Refinance mortgage involves replacing an existing loan with a new one, often to secure a lower interest rate or adjust loan terms, providing immediate financial relief and potential savings. Convertible mortgage allows borrowers to switch from a variable-rate to a fixed-rate loan within the existing mortgage framework, offering flexibility without the need for a full refinancing process. Choosing between these options depends on the borrower's financial goals, interest rate environment, and desire for stability or lower monthly payments.

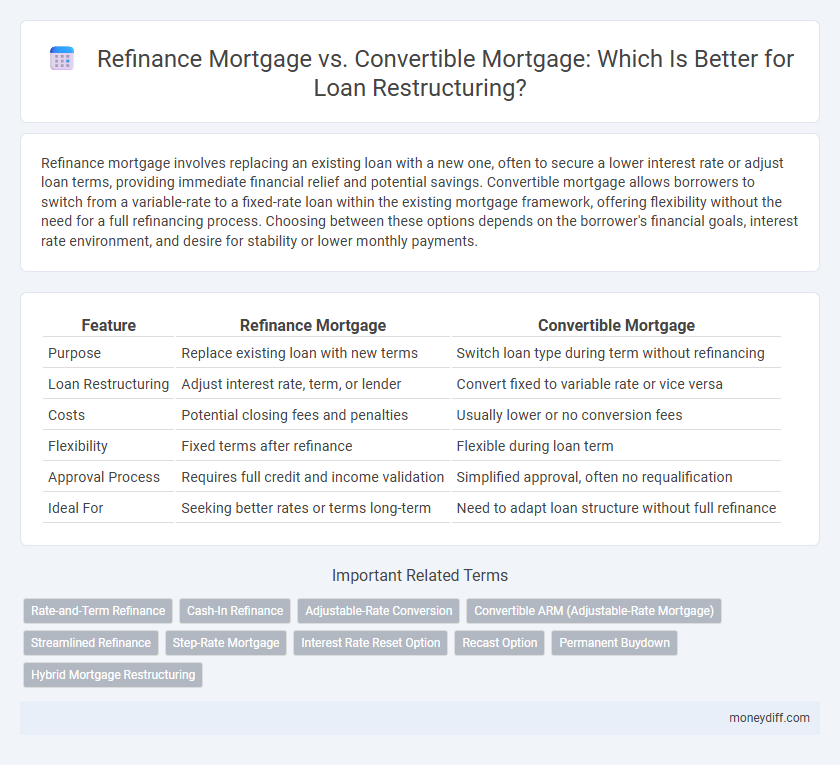

Table of Comparison

| Feature | Refinance Mortgage | Convertible Mortgage |

|---|---|---|

| Purpose | Replace existing loan with new terms | Switch loan type during term without refinancing |

| Loan Restructuring | Adjust interest rate, term, or lender | Convert fixed to variable rate or vice versa |

| Costs | Potential closing fees and penalties | Usually lower or no conversion fees |

| Flexibility | Fixed terms after refinance | Flexible during loan term |

| Approval Process | Requires full credit and income validation | Simplified approval, often no requalification |

| Ideal For | Seeking better rates or terms long-term | Need to adapt loan structure without full refinance |

Introduction to Mortgage Restructuring Options

Refinance mortgage allows borrowers to replace an existing loan with a new one, often securing better interest rates or terms to reduce monthly payments or overall debt costs. Convertible mortgage provides flexibility by enabling borrowers to switch from a variable-rate loan to a fixed-rate loan during the mortgage term without refinancing, aiding risk management amid interest rate fluctuations. Both options serve as strategic tools in loan restructuring, helping homeowners optimize their financial obligations and adapt to changing economic conditions.

What Is a Refinance Mortgage?

A refinance mortgage involves replacing an existing loan with a new mortgage, typically to secure better interest rates, reduce monthly payments, or access equity for other financial needs. This process allows homeowners to adjust the loan terms, such as switching from a variable to a fixed rate, enhancing financial flexibility. Compared to a convertible mortgage that offers options within the original loan, refinancing fully restructures the debt under new conditions.

Understanding Convertible Mortgages

Convertible mortgages offer borrowers flexibility by allowing existing loans to switch from variable to fixed interest rates without refinancing. This option can help manage interest rate risk and avoid closing costs typically associated with refinancing. Understanding convertible mortgage terms is essential for effective loan restructuring strategies that adapt to fluctuating market conditions.

Key Differences Between Refinance and Convertible Mortgages

Refinance mortgages involve replacing an existing loan with a new mortgage at different terms, typically to secure a lower interest rate or adjust the loan tenure, while convertible mortgages allow borrowers to switch from a variable to a fixed rate without taking out a new loan. Key differences include the flexibility of rate options in convertible mortgages versus the potential cost savings and credit qualification requirements in refinance mortgages. Refinance often entails new application fees, appraisals, and credit checks, whereas convertible mortgages usually require simpler procedures and fewer costs.

Benefits of Refinancing Your Mortgage

Refinancing your mortgage can lower interest rates and reduce monthly payments, improving cash flow and overall financial stability. It offers the flexibility to alter loan terms, such as switching from an adjustable-rate to a fixed-rate mortgage, which can provide long-term savings. Compared to convertible mortgages, refinancing often delivers immediate cost benefits and the opportunity to consolidate debt or access home equity more efficiently.

Advantages of Choosing a Convertible Mortgage

A convertible mortgage offers the flexibility to switch from an adjustable-rate to a fixed-rate loan without refinancing, providing stability against interest rate fluctuations. Borrowers benefit from lower initial rates and the option to lock in a fixed rate when market conditions are favorable, minimizing refinancing costs and penalties. This adaptability makes convertible mortgages ideal for strategic loan restructuring and long-term financial planning.

Costs and Fees: Refinance vs Convertible Mortgages

Refinance mortgages typically involve closing costs ranging from 2% to 5% of the loan amount, including appraisal fees, title insurance, and origination charges. Convertible mortgages often have lower upfront fees since they allow borrowers to switch from a variable to a fixed rate without full refinancing but may include conversion fees or higher interest rates. Comparing overall costs requires analyzing the long-term interest savings against these fees to determine which option offers better financial benefits for loan restructuring.

Eligibility Requirements and Application Process

Refinance mortgages usually require a strong credit score, stable income, and a sufficient home equity to qualify, with an application involving a full credit check, property appraisal, and income verification. Convertible mortgages often demand less stringent eligibility as they allow switching from a variable to a fixed rate within the same loan term, typically requiring a simple request or minimal documentation rather than a full loan application. Understanding the eligibility criteria and application steps helps homeowners choose between refinancing for better rates or converting for payment stability during loan restructuring.

Which Option Is Best for Loan Restructuring?

Refinance mortgages offer lower interest rates and immediate cash flow relief by replacing an existing loan with a new one, making them ideal for borrowers seeking reduced monthly payments or debt consolidation. Convertible mortgages provide flexibility by allowing a fixed-rate loan to switch to a variable rate or vice versa, accommodating changes in market conditions without the costs of refinancing. For loan restructuring, refinancing is often best for achieving cost savings and debt consolidation, while convertible mortgages suit those seeking adaptability in interest rate management.

Tips for Deciding Between Refinance and Convertible Mortgages

When deciding between refinance and convertible mortgages for loan restructuring, analyze current interest rates, loan terms, and your long-term financial goals to ensure cost-efficiency. Calculate potential savings from refinancing versus the flexibility benefits offered by convertible mortgages, such as switching from fixed to variable rates without penalties. Consult a mortgage advisor to evaluate eligibility criteria, fees, and market trends that impact the choice between these restructuring options.

Related Important Terms

Rate-and-Term Refinance

Rate-and-term refinance restructures existing mortgage debt by adjusting interest rates and loan duration to achieve lower monthly payments or improved loan terms without increasing principal balance. Convertible mortgages offer flexibility to switch from variable to fixed rates, but rate-and-term refinance specifically targets optimized financial outcomes through renegotiated interest rates and loan terms, making it a strategic choice for borrowers seeking cost-effective debt management.

Cash-In Refinance

Cash-in refinance involves paying down a portion of the mortgage principal upfront to secure lower interest rates or better terms, often leading to reduced monthly payments and overall interest costs. In contrast, a convertible mortgage allows borrowers to switch from a variable to a fixed rate within an existing loan term without refinancing, providing flexibility but typically lacking the principal reduction benefits of cash-in refinancing.

Adjustable-Rate Conversion

Refinance mortgage offers the option to replace an existing loan with a new one, often securing better interest rates or terms, while a convertible mortgage allows borrowers to switch from a fixed-rate to an adjustable-rate loan within a specified period. The adjustable-rate conversion feature in convertible mortgages provides flexibility to capitalize on falling interest rates without the need for full refinancing, potentially lowering monthly payments and overall loan costs.

Convertible ARM (Adjustable-Rate Mortgage)

Convertible ARM loans offer homeowners the flexibility to switch from an adjustable interest rate to a fixed rate mortgage during the loan term, providing a strategic advantage in loan restructuring by allowing borrowers to capitalize on lower initial rates and later secure payment stability. In contrast, traditional refinance mortgages replace the existing loan entirely, potentially incurring higher closing costs and losing previous loan terms' benefits, while convertible ARMs streamline transition without full refinancing hassles.

Streamlined Refinance

Streamlined refinance offers a simplified process with reduced documentation and faster approval times, making it ideal for borrowers seeking lower interest rates or better loan terms without extensive credit checks. Convertible mortgages provide flexibility by allowing borrowers to switch from a variable to a fixed rate, but actual loan restructuring via streamlined refinance ensures immediate cost savings and improved loan conditions.

Step-Rate Mortgage

Step-rate mortgages offer structured interest adjustments, making them a strategic option for borrowers considering loan restructuring through refinance or convertible mortgage paths. Refinancing replaces the existing loan with a new one at a typically lower rate, while convertible mortgages allow switching from an adjustable-rate to a fixed-rate loan, both benefiting from the predictable increases in step-rate mortgages.

Interest Rate Reset Option

Refinance mortgages offer borrowers the opportunity to replace an existing loan with a new one, typically at a lower interest rate, providing immediate savings but involving closing costs and underwriting processes. Convertible mortgages include an interest rate reset option allowing borrowers to switch from a variable to a fixed rate during the loan term without refinancing, enabling flexible loan restructuring tailored to market conditions.

Recast Option

Refinance mortgage allows borrowers to replace their existing loan with a new one, often securing lower interest rates or better terms, while a convertible mortgage offers flexibility to switch from a variable to a fixed rate without refinancing costs. The recast option within refinancing lets borrowers reduce monthly payments by making a lump-sum payment toward the principal, maintaining the original loan terms and avoiding the fees typically associated with loan restructuring.

Permanent Buydown

Refinance mortgages allow homeowners to replace their existing loan with a new one, often to achieve lower interest rates or better terms, while convertible mortgages provide flexibility to switch from an adjustable to a fixed rate without reapplying. Permanent buydown options in refinance mortgages reduce the interest rate permanently by paying upfront points, offering long-term savings, whereas convertible mortgages may not include permanent buydown features but grant adaptability in loan structuring.

Hybrid Mortgage Restructuring

Hybrid mortgage restructuring combines the flexibility of a refinance mortgage with the adaptability of a convertible mortgage, allowing borrowers to modify interest rates or loan terms without full refinancing costs. This approach optimizes loan management by enabling partial adjustments to existing mortgage conditions while preserving original contract benefits, enhancing financial agility and long-term savings.

Refinance Mortgage vs Convertible Mortgage for Loan Restructuring. Infographic

moneydiff.com

moneydiff.com