interest rate increases, reducing financial risk compared to buy-to-let mortgages that often focus on rental income to cover costs. This approach offers greater security for lenders and investors by prioritizing long-term payment stability over immediate rental yields.

Buy-to-Let Mortgage vs Rent-to-Own Mortgage for investment properties. Infographic

moneydiff.com

moneydiff.com